Regulated electricity network prices are higher than necessary

Download Full Report

View Press Release

Key Findings

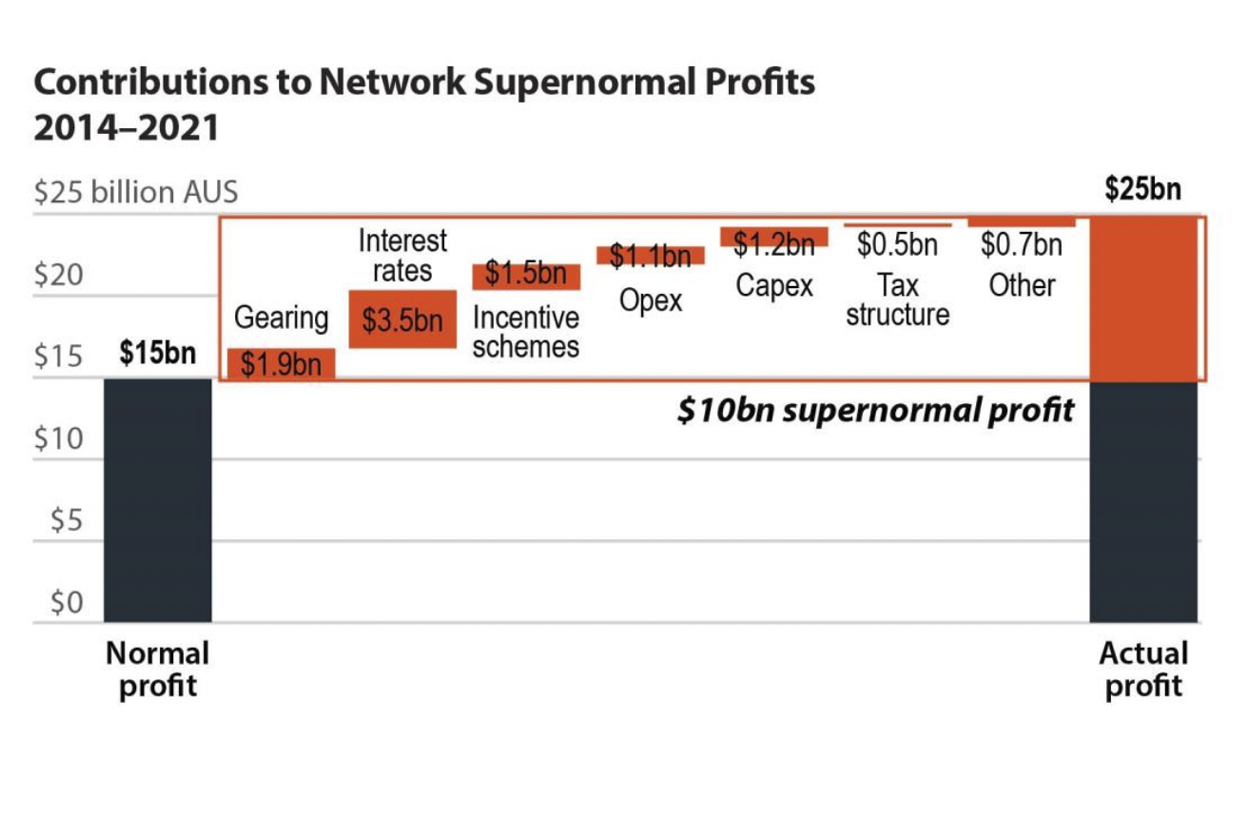

Over 2014-2021, Australian consumers were charged $10 billion more for electricity network services than necessary to ensure a reliable service.

Weaknesses in the regulatory system have allowed these excessively high returns or “supernormal profits” in favour of network shareholders, diverting funds that could have been invested in Australia's necessary energy transition.

Correcting regulatory failure requires substantial reforms including changes to the National Electricity Law and Rules, monitoring and reporting on supernormal profits, improving consumer representation in regulatory processes and ensuring frameworks for future investment are efficient.

Executive Summary

Consumers are paying much more than necessary for safe and reliable electricity.

