IEEFA update: Offshore wind power, the underexplored opportunity that could replace coal in Asia

The global renewable electricity sector transformation has gained unprecedented impetus due to accelerated deflation in wind and solar power costs. Classic benefits of technological improvements, innovative financing, low externalities and economies of scale have all come to fruition in the renewable energy sector. In IEEFA’s view, similar momentum is unfolding in the underexplored domain of offshore wind power, likely to grow into a major US$20-30 billion annual global market in the coming decade.

Offshore wind power offers an opportunity in emerging Asian markets by 2030 to further reduce overreliance on emissions intensive, expensive, inflexible, imported coal-fired electricity.

The recent technological development of offshore wind turbines has been dramatic. The rotor diameter of offshore turbines has jumped from 80 metres to more than 164 metres and average capacity has doubled, climbing from 1-2 megawatts (MW) in 2012 to 4-6MW today and still rising. Leading players like Orsted and Siemens are betting on another doubling in size to 10-14MW by 2024.

These technological improvements and cross-sector learning from other industrial sectors such as maritime, automotive and shipbuilding have pushed costs down significantly in the past 10 years. Today, offshore wind technology is getting close to matching the cost of energy from its onshore counterpart, due to its near-limitless size potential, proximity to coastal city load centres, exceptional utilisation rates plus subsea grid technology improvements by world leaders like Prysmian Cables.

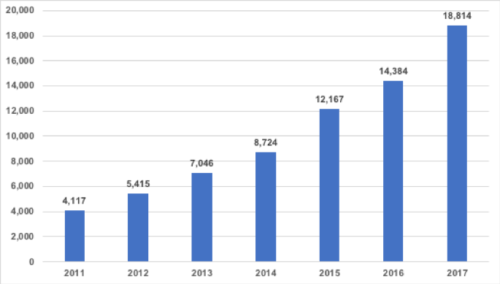

Bloomberg New Energy Finance (BNEF) projects the offshore wind power market to grow at a compound annual growth rate of 16% to reach a total global capacity of 115 gigawatts (GW) by 2030, a sixfold increase from 2017. IEEFA notes that this estimate includes North America and Europe, but possibly understates the enormous offshore wind potential of Asian economies.

Global Installed Offshore Wind Capacity (MW) 2011-2017

Source: Global Wind Energy Council

To date, the growth in offshore wind power has been concentrated in Europe, with 84% of the total 18.8GW of global offshore wind capacity installed in Northern Europe. A record 4.3GW of offshore wind power capacity was installed across nine markets in 2017.

Last year, three German offshore wind auctions totalling 1,380MW resulted in a zero premium strike price. The projects will be commissioned between 2023-2025 and will offer electricity at prevailing wholesale market prices at that time. Early in 2018, the Netherlands awarded its first non-subsidised offshore wind tender of 750MW to wind power developer Vattenfall.

OVER THE LAST DECADE EUROPE HAS SUBSIDISED THE RESEARCH, DEVELOPMENT AND DEPLOYMENT of the offshore wind sector, creating the policy support needed to drive the sector’s current deflationary price trend. IEEFA believes Asian countries such as China, India, Japan, South Korea, Taiwan and Vietnam are set to capitalise on Europe’s lead in the coming decade. In fact, BNEF suggests China (2.7GW at the end of 2017) will overtake the U.K. (currently with 6.8GW) in installed capacity by 2022.

