IEEFA Australia: Contracting with Adani Australia entails counterparty risks

16 August 2019 (IEEFA Australia): Contractors, employees and debtors seeking work with Adani Mining are taking a financial risk with reports of previous contractors being burnt and the listed Indian parent company – Adani Enterprises Ltd – still lacking the financial capacity to deliver on the project, concludes a new briefing note out today.

16 August 2019 (IEEFA Australia): Contractors, employees and debtors seeking work with Adani Mining are taking a financial risk with reports of previous contractors being burnt and the listed Indian parent company – Adani Enterprises Ltd – still lacking the financial capacity to deliver on the project, concludes a new briefing note out today.

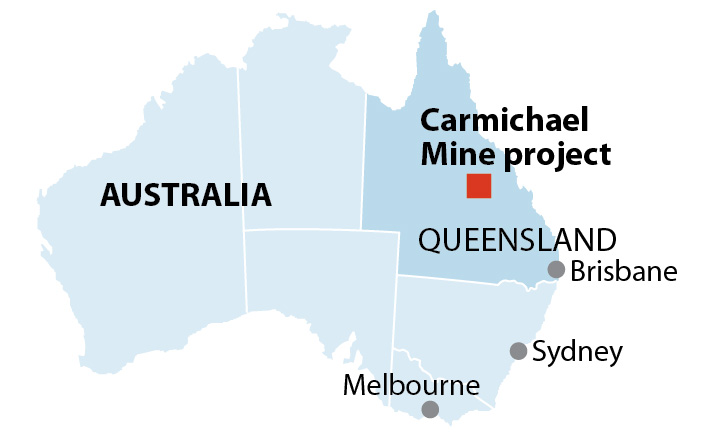

Written by the Institute for Energy Economics and Financial Analysis (IEEFA), the note Adani Carmichael Contractor Risks highlights the convoluted financing and legal arrangements set aside for the Australian and tax haven-based entities behind the Carmichael mine and rail project proposal, making it an uncertain financial bet for Australian contractors, employees and debtors.

It’s an uncertain financial bet for Australian contractors, employees and debtors

Tim Buckley, author of the note, says contractors would have first heard alarm bells when Adani announced it would have to self-fund the mine and rail proposal back in 2018.

“Savvy contractors would see this unusual step for what it was – an acknowledgement that not one single global financial nor corporate backer was willing to put dollars into this massively delayed, extremely high carbon emission proposal,” says Buckley.

“And it would have offered zero comfort to engineering firm AECOM, who was in a legal fight with Adani up until last month, over millions of dollars of work it completed on the Carmichael rail years ago before the project was downsized again.”

Not one single global financial nor corporate backer was willing to put dollars into this massively delayed proposal

IEEFA found the funding for the Carmichael mine and rail infrastructure project is now proposed to be coming from the Indian listed parent company Adani Enterprises Ltd (AEL).

“THE PROBLEM IS, ADANI ENTERPRISES DOESN’T CURRENTLY HAVE THE FINANCIAL CAPACITY TO DELIVER ON THE PROJECT, particularly in light of multiple, concurrent multi-billion-dollar expansions into new business areas back in India, including data centres, airports, domestic Indian coal and iron ore mining,” says Buckley.

“In IEEFA’s view, without a multi-billion-dollar equity and/or debt raising venture, or even more opaque related party transfers, Adani Enterprises does not have the financial capacity to self-fund its Carmichael thermal coal and rail proposal.

“This a serious red flag for contractors and persons seeking an ongoing arrangement with the entity.”

This is a serious red flag for contractors and persons seeking an ongoing arrangement with the entity

IEEFA found that Adani Mining Pty Ltd, responsible for the Carmichael coal mine, has negative tangible assets, zero income, billions of existing liabilities, and negative shareholder funds of A$507 million.

Adani Mining appears insolvent, were it not for a parent entity guarantee from Adani Enterprises in India, but IEEFA notes this is via tax-haven controlled entities based in Singapore and Mauritius.

“ADANI MINING IS ALREADY CARRYING $1.8 BILLION DOLLARS OF DEBT IN AUSTRALIA, and a parent entity is providing potentially a 12 month guarantee only, and even this is via tax havens,” says Buckley.

“With this in mind, contractors and people hoping to get work with Adani in Australia need to ascertain carefully their creditor position should any default occur in the future.”

Adani’s Carmichael thermal coal proposal is unviable and unbankable

The project’s commercial value is predicated on a view that the seaborne thermal coal market will remain robust for decades to come, a scenario entirely inconsistent with the International Energy Agency’s evaluation of the likely market outcome should the Paris Agreement be achieved.

“In IEEFA’s view, Adani’s Carmichael thermal coal proposal is unviable and unbankable on any normal commercial evaluation, absent massive government subsidy support in both India and Australia,” says Buckley.

“Adani’s suggestion it will self-fund this proposal is a clear acknowledgement of this.”

Read the briefing note: Adani Carmichael Contractor Risks, Buyer Beware: Contracting with Adani Australia Entails Counterparty Risks

Media Contact: Kate Finlayson ([email protected]) +61 418 254 237

Author Contact: Tim Buckley ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.