IEEFA: Adani’s Godda power project ‘left behind’ by changing energy policy in India and Bangladesh

The Adani Group’s recent acquisition of a coal block in Jharkhand has further highlighted how misaligned the Godda coal power project is with Indian energy strategy.

Furthermore, new developments in Bangladesh – where Godda power is intended to be exported – mean the project is also looking increasingly out-of-step with Bangladesh’s energy policy.

In our recent report on the Adani Group, we noted how India’s most valuable energy group is leading the nation’s energy strategy in areas such as renewable energy installation, solar module manufacturing and transmission, but lagging in others.

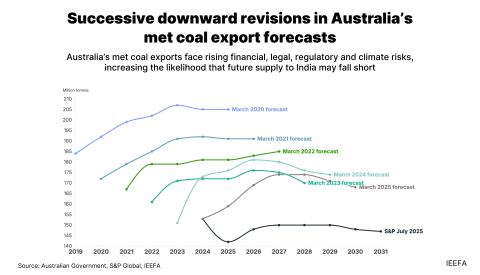

Specifically, Adani’s delayed but continuing development of the Carmichael coal mine in Australia, and the Godda power project that it will supply, go against stated Indian government strategy of reducing reliance on thermal coal imports.

This stance on coal imports has only hardened since COVID-19 as the government has reaffirmed the need to improve energy security by increasing use of renewables and domestic coal to protect Indian jobs.

ADANI’S PLAN TO IMPORT COAL FROM AUSTRALIA and transport it 700km inland by rail to the Godda power plant always looked logistically challenged, especially given the project is situated in India’s biggest coal-producing state.

Now that Adani has acquired a coal block in the state as part of an Indian government plan for commercial mining to reduce reliance on coal imports, the project as it stands looks even more out of line with Indian energy policy.

Indian banks were struggling with non-performing loans to coal projects even before COVID-19

The fact that State Bank of India (SBI) is now reportedly about to lend Rs. 5,000 crore (US$674m) to the Adani Group for the Carmichael project means that another state-owned financial institution is backing a vertically integrated energy project that runs counter to stated Indian energy policy. The publicly-owned Power Finance Corporation (PFC) has already lent the Adani Group Rs. 10,000 crore (US$1.3bn) for the Godda project despite it being burdened with large non-performing loans to coal power projects.

Indian banks were struggling with non-performing loans to coal projects even before the impact of COVID-19. SBI’s potential loan is now being reported as it emerges that India may be the major economy that is most impacted by the pandemic, with reduced economic output continuing throughout the first half of this decade.

The result is likely be a worsening of problems that existed prior to COVID-19 including raised corporate balance sheet stress and more non-performing loans, undermined further by solar hitting new record lows of just Rs2/kWh.

Meanwhile, construction at Godda has not escaped the widespread impact of COVID-19. With work on the project to be completed by a Chinese contractor using Chinese workers and imported equipment, the pandemic-induced lockdown caused a construction delay.

HOWEVER, THE DELAY DOES PROVIDE AN OPPORTUNITY – the Godda project could be reconfigured to better support the Indian economy as it recovers from the pandemic.

The project could be reset to use Indian power technology rather than Chinese. Bharat Heavy Electricals Ltd – India’s largest power generation equipment manufacturer – could be tasked with providing power equipment for Godda, helping to protect Indian manufacturing jobs. This makes even more sense considering that the Godda project has been financed by state-owned PFC and supported by a special economic zone.

The Godda project could be reconfigured to better support the Indian economy as it recovers from the pandemic

With Adani now set to develop a coal block in Jharkhand state, the Godda power plant could also be supplied with domestic rather than imported coal, further protecting Indian jobs. This would also better align the Godda project with the overall energy strategy of the Indian government which is seeking to reduce reliance on thermal coal imports.

Use of domestic coal at Godda is only allowed if the generated power is consumed in India rather than exported to Bangladesh. However this idea is making more and more strategic sense – Bangladesh has a major overcapacity problem which is only set to get worse even without the Godda project.

OVERALL POWER CAPACITY UTILISATION IN BANGLADESH FOR THE FISCAL YEAR (FY) 2019 WAS JUST 43%, while capacity payments to plants lying idle much of the time reached Tk90bn (US$1.1bn).

The Bangladesh Power Development Board’s (BPDB) recently released FY2020 annual report revealed that overall power system utilisation has now declined once again to just 40%. Furthermore, with 2,000 megawatts (MW) of new power capacity due to come online before the end of the year, the overcapacity situation will get even worse.

Bangladesh is reportedly about to cancel its entire project pipeline of coal power plants that haven’t yet begun construction

Increased overcapacity and a rise in associated capacity payments will increase the financial burden on the BPDB and raise the likelihood of higher government subsidies or power tariffs for consumers to reduce its losses.

Perhaps unsurprisingly, November 2020 has seen a further report that the Bangladesh government is about to cancel its entire project pipeline of coal power plants that have not yet begun construction.

It seems increasingly likely that Bangladesh is about to cancel 13 coal-fired power plants as it swings more towards reliance on LNG with the probability that renewable energy will also get a higher priority in the nation’s next Power System Master Plan due in 2021. Bangladesh’s Sustainable and Renewable Energy Development Authority (SREDA) has recently backed a greatly enhanced solar target of 40,000MW by 2041.

Not only are Adani’s coal projects increasingly unaligned with Indian energy strategy and financially challenged by ongoing solar cost reductions, they are now being left behind by an accelerating change in Bangladesh power policy as well.

Related articles:

IEEFA: NTPC is the flag-bearer for India’s electricity sector transition