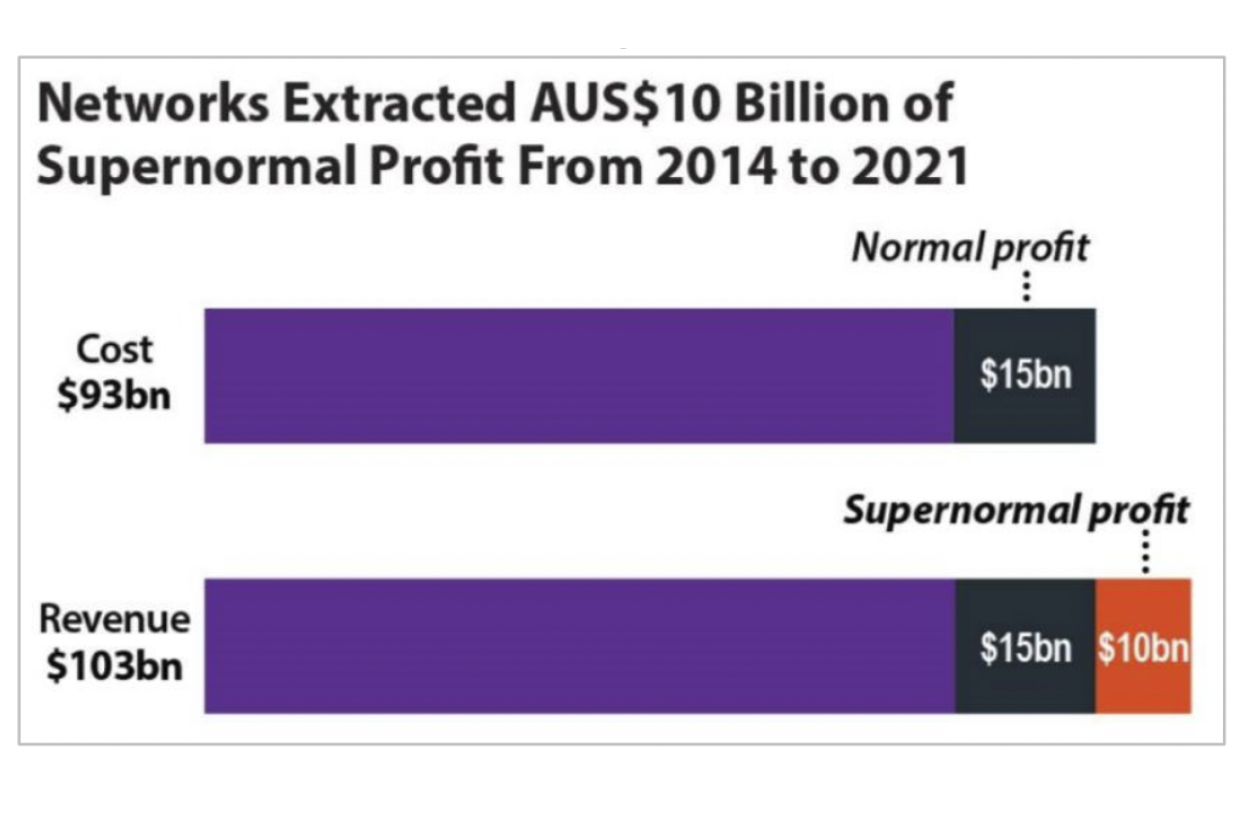

Data released by the Australian Energy Regulator (AER) in July 2022 shows that the actual returns received by electricity networks from 2014 to 2021 are consistently higher than the normal level of return. The total extra profit above normal levels, or “supernormal profit”, extracted by network businesses over the eight-year period was $10 billion. The actual profit received was 67% higher than the normal level of profit.

Total extra profit above normal levels, or “supernormal profit”, extracted by network businesses over 2014- 2021 was $10 billion.

Distribution and transmission network service providers in the National Electricity Market (NEM) are natural monopolies because it is not efficient to build multiple electricity networks alongside one another. To ensure that the networks do not exert monopoly pricing power, the AER regulates the prices networks charge consumers. The AER is responsible for making sure that networks charge consumers only what is required to cover the costs of investing in, building, maintaining and operating the networks, plus a reasonable profit to ensure compensation for investors.

