Early retirement for coal-fired assets in Pakistan could demonstrate economic viability and replicability

Success depends on stronger policy commitments and technical standards to unlock overseas financing

October 16, 2025 (IEEFA Asia): A new report by the Institute for Energy Economics and Financial Analysis (IEEFA), Pakistan-China Institute, and Renewables First presents a clear, bankable case for the early retirement of Pakistan’s imported coal-fired assets. The report’s case study, the 1,320-megawatt (MW) Sahiwal Coal-Fired Power Plant (CFPP) was commissioned in 2017 by China’s Huaneng Shandong Ruyi Energy under a thirty‑year power purchase agreement.

The report outlines a comprehensive valuation framework with multiple scenarios and retirement pathways to enable an early retirement transaction.

Notably, the authors propose a replicable model for accelerating the closure of other CFPPs based on this analysis. Sahiwal CFPP’s early retirement alone could avoid 27-38 million tonnes of carbon dioxide emissions over a 10-year reduction scenario.

The opportunity is ripe because debt amortization for the plant is nearly complete, and equity returns dominate. In recent years, the plant’s low utilization has imposed fiscal stress on public finances without proportional benefit. Meanwhile, approximately USD250 million (PKR82.7 billion as of December 2024) in outstanding financial arrears impacts project liquidity and sponsor dividends.

