Increased battery energy storage system (BESS) adoption presents opportunities for grid modernization and system planning in Pakistan

Rapid solarization and accelerating BESS adoption require strategic policies and infrastructure development

A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) highlights that Pakistan's rapid adoption of Battery Energy Storage Systems (BESS) offers a key opportunity to strengthen the national grid by enabling decentralized battery storage through infrastructure upgrades, optimized tariffs, improved governance, and greater system efficiency.

According to report authors Haneea Isaad (Energy Finance Specialist at IEEFA, Pakistan) and Syed Faizan Ali Shah (a renewable energy and power systems expert), the convergence of rising energy prices and falling costs for Distributed Energy Resources (DER), such as rooftop solar photovoltaic (PV) systems and BESS, has encouraged consumers to adopt decentralized energy solutions.

“Pakistan is leading a solar revolution, with 17 gigawatts (GW) of solar-based capacity deployed across both distributed and utility-scale levels. Integrating BESS to these systems is the next logical step, especially in decentralized, behind-the-meter applications,” says Isaad.

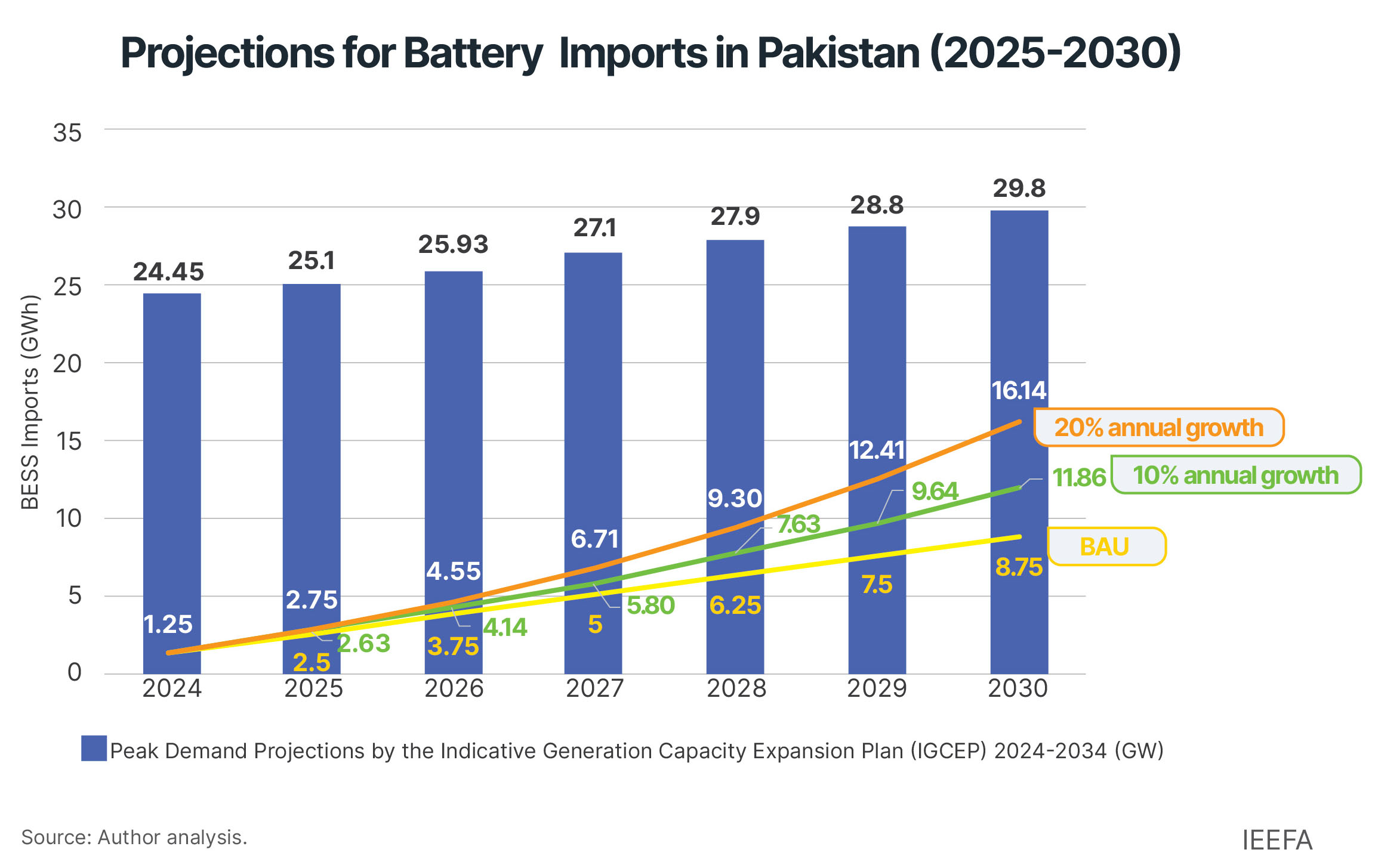

Pakistan imported approximately 1.25 gigawatt-hours (GWh) of BESS in 2024 and another 400 megawatt-hours (MWh) in January and February 2025.

IEEFA estimates that BESS imports could reach 8.75GWh by 2030 if current trends continue, and annual additions of BESS remain leveled at 1.25GWh. However, the rapid increase of solarization and generation capacity also presents significant challenges.

The report contains financial simulations to estimate the payback period for residential, commercial, and industrial BESS configurations and assesses how the potential trend of consumers exiting the grid on a large scale may reshape Pakistan’s energy sector dynamics.

Fast-growing BESS and potential grid defection

BESS has become vital for energy independence and resilience across Pakistan’s residential, commercial, and industrial sectors. These systems help reduce peak load and energy costs, improve reliability and power quality, and support peak demand management.

Despite high taxes and customs duties that add almost 50% to BESS costs, the solar-BESS combination still offers shorter payback periods of 3-6 years across all sectors.

“BESS stores cheap electricity produced during the day and discharges it during the evening peak. Its inherent peak shaving capabilities help flatten the evening peak demand, thereby reducing the need to ramp up fossil fuel-based plants,” says Isaad.

