Private sector driving renewable energy wave in India

Climate change – witnessed increasingly in extreme weather events – is now the biggest risk threatening energy and financial markets, and vulnerable people and communities.

The International Panel on Climate Change (IPCC) Sixth Assessment Report, Climate Change 2021 warns that to maintain the trajectory of 1.5 degrees Celsius by 2040, immediate urgent action must be taken.

To mitigate this climate risk, India has set ambitious targets for renewable energy.

The government has recognised that free solar and wind energy, backed up by batteries, and other clean technologies such as electric vehicles and green hydrogen, are necessary alternatives to increasingly obsolete high emitting fossil fuel generation plants – coal, LNG and gas.

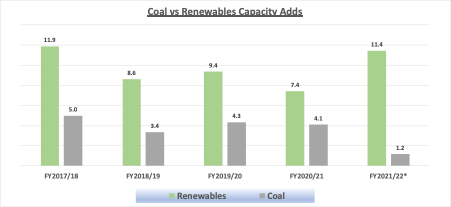

India’s energy supply growth is now being led by renewable energy capacity additions.

At COP26 in Glasgow, Prime Minister Narendra Modi announced 500 gigawatts (GW) of non-fossil fuel capacity and 50% of energy from renewable sources by 2030 coupled with a net zero target of 2070.

The response has been promising, and has brought forward increased competition in the traditionally coal-dominated energy market.

As a result, India’s energy supply growth is now being led by renewable energy capacity additions.

Figure 1: Capacity Additions of Coal vs Renewables in India 2017 – 2022

* Until January 2022

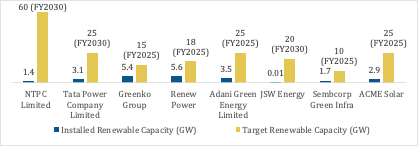

Further, that supply growth is being led by private sector players, despite initially being led by the public sector. Large power producers with coal constituting a large part of their portfolios, including Adani Group, Jindal and Tata Power, have announced big renewable energy targets and investment to match.

What caused the private sector to shift their focus to renewables?

India faced coal shortages from August to October 2021 which led to high prices at the power exchange. Then in January 2022 Indonesia announced a coal export ban. The crisis exposed price volatility and energy security risks for India, showing imported coal as an unreliable source of electricity generation that is heavily dependent on a long supply chain.

Imported coal is an unreliable source of electricity generation that depends on a long supply chain.

The largest business houses in the country responded by changing tack, turning their attention to cheaper, cleaner, reliable renewable energy. It shows economics are driving such decisions, coupled with the return on investment being much higher for renewable energy projects.

Globally, there has been significant global capital momentum away from thermal coal and coal-fired power generation in the last few years. In total, IEEFA has tracked 193 globally significant banks, insurers, and asset managers/owners that have implemented substantial formal coal exit policies since 2013. The year 2021 saw 51 new or updated policy statements.

This capital flow is a reflection of the rapidly diminishing economic merits of thermal coal and the growing understanding that alignment with the Paris Agreement and 1.5 degrees Celsius invariably leaves many coal projects as stranded assets, unable to deliver a viable return over their useful life. A flood of international capital is vying for renewable energy assets and the pool of economic, social and governance (ESG) led investors is growing rapidly.

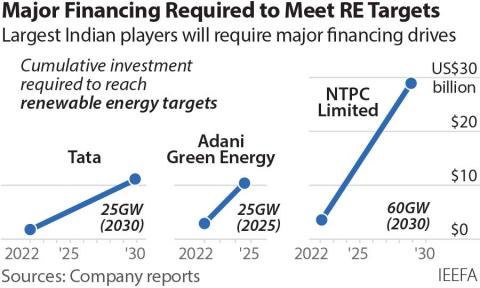

While India has the potential to attract a large part of this capital, the flows have not been sizeable to date due to concerns about “greenwashing” and the overhang of legacy thermal assets on the books of major players such as NTPC and Tata Power. That trajectory however is changing following recent big announcements for renewable energy deployment in the next few years.

In July 2021, Tata Power announced it would not build new coal-fired generation projects and is aiming for carbon neutrality by 2050. One week later JSW, another leading thermal power producer, announced 20GW of solar, wind and hydropower plants by March 2030 and an investment of Rs750 billion (US$10 billion) with the aim of also becoming carbon neutral by 2050.

Figure 2: Current and Target Renewable Capacity Of Major Sector Players

In fact, 2021 saw a sharp increase in renewable energy investment domestically and globally. India attracted about ~US$18.8 billion of that investment in renewable energy – three times the investment seen in 2020. Further, 2021 saw some big-ticket renewable energy investments by large private Indian companies.

| Company | Amount committed | To do what |

|---|---|---|

| Reliance | US$80 billion | By 2030-35, 100GW solar + giga factories for modules, fuel cells and storage |

| Adani | US$50 billion | By 2030, investment in renewables |

| ReNew Power | US$9 billion | By 2025, new solar and wind projects |

The share price performance of these companies indicates they are making the right moves by turning to renewables. Over a five-year period, Adani Green Energy Limited has risen massively by 6,000% and Reliance by 350% vis-à-vis a 110% rise in Sensex.

A focus on solar and green hydrogen

Private players are now building the ecosystem by increasing domestic manufacturing of solar modules, cells, wafers, and polysilicon, while reducing reliance on imports.

In October 2021, Reliance acquired REC Group of Norway for US$771 million. REC is a long-established solar module manufacturer with two facilities in Norway for making solar grade polysilicon and one in Singapore making PV cells and modules. Reliance has further invested US$29 million in German solar wafer manufacturer NexWafe GmbH and is entering a strategic partnership to commercialise NexWafe’s product in India.

Private players are now also betting big on green hydrogen (the only ‘renewable’ hydrogen) which will assist in decarbonising other sectors like refining, fertiliser, and steel.

Reliance has partnered with renewables pioneer Henrik Stiesdal to develop and manufacture hydrogen electrolysers. And Adani Group and Ballard Power Systems have joined hands to evaluate a joint investment in hydrogen fuel cells manufacturing in India. Green hydrogen is considered to be the fuel of the future and IEEFA notes fuel cell manufacturing will likely be a game-changer in India’s energy transition.

Private capital and power producers reeling under the burden of non-performing thermal assets are driving a course correction. Apart from the 30GW already under construction, no new thermal projects are likely to come online in India.

Renewable energy momentum is continuing and with the increasing competitiveness of ever-cheaper battery storage and unfolding new energy technologies, that momentum will likely escalate to a two-threefold increase in the growth of renewable energy by 2024.

This article was published by ET Energyworld.com.