IEEFA: These 7 auctions show India’s renewables sector is still primed for growth

22 September 2020 (IEEFA India): While the pace of renewable energy growth has slowed in India, positive outcomes in recent auctions suggest there remains plenty of appetite among domestic and foreign investors to build renewable infrastructure, according to a new IEEFA briefing note.

Policy-related headwinds and a collapse in electricity demand due to the COVID-19 crisis have disrupted India’s renewable energy capacity tendering and commissioning process.

But despite these setbacks, renewables are proving resilient with investment capital available for new projects with favourable risk-return profiles, says author Kashish Shah, Research Analyst at the Institute for Energy Economics and Financial Analysis (IEEFA).

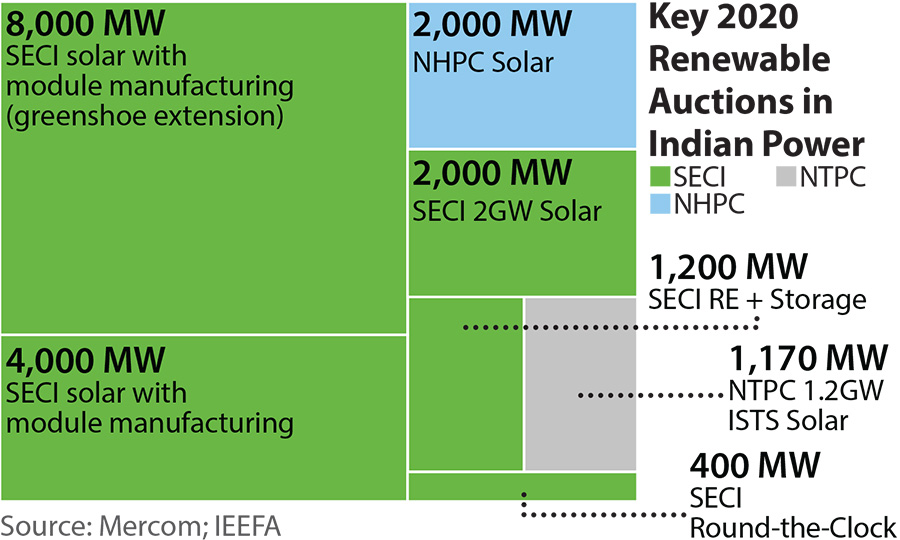

IEEFA’s note looked at the outcomes of seven renewable energy capacity and storage auctions held to-date in 2020. It found that together they attracted some US$10-20bn of investment commitments, despite the pandemic.

The note points to the Solar Energy Corporation of India’s (SECI) 2 gigawatt (2GW) solar auction in June as a particular highlight. It delivered India’s lowest-yet renewable energy tariff at Rs2.36/kWh (US$31/MWh) with zero indexation for 25 years.

Developers from around the world secured winning bids: Solarpack (Spain); Enel (Italy); Amp Energy (Canada); Eden Renewables (France); IB Vogt (Germany); Ayana Renewable Power (backed by the UK’s CDC Group); and ReNew Power (Indian, but backed by Abu Dhabi’s ADIA, Canada’s CPPIB, Japan’s JERA and the U.S.’s Goldman Sachs).

THE RECORD-LOW SOLAR TARIFFS ACHIEVED IN SECI’S JUNE AUCTION REFLECT 15% YEAR-ON-YEAR DEFLATION IN SOLAR MODULE PRICES.

“The cost competitiveness and continuing price deflation of renewable sources makes them a more viable energy generator than many existing thermal power plants, and all new import power plants,” says Shah.

“Domestic and global investors are sitting up and taking notice of declining renewables prices plus the clear government policy alignment and ambition, and this is reflected in the very positive results of these recent auctions.”

Near-term falling electricity demand is hitting India’s power distribution companies (discoms), exacerbating structural and financial issues in the sector.

By July 2020 the state-owned discoms had accumulated total overdue payment liabilities of Rs116,864 crore (US$15bn) to power generators across India, creating a massive liquidity crunch in the sector.

“The discoms are reluctant to sign even exceptionally low-cost new power purchase agreements (PPAs) when demand has collapsed and they are already locked into high capacity charges on legacy coal power supply agreements,” says Shah.

“SECI has been struggling to sign PPAs with discoms for its already auctioned 6GW of renewable energy capacity.

“The biggest loser from the collapse in electricity demand will be the thermal power sector, with its high marginal cost of production and lack of flexibility.

“The encouraging results of these auctions demonstrate strong investor interest in renewables in an extremely tough economic environment.

“At the moment there is more capital available than opportunities to invest in India’s renewable energy sector.

“With the right policy environment, India’s renewable energy sector will continue to attract international as well domestic investment capital.

“A green stimulus that accelerates investments into renewable energy infrastructure could help India to emerge from the economic slump by boosting employment, reducing fossil fuel imports and building energy security.”

Full report: Despite Pandemic Disruptions, India’s Renewable Energy Sector is Still Primed for Growth

Media contact: Rosamond Hutt ([email protected]) +61 406 676 318

Author contact: Kashish Shah ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.