Key Findings

Typical Australian households could see electricity bills rise by AUD665/year on average under the opposition Coalition’s plans to introduce nuclear to the country’s energy mix.

IEEFA analysed six scenarios based on relevant international examples of nuclear power construction projects; in every scenario, bills increased by hundreds of dollars.

For households that use more electricity, bills could rise more – for a four-person household, the bill rise was found to be AUD972/year on average across nuclear scenarios and regions.

The cost of electricity generated from nuclear plants would likely be 1.5 to 3.8 times the current cost of electricity generation in eastern Australia.

Australia’s main federal opposition, the Liberal-National Coalition, has proposed building seven nuclear power plants across the country, including both large-scale reactors and small modular reactors (SMRs). This report seeks to detail the likely impact on household consumers’ electricity bills from such a plan, based on recent real-world experience from construction costs for nuclear power plants around the world.

Rather than use theoretical projected costs, we have calculated the potential electricity bill impact for a range of nuclear cost recovery scenarios, based on the following real-world examples:

- Finland: Olkiluoto Unit 3.

- France: Flamanville Unit 3.

- UK: Hinkley Point C.

- US: Vogtle Units 3 and 4.

- US SMR: NuScale SMR.

- Czech Republic: Dukovany proposed plant expansion.

The first four scenarios are based on actual, recent nuclear power plant construction costs and timeframes for countries in liberal democracies where costs are transparent. Commenting on nuclear construction cost estimates, electricity market economist Professor Paul Joskow states: “The best estimates are drawn from actual experience rather than engineering cost models.”

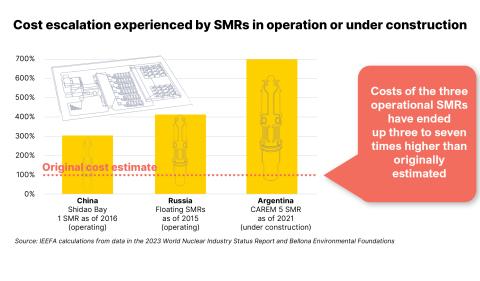

In the case of SMRs, no plants have been successfully completed in a democratic country, so we instead used the one example of a binding contract offer to build such a plant in the US, the now-cancelled NuScale project. We also used this approach for assessing the costs for a proposal to build South Korean APR technology (a design that the Coalition has cited for potential implementation in Australia) in a separate democratic country with laws protecting labour rights, outside of its country of origin – the Czech Republic.

