Key Findings

IEEFA estimates electricity networks extracted $2 billion of supernormal profits in FY22 – making total profits 2.5 times the levels necessary to compensate shareholders for risk.

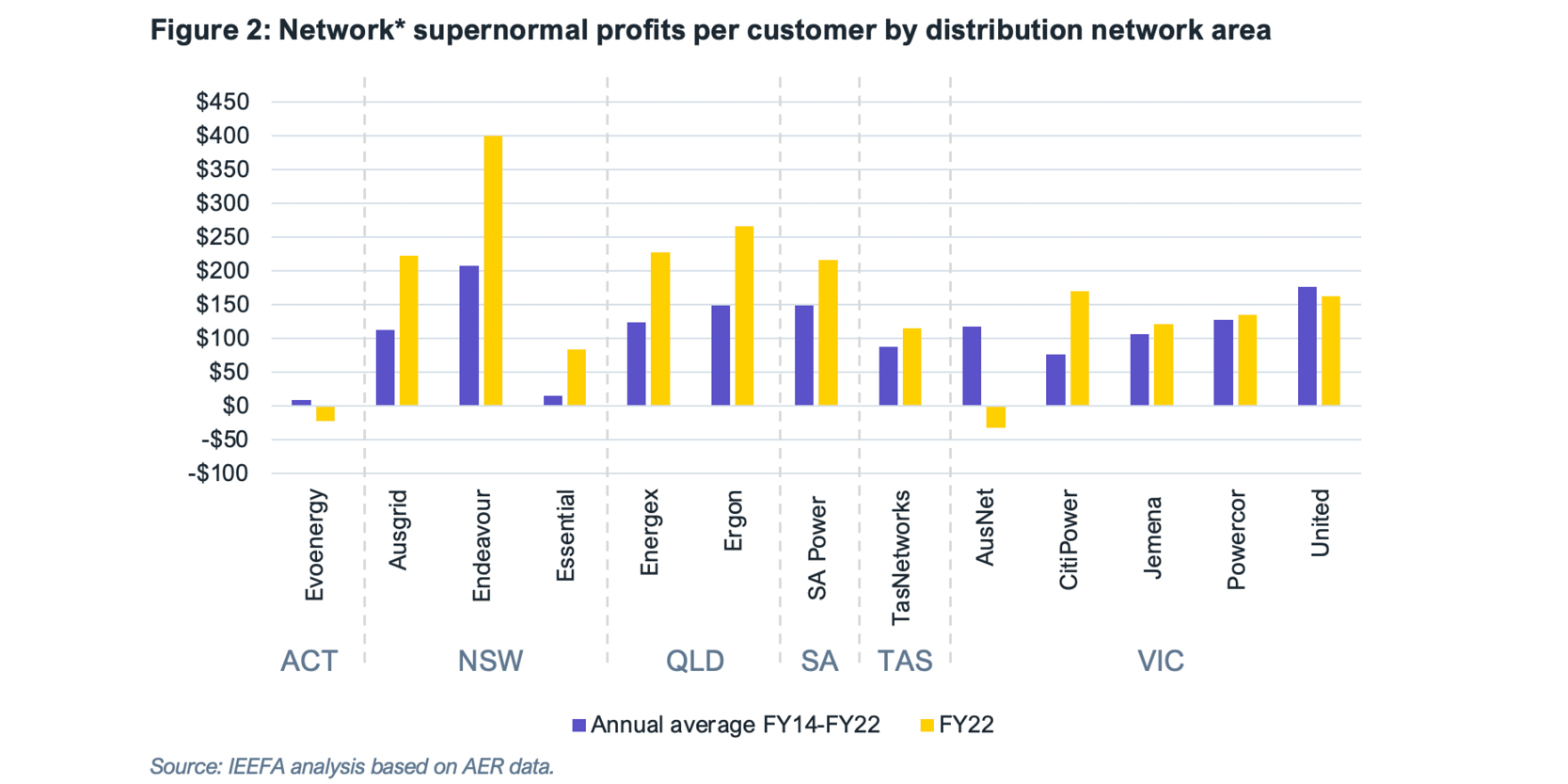

The supernormal profit per customer for FY22 ranged from $80-$400, depending on the network area.

The excessive supernormal profits were caused by weaknesses in the regulatory regime in favour of networks.

Governments can improve transparency, change the rules to avoid excessive network supernormal profits, and get power bills down.

Executive Summary

Opportunity to reduce power bills

Power bills can be fairer and more affordable if Australian governments agree to tackle unearned, persistent and excessive supernormal network profits that are inflating power prices without performance or reliability benefits. Change can only occur with government action.

IEEFA estimates the 18 monopoly electricity networks serving the national electricity market (NEM) are extracting persistent supernormal profits that inflated customer power bills in affected network areas by between $80 and $400 per customer in the 2022 financial year. IEEFA’s analysis uses profitability data from the 18 monopoly electricity networks in the NEM, released by the Australian Energy Regulator (AER) in July 2023.

