Why a production cap on plastics makes financial sense

Download Briefing Note

Key Findings

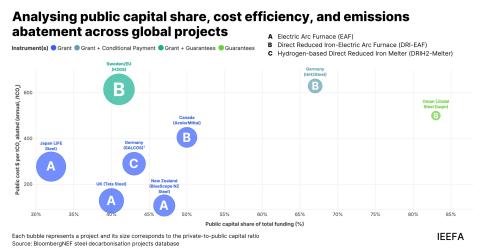

A production cap could smooth out current and structural market imbalances.

Slow economic growth will reduce demand for primary plastic polymers.

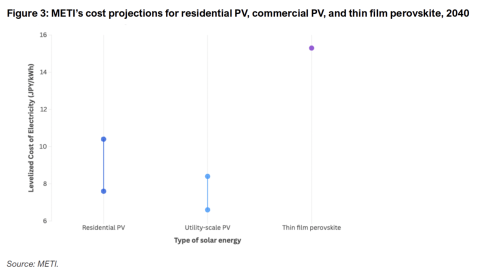

New technologies will reduce demand for virgin plastics.

Volatility and price instability likely will persist under current market conditions.

Geopolitics and trade will alter supply and demand trends.

Introduction

The United Nations Environment Assembly passed a resolution in March 2022 establishing an intergovernmental negotiating committee (INC) to develop an international legally binding instrument on plastic pollution, Including the marine environment. The goal of the instrument, referred to as the plastics treaty, is to end plastics pollution based on a comprehensive approach that addresses the full life cycle of plastic, including its production, design and disposal. Through INC’s four sessions, it has become clear that current and projected levels of plastic production are severely undermining any potential solution to end plastic pollution.

This paper articulates the economic and financial basis to establish a cap on global plastics production. The production cap, once adopted as part of the final legally binding agreement, is expected to serve as the linchpin to end plastics pollution. Combined with a host of demand and supply initiatives, the cap will serve as a tool to reduce the production of plastics, particularly primary plastic polymers that are used for unnecessary short-lived products.

The production cap proposed in the final agreement should allow production of only necessary plastics.