IEEFA update: Moody’s adjusts ExxonMobil credit outlook to negative

This week Moody’s changed ExxonMobil’s Triple-A rating from stable to negative, raising the prospect of the oil company being downgraded in 2020.

This week Moody’s changed ExxonMobil’s Triple-A rating from stable to negative, raising the prospect of the oil company being downgraded in 2020.

Moody’s has red-flagged ExxonMobil’s rising capital expenditures and weak revenues. The oil giant is challenged by a low price environment ($60/barrel) and diminished refining and chemical earnings. The problems for ExxonMobil’s business model are fundamental — revenues have eroded and rebounding oil prices are proving inadequate to fund operating expenses, capital plans and investor dividends.

Moody’s negative outlook is based on its assessment of recent actions by the company in light of current market conditions:

- Rising capital expenditures are not producing increased revenues. Moody’s identifies negative cash flow for the company in 2019 and expects the same in 2020 and 2021.

- Despite recent increases in capital expenditures compared to recent quarters, the company is still spending less than it did earlier in the decade. ExxonMobil’s lower capital spending could not keep pace with the more dramatic and negative impact of lower-for-longer oil prices.

- Rising dividend payments to investors masks the fact that ExxonMobil’s total shareholder distributions, dividends and share buybacks, have been substantially reduced. Earlier this decade, shareholders received annual payments of $40 billion in total distributions, while dividend payments now amount to $16 billion annually and there are no share repurchases. Capital expenditure discipline and reductions in total payments to shareholders are not enough to keep the company on a sustainable financial path.

- ExxonMobil anticipates selling assets through 2021 that will generate $15 billion in revenue, if successful. Moody’s anticipates higher debt levels for the company, even if it successfully executes its asset sale program.

“The company’s high level of capital investments cannot be funded with operating cash flow and asset sales at projected levels.”

Despite ExxonMobil’s efforts to reduce costs, Moody’s concludes: “The company’s high level of growth capital investments cannot be funded with operating cash flow and asset sales at projected levels given ExxonMobil’s dividend payout, absent meaningfully higher commodity prices and earnings from downstream and chemicals.”

These credit concerns are accompanied by a broader warning for ExxonMobil and other companies. “The negative outlook also reflects the emerging threat to oil and gas companies’ profitability and cash flow from growing efforts by many nations to mitigate the impacts of climate change through tax and regulatory policies that are intended to shift global demand towards other sources of energy and conservation.”

