Europe’s LNG capacity buildout outpaces demand

Europe plans continued LNG infrastructure buildout despite flattening imports and reductions to gas demand forecasts. Meanwhile, Russian supply of LNG holds steady

Key Takeaways:

Europe has added 36.5 billion cubic metres (bcm) of new LNG capacity since the beginning of 2022, while LNG consumption has only increased by 4.8 bcm so far this year, down on the 46.2 bcm increase in the same period in 2022.

Russian LNG supplies to Europe have so far remained steady in 2023, with Spain, France and Belgium the biggest importers

The European Union alone has spent €41 billion on LNG imports between January and July 2023, with the U.S. (€17.2 billion), Russia (€5.5 billion) and Qatar (€5.4 billion) the largest beneficiaries.

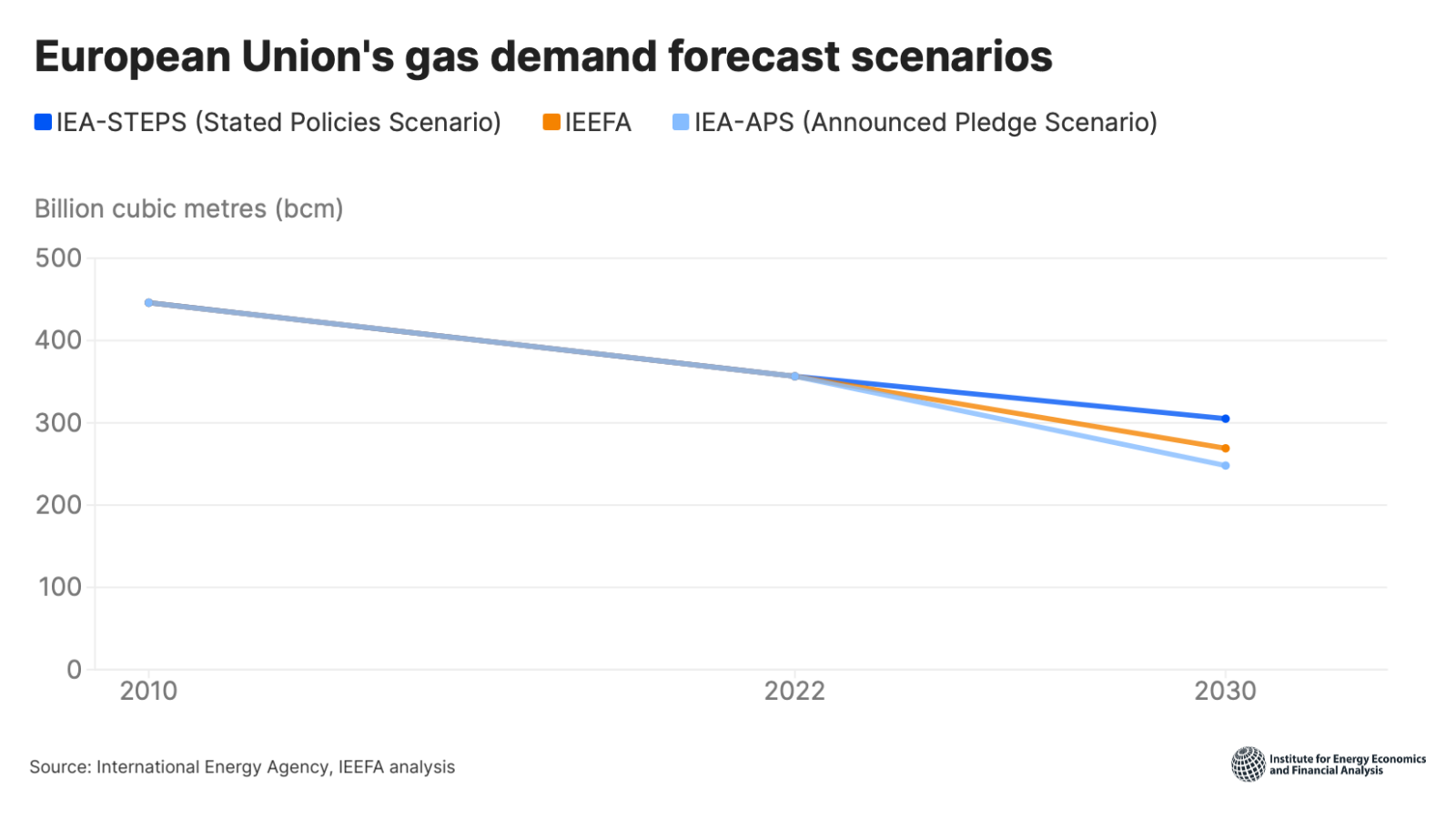

The annual import capacity of European LNG terminals is set to reach 406 bcm by 2030 as new terminals come online, while the continent’s total gas demand is expected to fall to around 400 bcm over the same period.

Brussels, 31 October 2023 | The gap between Europe’s LNG capacity and demand continues to widen. Europe has added six new LNG terminals since the beginning of 2022, plus one expansion, a previously mothballed terminal and a new floating storage regasification unit (FSRU) that is docked but not yet operational, while LNG imports have flattened and gas consumption keeps declining.

LNG import capacity is set to reach 406 billion cubic metres (bcm) in 2030, an increase of 143 bcm from 2021 levels, while gas consumption is forecast to fall to around 400 bcm as the continent pushes ahead with gas demand reduction policies.

The utilisation rate of Europe’s LNG terminals averaged 58% between January and September 2023. In the face of declining European gas consumption, it raises questions as to whether Europe needs to build additional LNG infrastructure through 2030.

“The decline in gas demand is challenging the narrative that Europe needs more LNG infrastructure to reach its energy security goals. The data is showing that we don’t,” said Ana Maria Jaller-Makarewicz, an IEEFA energy analyst. “Despite significant progress towards reducing gas consumption, countries in Europe risk trading a reliance on Russian pipelines for a redundant LNG system that further exposes the continent to volatile prices."

While European LNG imports from January to September 2022 increased by 62% in comparison with the same period in 2021, LNG imports in 2023 have flattened, increasing just 4% year-on-year. Meanwhile, the European Union (EU) has met its winter gas storage targets ahead of schedule.

The EU alone spent €41 billion on LNG imports between January and July 2023, with the U.S. (€17.2 billion), Russia (€5.5 billion) and Qatar (€5.4 billion) the largest beneficiaries.

As of September 2023, the EU, Türkiye and the UK had imported a total of 125 bcm of LNG.

European imports of Russian LNG between January and September 2023 remained steady compared to the same period in 2022. Top-line figures mask national variations, with Spain and Belgium increasing their LNG imports by 50% in 2023 compared to the previous year. Terminals in Belgium and France also continue transshipping Russian LNG volumes from the Yamal project.

This update is part of IEEFA’s European LNG Tracker, a publicly available interactive data set to visualise Europe’s LNG infrastructure, demand and capacity outlook, and import and export flows.

Explore IEEFA’s European LNG Tracker: https://ieefa.org/European-lng-tracker/

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org

Press contacts

Sofia Russi | [email protected]

Jules Scully | [email protected] | +447594 920255