TIAA climate policy gaps erode potential strength of $1.4 trillion fund

Key Findings

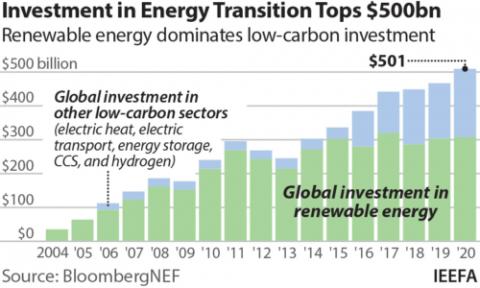

Large investment funds throughout the world are grappling with the climate question. Many are moving forward with plans to divest from fossil fuel assets, but TIAA has been lagging behind.

Large investment funds throughout the world are grappling with the climate question. Many are moving forward with plans to divest from fossil fuel assets, but TIAA has been lagging behind. Today, it faces strong public pressure to reform its weak investment strategy and develop an effective, transparent climate change policy.

TIAA is a Fortune 100 financial services company that serves a broad array of clients with a concentration in the higher education, health and not-for-profit spheres. It has $1.4 trillion in assets under management. In 2014, TIAA acquired Nuveen, which now serves as its principal investment arm.

The TIAA report reveals a corporate policy with major gaps and weaknesses

On the occasion of its first climate report, TIAA announced that it is setting a net-zero emissions requirement by 2050 for its General Account, real estate portfolio and corporate operations. The General Account covers approximately $285 billion in bonds, real estate and private equity. The climate report doesn’t specify the value of its real estate assets that would be covered by the net-zero policy.

The report discusses the company’s actions to date and plans for the future. The report described the core strategic tools TIAA and Nuveen use to achieve its climate goals:

- Engaging with portfolio companies;

- Encouraging portfolio companies to voluntarily adopt emission reduction goals;

- Pressing for emission reductions where TIAA has direct equity interests;

- Evaluating companies in its bond portfolio as maturity dates approach; and

- Advocating at the U.S. Securities and Exchange Commission (SEC) and New York State Department of Financial Services (DFS) for uniform disclosure standards related to climate change.

TIAA’s commitment includes a review the carbon footprint of the General Account, starting with its public corporate bond and direct real estate portfolio. Still, the TIAA report reveals a corporate policy with major gaps and weaknesses that erode its potential effectiveness.

Climate policy falls apart over divestment

The policy guidance fails most significantly on the question of divestment from fossil fuels. This tool has been chosen by many large funds, yet the climate report is silent on the question. In its proxy voting report summarizing the 2020-21 proxy season, TIAA makes clear it does not support divestment as a potential choice for its shareholder strategy. The company’s rejection of a divestment strategy largely relies on a rationale that if it sells its holdings, a smaller and less transparent fund may buy the stocks. TIAA argues the new equity owner would exercise less diligence on the emissions question.

This speculative musing lacks a factual basis. As investors have gotten rid of fossil fuel stocks for a mix of reasons over a long period, fewer investors have bought the stock. In 1980, the fossil fuel industry commanded 28 percent of the stock market. Oil and gas stocks were the Google and Amazon of their day. Today, the fossil fuel sector is only about 4 percent of the stock market (up from 2.7 percent, where it was prior to Russia’s invasion of the Ukraine). As a purely statistical matter, TIAA should provide a factual basis for its statement.

TIAA’s choice of argument displays a basic ignorance of the issue. Divestment is a financial action taken to defend a portfolio against a financial risk. As TIAA’s own executive director put it, climate risk is investment risk. If a fund the size of TIAA is faced with a risk of the magnitude as stark as climate change, one might expect the fund to consider what the fund would look like without fossil fuel holdings. What would happen if TIAA substantially reduced or eliminated fossil fuels from the portfolio? Could TIAA continue to meet its investment targets?

