Optimizing solar incentives and grid infrastructure in Pakistan can benefit power distribution companies and energy consumers

Investing in the grid and addressing inefficiencies in the power sector are necessary for greater renewable energy adoption

August 21, 2024 (IEEFA Asia): As solar panel prices in Pakistan hit an all-time low, the rapid increase in rooftop solarization has sparked debates over current energy policies. A new report from the Institute for Energy Economics and Financial Analysis (IEEFA) explores the potential impacts of different policy scenarios, identifying strategies that could benefit both energy consumers and power distribution companies (DISCOs).

“With rapidly decreasing solar panel costs and rising consumer electricity tariffs, distributed solar photovoltaic (PV) systems in Pakistan are becoming increasingly cost-effective,” says Haneea Isaad, an Energy Finance Specialist at IEEFA.

However, the recent surge in net-metered rooftop solar PV capacity has raised concerns among DISCOs about system reliability and increased capacity payments for non-net-metered consumers.

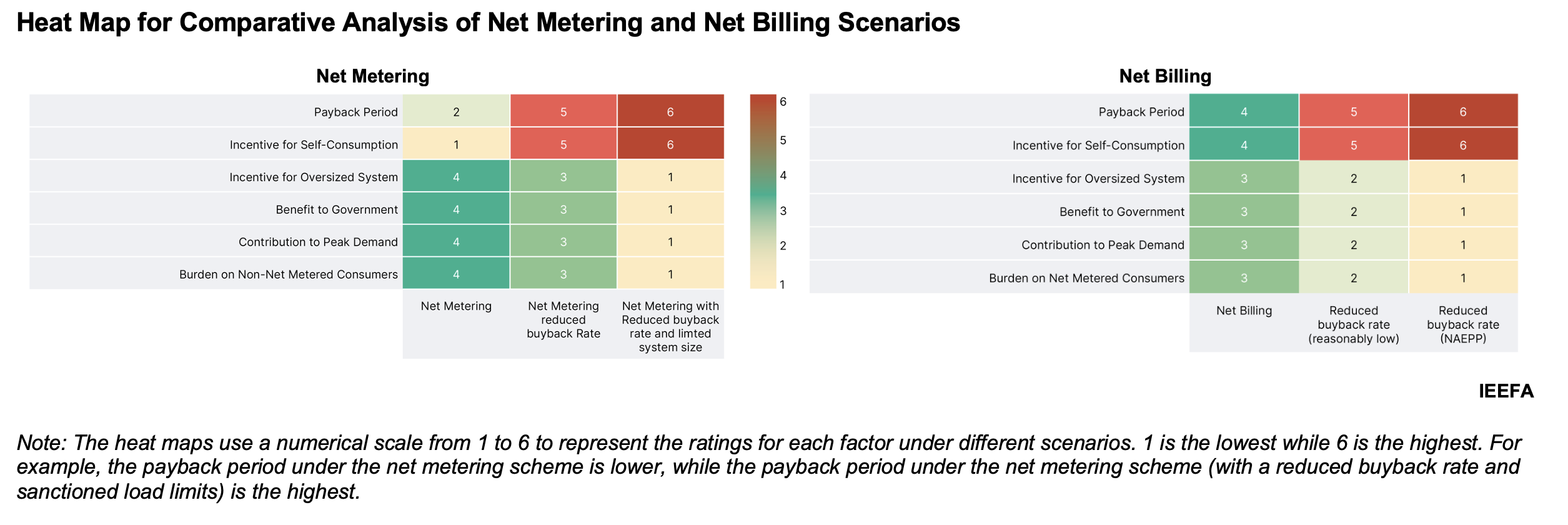

The government is currently considering several changes, including reducing buyback rates, and transitioning from net metering to net billing. Other proposed measures include creating a separate tariff category for net-metered consumers and limiting their system size allowance.

“Our report shows that a moderate reduction in buyback rates could provide relief to DISCOs while still encouraging self-consumption,” says Isaad. “The timing of these policy changes is crucial. While a revised policy with reduced incentives could be implemented immediately for new installers, a gradual phase-out of the current policy every quarter would offer a transitional period for both new and existing net metering beneficiaries.”

