Press release- New York State & City pension funds have been & will keep losing money on coal stocks and should sell them, report finds

STATE FUND ESTIMATED TO HAVE LOST MORE THAN $100 MILLION

Coal stocks have been and will continue to be a losing investment for New York State and City public pension funds, so the funds should sell those stocks, according to a new report by the Institute for Energy Economics and Financial Analysis. The report estimates that the State pension fund lost more than $100 million on its U.S. coal stocks over the last three years.

The report finds that:

- COAL STOCKS HAVE BEEN A LOSING INVESTMENT

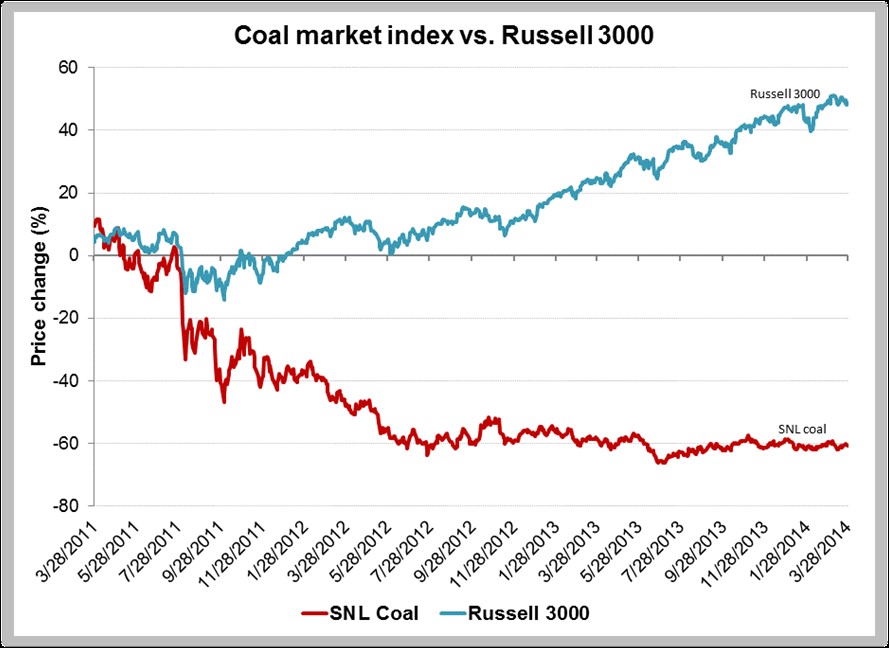

- In the past three years, U.S. coal stocks have declined by 61%, at a time when the stock market has increased by 47%.

- Peabody Energy, the world’s largest pure-play private sector coal company, has lost 74% of its value over the last three years.

- The New York State pension fund, which reports its holdings, has lost an estimated $108 million in share value since 2011 on the portfolio of the four largest U.S. coal stocks.

- The City funds, which do not publicly report individual stock holdings, probably had similar losses.

- COAL WILL CONTINUE TO BE A LOSING INVESTMENT IN THE FUTURE

- Despite the current recovery in the U.S. economy, coal companies continue to perform poorly, not sharing at all in the recovery.

- Goldman Sachs, a company with major holdings in the coal sector, has issued research showing that coal will continue to be a poor investment.

- The coal industry has no effective plan for a recovery. Exports and rising natural gas prices will be insufficient to lift coal stocks to a new period of sustained growth.

- Past success in preventing pollution controls and efforts to combat climate change have failed to prop up plummeting coal company fortunes.

- “Clean coal” continues to be a myth and the industry has developed no new technology to deal with its problems.

- On May 6, Stanford University announced it has decided to divest all coal stocks from its endowment, one of the largest of any college.

“The current position of the U.S. coal industry, and increasingly that of the world coal industry, is weak and the worst is yet to come, “ said Tom Sanzillo, Director of Finance of the Institute for Energy Economics and Financial Analysis. “New York’s pension funds owe it to both retirees and taxpayers to get out of coal and find profitable investments.”

“A prolonged decline in the coal markets at a time of a rising U.S. economy is stark and historically unique. Typically, as the economy heats up so does coal production and prices. What this decoupling suggests is that the U.S. economy is increasingly able to grow while burning less coal. And that will mean continued bad performance for coal company stocks,” Sanzillo said.