In its Strategic Plan 2020-2025, the AER states its key objective regarding network regulation is to ensure that “consumers pay no more than necessary for the safe delivery of reliable electricity and gas network services”. The National Electricity Law’s revenue and pricing principles state that returns to shareholders should be “commensurate with the regulatory and commercial risks involved in providing” regulated network services.

Under incentive regulation, regulated networks have the opportunity to earn supernormal profits by exceeding expected efficiency improvements. However, productivity and performance improvements do not explain sector-wide supernormal profits over eight years, spanning almost two five-yearly price control periods. The reason for the supernormal profit was that the AER and the network businesses overestimated the costs that network businesses would require to build, operate and maintain the network. Networks charged those overestimated costs to consumers, and shareholders retained the differences between revenues and costs.

In IEEFA’s view, the observed persistent sector-wide supernormal profits do not appear consistent with the revenue and pricing principles set out in the National Electricity Law, the National Electricity Objective, or the AER’s objective of ensuring that consumers pay no more than necessary for network services.

The supernormal profits issue needs to be examined and rectified. IEEFA has presented a range of recommendations in this report. If this situation is not improved, energy consumers will continue to pay more than required for electricity distribution and transmission network services.

NEM Networks Are Economically Regulated to Control Price to Consumers

Electricity networks are expensive businesses to run. In Australia, the economic regulation of electricity networks is undertaken by the AER. The AER regulates the amount networks can charge to consumers, under rules set by the Australian Energy Market Commission (AEMC).

The networks submit their expected future costs to the AER for its review. The AER makes revenue determinations allowing networks to recover future estimated efficient costs from consumers plus a return on capital invested (to ensure that investors in the networks are reasonably compensated). The total cost that networks can recover from consumers is the “regulated revenue”. The AER sets a regulated revenue for networks every five years, representing the total estimated amount that networks can charge consumers on their electricity bills for regulated network services.

The costs that the networks face, which determine the regulated revenue they can receive from consumers in the form of electricity network prices, include the following “building blocks”:

- repaying the capital cost associated with building the network (depreciation)

- providing a return on capital to investors who have invested in the network assets (including both debt and equity investors)

- the operating expenditure (opex) required to run the network—including maintenance, staffing and other operational costs

- tax costs

- other network business costs.

Estimates of future building block costs are adjusted for the cost of continued upgrades to and building of networks, subject to regulatory investment tests and AER review of regulated capital expenditure (capex) proposals.

Networks are also rewarded or penalised for productivity and quality performance through explicit “incentive schemes”. The cost or reward related to networks participating in incentive schemes is also added to, or subtracted from, the total allowed revenue for the given network business.

Equity shareholders in network businesses require adequate returns to incentivise them to invest. The AER determines a reasonable real return on equity for each network business (the “allowed” RROE), considering equity investor risk appetite and opportunity cost. This “allowed” RROE is included in the cost build-up for each network’s regulated revenue—that is, consumers pay for returns to equity shareholders through their electricity bills.

Networks Are Charging Consumers Too Much

As noted above, data released by the AER in July 2022 shows that the actual return to equity shareholders has significantly exceeded the allowed return level forecast by the AER over an extended period. Most network businesses are charging consumers significantly more than required to achieve their normal return and pocketing the difference in the form of additional returns.

The AER has released data on the percentage returns for electricity networks, but so far has not disclosed what the percentage return figures mean in dollar terms (i.e., the network business profits) or the bill impact on consumers.

To determine the profit the networks have made, IEEFA has converted AER inflation-adjusted RROE percentages data to dollar amounts using non-indexed regulated asset base data published by the AER. Applying a debt-to-equity ratio assumption of 60:40 (the only assumption in this analysis), supernormal profits can be determined from the difference between total costs (including normal profit) and total revenues.

If regulation were effective, then for the average network in the average year, costs and revenues should be more or less equal. However, IEEFA’s results demonstrate that actual regulated network revenue exceeded total regulated network costs by 10.8% during 2014-2021. This gap between cost and revenue is a supernormal profit extracted by networks—a charge for costs that do not exist.

In dollar figures, the supernormal profit over 2014-2021 was nearly $10 billion, or more than $1.2 billion annually. Of the 18 NSPs, 14 extracted supernormal profits above IEEFA’s expected profit multiple range.