“We recommend that consumers select the appropriate system size for their consumption needs, as this can significantly impact their return on investment. In addition, the government can optimize both the buyback rates and the grid system to promote further renewable energy adoption,” says Syed Faizan Ali Shah, the report co-author and an energy expert.

Optimizing the net billing mechanism

Pakistan’s current net metering policy allows solar energy system owners to receive credit for the electricity they contribute to the grid, with a unit-for-unit adjustment during off-peak hours. However, a shift to net billing would remove this off-peak adjustment, introducing separate tariffs for electricity imports from and exports to the grid.

The country’s current Distributed Generation and Net Metering Regulations were first adopted by the National Electric Regulatory Authority (NEPRA) in September 2015. The regulations created the framework for the successful adoption of distributed renewable energy in the country, with approximately 2.2 gigawatts (GW) of net-metered rooftop solar PV capacity connected to the grid by June 2024.

Under the current net metering regulations, excess energy generated from net-metered solar systems can be sold back to the grid at the National Average Power Purchase Price (NAPPP), which reflects the average cost per unit of power purchased by the DISCOs.

Under the current value of NAPPP, an attractive PKR27/kWh, the relatively higher per kilowatt (kW) cost of smaller 5kW and 7.5kW systems results in longer payback periods ranging between 2.4-4 years. As the system size increases, the payback period decreases, with a 25kW system recording the lowest payback period of 1.74 years.

“This report shows that lowering the buyback rate to PKR15/kWh would still offer reasonable payback periods, under five years, for most cases. It would only extend the payback period of consumers with 100% self-consumption by 6%,” says Shah.

The report finds that net metering remains particularly advantageous for average-sized systems, such as a typical 10kW installation, especially for consumers who utilize a higher share of generated output.

A proposed shift to net billing could lengthen payback periods for consumers with a higher self-consumption ratio, but it may also encourage the installation of oversized systems as consumers seek to maximize returns and minimize payback periods.

“Combining a reduced system limit with a net billing regime could discourage the installation of oversized systems while promoting the shift toward hybrid systems with battery energy storage,” says Isaad.

The report also examines the impact of reducing the system size for distributed generators to 80% of the sanctioned load.

“This results in a longer payback period compared to the standard net metering mechanism. The increase is most pronounced under the net billing scheme. However, limiting the system size could encourage a shift towards battery-based hybrid systems, offering greater autonomy from the grid and increased self-reliance,” says Shah.

Current regulations in Pakistan offer lucrative buyback rates for net-metered solar energy system owners, allowing them to earn credit for their grid contributions during daylight hours, along with favorable payback periods for their investments. Additionally, with solar panels constituting about 40% of the total cost of rooftop solar PV systems, the recent price drop in Chinese solar panels has further fueled solar PV growth in Pakistan.

However, a lack of programs supporting small and medium-sized consumers has led to distributed solar adoption being concentrated among the more affluent sections of society.

“This concentration of surplus power adjustment in a few distribution transformers increases the risk of overloading. Restricting system size could ensure a more equitable distribution of solarization and protect the distribution infrastructure,” says Isaad.

The report also examines case studies in Vietnam and Australia, demonstrating that gradually phasing out incentives is common practice for integrating new technologies worldwide.

“Recently, Vietnam’s Ministry of Industry and Trade proposed a new net metering scheme for rooftop solar. Under the new scheme, the government would offer a VND 671 ($0.026)/kWh tariff for surplus solar power. The policy stipulates that any excess PV energy sold to the grid cannot exceed 10% of the total power generated by a rooftop PV installation. This effectively curtails the incentive for oversized installations and promotes a great focus on self-consumption,” adds Isaad.

In the long term, the report recommends greater investment in performance monitoring systems to enhance real-time oversight of the distribution infrastructure. For consumers, achieving self-sufficiency in electricity generation should be the ultimate goal. IEEFA recommends a shift toward battery energy storage solutions, particularly as policy incentives for net metering are gradually phased out.

Read the report: The Future of Net-Metered Solar Power in Pakistan

Author contacts:

Haneea Isaad ([email protected])

Syed Faizan Ali Shah ([email protected])

Media contact: Alex Yu ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)