APLNG’s LNG price cut a sign of changing LNG market

Key Findings

Australia Pacific LNG’s recent AUD2 billion cut to its LNG contract price is clear evidence that shifts in international LNG markets are starting to have an impact on Australia’s LNG sector.

A global supply glut in the coming years due to the largest ever increase in new supply, particularly from low-cost Qatar, means Australia’s LNG sector will face increasing competition, which is already pushing down LNG contract prices.

IEEFA estimates that the new price could be as low as AUD13.50/GJ, broadly in line with recent domestic gas prices despite the additional cost of liquefying the gas, which may have implications for the broader social licence of Australia’s LNG industry.

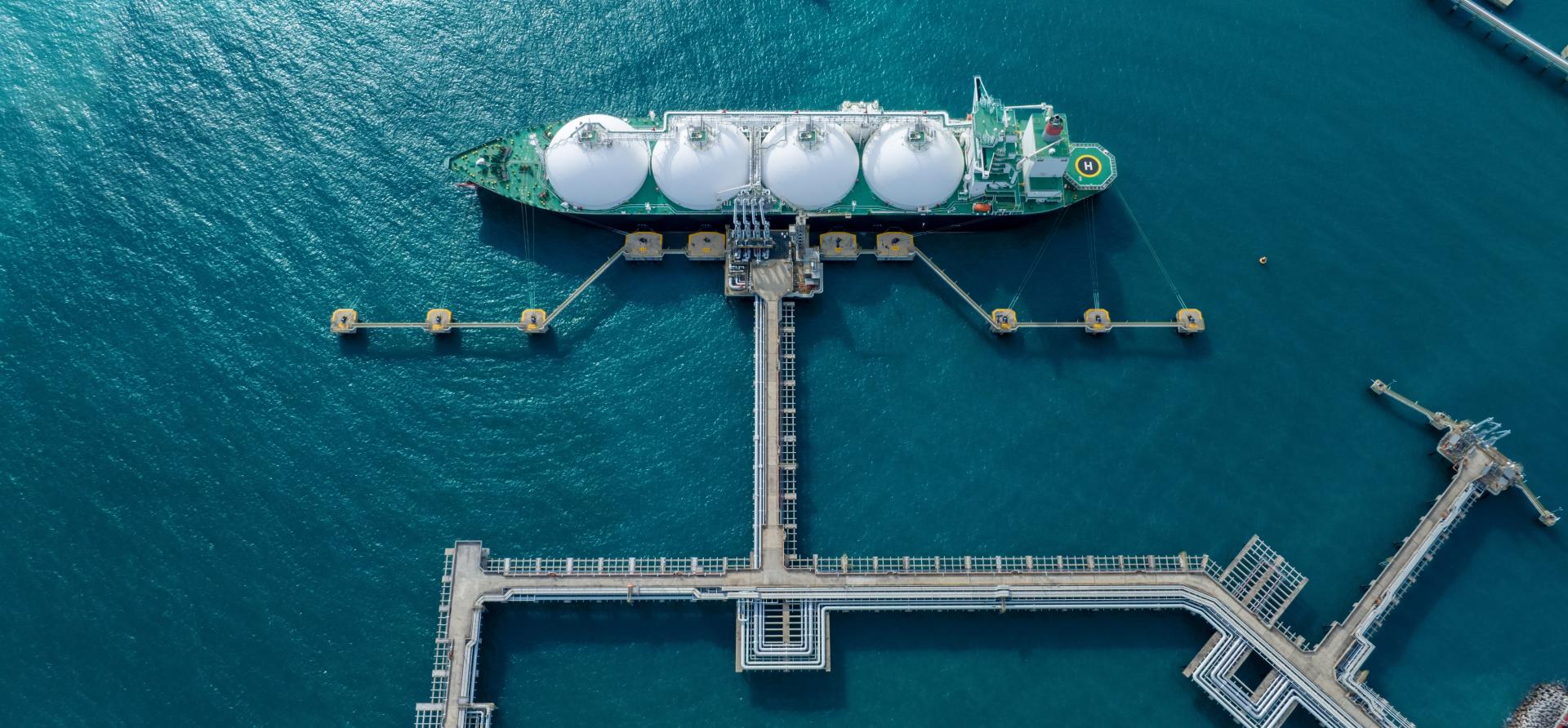

Australia Pacific LNG (APLNG), the largest liquefied natural gas (LNG) exporter on Australia’s east coast, recently lowered the LNG price under its 7.6 million tonne per annum LNG contract with Sinopec.

Anticipated to cost APLNG close to AUD2 billion over the next five years (based on the reported financial impact to Origin Energy, which owns part of the APLNG project, extrapolated over the five-year period), the price cut will no doubt impact on APLNG’s financial returns, but it is also an early indication that LNG market fundamentals are changing.

LNG price reviews are not unusual given the majority of LNG supply and purchase agreements (SPAs) have long terms (15 years or more). Long-term SPAs provide certainty to LNG project developers and their financiers, but they also expose parties on both sides to price risks – that is, risks that future prices will be lower or higher than prevailing prices when the SPA was signed. Formal contractual price reviews are intended to mitigate these risks, by allowing the seller and buyer to renegotiate the contract on a periodic basis, based on pricing sentiment at the time of the review.

For this reason, price review outcomes provide insights into contemporary and future market pricing. APLNG’s price cut, at a time of tight LNG market conditions, clearly reflects an expectation of lower LNG prices in future.

This is not surprising given the looming glut in LNG markets, which IEEFA first predicted in 2023, with the largest ever increase in global LNG liquefaction set to come online in the next few years. The anticipated glut is already pushing down LNG prices.