Network costs, profits and supernormal profits, 2014-2021

Sources: AER data, IEEFA analysis

The data shows that economic regulation of electricity networks in most of Australia over the period 2014-2021 has consistently failed to prevent networks from setting prices well above their total costs.

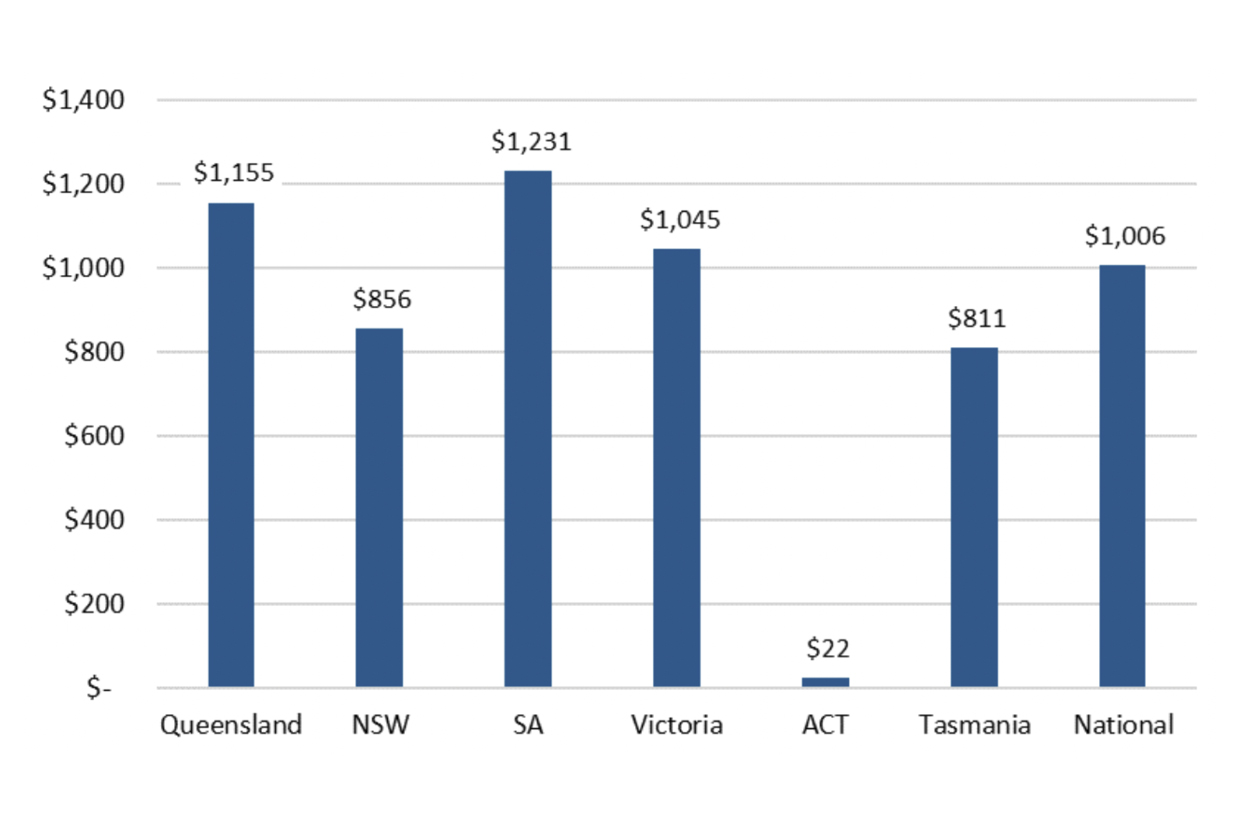

The supernormal profits built up over eight years imposed an additional cost of between $800 to $1200 per customer, depending on the state. Of all NEM jurisdictions, only the Australian Capital Territory (ACT) has managed to constrain revenue close to costs.

Cumulative Supernormal Profits per Customer by Jurisdiction, 2014-2021

Source: AER data, IEEFA analysis. Note: Western Australia is not part of the National Electricity Market and is excluded from this analysis. AER data for the Northern Territory is not available for the entire period.