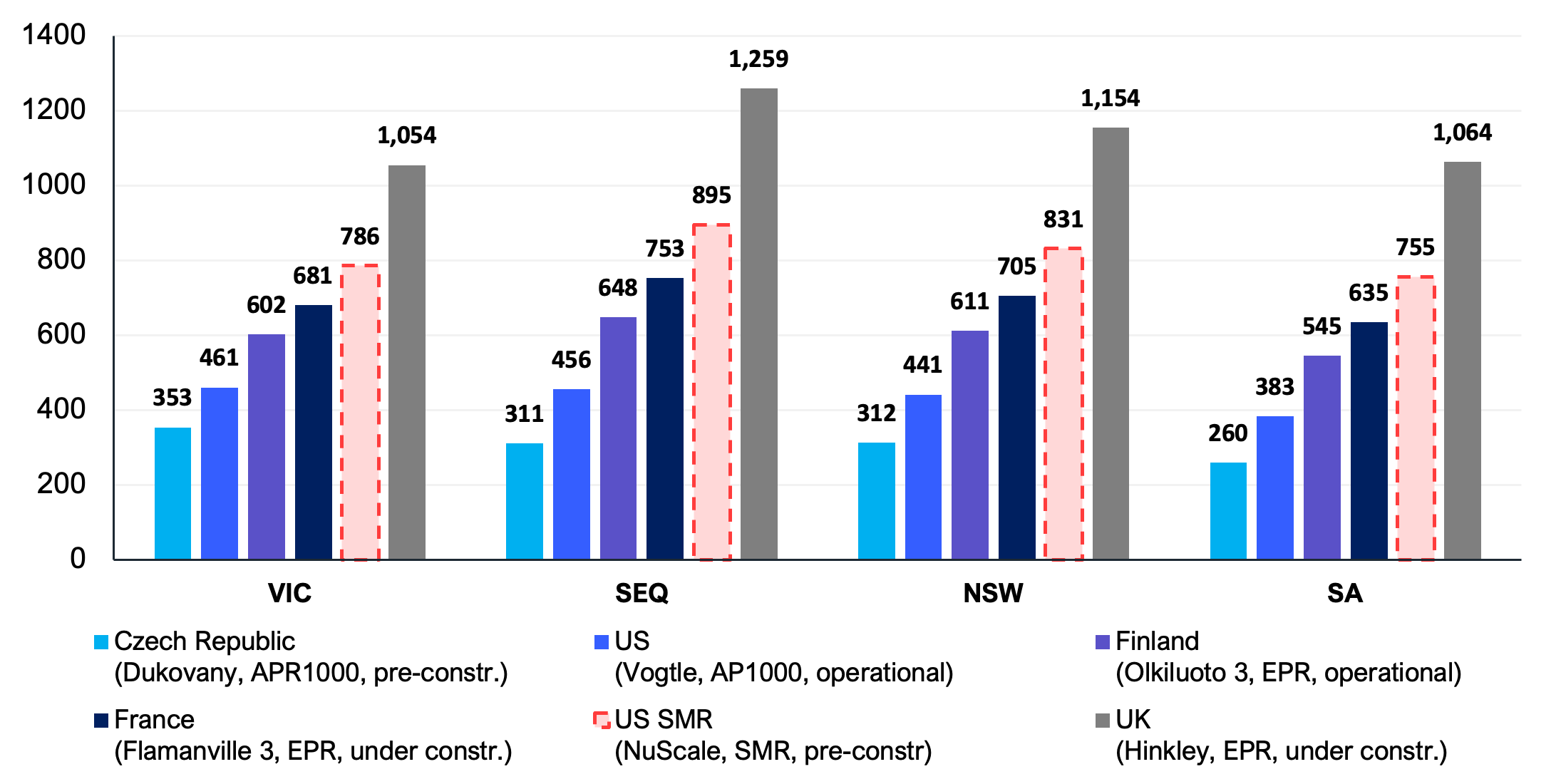

Household electricity bills impact

We found that electricity bills would need to rise in order for nuclear costs to be recovered. The chart below illustrates the resulting increase in typical household power bills if nuclear power plants with similar costs and characteristics to the international examples were built in Australia. The average bill increase was AUD665/year across states and nuclear scenarios for households with a median level of electricity consumption. The lowest impact is equivalent to bill increases of AUD260-AUD353 per year, linked to estimated costs for the pre-construction project Dukovany, which is highly likely to underestimate final costs. The lowest impact from a nuclear plant successfully completed (Vogtle) is AUD383-AUD461 per year for an average household. Meanwhile, the UK experience with Hinkley Point C indicates electricity bill rises of more than AUD1,000 per year are possible.

Figure 1: Increase in typical household electricity bill to recover cost of nuclear plants based on different countries’ experience (AUD/year)

Source: Various sources (see Appendix) and IEEFA calculations. Note: Bill increases are for a household with median electricity consumption levels.

The range of costs is wide due to the significant cost differentials for large-scale nuclear in different countries, and the significant cost uncertainty for SMR technology, which is still under development. The impact in each state can vary due to differing typical electricity consumption levels in each state, and different electricity bill cost structures.

For households using more electricity than the median level, the bill increases from nuclear would be higher. For example, for a four-person household the bill impact would be AUD972/year on average across nuclear scenarios and states, and for a five-person household AUD1,182/year.

How nuclear costs are reflected on electricity bills

These results might come as surprising to some, because large-scale nuclear is a mature technology currently in use across a wide range of countries. In addition, misinterpreted data on retail electricity prices (which also include the costs of powerlines and taxes, not just generators and so is misleading) can show some cases of nations that use nuclear who have lower retail prices than Australia.