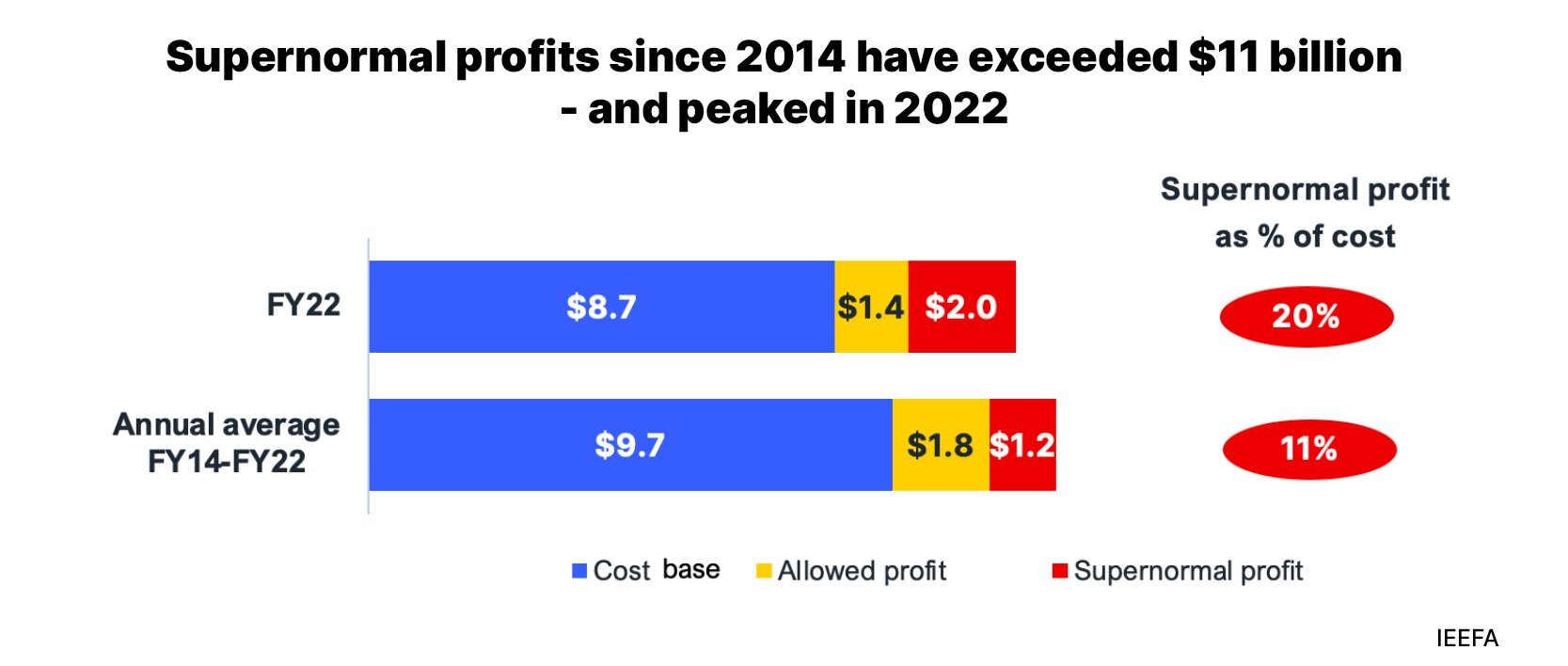

An analysis of this data shows that supernormal profits were recorded in eight of the past nine years. Estimated sector-wide supernormal profits were persistent, averaging about $1.2 billion a year over FY14-FY22 or 11% of total cost (including allowed profits). In FY2022, the combined actual profits were $3.4 billion, 2.5 times the risk-adjusted, allowed profit of $1.4 billion – a supernormal profit

of $2 billion.

The estimated supernormal profits in FY22 compared with the nine-year period FY14-FY22 are summarised in Figure 1.

From FY14-FY22, $11 billion of supernormal profit was extracted in total across all networks, on top of the allowed profit of $16 billion. This means wealth from NEM electricity customers has been transferred to network shareholders: private domestic shareholders, private offshore shareholders and the Queensland, NSW and Tasmanian state governments. The supernormal profit means network prices have been higher than necessary, harming power affordability. It has also diverted up to $11 billion of revenue away from necessary expenditure required to support reliability, including investment in new transmission and storage capacity.

The bill impact of structural excessive supernormal profits is substantial and ongoing.

The bill impact of structural excessive supernormal profits is substantial and ongoing. Regulated network charges represent the second-largest component of retail power bills, after wholesale energy costs. Figure 2 shows estimated supernormal profits per customer by distribution area – combining supernormal profits from both distribution and transmission networks. With a few exceptions, supernormal profits ranged from about $80 to $400 per customer in FY22. In that period, there appear to be no supernormal profits in the ACT or areas served by Ausnet in Victoria.

If the same supernormal profit trends from FY22 are assumed to continue, between 14%-69% of retail price increases this financial year – from 1 July 2023 – could have been avoided if profits were no more than sufficient to compensate shareholders for commercial and regulatory risk. Families and businesses are already experiencing power price shocks, and supernormal profitsare a significant contributor. This is an example of price rises driven by increased company profits rather than increased costs.

