IEEFA Europe: As risks mount, Poland’s PGE struggles to break from its fossil fuel past

The extreme case of Poland’s largest utility, PGE, shows how Europe’s more coal-intensive power companies are struggling to turn away from fossil fuels.

Headwinds facing fossil fuel electricity generation in Europe include the global transition toward low-carbon energy sources, pressure on investors to align their investments accordingly, and environmental advocacy opposing bank financing of coal companies.

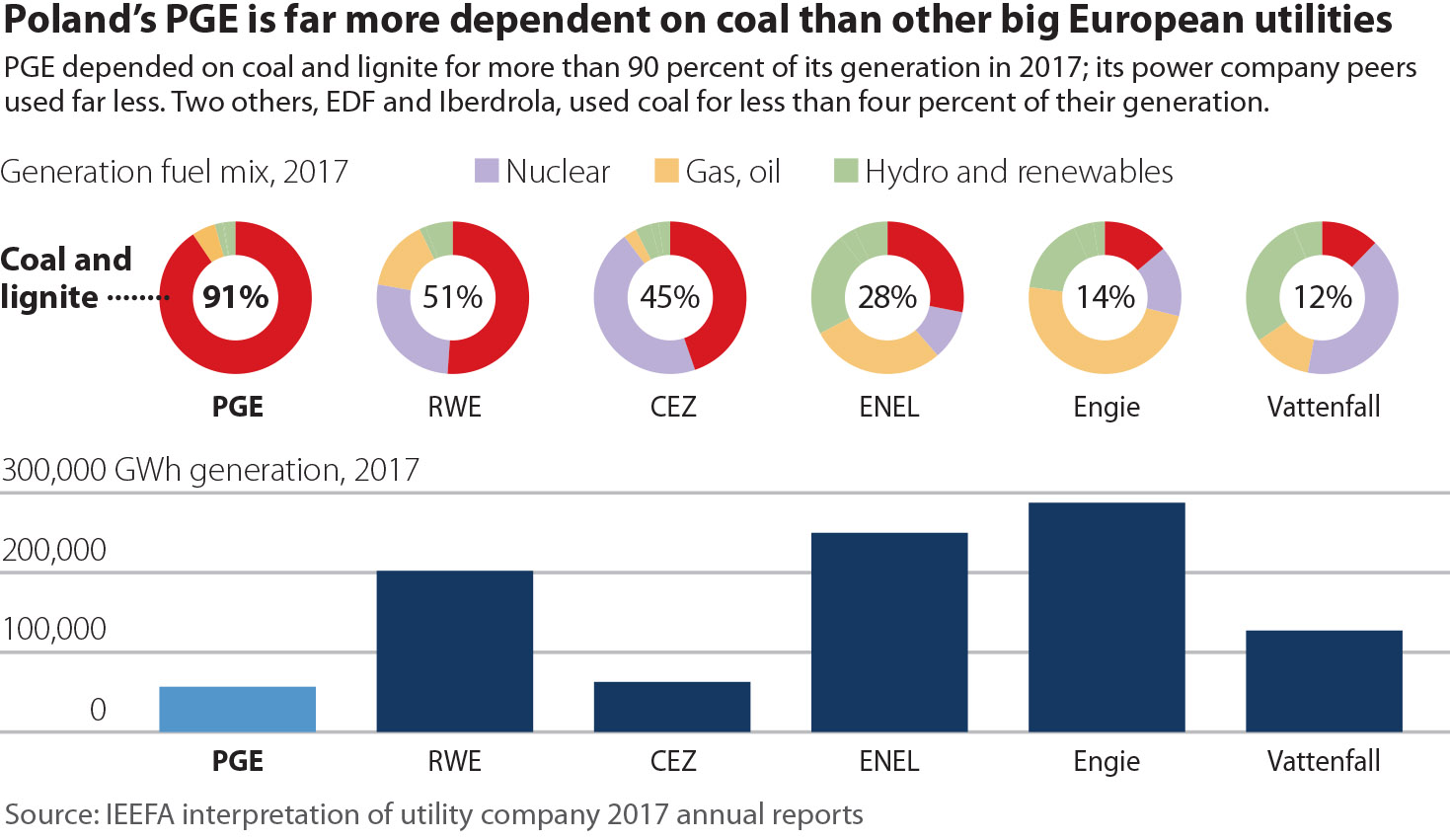

PGE is one of Europe’s most coal-intensive utilities; hard coal and brown coal (lignite) account for more than 90% of its generation (see the chart below based on a report we published yesterday: “Why a High-Risk, Fossil-Heavy Strategy Doesn’t Add Up”).

PGE has made some green noise lately, for example, to “embrace wind power.” In its latest annual report, the company lists a host of ideas and new technologies that it says are on the table, including “energy warehouses, electromobility, car sharing, bike sharing, construction of charging stations, LNG, diffuse energy sources, development of coal gasification installations, photovoltaics, intelligent home solutions, natural gas and demand management,” as well as nuclear power and offshore wind.

THAT SAID, THE NOTION THAT THE COMPANY IS ACTUALLY CHANGING DIRECTION IS BELIED BY ITS ACTIONS, and PGE’s real strategy is to dominate Poland’s power and heating sectors by doubling down on coal. At present, it is building three new coal power plant units, extending the life of its existing coal plants to make them compliant with new European air pollution regulations, and acquiring the coal generation assets of its rivals.

In 2017, the company spent PLN 4.3 billion acquiring the Polish assets of the French utility conglomerate EDF; PLN 2.8 billion in capital expenditures (capex) building new coal plants; PLN 0.6 billion in capex upgrading existing coal plants; and PLN 0.08 billion in capex on renewable energy (down 44% from 2016).

Last year, the company increased the capacity of its coal power plants by 65% and its coal-fired combined heat and power (CHP) plant capacity by 232% while increasing its renewable energy capacity by less than 3%.

These metrics don’t indicate a company “embracing wind power.”

In the report we published yesterday, we dug into the financial hazards of PGE’s coal-centric strategy and found that by increasing its coal dependency, PGE will also be increasing its exposure to carbon and air pollution risks largely out of its control, which may in turn make it difficult to compete in Poland’s new capacity market, a further risk to its financial stability.

Regarding air pollution risks, we estimated that making its existing coal power plants compliant with new EU emissions limits, which are known as BREF, would increase the utility’s coal generation costs by around 10%. Regarding carbon costs, we noted a more than trebling in European carbon prices over the last 12 months, with further rises expected.

These rising costs may make it more difficult for PGE to compete in Poland’s new capacity market, just as major coal-plant upgrades and new-build and acquisition programs create greater urgency to secure such capacity payments. Our findings echo warnings from rating agencies that failure by PGE to win capacity contracts would threaten its credit ratings, given the company’s capex plans and rising level of net debt. Should PGE fail to secure timely, long-lasting, reliable and appropriately sized capacity payments, the financial consequences could be dire.

Sinking more money into a coal-fired fleet will only lead to an increasingly costly capital expenditure spiral.

We combined these estimated costs and capacity market risks in a “hurry versus wait” analysis, comparing two scenarios in a stylized thought experiment, where PGE would choose either to “hurry” to an immediate shift to 100% renewables or “wait,” maintaining its present fossil fuel-heavy energy mix.

WE FOUND THAT EVEN UNDER THE MOST FAVORABLE (AND HIGHLY UNREALISTIC) CONDITIONS, INCLUDING zero growth in carbon prices and nearly 30 years of continuous capacity payments, the present value of cumulative carbon costs outweigh capacity market revenues at PGE by more than two to one.

Under this set of assumptions, the fossil-fuel-heavy “wait” scenario would be €3 billion more costly to PGE and its investors than an overnight switch to renewables.

These two scenarios are designed to be extremes, and a practical solution lies somewhere in between. At present, PGE’s fossil-heavy strategy risks leading the company into a vicious circle, sinking capital into coal plants to collect capacity payments, and to pay for carbon emissions. We have shown that it would cost less (in present value terms) for PGE to switch to a majority-renewables portfolio, while also reducing the company’s environmental regulatory risks.

PGE’s recent public statements suggest that it understands the importance of going green for investors, but its actions to date are still rooted in the past.

Gerard Wynn is an IEEFA energy finance consultant ([email protected]).

RELATED ITEMS:

IEEFA update: Heartland U.S. utilities continue to move away from coal

IEEFA op-ed: Japan remains mostly stuck in the energy policy past