IEEFA: NTPC is the flag-bearer for India’s electricity sector transition

The majority state-owned NTPC’s recent announcement that it will stop pursuing new greenfield coal-fired power projects is part of an ongoing strategic shift into renewable energy by India’s largest thermal power generation company.

NTPC’s long-term target of about 32 gigawatts (GW) of renewables by 2032 – 24.6% of its total planned capacity of 130GW – makes it a key player driving the electricity sector transition, in line with the Government of India’s ambitious goal of 450GW of renewables and hydro power by 2030.

In August 2019, NTPC announced it planned to set up a 5GW ultra-mega industrial solar park in Kutch, Gujarat, with an investment of Rs20,000 crore (US$2.7 billion).

Then, amidst the gloom of the economic downturn exacerbated by COVID-19, came the positive news that the Gujarat government is starting the land allotment process for a massive 42GW ultra-mega renewable energy park in Kutch. When fully commissioned this will be world’s largest renewable energy facility, twenty times the size of the world’s current largest operational one, Rajasthan’s 2.2GW Bhadla solar park.

Reportedly, NTPC will be allotted 10,000 hectares of land for its planned 5GW ultra-mega solar park in Kutch as part of the larger 42GW of planned capacity by the Gujarat government.

It currently has 2.3GW of renewable energy capacity under construction. When commissioned, this will take NTPC’s renewables portfolio to 3.3GW.

In financial year (FY) 2019/20, NTPC acquired two of India’s largest hydro power utilities: North-Eastern Electric Power Corporation Limited (NEEPCO) and THDC India Ltd (THDCIL), adding 3.3GW (1.8GW from NEEPCO and 1.5GW from THDCIL) to its existing capacity. This acquisition also included 527 megawatts (MW) of NEEPCO’s gas-fired capacity.

NTPC, along with Solar Energy Corporation of India, has also been playing an important role in facilitating renewable energy tenders by acting as a guarantor between renewable power producers and distribution companies (discoms).

The company also plans to gradually expand into electric vehicle charging infrastructure as the electrification of transport creates a convergence between the power and transportation industries.

Falling Coal-Fired Utilisation Rates, Rising Thermal Tariffs

However, while expanding into renewables NTPC will also continue to deliver thermal power for decades to come. As of August 2020, it has 52.9GW of coal-fired capacity operational – a quarter of India’s total coal-fired capacity.

FY2019/20 saw NTPC commission 3.4GW coal-fired capacity against its target of 5.2GW. In July 2020, it also added 0.8GW of Unit 2 of Lara Super Thermal Power Project in Chhattisgarh.

The addition of new coal-fired capacity amidst no growth in power demand during FY2019/20 cannibalised performance of NTPC’s own capacity. Based on reported Plant load Factor (PLF) and Plant Availability Factor (PAF), IEEFA estimates that NTPC’s coal plant utilisation factors reduced to 61.2% in FY2019/20 from 66.9% in FY2018/19.

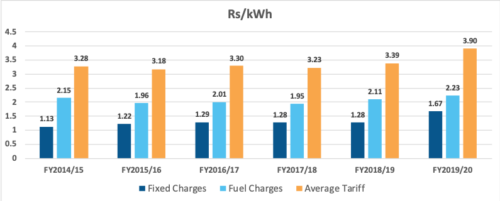

Moreover, increasing landed fuel costs and capacity charges from the incremental capacity saw NTPC’s average thermal tariff soar in FY2019/20 (See Figure 1).

Figure 1: NTPC Average Tariffs

NTPC’s average tariffs increased 15% from Rs3.39/kWh in FY2018/19 to Rs3.90/kWh in 2019/20, whilst renewable energy tariffs in India and globally continue on a consistently downward (deflationary) trajectory.

In June 2020, Solar Energy Corporation of India’s 2GW solar auction delivered India’s lowest-yet renewable energy tariff at Rs2.36/kWh (US$31/MWh) with zero indexation for 25 years.

We estimate the levelised cost of electricity for discoms for this tender to be Rs1.13/kWh (US$15/MWh) if India experiences 5% annual inflation over the 25-year length of the project.

In a move that could potentially reduce its overall fuel costs, NTPC recently invited bids for supply of 6Mtpa biomass pellets made out of stubble and husk to co-fire in its 17 coal-fired power plants across the country.