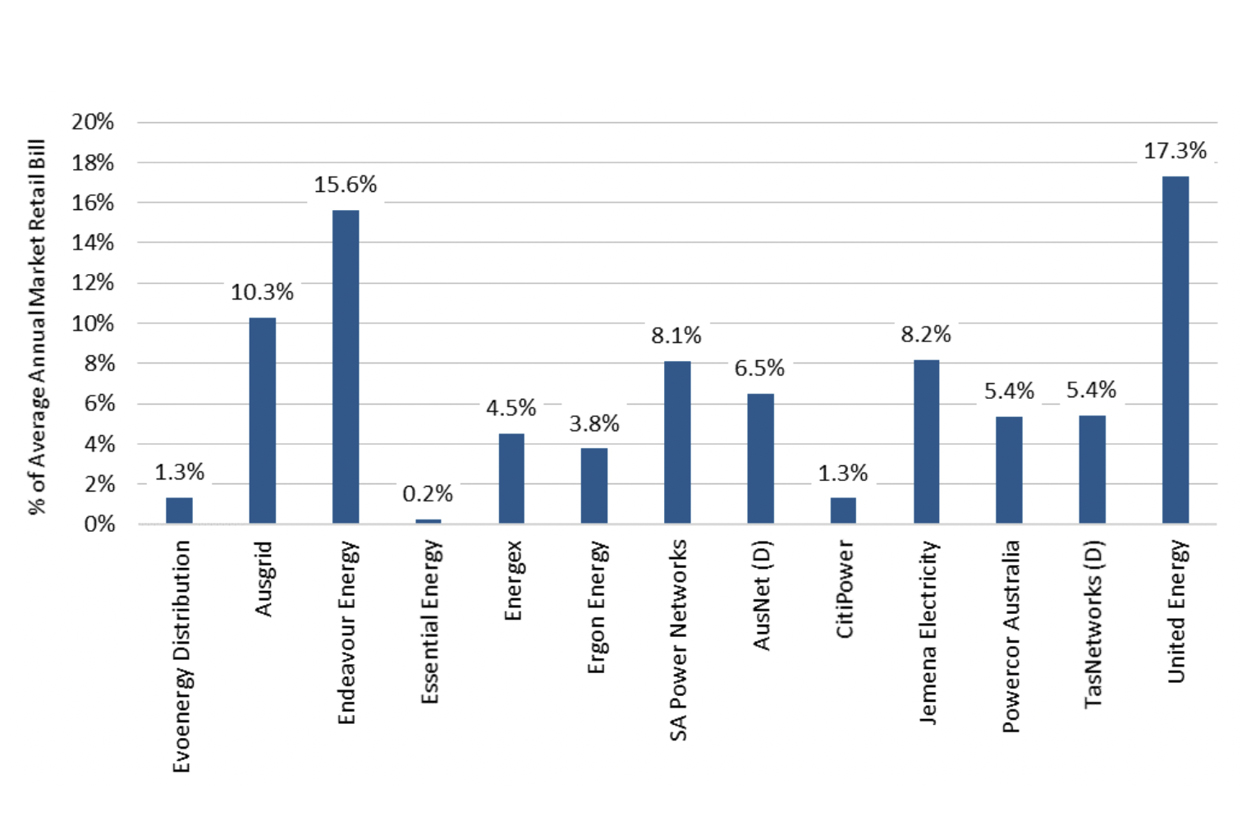

The following figure illustrates the extent to which retail bills have been inflated by total supernormal network profits, for each distribution network area, in percentage terms in 2020.

On average, across all networks, 6.8% was added to customers’ retail bills by network supernormal profits. The range was wide: from 0.2% for Essential Energy in New South Wales to 17.3% for United Energy in Victoria.

Estimated Retail Bill Impact of Network Supernormal Profits, 2020, by Distribution Network (relative to average market retail bill)

Source: AER data, IEEFA analysis—combining both transmission and distribution network service provider supernormal profits for the 13 electricity distribution network areas.