The problem

Historically, there has been insufficient transparency over the existence, size, bill and efficiency impacts of network supernormal profits. The AER has not disclosed the total dollar or per-customer bill impacts of network supernormal profits in its regular reporting of network performance. It does not refer to persistent supernormal profits, despite these being relevant to its recent reviews such as its reviews of incentive schemes and the rate of return. IEEFA has undertaken extensive research and analysis to attempt to fill this information gap.

The AER refers to a variety of factors causing actual returns on equity to be consistently higher than the allowed level in its network performance report. IEEFA accepts the AER’s analysis of the various cost buckets that have led to higher than expected network returns on equity. However, IEEFA believes that the AER’s explanation does not demonstrate that these actual return outcomes are consistent with effective incentive regulation and the National Electricity Law (NEL) revenue and pricing principle that returns to shareholders should be “commensurate with the regulatory and commercial risks involved in providing” regulated network services.

The allowed return on equity, and therefore the allowed profit, is set by the AER to compensate shareholders fully for regulatory and commercial risks. Returns consistently well above the allowed return therefore appear inconsistent with the NEL pricing principle.

Networks have an opportunity to earn higher returns on equity by increasing productivity. However, this does not appear to be the reason for the observed supernormal profits. Comparing AER productivity data with profitability data shows that supernormal profits are unrelated to productivity. Total productivity has improved only marginally since 2014, and remains well below the levels estimated in 2006 when productivity analysis was first undertaken on an NEM-wide basis.

Defining excessive supernormal profits

Some level of profit above the allowed level – i.e. supernormal profit – is reasonable. However,the profit outcomes observed by IEEFA appear unreasonable. IEEFA has drawn from expert advice on the acceptable level of supernormal profits under effective incentive regulation to understand whether the supernormal profits observed are reasonable. This expert advice found that the regulator would have less information than the networks surrounding their cost data, and therefore networks would be able to extract some level of additional profit referred to as “information rents”. The “information rent” concept has previously been relied upon by the AER to explain supernormal profits.

IEEFA has applied the concept of information rents to suggest that actual profits could be up to 30% (1.3 times) above allowed profits, where these are earned by higher than average levels of productivity. If actual profits are more than 1.3 times allowed profits, the supernormal profit exceeds reasonable information rents under effective incentive regulation.

Most supernormal profits are excessive compared with reasonable expectations under effective incentive regulation.

Most supernormal profit outcomes exceed the information rents threshold. Of the 162 individual profit outcomes over the past nine years:

- 64% are above the upper boundary of the expected range under effective incentive regulation (actual profits up to a multiple of 1.3 times allowed profits);

- 20% are within the acceptable range (0.9-1.3x), and;

- 16% are below the lower boundary of the expected range (0.9x).

This means the supernormal profits are excessive. The excessive, sector-wide supernormal profits are structural and persistent, and not the result of timing and short-term factors. Excessive supernormal profits over nine years cannot be explained by “outside factors” such as innovation or productivity improvements, changes in financing costs, a higher tolerance for financing risk, or changes in the level of inflation. Supernormal profits do not reflect “gold plating” or over-investment, as they are calculated after all investments in new or replacement assets.

IEEFA’s interpretation of network profitability and other relevant AER data over 162 reporting periods and entities is that the combined institutions that govern network regulation in Australia are not adequately protecting electricity consumers from the monopoly pricing power of networks. IEEFA has considered alternative explanations for supernormal profits and they do not withstand critical scrutiny. The AER has so far not provided any evidence or considerations to defend the proportion of outcomes that are well in excess of an actual to allowed profits multiple of 1.3.

Substantial new regulated network investment is required to support the energy transformation to allow the timely replacement of high-emissions power stations with renewable energy and storage. Excessive regulated network profits are inefficiently raising consumer bills, and impeding this transformation.

What can be done?

The Energy and Climate Change Ministerial Council in its July 2023 communique emphasised energy reliability and affordability measures and collaboration on climate change. The analysis in this report identifies a tractable opportunity for the Ministerial Council to promote more affordable and reliable electricity network supplies in the long-term interests of electricity consumers and the economy more broadly.

A draft of this report was shared with the AER and all Energy Ministers of NEM jurisdictions, seeking their comments and suggestions for improvements. Responses were received from a number of jurisdictions. These responses indicate Ministers are yet to decide whether to take action on network profits.

NEM Ministers should obtain independent expert advice to test the IEEFA analysis, and identify suitable remedies to bring network profits to reasonable levels. Potential remedies include changes to the laws and rules governing the economic regulation of monopoly networks, alongside the introduction of greater transparency and independent monitoring of network profits by the Australian government.

These changes could be made in time to come into effect from mid-2024. Without these changes, excessive supernormal network profits and less affordable power bills will likely continue for the foreseeable future.

Substantial new regulated network investment is required to support the energy transformation to allow the timely replacement of high-emissions power stations with renewable energy and storage. Excessive network profits are inefficiently raising consumer bills, and impeding this transformation.