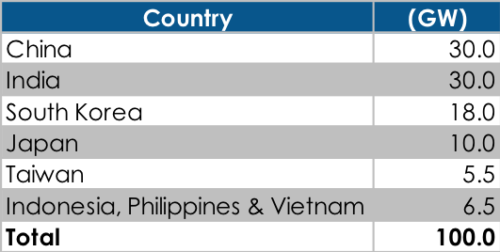

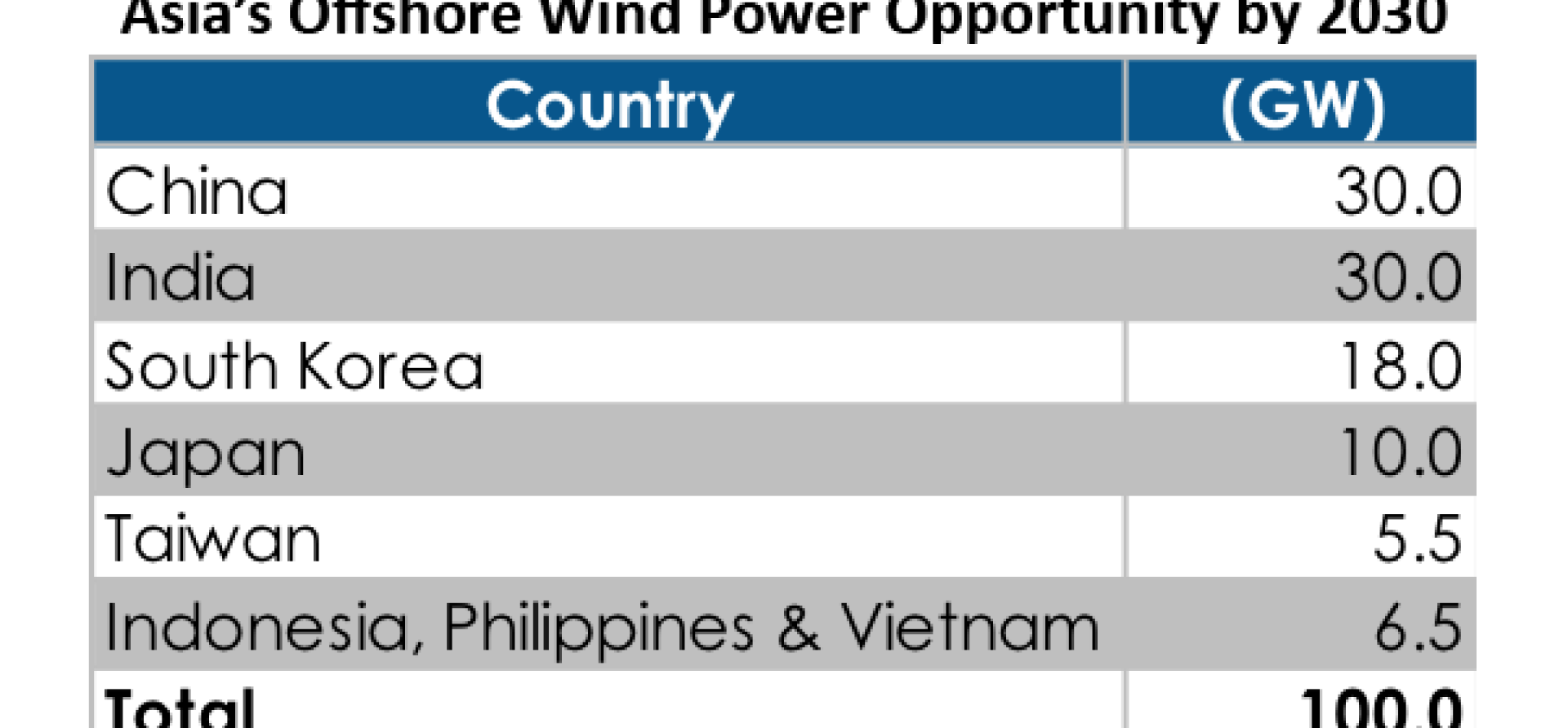

China has an aggressive target to install 10 GW of offshore wind by 2020. It remains to be seen if the country can hit that mark, but installations have picked up speed in the past two years. According to GWEC, China’s installed offshore capacity at the end of 2017 totalled 2,788MW. Going forward, Wood Mackenzie’s MAKE consulting unit expects installations to climb steadily through 2030 when China’s total capacity could top 30GW, providing clean power to its major economic hubs, most of which are located along the coast.

In August, China’s state owned utility China Three Gorges won clearance to construct the 400MW Yangjiang offshore wind farm off the coast of Guangdong province. It is the third offshore wind farm that the utility will build in the same province.

South Korea is not far behind. The country’s goal is to install 18GW of offshore capacity by 2030; of this 4GW is already in the pipeline. As part of this pipeline, in June 2018 the renewable energy investment giant Macquarie Capital was reportedly looking into investing in a 1GW project planned for offshore Pohang with local developer Gyeongbuk.

Similarly, Taiwan and Japan have set targets of 5.5GW and 10GW respectively.

India’s ambitious 2027 renewable energy capacity target of 275GW has put the country in a spotlight. It has set an offshore wind power capacity target of 5GW by 2022 and accelerating from there to reach 30GW by 2030. In April 2018 the Indian Ministry of New & Renewable Energy issued a call for expressions of interest to develop a 1GW offshore wind project on its western coast. It received an overwhelming response from total 34 companies including Indian wind power giants such as Sterlite Power Grid, Inox Wind, Suzlon Energy, and Mytrah Energy. Some of the well-known foreign participants included Orsted, Alfanar, Deep Water Structures, EON Climate & Renewable, Terraform Global, Macquarie Group, Shell, and Senvion.

Other Asian markets such as the Philippines, Indonesia and Vietnam are yet to formulate offshore wind energy targets. But, as they progress to build onshore wind power capacity, offshore developments likely will follow.

Asia’s Offshore Wind Power Opportunity by 2030

Source: Media reports, Government documents, IEEFA estimates

Asian economies have a cumulative ambition to build up to 100GW of offshore wind capacity by 2030. Offshore wind development has the potential to reach the same cost efficiencies of its onshore counterpart, with prices pushed downward in particular by the upward movement in offshore turbine generation capacity. Successful commercialisation of floating offshore wind will also drive the sector’s development in Asia. Having said that, reaching the region’s 100GW target by 2030 will be a mammoth undertaking.

Lessons from Europe indicate that offshore wind power facilities can achieve capacity utilisation rates of 55%. By 2030, if the Asian countries noted above can install 70% of the 100GW target, this could replace about 300-350 million tonnes of coal annually – 35-40% of the current global seaborne trade.

The sector is still in an embryonic state in Asia. Developers should carefully explore opportunities by doing small projects, given it is a difficult task to install wind turbines offshore. Performance related uncertainties will only disappear as more wind installation data is accumulated.

Governments must plan for needed grid-connection arrangements to keep pace with the acceleration in offshore wind developments. Offshore wind is a valuable new power source that can help countries move to a more reliable, cheaper and cleaner energy economy.

Tim Buckley is IEEFA’s director of energy finance studies, Australasia. Kashish Shah is an IEEFA research associate

RELATED ITEMS:

IEEFA update: China moves heavily into foreign wind markets

IEEFA Europe: Technology Gains Help Drive a Rush From Capital Markets Into Offshore Wind

IEEFA Report: ‘Here and Now’ — Nine Electricity Markets Leading the Transition to Wind and Solar