Nuclear in Australia will increase household power bills – the question is how much?

Households will face further financial pressure if the Coalition’s proposal becomes a reality

Key Takeaways:

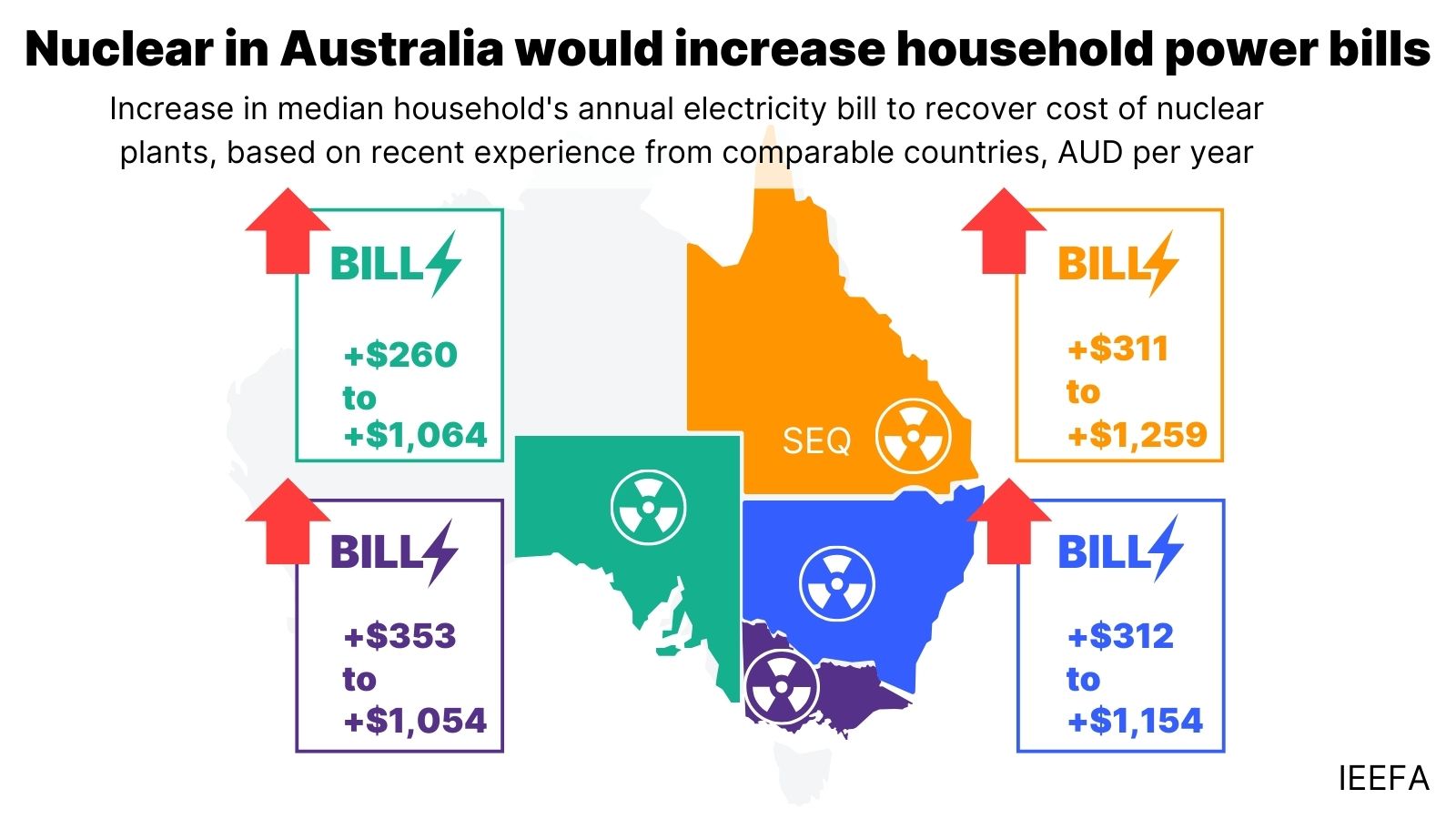

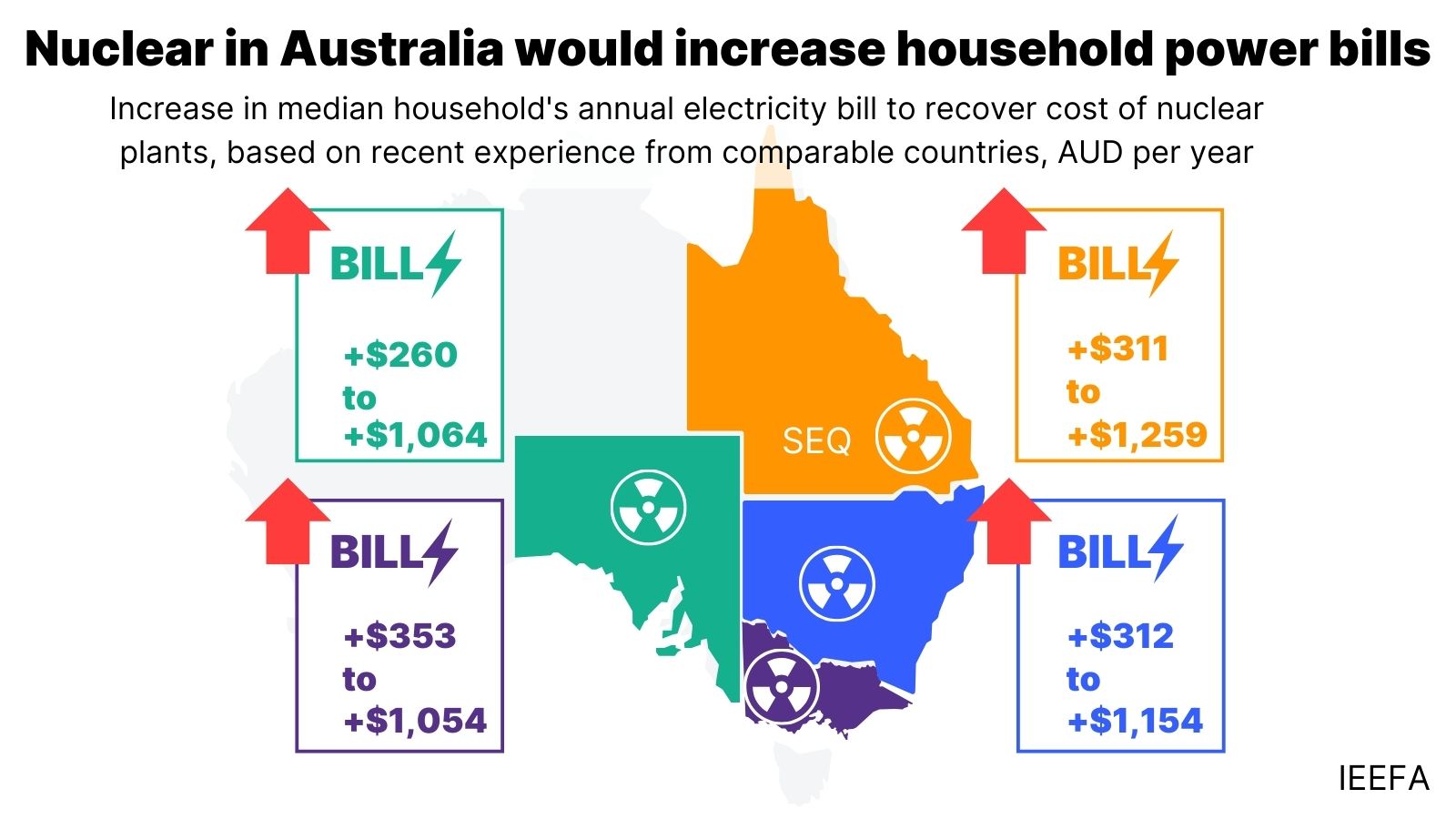

Typical Australian households could see electricity bills rise by AUD665/year on average under the opposition Coalition’s plans to introduce nuclear to the country’s energy mix.

IEEFA analysed six scenarios based on relevant international examples of nuclear power construction projects; in every scenario, bills increased by hundreds of dollars.

For households that use more electricity, bills could rise more – for a four-person household, the bill rise was found to be AUD972/year on average across nuclear scenarios and regions.

