Taming electricity price inflation starts with addressing network supernormal profits

Key Findings

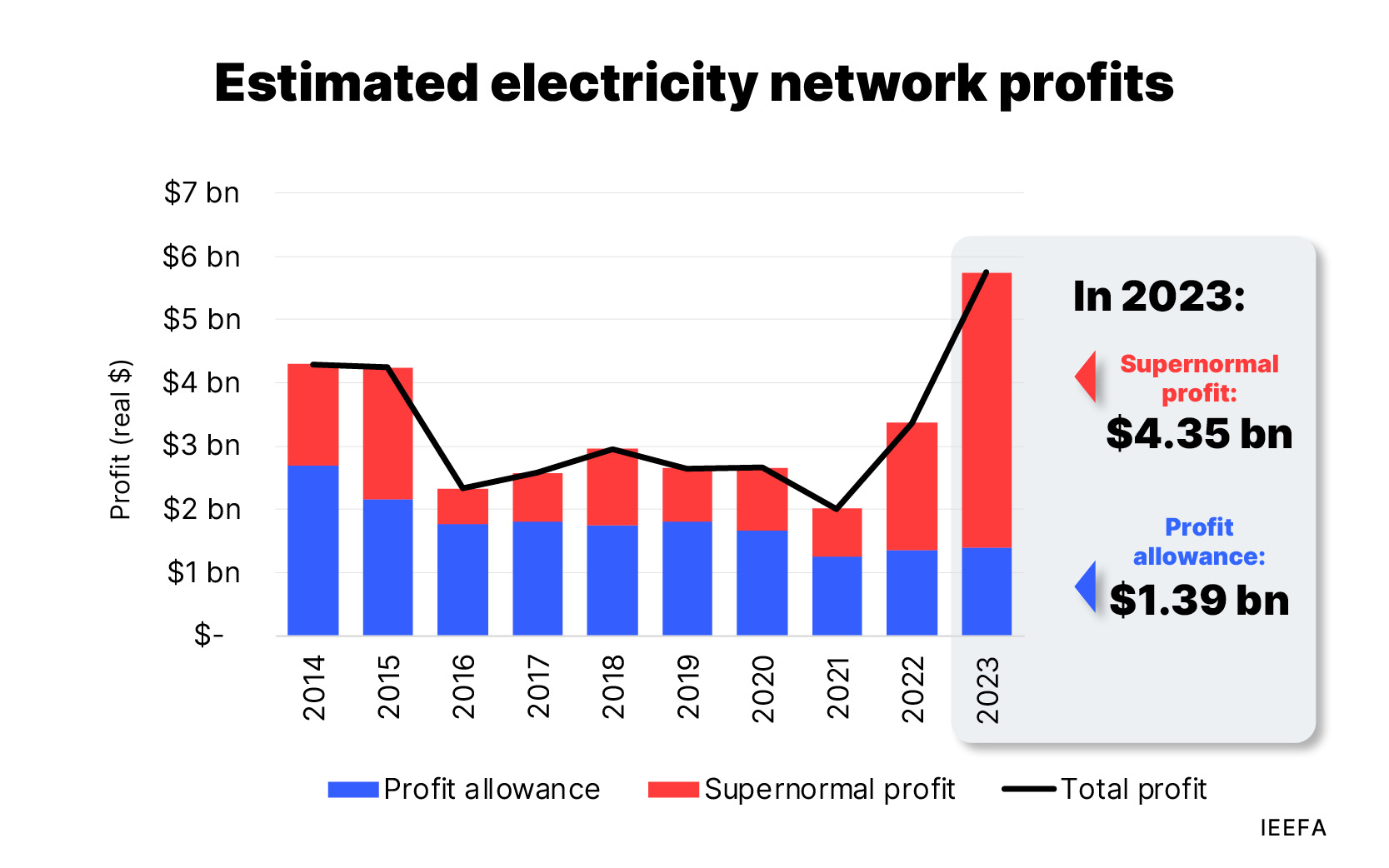

Electricity networks made an estimated $4.35 billion in supernormal profits in the 2023 regulatory year – in addition to their $1.39 billion profit allowance as regulated monopolies.

The federal government is spending $3.5 billion on energy bill rebates this year. If it acted to curtail electricity networks’ supernormal profits, it could deliver much larger, sustainable savings, none of which would come from taxpayers.

IEEFA research shows the networks have been making excessive profits for the last decade, but the latest record figures show the situation continues to worsen, despite the ongoing cost-of-living pressures faced by Australian households.

A lack of transparency and accountability from the federal regulator has helped the networks evade the scrutiny other sectors, such as supermarkets, have faced over their profitability during the cost-of-living crisis.

The latest inflation figures show that Australia’s inflation rates may finally be stabilising. Among other drivers, the Australian Bureau of Statistics (ABS) has acknowledged that energy bill rebates introduced by the federal, and some state governments, have driven a significant reduction in electricity prices.

In the 2024-25 financial year alone, $3.5 billion of taxpayer funding was allocated to the federal government’s Energy Bill Relief Fund. And while it is promising to see it have an effect, it raises a question: What happens when these energy rebates run out?

For Australia to achieve long-term, sustainable reductions in energy prices, we must address the underlying drivers of inflated electricity prices. A logical starting point is network costs, which typically make up the largest portion of electricity bills – around 45% on average.

IEEFA estimates that electricity networks made $4.35 billion in supernormal profits from consumers in the 2023 regulatory year; a sum that is much larger than the latest Energy Bill Relief Fund expenditure, and sits on top of networks’ regular profit allowance of $1.39 billion. So how did we get here?

While electricity networks provide an essential service, they also function as natural monopolies. To protect consumers, the Australian Energy Regulator (AER) oversees and approves the charges that network operators can pass on. This ensures networks can recover their costs while earning a reasonable profit.

However, analysis published by IEEFA since 2022 has revealed a concerning trend. By comparing the profits of regulated electricity networks against the AER’s ‘allowed’ rate of return, we found that networks consistently exceed these allowances by very large margins. Between 2014 and 2022, electricity networks amassed approximately $11 billion in supernormal profits, bringing their overall profits to nearly 1.7 times their regulated allowance of $16 billion. This resulted in excess charges of $120 per customer per year on average.

More recent data from the AER shows the situation has only worsened. The AER 2024 network performance report shows that the average return on regulated equity – the profits experienced by network shareholders – has soared to record levels. Electricity network returns on average exceeded 13% in the 2023 regulatory year, though in the most extreme example, equity holders of Endeavour Energy in NSW received a 34% return.

Adding on the $4.35 billion in supernormal profits we have estimated for 2023 to IEEFA’s previous findings, this suggests networks have made an eye-watering $15 billion in supernormal profits since 2014.

So why is it that these regulated monopolies, providing an essential service, haven’t faced the same scrutiny that other sectors – like supermarkets – have faced over their profitability during the cost-of-living crisis?

Firstly, there is an issue with transparency. While the AER reports on these profits as percentage returns, it does not disclose network profits in absolute dollar terms. In order to calculate this, IEEFA had to request additional data from the AER (gearing ratios), which were provided only in an aggregate form across all networks. Our 2023 estimate above is based on the assumption that aggregate network gearing did not change between 2022 and 2023.

In their response to IEEFA’s previous findings on supernormal profits, the AER has claimed “We derive a similar outcome to IEEFA”, and that “The difference is that our estimate uses the actual leverage of the networks businesses as opposed to average gearing across networks used by IEEFA.”

The AER also states that “The ability of business to outperform the regulated return is the incentive-based framework working as intended under the legislation”, and “The incentive schemes in place under the regulatory framework reward networks for improving productivity and service performance beyond benchmarks. This ultimately provides benefits to customers in the form of lower prices and superior service levels.”

While it is true that the regulatory system allows networks to make additional profits above the AER’s allowed rate, the sheer scale of these supernormal profits is extraordinary, and IEEFA has not seen evidence that they are associated with productivity improvements.

This raises the question: If the regulatory system is supposed to deliver net benefits for consumers, where are these benefits, and do they really outweigh the billions in supernormal profits made by electricity networks?

The AER has pointed to several areas of improvement since 2014: networks have reduced their capital and operating expenditure; service performance levels have improved; and revenue per customer has declined.

However, the problem with measuring performance against 2014 levels is that it is a very poor baseline. It follows a period that is widely characterised by significant over-investment in electricity networks, which has left many networks underutilised today.

Certainly, efficiency gains from this baseline should be expected. But was it reasonable for consumers to pay billions in “rewards” for these improvements?

The $3.5 billion in taxpayer money that the federal government has allocated to the Energy Bill Relief Fund for 2024-25 does not address any of the underlying drivers of higher electricity prices. Had it taken steps to curtail supernormal profits in electricity networks, it could have delivered up to $4.35 billion in savings to consumers in 2023, none of which would need to come from taxpayers.

While short-term rebates may offer relief, until governments address excessive profits in our energy system, Australian consumers will continue to pay more than necessary for their electricity.