When this question was asked by New York City pension funds to the investment community, BlackRock—one of the largest investment firms in the world—stepped forward and answered the question: “Yes,” you can divest, and “yes,” you can continue to meet your investment targets. Even though it is opposed to divestment as a matter of policy, BlackRock reached this conclusion because its own research led to that response. BlackRock performed a survey revealing that none of the funds that had divested had lost money and the results were either positive or neutral.

A call for action

For such a large fund, TIAA has very small climate ambitions. It is unclear why the company has taken a hands-off policy toward its total portfolio of $1.4 trillion and only focused on its $285 billion General Account and real estate assets. Put another way, it appears that its plan to adopt a net-zero policy for emissions financed by TIAA covers only about 20% of the portfolio— the value identified in its presentation of the General Account.

Between April 1st and April 14th, climate organizers held nine actions across the country demanding that TIAA divest from fossil fuels by 2025. Over the preceding two years, university faculty senates and unions passed 15 resolutions letting TIAA know that they wanted TIAA to adopt a policy to divest from fossil fuel companies. rapidly and completely.

For such a large fund, TIAA has very small climate ambitions

What the faculty, students and others who are raising the divestment issue with TIAA are saying is clear. The fossil fuel sector has performed poorly over the last decade. Its outlook is negative. The current spike in oil and stock prices is driven by the head of Russia pursuing a geopolitical strategy that has horrified the world.

TIAA’s policy of engagement Is weak, ineffective, and a missed opportunity

TIAA’s climate report is correct in one respect; it needs a transparent rendering of its fund structure and a carbon footprint analysis to track and mirror its financial holdings.

Greater transparency could have a positive impact. TIAA is conducting research to improve its understanding of the depth of Scope 1, 2 and 3 emissions financed by its investment portfolio. The company is focusing its effort on its real estate and bond portfolio (and the longer-term commitment on private equity). It could produce very important results not only for TIAA but also for funds around the world. A fund as large as TIAA is in a unique position to send the right kind of message and to provide support to its peers. The actions it takes to further its emissions reductions will have considerable results. TIAA is aware of its role, particularly in bond investments—its approach of surveying its portfolio and looking to take investment actions as bonds mature is promising. How it is assessing those companies in its portfolio and what actions it plans to take is important now for the investment community. It is unfortunate that TIAA did not chose to publish its criteria for review of companies in its portfolio.

The program of engagement is presented in a lackluster manner. TIAA discloses that 147 companies have been contacted and some have agreed to TIAA’s request for greater disclosure on climate risk. The TIAA climate report, however, offers no discussion of the standards it uses to evaluate responses. It also provides no policy discussion about how to address those companies who comply and those who fail to comply. The oil and gas industry as a whole, its business model, and specific companies like ExxonMobil have proved that the engagement process that works for many companies across the economy is unworkable for the fossil fuel industry. TIAA’s own shareholder report provides a detailed account of how it and other shareholders went to extraordinary lengths with ExxonMobil. While TIAA’s report is optimistic about ExxonMobil events that have occurred subsequent to the shareholder report release show the optimism was unfounded.

A question of fiduciary duty

The issue of divestment is ripe for discussion. Can TIAA’s climate commitment be taken seriously so long as it has not even considered what its portfolio could look like without any reliance on coal, oil and gas companies?

Even if TIAA were to reject divestment again, at least it should be done based on factually sound information and considered judgments. Its rejection of divestment has been made without proper diligence and attention to fact.

The issue of divestment is ripe for discussion

It would appear that TIAA board and management does not want to know the answer to the questions: What would the portfolio look like with no fossil fuel investments, and could such a portfolio achieve the fund’s financial targets both for the General Account and for the larger assets under its care?

The essence of the fiduciary duty is not whether an action succeeds, fails or just muddles through. The essence is whether or not all the important, thoughtful questions are asked and answered before the fiduciary acts. At this time thoughtful questions about fossil fuels financing emissions cannot ignore the suffering of people from more frequent and extreme weather events.

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis.