Woodside’s Browse gas play: risky and redundant

High cost, high emissions, uncompetitive and unnecessary

Key Takeaways:

Woodside’s Browse gas project is unlikely to be competitive either domestically or internationally, based on IEEFA cost estimates.

Browse gas is likely four times more expensive than existing domestic gas and could depress industrial demand. Diverting cheaper LNG feedgas would be a better solution for Western Australia's energy security.

Browse LNG may struggle to find buyers in an oversupplied global market. Potentially 60% more expensive than Qatar's LNG, it is likely twice the price needed to unlock new demand in Asia through coal-to-gas switching.

The project's carbon-intensive gas and reliance on costly, unreliable carbon capture could push project costs up by about 9% and drive carbon prices higher for everyone.

12 November 2025 (IEEFA AUSTRALIA): Woodside Energy’s proposed Browse gas project, in ecologically sensitive waters off Western Australia, poses significant financial and environmental risks — with little evidence it is essential for energy security in Western Australia or Asia, warns a new report.

Despite being touted as a replacement for declining gas fields feeding the North West Shelf (NWS) liquefied natural gas (LNG) project, analysis from the Institute for Energy Economics and Financial Analysis (IEEFA) estimates Browse is likely too expensive to compete in both domestic and global energy markets, and could drive up gas prices across the state.

“After more than 50 years, Browse remains undeveloped for a reason — it’s complex, likely to be costly and faces an uncertain market outlook,” says Joshua Runciman, IEEFA’s Lead Gas Analyst. “Our analysis shows the project risks increasing costs for consumers, investors and the broader Australian economy while adding to national emissions.”

Too expensive for domestic and export markets

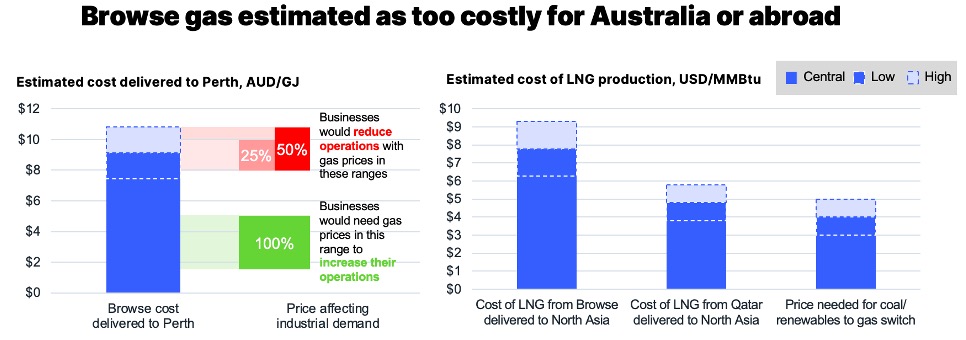

IEEFA estimates Browse gas will cost about AU$7.80 per gigajoule (GJ) to produce — rising to more than AU$9/GJ delivered to Perth. This is over four times the cost of existing domestic gas and on par with levels the Australian Energy Market Operator (AEMO) says would cause industrial users to reduce operations.

On international markets, Browse LNG is expected to cost about US$7.8 per million British thermal units (MMBtu) delivered to North Asia — roughly 60% higher than Qatar’s LNG, which already faces a growing surplus of unsold supply.

“Browse LNG may struggle to compete with lower-cost producers like Qatar,” says Mr Runciman. “It’s also likely to be far too expensive to displace coal in Asia, undermining claims that the project supports regional decarbonisation.”

The International Energy Agency (IEA) has found that LNG prices would need to fall to US$3–5/MMBtu to incentivise greater coal-to-gas switching – nearly half the estimated cost of Browse LNG.

High emissions, high costs

The Browse field contains about 10% CO₂ in its gas – far higher than many other fields. At peak production, the project could emit up to 6.8 million tonnes of CO₂ equivalent (MtCO₂e) a year, representing 3-4% of Australia’s total projected emissions in 2035.

Woodside plans to use carbon capture and storage (CCS) to offset some emissions. However, IEEFA has found that CCS technology remains expensive and unreliable. Chevron’s Gorgon CCS project, which is similar in scale, has captured less than half its target of CO₂.

IEEFA estimates the proposed CCS system for Browse could increase project costs by at least 9%, while residual reservoir emissions would still need to be offset with carbon credits — potentially putting upward pressure on carbon prices across the economy.

Not needed for energy security

WA already produces eight times more gas than it consumes domestically, with 3,350 petajoules (PJ) of production in 2024 compared with 418PJ of domestic supply. While AEMO projects potential shortfalls later in the decade, IEEFA finds these are small relative to total LNG exports, and could be addressed by redirecting a small portion of uncontracted LNG to local markets.

IEEFA also points to unmet domestic supply obligations under WA’s gas reservation policy –averaging just 8% instead of the required 15% of LNG production – as another area where government policy reform could ease domestic shortfalls.

“WA doesn’t need Browse to keep the lights on,” says Mr Runciman. “More effective use of existing gas, combined with renewables and electrification, would strengthen energy security without relying on what is likely to be an expensive new source of gas.”

Globally, LNG markets face a wave of new supply, with capacity expected to rise 60% by the early 2030s. The IEA projects that even under slow energy transition scenarios, existing and under-construction LNG projects will more than meet global demand to 2040 – leaving high-cost projects such as Browse potentially exposed to price collapses and stranded asset risks.

A risky and redundant project

IEEFA’s report concludes that the Browse development could increase domestic gas prices, raise Australia’s emissions, and fail to deliver the promised energy security benefits – creating more risk than reward for investors and the nation.

“Browse is a high-cost, high-emission project chasing a declining market,” says Mr Runciman. “It’s time to focus on affordable, clean energy solutions that deliver genuine long-term benefits for Western Australia and Australia.”

Read the report: Browse gas: Expensive, emissions-intensive, unnecessary

Media contact: Amy Leiper [email protected] +61 (0) 414 643 446

Author contacts: Joshua Runciman [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute's mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)