At the same time, LNG demand in mature markets, particularly in Europe and Japan, is falling and demand growth is increasingly shifting to more price-sensitive emerging markets. Future LNG demand is also inherently uncertain, as acknowledged by the President of the International Group of Liquefied Natural Gas Importers.

APLNG’s price cut is also an indication of the increasing competition faced by Australian LNG exporters. IEEFA’s Future of Australian LNG report identified several drivers underpinning increased competition, including:

- The looming glut of new supply.

- Australia’s relatively high LNG costs, particularly for new developments – especially compared to Qatar.

- Large volumes of LNG looking for end buyers held by Qatar and a range of portfolio players (including Japanese companies reselling Australian LNG).

- Expiry of existing LNG SPAs, which will either require recontracting or increase the exposure of Australian LNG sellers to volatile spot markets.

In the absence of material and sustained LNG demand growth, it is likely that Australian LNG projects will face sustained competition well into the next decade.

Finally, the outcome of APLNG’s price review may also have implications for the broader social licence of Australia’s LNG industry, which has been a topical issue. Reported estimates of the price cut would be equivalent to a decrease of AUD1 per gigajoule (GJ). Based on Australian government statistics on the average price of Australian LNG sold to China, IEEFA estimates that the new price payable by Sinopec could be as low as AUD13.50/GJ, broadly in line with domestic gas prices in the first quarter of 2025, and that excludes the additional cost of liquefying the gas.

While this is not unexpected given Sinopec’s investment in APLNG and its subsequent LNG SPA, it is not likely to be popular among the broader Australian public given the impact of high prices on the east coast in recent years. That said, APLNG’s exports to Sinopec are not discretionary and are required by the long-term contract. At the same time, nonetheless, continued LNG spot sales by the Queensland LNG exporters (including APLNG) have contributed to higher prices on the east coast while also earning windfall profits for those exporters.

Australia’s Minister for Resources Madeleine King recently remarked: “A well-supplied domestic gas market at a reasonable price is fundamental to the social licence of this industry to operate.”

With the financial returns from LNG exports likely to decline in the coming years, and gas shortages looming in Australia, LNG exporters may be wise to heed her words.