IEEFA Australia: No amount of government subsidies can halt decline of gas

Key Findings

The economics of power production in Australia are changing rapidly. Coal and gas cannot compete against renewables.

Trading partners are rapidly adopting firm and ambitious goals towards net-zero emissions.

The rapid advance of technology is having greater effect in reducing emissions than political commitments, with renewables superseding gas in key sectors of demand, domestic heating and cooking, and electricity generation

Today, the early closure of Yallourn coal-fired power station in Victoria was announced. The closure is four years earlier than anticipated and points to the rapidly changing economics of power production in Australia.

The closure of Yallourn coal-fired power station is four years earlier than anticipated

Put simply, coal and the more expensive gas can’t compete against cheaper renewables.

EnergyAustralia announced Yallourn will be replaced with a 350 megawatt (MW) "giant battery" to be completed by 2026, with four hours' storage. Batteries are replacing coal, not gas.

And yesterday it was discovered the Australian Government had turned to Boston Consulting Group to design a plan to dole out hundreds of millions of dollars in gas-fired recovery money.

These generous subsidies, however distributed, will fall on an industry in decline that will not stimulate the economy.

Falling wholesale electricity cost are stranding gas-fired power assets

The rise of cheap renewable energy has put pressure on wholesale electricity prices.

Future prices for baseload electricity in Victoria plummeted this past year, falling from more than $80 per megawatt-hour in March 2020 to $24 in March 2021.

Gas simply can’t compete at such low prices.

Net zero commitments are changing export markets

As Australia drags the chain on climate change commitments and has only sparse plans to reduce emissions, its trading partners are rapidly adopting firm and ambitious goals.

High greenhouse gas emitting methane does not sit well with net zero emissions

There is a stark and growing realisation that the gas (and pipeline) industry has been under-reporting its emissions with gas in fact being a high greenhouse gas emitting fuel that is worse for the climate than coal in the short term.

It is early days in what exactly this means but it is clear that, over the next decade, gas will have to be phased out of most of its uses.

Gas industry is being squeezed globally

In Europe, a taxonomy has been introduced that effectively means gas plants can no longer be built for power generation. (A taxonomy is a classification system that provides definitions to companies, investors and policy makers on which activities can be considered environmentally sustainable.) The European taxonomy may well be adopted globally.

A system of carbon tariffs is also being introduced in the U.S. and Europe.

The British utility Drax has scrapped plans to build the UK's largest gas-fired generator in Yorkshire following fierce opposition from climate groups.

There is a renewed vigour on climate change policies by the U.S. that will drive global change. The Democrats have set an ambitious interim goal of 80% clean electricity by 2030 and 100% by 2035.

And China, the world’s fastest growing demand source for gas, is looking to go net-zero emissions by 2060.

Technology is usurping gas

However, perhaps what is more concrete than political commitments to lowering emissions is the rapid advance of technology.

Essentially, gas is being superseded in two of its key sectors of demand, domestic heating and cooking, and gas-powered electricity generation.

In Australia, it is cheaper to heat your home with a heat pump (electric air conditioner), more efficient to heat water with a heat pump system and to replace your stove with an induction cooktop. The gains in heat pumps’ efficiency are making gas uncompetitive as a domestic fuel source.