However, in almost all cases around the world, the cost of nuclear power plant construction and financing is not fully reflected in market prices for power. This is because either nuclear power plants are very old and their costs are largely depreciated, or governments have acted to recover the costs either through taxpayers, or via levies which are independent of electricity markets – for example in France, the UK and Ontario, Canada. In other jurisdictions, such as a number of US states including Georgia where the Vogtle power plant is located, there isn’t actually an electricity market in operation, with consumers instead served by a regulated monopoly without any competitive choice.

The Coalition has outlined something different, ruling out taxpayer subsidies and stating that any government investments in nuclear plants would receive a commercial return. This implies that the Coalition expect that wholesale electricity market prices will be sufficient for nuclear power plants in each state to recover their construction costs plus a commercial level of return. The Coalition has also outlined that these nuclear power plants would operate at full capacity almost all of the time. Therefore, power prices would need to average out at the level a nuclear plant needs to be commercially viable – to recover their costs – almost all of the time.

High costs of recent nuclear projects

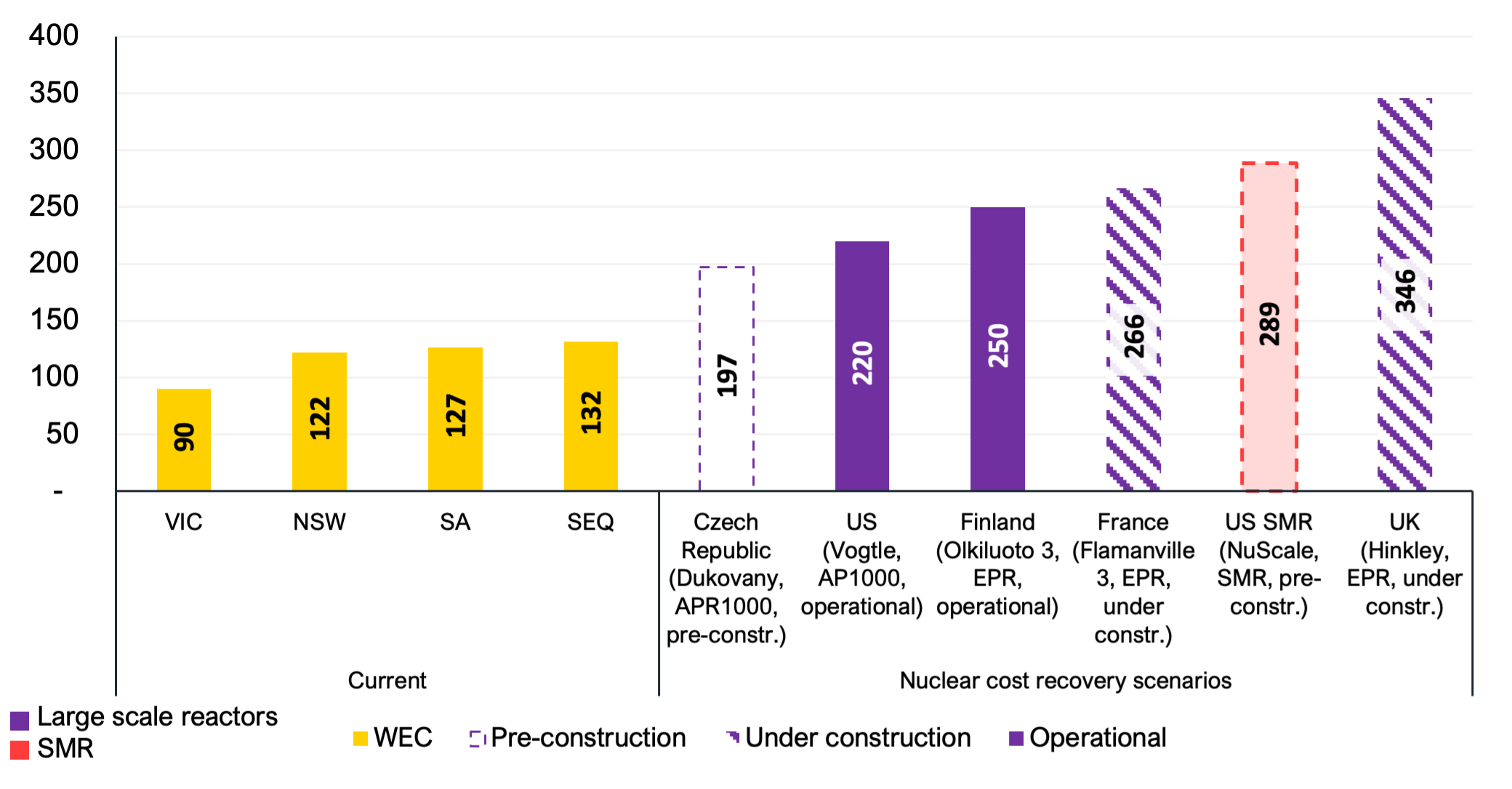

The reason bills increased in this study is because recent large-scale nuclear projects across Europe and North America involved very high costs. The European Pressured Reactor (EPR) program had promised to deliver more efficient, safer nuclear power. However, the three recent projects (Olkiluoto 3, Flamanville 3 and Hinkley Point C), which have either just been completed or are under construction, have all faced construction challenges, delays and cost-blowouts. If plants with similar costs and characteristics were built in Australia, they would require a levelised cost of electricity (LCOE) between AUD250 per megawatt-hour (MWh) and AUD346/MWh to recover their costs.

A few other types of reactors are being built or considered internationally of a similar design to what the Coalition indicates might be built in Australia: the South Korean APR1000 design proposed at Dukovany in the Czech Republic; and a Westinghouse AP1000 design recently completed at Vogtle in the US. The Vogtle plant experienced seven years of delays and actual capital costs (excluding financing costs) 1.7 times the original estimates. Those plants present LCOEs of between AUD197 and AUD220 per MWh in an Australian context – noting the Dukovany costs are only initial pre-construction estimates and could rise.

Based on NuScale, we estimate that the LCOE of nuclear SMR in an Australian context would be AUD289/MWh – but could be far higher if construction extends beyond the 3.25 years used in this study – as financing costs increase as construction timelines extend.