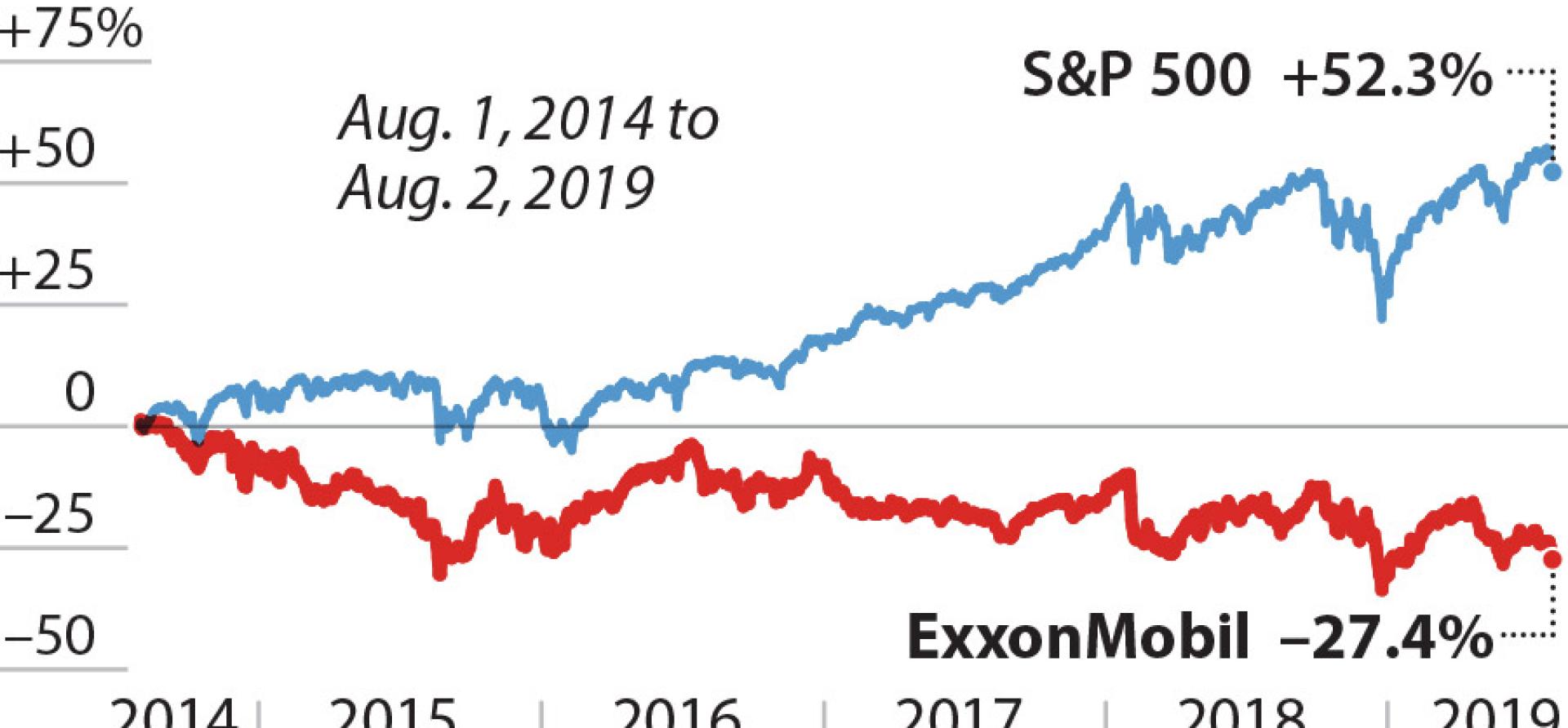

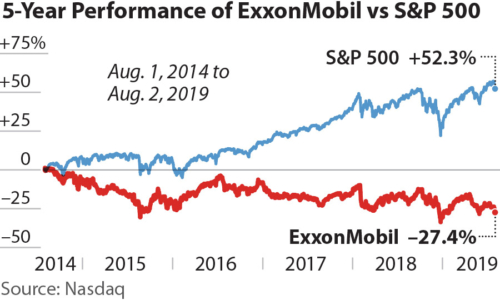

The cumulative impact of the risks identified by Moody’s adds up to a negative outlook for ExxonMobil. The financial factors considered by Moody’s reflect more than the current state of affairs. The analysis situates ExxonMobil’s present financial condition against the backdrop of recent business decisions. Over the past few months, the company has acknowledged that its attempt to pick up quick cash from the Permian Basin came up short. The company now sees the investment as a long-term proposition at a time when heavy capital investments and low earnings have undermined the company’s basic value proposition to investors.

Moody’s suggests that the company could experience a turnaround if it successfully executes its capital program, keeps a lid on rising debt levels, increases production growth and adds to its chemical and refining capacity.

We are skeptical of this formula. ExxonMobil has successfully executed on its plans to expand production levels in the Permian but, as Moody’s and ExxonMobil officials recently acknowledged, this has not improved its cash position and the longer term is increasingly uncertain. With lower-for-longer prices and a corporate decision to continue maximum drilling and exploration and rising dividend levels, debt levels are likely to rise. There is also reason to be concerned that ExxonMobil’s move to increase its refining and chemical capacity is taking place at a time when other large oil and gas players are doing the same. Oversupply and downward pressure on margins are quite likely.

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

RELATED ITEMS:

IEEFA update: Fracking sector spills more red ink in Q3

IEEFA update: ExxonMobil abandons goal of “quick cash” from Permian fracking