IEEFA India: How state governments can manage mounting power distribution sector debts

10 September 2020 (IEEFA India) ‒ State governments should be made responsible for improving the finances of their struggling power distribution companies (discoms), which continue to incur huge losses, according to a briefing note prepared by IEEFA for the Fifteenth Finance Commission of India.

The financial distress of the state-owned discoms has led to major liquidity issues across India’s power sector. As of May 2020, the discoms had overdue payments to generators totalling Rs116,340 crore (about US$16bn).

STATE GOVERNMENTS SHOULD BE MADE DIRECTLY RESPONSIBLE AND ACCOUNTABLE FOR FUNDING THE STATE POWER SECTOR AND FUTURE FUNDING SHOULD BE CONTINGENT ON IMPROVING THE DISCOMS’ POOR FINANCIAL HEALTH, say the authors Tim Buckley, Director of Energy Research at the Institute for Energy Economics and Financial Analysis (IEEFA) and Vibhuti Garg, Energy Economist at IEEFA.

The financial distress of state-owned discoms has led to major liquidity issues

“The central government has tried repeatedly to overhaul the power distribution sector through schemes like Integrated Power Development Scheme (IPDS) and Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY). It has also provided bailout packages like Ujwal DISCOM Assurance Yojana (UDAY). But these reforms have not delivered the sizeable and sustained improvements the sector so desperately needs,” says Buckley.

“The discoms continue to incur massive operating losses and debts – and their position has deteriorated further with the collapse in electricity demand due to COVID-19.”

Garg says absence of political will and competition, coupled with corruption and red tape, unsustainable cross-subsidies, economically inefficient tariff-setting processes, expensive thermal power purchase agreements (PPAs), and lack of modern technology and infrastructure development are adding to these losses.

“Unless we tighten the screws on state governments’ fiscal management and tackle the structural issues at the heart of the discoms’ troubles, these losses will continue to mount,” she says.

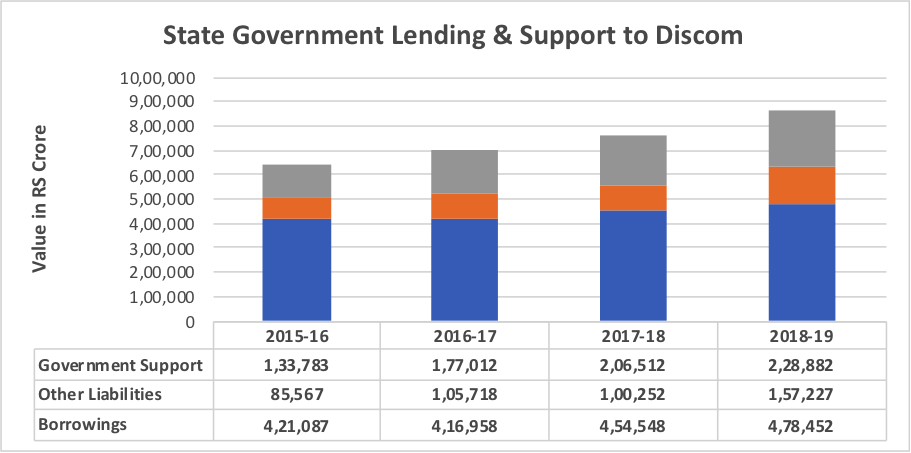

IEEFA’s note points out that as well as lending directly to the discoms, the state governments have been providing additional support through grants and subsidies, off-budget financing directly or through specially incorporated entities.

The states also act as guarantors for the discoms’ borrowings from financial institutions, increasing their exposure to the power sector.

“IN THE LAST TWO YEARS, THE POOR PERFORMANCE OF THE DISCOMS HAS LED TO FURTHER INCREASES IN LENDING AND SUPPORT FOR THE SECTOR, INCREASING THE FISCAL RISK TO THE STATE GOVERNMENTS. With the COVID-19 pandemic, this risk increased further as the discoms needed more funds from the state governments to deal with their cash flow issues,” says Garg.

IEEFA’s analysis shows that while the state governments are lending on average 6.2% of their budget to the energy sector, the outstanding liabilities of the energy sector as a proportion of Gross State Domestic Product (GSDP) are quite high. States are required to keep fiscal deficits within 3% (or 5% for FY2020/21) of their GSDP. But fiscal deficits as a proportion of GSDP exceed that limit if just the energy sector is included.

“A few state governments with better performing state discoms, such as Maharashtra, Gujarat and Karnataka, have less risk exposure. But for states like Rajasthan, Uttar Pradesh and Tamil Nadu it is high,” says Garg.

All debts need to be fully consolidated on state balance sheets

Buckley and Garg say the various forms of funding to the power sector need to be properly accounted for and all debts fully consolidated on state balance sheets.

They recommend determining a borrowing limit for the power sector based on overall share of GSDP after accounting for all forms of state government support to the sector. This is critical as funding to the power sector is crowding out funds for infrastructure development and building of socio, economic and human development.

Further, there is a need to improve transparency and the timely reporting of data and accounts so that state discom finances and state government lending to the power sector can be properly monitored and evaluated.

“During COVID-19, sound fiscal management by the state governments is more important than ever, because a lack of government revenue will force states to borrow more or cut back expenditure, and this will have an impact on the socio-economic development within the states,” says Garg.

Full report: India’s Power Distribution Sector Needs Further Reform

Media Contact: Rosamond Hutt ([email protected]) +61 406 676 318

Author Contact: Tim Buckley ([email protected]); Vibhuti Garg ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.