Isaad adds that this could lead to the underutilization of expensive liquified natural gas (LNG) peaking plants, which are locked into the grid for the next 23-28 years, further reinforcing Pakistan’s surplus LNG dilemma. The country had to defer its LNG agreement with Qatar for 2025 and delay deliveries until 2026 due to low utilization of LNG-based power plants, the main off-taker for contracted LNG.

As the government considers eliminating incentives provided to net-metered consumers to slow the pace of solar PV additions, consumers may be motivated to add BESS to existing solar PV setups. This may further reduce consumer reliance on the grid and drive consumers away from the grid altogether.

“Due to contractual obligations resulting from long-term power purchase agreements, the exit of paying consumers from the grid leads to an increase in fixed costs or capacity payments for those that remain on the grid,” says Shah.

Energy stored in and dispatched by BESS can permanently reduce grid demand, potentially reaching 11.5 terawatt-hours (TWh), or 8.4% of the actual 2024 electrical demand from the grid annually, depending on the rate of BESS addition to existing solar PV installations.

The authors suggest that the government should carefully assess new capacity additions and shift contracts to a ‘take and pay’ basis so utilities only pay for actual energy purchased from plants. This would prevent peaking plants from becoming stranded assets.

Grid modernization for successful DER integration

Diverse DER locations and the increasing energy feedback from solar PV systems across major load centers have created issues such as reverse power flow and negative loading on distribution transformers in feeders with excessive rooftop solarization.

“Successfully integrating DER requires hosting capacity analysis in the distribution network. We recommend the widespread adoption of smart meters, consumer and transformer monitoring systems, and feeder-level automation and modernization to support this integration,” says Shah.

A cohesive Information and Communications Technology (ICT) strategy to enhance data collection and communications is also needed to improve distribution system planning with a bottom-up load forecasting approach, which could more accurately reflect localized demand dynamics.

“This method allows for granular insight into consumption patterns, the impact of DERs, and local constraints, which are often overlooked in top-down forecasting methods. A more realistic estimation of future capacity requirements helps avoid over-procurement or underutilized infrastructure investments,” says Isaad.

Read the report: Battery storage and the future of Pakistan's electricity grid

Author contacts:

Haneea Isaad ([email protected])

Syed Faizan Ali Shah ([email protected])

Media contact: Josielyn Manuel ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)