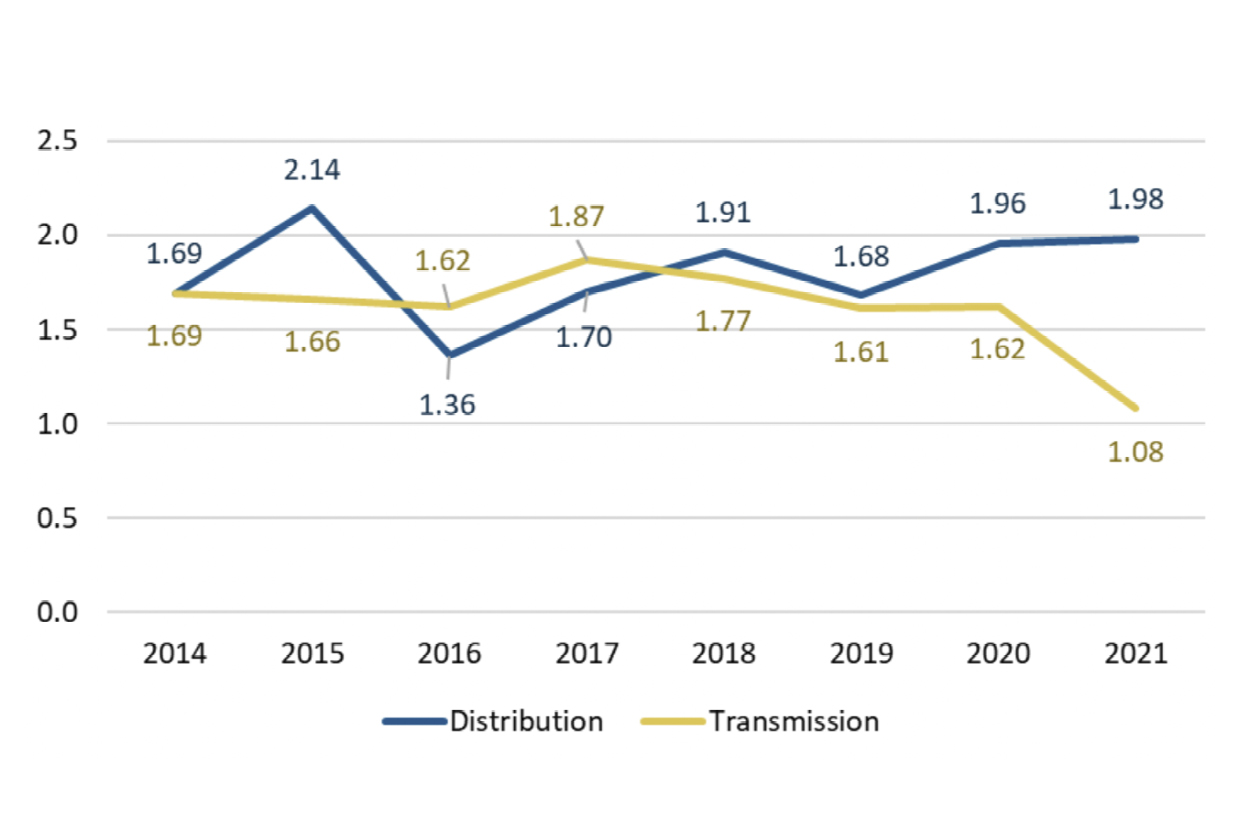

The actual profit received by networks has been consistently higher than the normal profit throughout the period, as shown in the figure below, which shows the actual profit as a multiple of normal profit. If actual profit were equal to normal profit, the profit multiple would be one. However, it is consistently above one. This shows that, across the sector, supernormal profits were extracted for every year of the period.

Profit Multiples Across Distribution and Transmission Networks by Year (actual profit as multiple of normal profit), 2014-2021

Source: AER data, IEEFA analysis.

How Have Networks Been Able to Overcharge Consumers?

Networks have been able to overcharge consumers and extract supernormal profits, despite network prices being economically regulated by the AER. There has been an ongoing wealth transfer from Australian energy consumers to the owners of Australia’s energy networks, including overseas owners.

How did this happen when network prices are regulated? Actual network costs were persistently lower than the estimated costs used to set regulated prices, over 2014-2021 (80% of the two five-year revenue control periods). The total impact of these overestimated costs was not being disclosed publicly for most of the period. Errors in estimation methods were not comprehensively tackled during five-yearly price resets. Consumers were charged for network service provider (NSP) “costs” that did not exist.