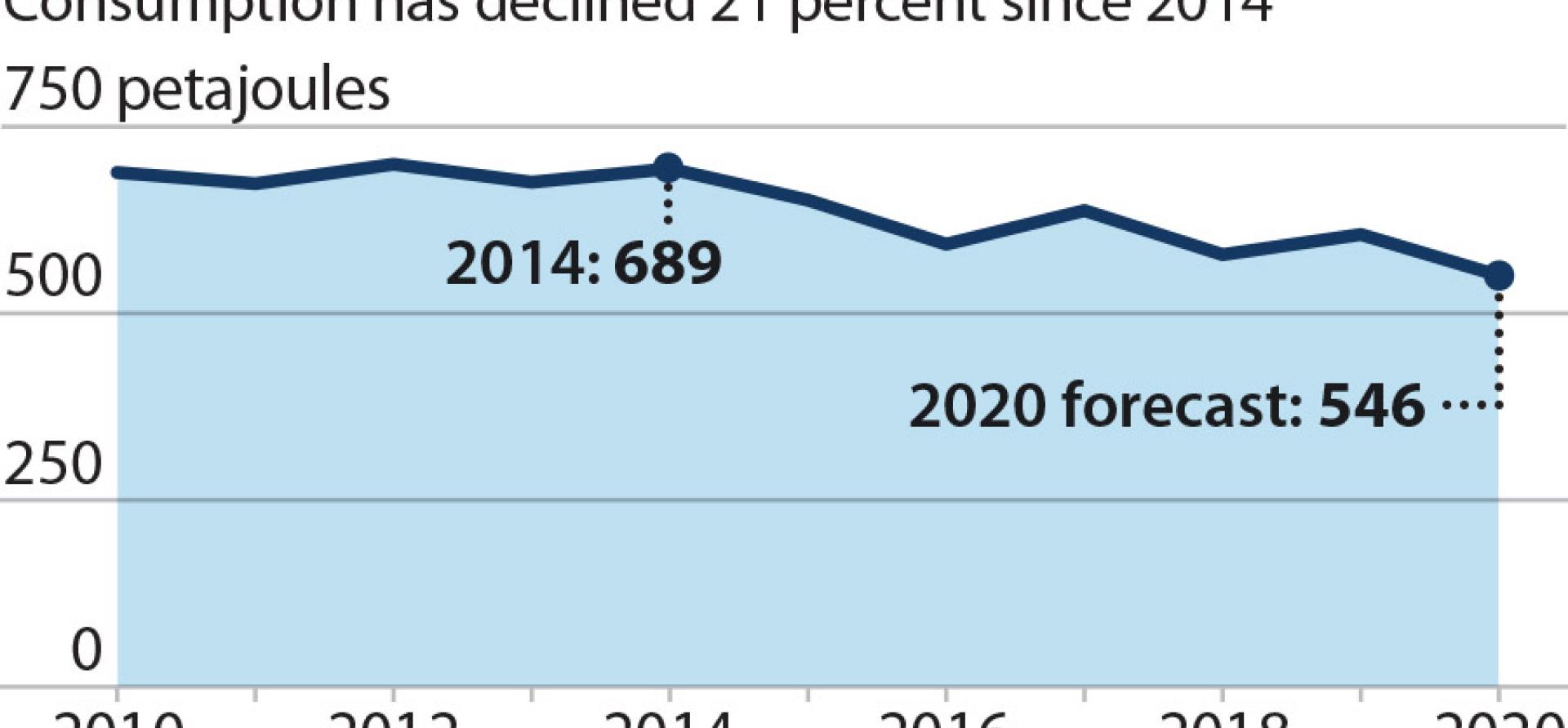

Australian gas consumption is down 21% since 2014, driven by the decline of gas powered generation.

Gas usage in gas-fired power plants is rapidly declining – by 58% since 2014, while renewables have increased to produce 28% of the energy in the National Electricity Market. Essentially, as renewables have increased, gas usage has decreased.

Gas is not serving as a transition fuel, rather it is a fuel exiting the energy system

Gas’s demise as a fuel for electricity generation is being hastened by the rise of grid scale batteries. Batteries reached a tipping point some time before September 2020 when the decline in their cost suddenly made them competitive as a substitute for gas peaking plants.

Batteries reached a tipping point some time before September 2020

A rash of grid scale battery projects has ensued.

At the time it was built, the Hornsdale Big Battery in South Australia was the largest grid scale battery in the world at 100MW/129 MWh. It has since been expanded to 150MW/193MWh.

Since November 2020 there has been a flood of new battery projects proposed for Australia, totalling 3000MW. The largest is CEP Energy’s 1200MW plant in the Hunter Valley, some 12 times the size of the Tesla big battery in South Australia.

Vastly different to the lengthy gas infrastructure development timeline, batteries are fast to deploy. Neon’s 300MW facility, announced in November 2020, has already reached financial close and will be operational by the end of 2021.

All of the large, proposed battery projects have land and connection points to the grid, making their realisation more likely.

In the short term, big grid-scale batteries will not entirely replace gas. They will however take the cream out of the market and crimp gas’s profitability and usage.

Technology will ultimately decide gas’s fate

With gas on the way out and batteries picking up the load, it is highly unlikely that any gas-fired power plants will be built by the private sector in Australia ever again.

Politics, emission targets, carbon prices and taxes will all play a big part in gas’s decline as a fuel source globally but technology ultimately will seal its fate.

As with all technological disruptions, these usually occur faster and are far more brutal than even their most ardent proponents expect.

Engaging consultants may appear to place the government at arm's-length from its gas-fired subsidy scheme.

The markets, however, are telling Australians that it is wasted money on a declining industry.

* AEMO. Natural Electricity & Gas Forecasting.

This commentary first appeared in RenewEconomy.

Related articles: