IEEFA Update: Wall Street Gets the Exxon Heebie-Jeebies

News of note this week on sentiment toward ExxonMobil comes by way, among others, of the Wall Street Journal:

News of note this week on sentiment toward ExxonMobil comes by way, among others, of the Wall Street Journal:

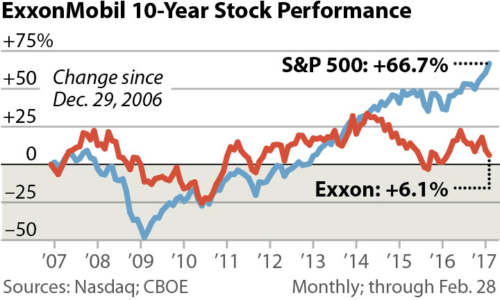

“Exxon has lost cachet among institutional investors in recent years: Most portfolios hold a smaller proportion of Exxon stock than its relative size in the S&P 500 index, according to Evercore ISI analyst Doug Terreson.”

“This ‘underscores investor concern’ over Exxon’s strategy.”

No kidding.

Exxon investors are much less deferential to management than they used to be, and skepticism has only grown with the arrival of the company’s new CEO, Darren Woods, who says he’s betting on natural gas markets over the next few years while hoping to squeeze some life out of Exxon’s conventional oil holdings.

The company’s latest initiatives—in Norway, Guyana, North Dakota and Texas—come hot on the heels of its huge write-down of its Canadian oil sands reserves, a move that perhaps stirred an awakening among institutional investors especially.

Does the company have a bright future, or is its outlook “alarming,” as one analyst suggested this week to the New York Times?

Bloomberg News in its article on Woods’ debut, under the headline “Exxon’s New CEO Shifts Investments to Quick-Earning Shale Oil,” chronicled the concern in deeper detail.

“Exxon has never been more out of favor with analysts in its modern history,” the article noted. “The proportion of ‘buy’ recommendations among analysts following the company is at its lowest since at least 1997, two years before the $88 billion Mobil merger. Seven analysts have the equivalent of a sell rating on the company, with five buys and 17 holds.”

“Exxon was a late-comer to shale, shunning it for the first decade of this century as a niche that couldn’t generate enough output to make a mark on the balance sheet of a major international explorer. When Tillerson steered Exxon into shale drilling with its $34.9 billion acquisition of gas explorer XTO Energy in 2010, he conceded Exxon had missed out on the first wave of the fracking revolution.”

“Investors may still be looking for more as Exxon ‘continues to struggle to showcase upstream volume growth over the near to medium term,’ said Vincent Piazza, a Bloomberg Intelligence analyst. The company’s production has fallen in four of the past five years and averaged 4.05 million barrels a day in 2016.”

Reuters weighed in similarly:

“Woods sought to assuage Wall Street concerns that Exxon has lagged Chevron Corp (CVX.N) and other peers in its ability to replace the oil and gas reserves it needs for future profitability.

It was a tough task, with analysts critical of the company’s ability to sustain growth. Of 25 Wall Street analysts tracking Exxon, only five recommend buying its shares, less than a third of the 17 who advise buying Chevron’s shares, according to Thomson Reuters data.”

“Woods did an effective job in laying out the story, but he was hamstrung by his predecessor’s mistakes and the market’s increasingly skeptical sentiment on the stock,’ Raymond James analyst Pavel Molchanov said.”

SO THE CADRE OF STOCK ANALYSTS WHO FOLLOW EXXON ARE NOW OFFICIALLY NERVOUS, and the financial press is more or less acknowledging that former CEO Rex Tillerson’s reign of error leaves Woods with challenges that are unprecedented in Exxon’s history.

Woods is saying loud and clear that Exxon needs revenue, and that it could use it sooner rather than later—quite a reversal by an outfit that has traditionally waved off questions about revenue.

The conditions that created the need for the company to recently write off 20 percent of its proven reserves haven’t changed—and that was no small write-down. We’re talking $20 billion or more in lost assets, lost because they cannot be extracted profitably so long as oil prices—stuck lately in the $50-$55 per-barrel range (roughly half what they were for a good part of the past 10 years)—stay low.

Woods would have us believe there is a brave new world in which oil development can be profitable with prices as low as $40 per barrel. We’re skeptical of that assertion, even with the oil industry’s vast technical prowess.

Nor are we bullish on natural gas prices. In fact, we think Exxon investors may well be scraping their shoes for quite some time of what the bull left behind on the Canadian oil sands write-down.

Tom Sanzillo is IEEFA’s director of finance.

RELATED POSTS:

IEEFA Exxon: Questions, More Questions