IEEFA India: Scaling up rooftop solar finance

India has set a target of 40 gigawatts (GW) of rooftop solar by 2022.

As of 30 June, 2021 India had 7.7GW of installed rooftop solar capacity. The commercial and industrial (C&I) sector accounts for about 75% of the total rooftop solar installations in India and accessible financing is a prerequisite to drive growth in the C&I rooftop solar market.

The C&I sector is set to drive future growth in the rooftop solar market as it is becoming increasingly economical for businesses to draw power from their own installations rather than the grid.

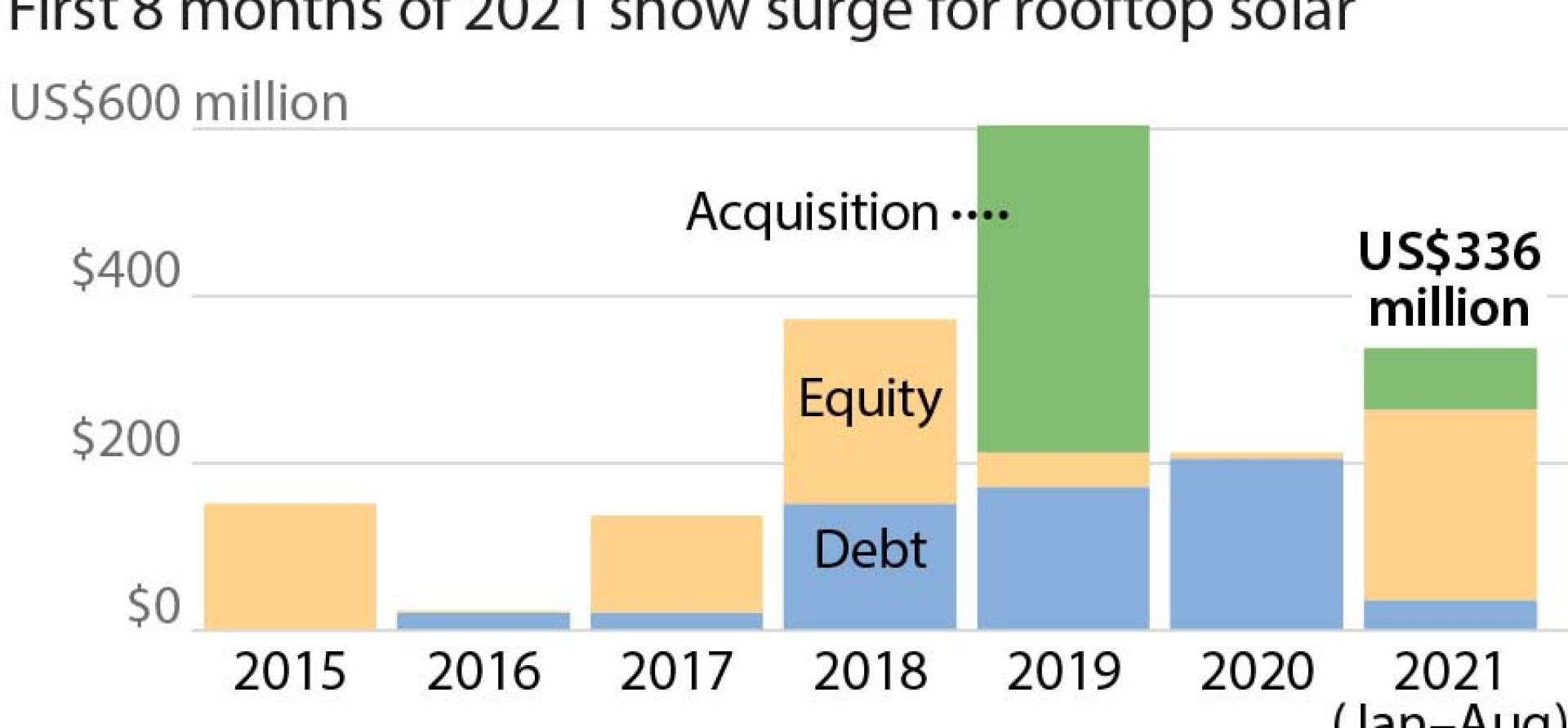

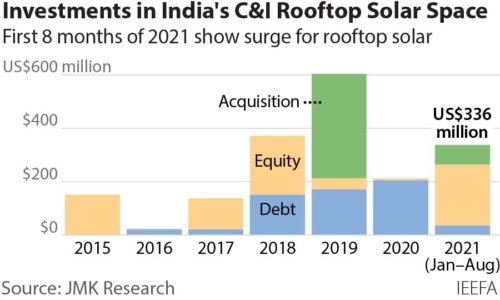

2021 witnessed a sudden surge in investments in the C&I rooftop solar space. Pandemic times have steered customers’ transition to rooftop solar due to the increasing need to optimise their power purchase costs. About 45% of the US$2 billion investments were raised in the first eight months, indicating a significant growth trend ahead.

