France maintains LNG buildout amid ongoing Russian shipments and falling gas demand

Key Takeaways:

Despite France's gas consumption plummeting to a ten-year low in August 2023, the country continues expanding its LNG infrastructure.

Russia is the second-largest supplier of LNG imports to France, even though the country wants to break its dependency on Russian LNG.

Russian LNG from the Yamal plant continues to be transshipped at France's Montoir-de-Bretagne LNG terminal and sent to other markets.

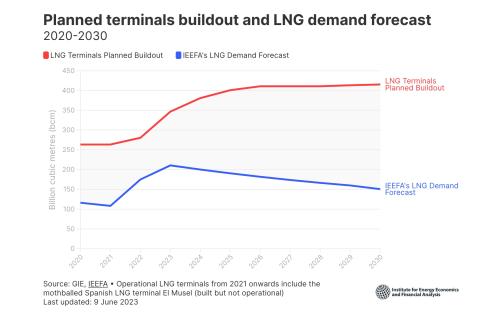

As the utilisation rate of France’s LNG terminals is not growing as expected, this raises the question of why the country is expanding its import capacity.

10 October 2023 (IEEFA) | France risks unnecessary investments in new liquified natural gas (LNG) infrastructure as the utilisation rates of existing terminals decline and gas use falls, according to new research from the Institute for Energy Economics and Financial Analysis (IEEFA).

The average utilisation rate of France’s operational LNG import terminals was 60% between January and August 2023, down on last year’s rate of 74%, raising doubts about the need for the new floating storage regasification unit (FSRU) that recently arrived at the port of Le Havre.

With a regasification capacity of 5 billion cubic metres, Le Havre FSRU is expected to be operational for the next five years.

Despite gas use declining 9% in 2022 due to higher prices and lower consumer consumption, France is also considering increasing the capacity of operational LNG terminals and international gas pipelines.

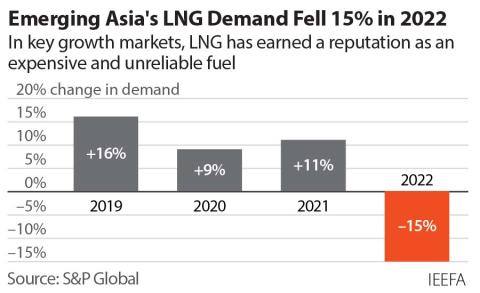

“Gas and LNG infrastructure is currently at risk from falling demand and high and volatile prices,” said Ana Maria Jaller-Makarewicz, author of the report and an energy analyst at IEEFA. “If demand continues declining, France and neighbouring European countries risk investing in gas infrastructure that will fail to improve security of energy supply and could become underutilised.

“Although France has advocated for investing in projects that improve European security of supply while reducing Russian gas dependency, paradoxically Russian gas is finding an alternative way to reach French ports in the form of LNG.”

While the stated aim of the Le Havre terminal is to partially offset the reduction or cessation of gas supplies from Russia, France continues importing Russian LNG and allowing transshipments destined for other markets.

Engie signed a 23-year deal in 2015 to import 1 million tons of LNG annually from Russia’s Yamal LNG project for transshipment at the Montoir-de-Bretagne terminal on France’s west coast. The contract has since been inherited by TotalEnergies.*

The U.S. was the top exporter of LNG to France in 2022, followed by Russia, Algeria, Qatar and Nigeria, according to Kpler.

Read the report: https://ieefa.org/resources/frances-lng-paradox

* This paragraph has been updated to show that TotalEnergies inherited Engie’s contract.

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org

Press contact

Jules Scully | [email protected] | +447594 920255