The cost of electricity generated from nuclear plants would likely be 1.5 to 3.8 times the current cost of electricity generation in eastern Australia.

20 September 2024 (IEEFA Australia): The Liberal-National opposition’s proposal to introduce nuclear power to Australia’s energy mix could see median household electricity bills rise by an average of $665 per year, a leading energy think tank has warned.

The Coalition has outlined plans, if elected, to build seven nuclear power stations across the country. However, the Institute for Energy Economics and Financial Analysis (IEEFA) found that based on the European and US experience of nuclear reactor construction over the past 20 years household power bills would go up.

Bowyer and co-author Tristan Edis detail these findings in a new IEEFA report, Nuclear in Australia would increase household power bills.

Johanna Bowyer, Lead Analyst for Australian Electricity at IEEFA, explains: “Our goal was to understand how the Coalition’s nuclear plans would financially impact Australian households, so our research drew upon nuclear power plant costs from comparable real-world nuclear projects in countries similar to Australia.”

“In the international examples examined, the capital cost of nuclear power plants was very high – up to $90 billion. Recent international large-scale nuclear projects have experienced construction challenges, delays and cost-blowouts. Capital costs, excluding financing costs, of recent nuclear power station builds we analysed had blown out by a factor of 1.7 to 3.4 times.”

“The cost of electricity generated from nuclear plants would likely be 1.5 to 3.8 times the current cost of electricity generation in Eastern Australia. For nuclear power plants to be commercially viable without government subsidies and generating 24/7 - as the Coalition proposes - electricity prices would need to rise to these higher levels to allow the nuclear power plants to recover their costs. This would result in a large increase in wholesale market prices which would then flow through to household bills.”

Bowyer states, “The annual bill increase was anywhere between $260 and $1259 for a household using a median amount of electricity, depending on which international nuclear example is used to indicate Australian nuclear costs, and which state the household is in.”

The lowest bill increase out of all six nuclear scenarios corresponds to the Czech Republic’s Dukovany project, which is still in the pre-construction stage and therefore is likely to underestimate final costs.

The report looks at the bill impact across four regions: NSW, South Australia, South East Queensland, and Victoria, and across different sizes of households.

“For households with larger electricity use, they would see higher bill rises with nuclear. For 4-person households the average annual bill increase across regions and nuclear project examples would be $972 and for 5 or more person households it would be $1182. In a cost-of-living crisis, bill increases like this are a big deal,” Bowyer says.

Tristan Edis, a director at energy advisory firm Green Energy Markets noted, “The bill rises could be even higher than what we’ve modelled. This is because we have used a range of optimistic assumptions around nuclear. This included assuming a 60-year economic lifetime ignoring likely mid-life refurbishment costs, a very high level of utilisation or capacity factor (93%), and no allowance for a financing premium to cover the high construction risks associated with nuclear plants."

“Further, Australia has very limited nuclear capability, and all examples used were from countries which already have an established nuclear industry. So, Australia could see even higher bills than what our study shows.”

Edis observed, “Nuclear is often mistakenly perceived to be a cost-effective technology because it is in widespread use across the globe. Yet most of the plants built in the western world were committed based on projected costs and timeframes that turned out to be horrible underestimates. They almost make Snowy 2.0 look good by comparison.”

“The end result has often been bankruptcy and taxpayer-funded bail-outs for many of the firms involved. This has been the case for Ontario’s publicly owned utility, for Westinghouse with its AP1000 design, and for France’s AREVA and EDF. These cost blow-outs are sometimes not apparent in the electricity prices seen in other countries, but that’s just because it is the taxpayer picking up the tab instead.”

Bowyer adds: “Our analysis indicates that the Coalition’s plan is unlikely to represent a realistic cost-effective energy solution for Australia. Household power bills would need to rise significantly for nuclear power plants to become a commercially viable investment in the absence of substantial, taxpayer-funded government subsidies. The nuclear proposal needs to be thoroughly scrutinized as it looks very expensive.”

Read the report: Nuclear in Australia would increase household power bills

Media contact: Amy Leiper [email protected] +61 (0) 414 643 446

Author contact: Johanna Bowyer, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)