In earlier years, raising finance was a big challenge. Banks were reluctant to finance rooftop solar projects, for which the technology was nascent. Non-banking financing companies (NBFCs) offered loans with high interest rates, making rooftop solar an unviable option.

Access to finance is still a big bottleneck, especially for micro, small and medium-sized enterprises (MSMEs). Lack of creditworthiness, lack of collateral and long-term uncertainty (both regulatory and policy) are among the barriers to the growth of rooftop solar installations by MSMEs.

Project developers’ main sources of funds for rooftop solar installations are: equity investments; debt capital; mergers & acquisitions; and loans or concessional credit lines. Since 2015, rooftop solar project developers have raised more than US$2 billion, 48% (US$985 million) of which came from equity funding and 29% (US$599 million) from debt.

In earlier years, banks were reluctant to finance rooftop solar projects, for which the technology was nascent

Almost all (99%) of equity investments in this sector came from foreign entities looking to tap the Indian market, given the high growth potential and healthy return on equity (ROE). The investors can own as much as a 100% stake in such projects, which is not possible in other countries.

Further, the investments have been limited to few major players (Fourth Partner, Amplus, CleanMax, Cleantech, Amp Energy) with sizeable portfolios, bankable track records and the distribution of portfolios across different states in India, which reduces risks for investors.

Innovative financing models need to be developed to facilitate rooftop solar adoption especially in the MSME segment. Such models supported by Ministry of New and Renewable Energy (MNRE) and Ministry of Micro, Small and Medium-sized Enterprises (MSME) could lead to extensive adoption of solar in this segment.

Development agencies are tapping the market via nationalised banks and NBFCs to improve access to affordable financing options, while promoting clean energy. The US$625 million World Bank-State Bank of India (SBI) credit line and the Green Climate Fund (GCF)-Tata Cleantech credit lines specifically target India’s rooftop solar sector.

Development agencies tap nationalised banks and NBFCs to improve access to affordable finance and promote clean energy

To facilitate rooftop solar adoption in the MSME segment, NBFCs and funds have formed strategic partnerships to develop and scale commercial rooftop solar finance solutions. Among the funds aiming to aid rooftop solar adoption in the MSME segment are the Tata Power-SIDBI tie-up and the US$41 million loan portfolio guarantee by the U.S. International Development Finance Corporation (DFC) and the U.S. Agency for International Development (USAID).

First-Loss Financing Arrangements and Risk Absorption Funds are other avenues. The MSME sector, via SBI’s current rooftop solar lending portfolio, can leverage concessional debt and fulfil India’s ambitious target for large-scale implementation of rooftop solar. The World Bank is working with the Ministry of MSME to bring in a credit guarantee mechanism catering to enterprises seeking to reduce their long-term energy expenses by investing in rooftop solar.

To accelerate rooftop solar installation and access to finance and to make this sector a viable and attractive proposition for investors, these measures need to be undertaken.

- Primarily, avoid regulatory flipflop. State regulations need to be consistent and should be implemented with a long-term perspective, reflecting the interests of all stakeholders and not stifling the sector when it starts picking up pace.

- Frame favourable state policies, which will lead to broader adoption.

- Encourage distribution companies (discoms) to participate in rooftop solar via the operating expenditure (OPEX) financing route. Discoms can offer lease or power purchase agreement (PPA) services at a lower cost than the private sector because of synergies in marketing, sales operations and a large customer base, which can lower customer acquisition costs.

- Explore alternative arrangements for disbursing unutilised concessional credit lines, among them introducing new implementing agencies or financial intermediaries to channel the low-cost funding available to the C&I segment.

- Aggregate smaller-sized rooftop solar projects. Smaller projects find it difficult to get access to affordable financing by virtue of their size.

- Streamline the loan disbursal process and improve equipment quality. This will mean projects become more credible for investors.

By Vibhuti Garg, Economist and Lead India at the Institute for Energy Economics and Financial Analysis (IEEFA).

This article first appeared in RenewableWatch.

Related articles:

IEEFA/Ember India: Uttar Pradesh is at a crossroads in its electricity transition

IEEFA: Agrivoltaics – how India can combine solar power and farmland

IEEFA: Innovative financing can help India achieve its renewable energy goals