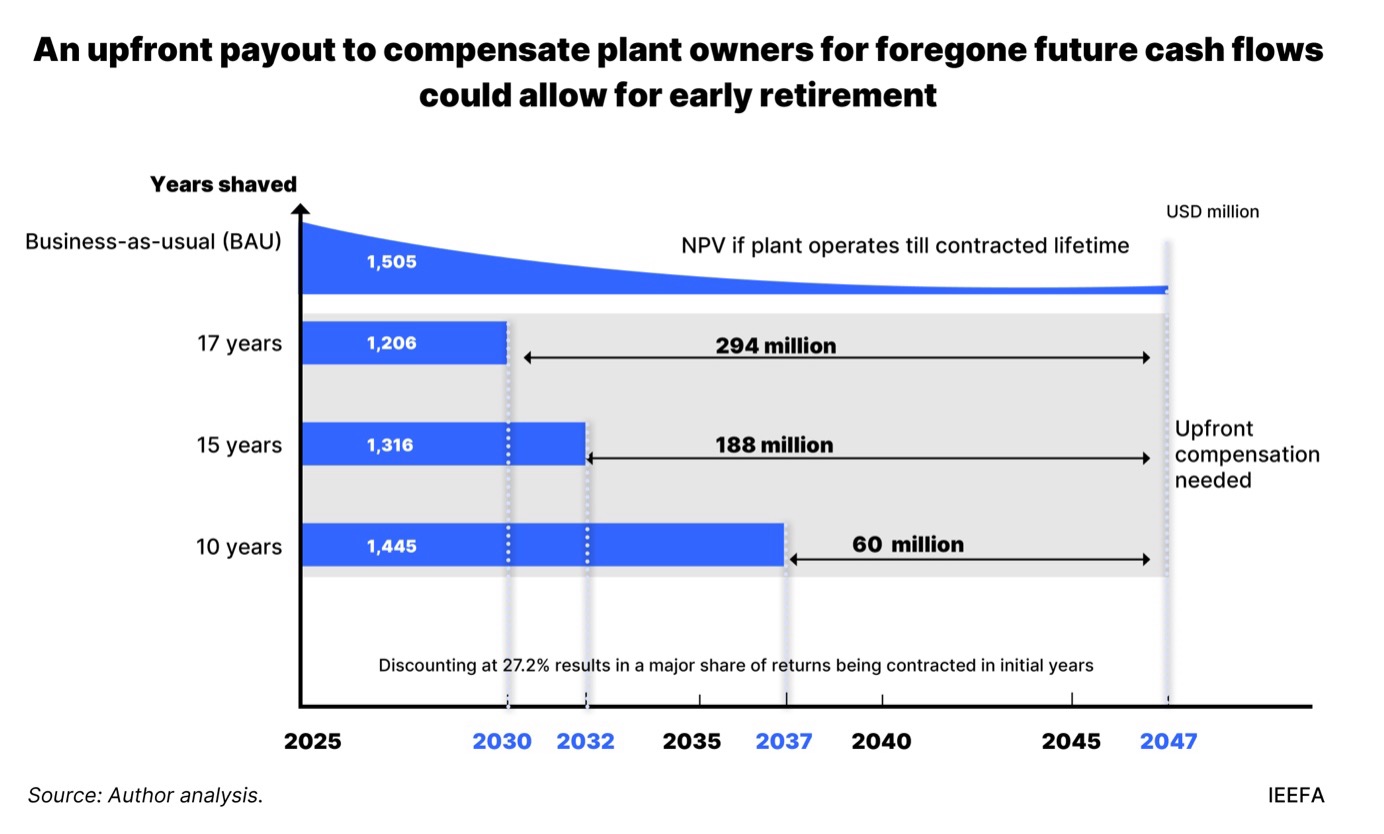

The early retirement of the Sahiwal CFPP is deemed economically viable within a USD0.4–1.5 billion compensation range, with modest 5–10 year acceleration scenarios. This would cost less than USD100 million, compared to an annual import bill exceeding USD200 million, or USD5 billion in continued capacity payments through 2046. For project sponsors, an upfront payout mitigates the risk of future losses stemming from low utilization. It increases the transaction value by monetizing the asset’s remaining equity value earlier than previously anticipated, while allowing potential resolution of pending arrears.