Actual network costs were persistently lower than the estimated costs used to set regulated prices, over 2014-2021.

For the most part, estimation errors do not reflect the information advantages of networks relative to the regulator, under effective incentive regulation. Instead, they reflect ongoing decisions by the regulator to retain theories and assumptions to estimate key costs, rather than using data and evidence.

A further contributing factor is that the regulator was unable to correct some estimation errors as a result of successful legal proceedings initiated by networks. The main costs that were overestimated were financing costs (interest rates), opex, capex and tax. Overly generous network productivity and performance reward schemes (called “incentive schemes”) also contributed to sector-wide supernormal profits.

The sources of the variances between the normal profit and the actual profit, resulting in the supernormal profit over the eight-year period are shown in the figure below. The actual profit received by networks was 67% higher than the normal profit level over the period.

Source: AER data; IEEFA analysis. Derived from Figure 4.6 of AER. Electricity network performance report 2022, p. 32.

For the cost buckets below, networks charged consumers more than required to cover their actual costs.

- Gearing: Gearing refers to the proportion of finance raised from different sources—debt and equity. It is expressed as a ratio of debt to equity. The total cost of capital is affected by the gearing ratio. The AER used and continues to use standardised gearing assumption for all NSPs to determine the total revenue required by NSPs. The gearing contribution to supernormal profits may reflect NSP decisions to maximise supernormal profits from other contributing factors by adjusting their gearing ratios.

- Interest rates: Some of the contribution to supernormal profits from lower interest rates reflects falling interest rates and the methodology used to estimate future debt servicing costs. However, some of this contribution reflects ongoing decisions to apply benchmark credit ratings in the bottom third of investment grade ratings, that do not correspond to actual credit ratings and debt financing charges.

- Incentive schemes: The AER rewards networks for productivity and innovation through incentive schemes. However, incentive payments for average or below average performance and efficiency appear to have resulted in sector-wide over-compensation under these schemes.

- Opex: The AER’s estimates of efficient operating expenditure (opex) appear consistently too high. These estimates are constrained by limited data, including on vegetation management and other environmental factors that vary between networks, making it difficult to estimate the extent to which differences in opex between networks reflect differences in performance.

- Capex: As shown in the AER’s 2021 network performance report, total NSP capital expenditure (capex) over the 2014-2021 period underspent allowances for five out of the eight years, contributing to supernormal profits for both transmission and distribution.

- Tax: The AER identified problems with its benchmark methods for estimating tax in a 2018 review, drawing on data provided by the Australian Tax Office. Before this change, tax allowances significantly exceeded actual tax costs.

- Other: It appears there were further costs that were overestimated by the AER and networks that also contributed to supernormal profits for networks.

Economic Regulation of Energy Networks Is Not Effective

The AER’s explanation of network profits relies on a theory regarding information advantages (“rents”) held by networks even under effective incentive regulation. This theory is applied to estimate efficient supernormal profits based on a multiple of the total value of the network regulatory asset base (RAB) being financed by debt and equity.

However, it is an incomplete explanation because it overlooks the fact that debt holders financing around 60% of RABs do not benefit from supernormal profits. Supernormal profits are received by equity holders financing around 40% of RABs implying that supernormal profits should not be compared with RABs but with a normal return on equity for around 40% of RABs.

This report finds that, on reviewing network profitability data, and the AER’s incomplete explanation of persistent and substantial supernormal profits:

- Actual profits exceeding normal profits by 1.7 times over 2014-2021 does not appear consistent with Objective 3 in the AER’s Strategic Plan 2020-2025 for “ensuring that consumers pay no more than necessary for the safe and reliable supply of electricity network services”.

- An assessment of individual contributions of various cost buckets to overall supernormal profits reveals the persistent application of false theories and incorrect assumptions, in place of data for estimating costs and revenues, and not reasonable information “rents” under effective incentive regulation.

- When considering the reasonableness of supernormal profits, normal profits attributable to shareholders are the appropriate benchmarks for assessing whether returns to shareholders are commensurate (“correspond”) with regulatory and commercial risks in providing network services (National Electricity Law [NEL], section 7A(5)). Using this benchmark, actual profits exceeded normal profits by a multiple of 1:1.7 (NEL, section 7A(5)).