NTPC plans to have 10% of biomass co-fired with coal. This will materially reduce stubble burning – a major cause of air pollution in northern India while also providing farmers a much needed second source of income.

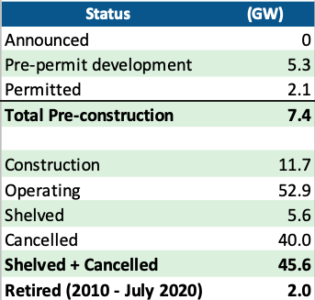

NTPC has 11.7GW of coal-fired power plants under construction and 7.4GW of coal-fired capacity under pre-construction development stages with various regulatory and environmental approvals pending (See Figure 2), according to data from Global Energy Monitor’s (GEM) Global Coal Plant Tracker (GCPT).

Figure 2: NTPC Coal-fired Power Project Pipeline

IEEFA believes that NTPC will likely discontinue its 7.4GW of pre-construction capacity. There is also a clear risk of underperformance on its 11.7GW of under-construction power plants – evident in the consistently declining utilisation rates in the five years to FY2019/20 due to the addition of new capacity well ahead of demand growth.

Under continuing pressure from deflationary renewable energy tariffs, India’s coal-fired fleet’s utilisation rates have collapsed to an unsustainable low of below 60% for the last three years.

The thermal power sector is also facing difficulties with getting domestic coal linkages, water unavailability, environmental litigation, financial stress of state-owned discoms and delays in construction.

As a result, the sector has accumulated US$40-60 billion in stranded assets.

Global Finance Moving Away from Coal

Governments, investors and utilities across the globe are rapidly moving away from coal as they realise the need to accelerate the transition to a low-cost, low-emission and sustainably profitable energy economy.

To date, nearly 150 major financial institutions including multi-lateral development banks, insurers, export credit agencies and private banks have announced coal-exclusion policies.

In the last week of September, KB Financial Group became the first South Korean financial entity to renounce coal when it retracted plans to invest in coal-fired power projects. The company has decided instead to direct finances to low-carbon and renewable energy projects.

This followed news from Poland, one of the world’s top coal-producing countries, that the state-owned bank PKO BP had adopted a coal policy in 2020 that rules out financing new coal and lignite mines and coal plants. The policy also commits Poland’s largest bank to a gradual reduction in financial support for existing companies in the coal sector but does not set absolute targets for reductions.

Leadership in the Transition to Clean Energy

NTPC is contributing to the Indian government’s long-term ambition to reduce thermal coal imports towards zero. It has managed to drastically reduce thermal coal imports from 9.7 million tonnes (mt) in FY2015/16 to 2.8mt in FY2019/20 by increasing its own annual inhouse coal mining capacity to 16.8mt in 2019/20.

Expensive energy imports are detrimental to India’s trade account deficit, undermining the currency, boosting inflation and hence interest rates, and weakening energy security.

Prudent planning and investment for emission-control implementation is another key area in which NTPC is setting an example for India’s other thermal power operators to follow.

In FY2019/20, NTPC placed orders for implementing emission-control systems for 25.8GW of its coal-fired capacity. This will make NTPC’s entire coal-fired power fleet compliant with environmental regulation norms.

Even as renewable energy delivers all the incremental electricity demand growth of India in the coming decade, thermal power will remain a key part of India’s energy mix, increasingly relied upon for peaking power supply. NTPC, with its financial and operational capabilities as well as its political clout, is one of the last entities in India that can still procure sufficient capital access to risk building new coal-fired capacity amidst the ongoing distress and loss of competitiveness in the thermal power sector.

Even so, the company’s focus on more renewables, particularly its intention to build an ultra-mega solar park in Gujarat, will be a major facilitator of India’s electricity sector transition. NTPC’s target of 32GW of renewables by 2032 represents a material component of India’s overall clean energy target, driving both deflation and progressive decarbonisation while working to reduce air pollution and water scarcity pressures, as well as providing a much-needed clean energy investment and job stimulus as India starts to recover from COVID-19.

Kashish Shah is a Research Analyst at IEEFA.

This commentary first appeared in ET Energyworld.