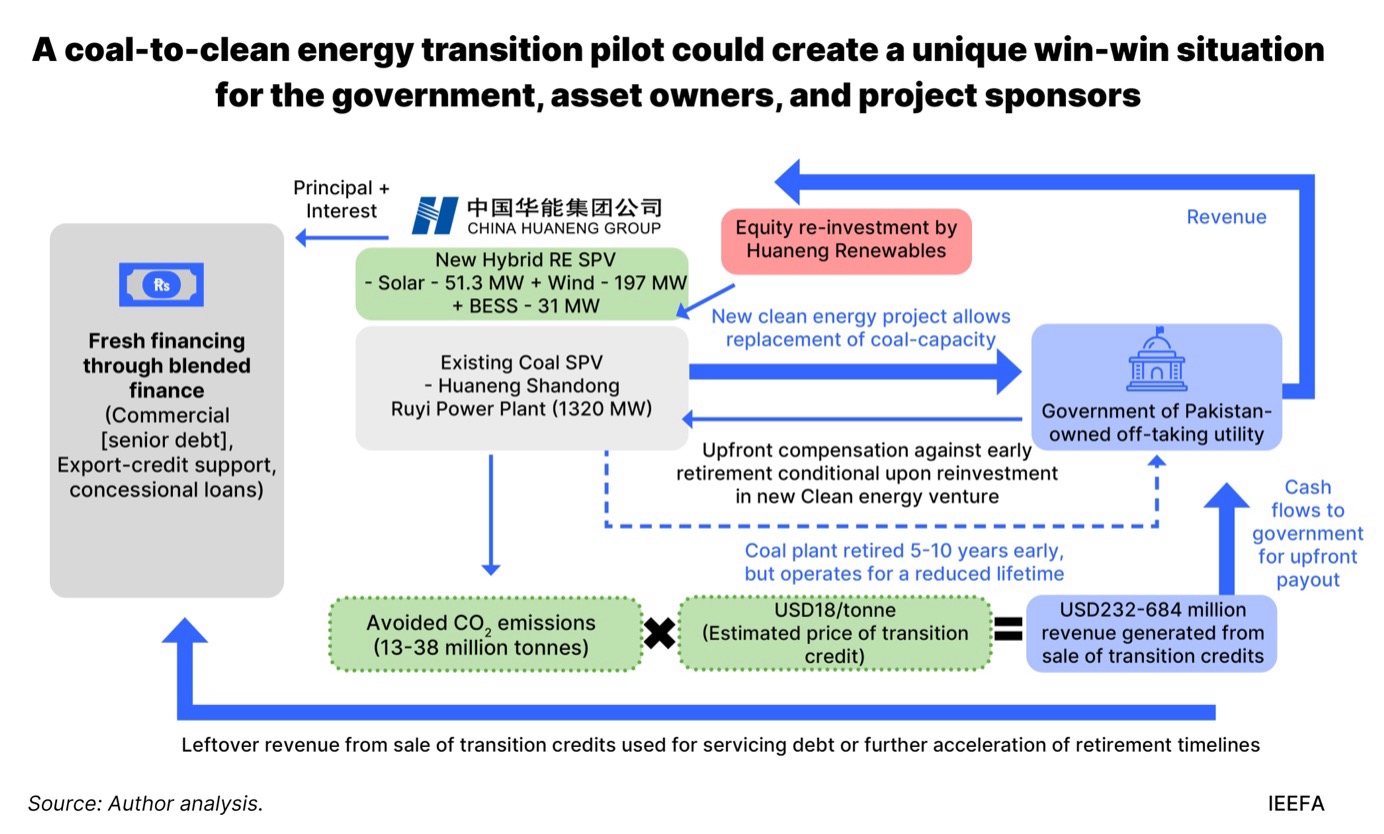

Pakistan’s strained economy and limited domestic capital may not be sufficient to fully finance this transition. However, the mobilization of funds through the Green Investment and Finance Partnership (GIFP) could establish a Chinese counterpart to the energy transition mechanism (ETM) for phasing out coal in the region. Such an initiative would signal China’s readiness for global leadership in clean energy.

Evaluating the techno-economic hurdles

Between 2014 and 2018, Pakistan relied on a rapid buildout of imported coal power plants, financed under the framework of the China‑Pakistan Economic Corridor (CPEC), to end widespread load shedding. Nine projects with a total capacity of 10.4 gigawatts (GW) were fast-tracked, backed by sovereign guarantees and dollar‑indexed tariffs.

However, falling electricity demand due to rising rooftop solar installations and weak industrial output has reduced utilization at plants such as Sahiwal to below 20%, even as capacity payments continue to inflate circular debt.

In addition, the authors highlight several challenges facing Pakistan’s relatively young coal fleet, which is backed by sovereign guarantees and long-term Power Purchase Agreements (PPAs). These challenges range from overall macroeconomic instability and weak domestic markets to falling electricity demand amid the growing adoption of distributed energy resources (DER).

The report also notes that Pakistan and China lack a clear policy signal on early coal retirement, unlike other countries.

For instance, while Indonesia and South Africa are still developing their frameworks, the Philippines has advanced rapidly with a pilot coal retirement transaction, largely driven by the private sector in collaboration with the Asian Development Bank (ADB). In November 2022, the Philippines completed the world’s first ETM deal — facilitating the early retirement of the 246MW South Luzon Thermal Energy Corporation (SLTEC) coal plant in Batangas. Spearheaded by ACEN (Ayala Corporation’s energy arm), this transaction demonstrates how an ETM can be executed in practice.

Like most Asian countries, the absence of carbon pricing mechanisms limits Pakistan’s access to transition finance. The country would need institutional mechanisms to calculate, verify, and monitor carbon credits, an essential step toward ensuring credibility in international markets. If Pakistan’s CFPPs meet the eligibility criteria under such standards, transition credits could provide an additional revenue stream to complement offers to CFPP owners.

Laying the financial ground for win-win partnerships

The authors assessed the optimal timelines for Sahiwal CFPP’s early retirement across multiple pathways.

An upfront buyout can compensate owners for foregone future cash flows through a lump-sum settlement, while a negotiated reduction in the Return on Equity (ROE) component of the plant tariff could accelerate the plant equity value under a business-as-usual scenario.

Re-channeling the lump-sum settlement into equity for a coal-to-clean energy transition project could create opportunities for both investors and the government. Such coal-to-clean reinvestments would allow investors to shift exposure from a low‑utilization coal asset to cost‑competitive renewable energy projects.