“These findings are relevant to every state,” said Richard Woo, CEO, The Russell Family Foundation, based in Gig Harbor, Washington. “Innovation in the coal sector hasn’t shown an ability to adequately address environmental concerns or stem deep financial losses. As a foundation committed to environmental sustainability and grassroots leadership, we recently divested ourselves of coal and joined others in the global initiative, Divest-Invest Philanthropy. We believe every state should invest in ideas that help people achieve progress in their communities while turning a profit. It’s good for local people, and it’s good for public investment funds.”

“One of the coal industry’s main strategies has been to defeat clean air legislation. The industry was instrumental in defeating climate legislation in Washington. Since then stock prices have plummeted,“ Sanzillo said.

A SUMMARY OF THE REPORT’S ANALYSIS AND FINDINGS

1. COAL’S ROLE IN GENERATING ELECTRIC POWER IS DECLINING RAPIDLY

- Most coal is used by utilities to generate electricity. The coal industry supplied 50% of the nation’s electricity as recently as 2003. Coal’s market share dropped to a historic low of 33% in April 2012. Despite a recent increase, some industry analysts estimate coals share will fall to 21% by 2038.

- Most coal-burning power plants are old and are not being replaced. By 2020, more than 70% of all existing coal-fired power plants will be more than 40 years old, and 36% will be more than 50 years old.

- Plans to replace the old plants have already failed. In 2005, the coal industry and the federal government launched an initiative to build 150 new coal plants. Due to changing market conditions and public opposition, those plants have not been built. In total, 182 proposed new plants, valued at $273 billion, have been canceled at various stages of development.

2. COAL STOCKS HAVE BEEN A BAD INVESTMENT

- In the past three years, U.S. coal stocks, including the nation’s leading companies – Peabody Energy, Alpha Natural Resources, Cloud Peak Energy and Arch Coal – have declined by 61%, while the Russell 3000 Index, the broad measure of the stock market, has increased by 47%. Peabody Energy, the world’s largest pure-play coal company, has lost 74% of its value over the last three years.

- Industry profits are down, 26 small coal producers have gone bankrupt, mine employment levels are on the decline, and Wall Street analysts are questioning coal’s future. Recently, Goldman Sachs (a company with major holdings in the coal sector) and Bernstein Research have published market research showing that the window for investors on thermal coal (coal for electricity plants) is closing. The metallurgical coal markets (coal for steel production) will be insufficiently robust to offset these losses.

3. THE COAL INDUSTRY HAS NO EFFECTIVE PLAN FOR THE FUTURE

- The industry’s opposition to clean air, clean water, mining health and safety, and efforts to combat climate change has proven profitable in the past. This political strategy is no longer working. The industry’s most significant recent political victory occurred with the defeat of a federal energy and climate bill in 2010. Despite this victory for the coal industry, stock prices for coal companies have since plummeted – at a time when the nation’s economy is recovering and the broader stock market has enjoyed robust growth.

- Efforts by the coal industry to step up coal exports from the U.S. are floundering on a weakened global market as China reduces coal demand and public opposition to air pollution grows.

- Natural gas prices will not increase enough to substantially increase the use of coal.

- Cost cutting and selling assets has not resulted in stronger companies. Instead, the industry is still burdened by high debt.

- The coal industry has a long reputation of failing to invest in innovation.

4. NEW YORK PENSION FUND HOLDINGS AND LOSSES

The New York State Common Retirement Fund publishes a listing of all of its equity holdings as of March 31 of every year. In its most recent report at the end of March 2013, the CRF held 2,469,125 shares of coal stocks in an overall portfolio valued at $161 billion. At that time, coal stocks represented one and one half hundredths of one percent of the Funds investment. Between April 2011 and April 2014, coal stocks in the Funds portfolio declined by an estimated $108 million.

The five New York City pension funds had a collective value of $147.91 billion as of October 31, 2013. They don’t disclose individual holdings, but it can be assumed that coal holdings are of a similar order of magnitude and so the funds would likely also have had losses.

Contact: David Neustadt, 917-671-6576, [email protected]

# # #