We can’t afford to fall back on gas to fill nuclear gap

Key Findings

The Coalition has indicated that its plan to introduce nuclear power in Australia will depend heavily on gas, to fill the gap in energy generation while nuclear plants are being built.

However, gas is one of the most expensive forms of electricity generation and its role in the National Electricity Market (NEM) is in decline.

Using gas as a stopgap measure while Australia waits for nuclear power would accomplish little other than increasing energy costs for consumers, which could be reduced by taking up low-cost renewable energy backed with storage.

The federal Coalition plans to build seven nuclear power stations in Australia to run as baseload generators – operating nearly all of the time, similar to Australia’s coal power stations.

A recent IEEFA report found nuclear power in Australia would raise electricity bills by $665 a year on average across the regions analysed. Given these plants take decades to build, what happens during the transition period between coal retiring and nuclear coming online?

While the finer details of the Coalition’s policy are yet to be released, it has confirmed that gas will be a “huge feature”.

Meanwhile, federal government modelling estimates that filling the energy gap with gas while waiting for nuclear power to be built would cost $70 billion.

Gas has been part of Australia’s electricity mix for decades – so why is ramping it up now such a bad idea?

Gas generation is expensive, and in decline

Burning gas is one of the most expensive forms of electricity generation in Australia. CSIRO research finds that the levelised cost of gas-fired electricity used for peaking can be up to twice that of renewable energy with integration costs.

Gas is usually relied on mainly when other forms of generation aren’t available, such as to ramp up electricity supply quickly during peak demand times, or as a back-up when there is an outage at a coal power station.

And when gas is called on – the wholesale price of electricity goes up. When this coincides with volatility in international gas prices, the impact on electricity prices can be profound, as Australians learnt the hard way in 2022.

The Australian Energy Market Operator (AEMO) tracks the “price-setting” dynamics of different technologies in the national electricity market (NEM). Their reports show that the more often gas generators are used, the more upward pressure is placed on wholesale electricity prices. Conversely, increasing renewable energy generation places downward pressure on prices.

It’s therefore unsurprising that as the level of renewable energy in the NEM has increased, the level of gas power generation in Australia has generally trended downwards.

The role of gas is narrowing

IEEFA’s latest briefing note unpacks the gas generation forecasts in AEMO’s Integrated System Plan, which maps the least-cost pathway for Australia’s energy system to 2050.

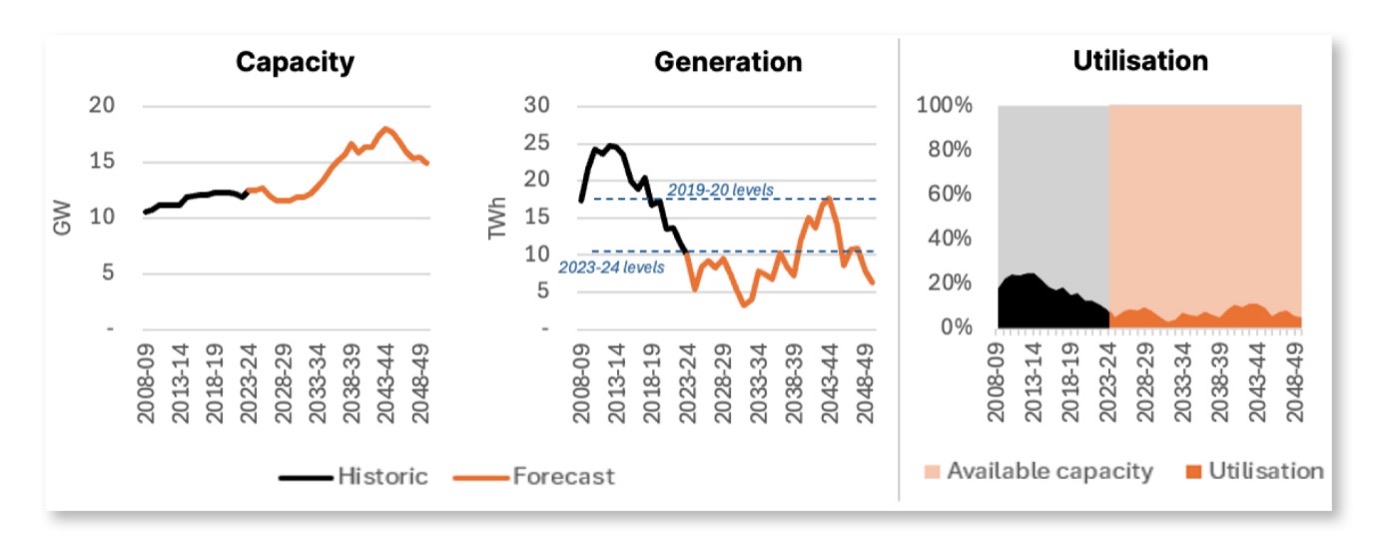

While AEMO has forecast that more gas generation capacity will need to be built, it also expects that gas generators will be called on much less frequently than in the past – operating on average only 7% of the time.

The amount of electricity generated from gas is forecast to stay at or below its current level for the near term. While a small resurgence is expected from the mid-2030s, gas generation is never expected return to pre-pandemic levels.

Gas power generation forecasts in AEMO’s 2024 ISP

This is a very different proposition to the idea of gas stepping in to fill a significant energy supply gap while Australia waits for nuclear plants to be built.

Yet it’s more grounded in the economic reality of how gas works in Australia’s electricity market, which is undergoing a rapid transformation due to its accelerating share of renewable energy.

When the sun is shining and the wind is blowing it doesn’t make sense to burn gas.

Furthermore, the inherent uncertainties in AEMO’s forecasts raise the question of whether the future of gas generation may be even less than predicted.

Recent real-world experience in South Australia and California shows batteries rapidly eating away at the market share of gas generation during evening peak times.

And while gas generation is considered an appealing solution to manage prolonged “low-VRE” (variable renewable energy) periods when both wind and solar output are low, AEMO admits such events are rare and extremely difficult to predict. Research has failed to find evidence of anything more than a 30% reduction in VRE availability in 40 years of weather data.

Despite prevailing narratives from the gas industry, AEMO modelling shows very little gas is needed under a lowest-cost pathway for Australia’s energy system. In fact, the expensive nature of gas, compared with renewables and storage, means it may play a lesser role than the market operator forecasts.

Falling back on gas as a stopgap measure while Australia waits for nuclear power would be a significant diversion from this least-cost pathway. It would accomplish little other than increasing energy costs for consumers, which could be reduced by taking up low-cost renewable energy backed up with storage.

First published in ReNew Economy.