Capital costs (excluding financing costs) of recent nuclear power builds have tended to blow out by a factor of between 1.7 and 3.4, leading to financial difficulties for companies involved. All conventional nuclear projects built in recent years in the US and Europe – Vogtle, Olkiluoto 3, Hinkley Point C and Flamanville 3 – have contributed to financial difficulties for companies involved. Westinghouse, which was the technology provider for Vogtle, filed for bankruptcy protection in 2017. France’s AREVA, who was the original technology provider for Olkiluoto 3, Flamanville 3 and Hinkley Point C, came close to bankruptcy over 2015, which required a French Government-sponsored bail-out.

The chart below details the wholesale market prices required for each of the recently constructed or quoted nuclear plants to be commercially viable, relative to the current wholesale electricity costs being passed through in household electricity bills in the regions of Victoria, NSW, South East Queensland (SEQ) and South Australia (SA).

Figure 2: Current wholesale energy cost (WEC) component of current household bills compared to commercial price to recover nuclear plant costs in Australian context (AUD/MWh)

Source: Various – see Appendix. SEQ: South East Queensland. Current wholesale energy cost is based on market rates, the DMO and the VDO. Current WEC excludes GST, losses, ancillary services, RERT, directions cost, prudential costs and fees. Nuclear LCOEs represent the cost of these projects translated to an Australian context with specific assumptions taken.

Australia would likely face even higher large-scale nuclear costs than these recent international examples, due to the country’s limited nuclear capability and the small size of any potential Australian nuclear build-out program. With seven nuclear power stations proposed (two of them SMR-only), all at separate sites, there will be limited scope to achieve learning-based cost reductions like those seen in a large continuous build program, for example the build program in South Korea on which CSIRO’s GenCost costings are based. South Korea has built 26 reactors since the 1970s. Further, the assumptions in this report have provided an optimistic levelised cost of electricity for nuclear, for example using a 60-year economic lifetime, 93% capacity factor, and a low discount rate.

Our analysis suggests household power bills would need to rise significantly for nuclear power plants to become a commercially viable investment in the absence of substantial, taxpayer-funded government subsidies. In IEEFA’s opinion, any plan to introduce nuclear energy in Australia – such as that proposed by the Coalition – should be examined thoroughly, with particular focus on the potential impact on electricity system costs and household bills, and with detailed analysis of alternative technologies such as renewables and firming.