IEEFA Ohio/Pennsylvania: Bracing for Economic Fallout From Failing Power Plants

Time has borne out what we said in a report we published in 2014 arguing that FirstEnergy was in financial trouble and that its strategy of seeking bailouts from customers might not be enough to turn around the company’s flagging fortunes.

This excerpt from that report—“FirstEnergy: A Major Utility Seeks a Subsidized Turnaound”—summarizes our assessment:

“FirstEnergy is burdened by heavy reliance on an underperforming merchant coal fleet in a weak competitive market and a regulated coal plant portfolio that is profitable but unable to carry legacy debt and likely additional environmental retrofit costs.”

Three years on, FirstEnergy continues to founder and today is flirting with bankruptcy. Its stock price has not recovered, and in 2016 the company posted a loss of $6.2 billion. FirstEnergy’s net income has been less than the dividends paid to shareholders every year from 2011 through 2016, meaning that FirstEnergy has not been generating enough profit to support its annual payment to shareholders.

This is obviously no more sustainable a business model than it was three years ago.

This is obviously no more sustainable a business model than it was three years ago.

FirstEnergy’s weakness is driven by its competitive generation business, FirstEnergy Solutions (FES). FES has been in dire straits for several years now because low wholesale energy market prices (driven by cheap natural gas, the rise of renewables, and relatively flat electricity demand) have made it difficult for FES’s coal and nuclear plants to compete. FES’s revenues declined every year from 2013 through 2016, and just within the past six months all three major credit rating agencies have downgraded its corporate bonds. In the fourth quarter of 2016, FES took an $8 billion loss to write down the value of its remaining coal and nuclear units— an acknowledgement that FES’s coal and nuclear plants have lost 88 percent and 90 percent of their value, respectively.

On an earnings call this year, FirstEnergy CEO Chuck Jones stated that the company will be getting entirely out of the competitive electricity-generation business by mid-2018, and Jones floated the possibility that the FES subsidiary could go bankrupt.

WHAT DOES THIS MEAN FOR FES’S REMAINING POWER PLANTS AND FOR COMMUNITIES affected by whatever happens to these plants?

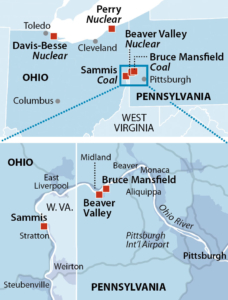

After having already sold off or retired several plants over the past few years, FES has seven remaining large power plants. Five are in Ohio: the Bay Shore coal plant (135 megawatts, scheduled to retire in 2020), the Davis-Besse nuclear plant (908 MW), the Perry nuclear plant (1108 MW), the Sammis coal plant (2210 MW with four of seven units scheduled to retire by 2020), and the West Lorain gas plant (545 MW). Two are in Pennsylvania: the Bruce Mansfield coal plant (2510 MW) and the Beaver Valley nuclear plant (1808 MW).

The Ohio nuclear plants—Davis-Besse and Perry—are the subject of a proposed bill in the Ohio legislature (introduced by a legislator whose law firm includes lobbyists for FirstEnergy). The bill would provide a ratepayer subsidy to Davis-Besse and Perry for up to 16 years to prop up the continued operation of the plants. If this legislation passes, it would help FirstEnergy find a buyer for these plants if FES goes bankrupt.

No legislation is pending to bail out the coal plants, although the Public Utilities Commission of Ohio last year approved a bailout of $200 million per year for up to five years for FirstEnergy. This was substantially less than the original $4 billion subsidy FirstEnergy had sought to preserve Sammis and Davis-Besse, and apparently not enough to deter FirstEnergy from its plans to exit the competitive power-generation business.

If FirstEnergy Solutions goes bankrupt, FirstEnergy would be looking to sell or retire FES coal and nuclear assets. Given the poor performance of the portfolio (as evidenced by the recent write-down of nearly 90 percent of its value), we think it highly unlikely that FirstEnergy would be able to find a buyer who would continue to operate these units for the long term— if it can find a buyer at all. Examples of coal plants recently emerging from bankruptcy, including Pennsylvania’s Homer City coal plant and many of the coal plants in Texas owned by Vistra Energy (a new company created out of the bankruptcy of Luminant and TXU), continue to struggle financially and are still seen as likely candidates for retirement.

Just restructuring or shedding debt through bankruptcy is not enough to make coal plants profitable in today’s market.

An electricity-generation transition is sweeping the U.S. as natural gas and renewables continue to make coal-fired and nuclear generation less and less competitive. Energy companies that have failed to recognize and responsibly manage this trend include FirstEnergy, and FirstEnergy Solutions is the poster child of the corporate result.

MANY COMMUNITIES IN OHIO AND PENNSYLVANIA WILL BE AFFECTED AS THE FES SPIRAL PLAYS OUT, and it is in the best interest of those communities to plan now for the potential closure of these plants. It’s unlikely that FES or any owner will be able to operate these plants profitably over the long term, and the implications are serious for the many towns and cities affected. An industry in decline is not compatible with job stability, balanced municipal and county budgets, and economic growth.

Where to begin?

Ohio and Pennsylvania lawmakers could look to nearby New York State, which created the Electric Generation Facility Cessation Mitigation Fund in 2016 to help communities protect their tax bases when power plants close. The fund, originally set up with $30 million in annual funding for five years, recently was expanded to provide $42 million annually for seven years.

State support of this type will prove crucial in Ohio and Pennsylvania, allowing the continuation of public services and school funding during a transition time in which they can develop alternatives to power-plant economies.

Cathy Kunkel is an IEEFA energy analyst.

RELATED POSTS:

IEEFA Op-Ed: Coal Will Not Recover

IEEFA New York: A Case of a Community Dealing Constructively With Its Loss of Coal-Industry Revenues