Drawing on baseline plant valuations, the quantified financial impacts of accelerated retirement timelines, and compensation mechanisms for project sponsors, the authors conclude that Sahiwal represents a logical pilot for accelerated retirement. Its early retirement is economically viable within a USD0.4–1.5 billion compensation range under modest 5–10 year acceleration scenarios. The early closure of the Sahiwal CFPP could avoid 27-38 million tonnes of carbon dioxide emissions over a 10-year reduction scenario.

The report also includes a survey on the challenges facing Chinese investors in Pakistan. Given the persistent issue of delayed financial settlements, and the higher margins of return for investment in coal-fired capacity, any attempts to reconfigure existing coal-fired plants (retrofitting, revising energy tariffs, and restructuring debt) could present a significant roadblock.

An accelerated coal phaseout would, therefore, require legal restructuring and the renegotiation of power purchase agreements for CFPPs. Explicit commitments from both China and Pakistan are crucial, particularly the establishment of robust standards and policies with broader goals of economic decarbonization.

The report authors are available for interview:

Haneea Isaad (Energy Finance Specialist, IEEFA)

- “Our previous report ‘Making the energy transition mechanism meaningful: A case study from Pakistan’, first offered stakeholder analyses for asset sellers and owners, policymakers, and transition investors. In this report, we have provided a comprehensive discounted cash flow model to demonstrate how financial incentives must align stakeholder interests to accelerate the transition away from coal-fired generation while protecting investor returns.”

- “Through our analyses of early coal retirement plans in countries such as Indonesia, the Philippines, and South Africa in this report, we find that the techno-financial constraints faced by Pakistan’s current fossil fuel fleet and geopolitical factors, particularly the government-to-government arrangements that helped create these assets, make implementing similar mechanisms challenging. However, the financial risks of imported fossil fuels, as IEEFA’s studies have repeatedly highlighted, along with the opportunities outlined in this report, demonstrate the case for a focused, asset-level approach in Pakistan via direct negotiations.”

Mustafa Hyder Sayed (Executive Director, Pakistan-China Institute)

- “Our case study marks a new chapter in international cooperation for sustainable energy finance. While a Western-backed model, which aims to retire Chinese-sponsored assets, is rare, a recent statement by China and the EU during a joint summit indicates that there could be cooperation on climate change matters, including a push for green technology and green financing.”

- “By choosing a pilot project, such as retiring a coal plant in Pakistan under CPEC, China can be a proof of concept for accelerated and scalable coal retirement. The Green Investment and Finance Partnership (GIFP) also provides China with a leadership role in global energy transition finance.”

Umar Farooq (Senior Research Associate, Pakistan-China Institute)

- “China’s widespread and record adoption and manufacturing of renewable energy could easily lead to a pilot whereby Chinese clean energy technologies can be seen displacing its overseas coal-fired power plants in the developing world.”

- “Pakistan would have to provide the political push for early coal retirement, along with robust standards and policies and decarbonization on a broader economic front, and lay out the technical criteria to aid a transition towards clean energy.”

Ahtasam Ahmad (Energy Finance & Climate Tech Lead, Renewables First)

- “Choosing an early coal retirement pathway depends on financing cushions, governance capacity, and sector reform. Our approach treats each CFPP as an independent entity, similar to how these facilities typically operate as special-purpose vehicles with dedicated project financing.”

- “A modest 5–10-year acceleration, coupled with distributed payments or partial reinvestment, could retire Sahiwal CFPP for below USD100 million in public exposure. This would be a fraction of the plant’s booked equity value and far less than the cumulative capacity payments (USD5 billion) Pakistan would otherwise pay until 2046. More ambitious timelines require larger compensation but cost substantially less than business-as-usual (BAU) scenarios.”

Read the report: Repurposing Pakistan's coal-based assets

Read this press release in Chinese: 巴基斯坦提前退役燃煤电厂展现其经济可行性和可复制性

Media enquiries: Alex Yu [email protected] | Umar Farooq [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)