IEEFA update: Dwindling odds of success for retrofit of New Mexico coal plant with carbon capture

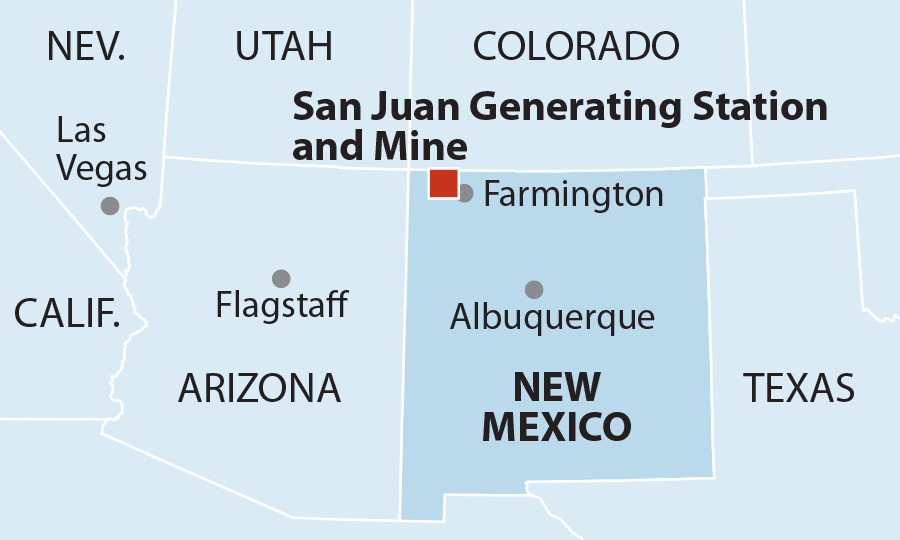

Sept. 16, 2020 (IEEFA) — The proposed retrofit with carbon capture technology of a coal-fired power plant in San Juan County, N.M., shows dwindling chances of success, according to a briefing note released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

Sept. 16, 2020 (IEEFA) — The proposed retrofit with carbon capture technology of a coal-fired power plant in San Juan County, N.M., shows dwindling chances of success, according to a briefing note released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

The analysis concludes that the plan is most likely a lost cause, although the initiative continues to be touted by its promoters as on-track with claims that the plan can somehow be made workable by 2023.

“Prospects for success on a proposal to turn the coal-fired San Juan Generating Station into a carbon-capture project have faded, hurt by the recent mothballing of a similar project in Texas, oppositional market forces, no known interest from investors, and political and industry realities that favor less complicated and more cost-effective forms of electricity generation,” the brief states.

“The project continues nonetheless to be touted as a done deal by its promoter, a thinly capitalized startup called Enchant Energy, which was founded and is operated by a handful of individuals who are little known in New Mexico and funded solely by a one-time U.S. Department of Energy grant.”

Building on previous IEEFA research questioning the viability of the project, the analysts detail several current indicators that “suggest insurmountable barriers” to the success of a retrofit.

- Coal-fired carbon-capture projects do not pencil out, “owing to their complexity and high maintenance and operations costs” and because of fierce competition from less expensive renewable generation. The brief cites the recent mothballing of Petra Nova, which was a similar experimental project in Texas and the only existing coal-fired carbon capture sequestration and usage (CCSU) project in the U.S.

- The proposed project has no known buyers for most of the electricity it would ostensibly produce, and no access to transmission.

- While Enchant Energy asserts that the project is “attractive to investors,” none are known to have come forward after the company announced an equity-raising initiative in the summer.

- The timeline Enchant has put forth remains improbable, with executives stating that the company will somehow have carbon emission off-take agreements and power purchase agreements in place by the end of December. However, aside from Farmington or Enchant itself, there is little likelihood any buyer will sign a PPA or a carbon-offtake agreement anytime in the foreseeable future.

- Enchant has abruptly changed elements of its business plan but not accounted for how much those changes would cost or how practical they would be. Specifically, company executives say that the retrofit may not be geared to pipe carbon dioxide into the Permian Basin for enhanced-oil recovery but instead be recast as a local carbon sequestration project. Enchant has not yet shown how or where emissions would be sequestered—a question that would require extensive siting studies and permitting at considerable cost, a process that could take years to complete.

- The state of New Mexico and the utility have both moved on. Utility company co-owners of the San Juan station have shown no interest in cooperating, the Public Regulation Commission of New Mexico is skeptical of the project, and the landmark New Mexico Energy Transition Act of 2019 has no place in it for coal plant retrofits.

Full brief: Dwindling Odds of Success for Retrofit of New Mexico Coal Plant for Carbon Capture

Author Contacts

Karl Cates ([email protected]) 917 439 8225

Dennis Wamsted ([email protected])

Media Contact

Vivienne Heston ([email protected]) +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.