- There are no reliability benefits from persistent large supernormal profits since all supernormal profits are measured after reinvestment in regulated networks (NEL, section 7A(6)), and overinvestment reduces reported profits.

- Persistent and large supernormal profits have contributed to increased investment in and use of substitutes for network services by consumers, resulting in widespread underutilisation of network assets (NEL, section 7A(7)).

- Inefficiencies from excessive network prices, and wealth transfers created by persistent sector-wide supernormal profits, are impeding the energy transformation. The $10 billion supernormal profits over just eight years is approaching the estimated regulated transmission investment requirements in the Australian Energy Market Operator’s (AEMO) Integrated System Plan for assets with expected lives greater than 50 years.

Considering sector-wide outcomes over a majority of two regulatory control periods alongside the factors that resulted in persistent supernormal profits, consumers have clearly been paying substantially more than necessary for safe and reliable regulated energy network services.

Inefficiencies from excessive network prices, and wealth transfers created by supernormal profits, are impeding the energy transformation

Economic regulation of electricity networks across most of Australia over 2014-2021 has consistently failed to prevent networks from setting prices well above their total costs and generating sustained and substantial supernormal profits. In IEEFA’s view, this outcome appears inconsistent with the National Electricity Objective and the revenue and pricing principles in the National Electricity Law.

Impact on Efficient Investment and Use of Electricity

Persistent and excessive supernormal profits mean that overall retail electricity prices are currently higher than necessary. Higher prices inefficiently suppress demand for network services and encourage higher than efficient investment in non-network alternatives, including consumer energy resources. High network prices have already contributed to the widespread underutilisation of existing network capacity and excess network capacity. This, in turn, has adversely affected the overall productivity of the sector.

Supernormal profits transfer wealth and result in deadweight losses, reducing the gross domestic product and the international competitiveness of Australian exports and import substitutes. Supernormal profits may lead to consumers investing in substitute assets and services at higher than optimal levels, reducing the utilisation of network assets. As a result, supernormal profits reduce dynamic and overall economic efficiency over the long run.

Supernormal profits are not being reinvested in higher levels of regulated capital investment, as assumed in many assessments of the costs and benefits of supernormal profits. Instead, shareholders are retaining them, including in the form of dividends.

Substantial resources are being diverted from the energy transformation and investment and usage outcomes are being distorted by excessive network prices.

This means that financial resources that could fund investment in the energy transformation are being diverted by wealth transfers from consumers to network shareholders, many of whom are overseas. This delays and raises the cost of the energy transformation.

Unless corrected, the total costs to consumers from the profit component of future regulated transmission investment would be 85% higher than the normal profit level over the typical 50-year life of major transmission assets. This would increase the cost of the energy transformation and deter investment in low carbon generation.

How to Fix the Issue

Fast and effective action is required to improve economic regulation so that it constrains network supernormal profits.

We recommend that the Australian Government establish an independent commission of inquiry into the performance of NEM institutions and arrangements, working jointly with participating NEM jurisdictions.

The commission's first step should be to recognise that network economic regulation outcomes for 2014-2021 were inconsistent with the National Electricity Objective. So far, there has been no recognition that economic regulation has failed. As a result, there is currently no impetus to address the causes of this failure.

Outcomes-based reporting and monitoring should be undertaken to ensure that supernormal profits are limited to networks that outperform efficient benchmarks.

The next step is to introduce effective performance metrics, reporting and monitoring arrangements for the energy market bodies involved. Clear performance metrics should be established for each organisation based on ensuring that sector-wide regulated network revenues more or less match total costs. Regular outcomes-based reporting and monitoring should be undertaken to ensure that supernormal profits are limited to networks that outperform efficient benchmarks.

The commission should also work on making a comprehensive set of changes to the National Electricity Law and Commonwealth accountability arrangements for the AER to improve the economic regulation of networks. In IEEFA’s view, this should include the following:

- Establish a clear outcomes-based performance evaluation framework within the National Electricity Law for the AER’s economic regulation of networks, including how AER is performing against Objective 3 of its Strategic Plan 2020-2025 of “ensuring that consumers pay no more than necessary for safe and reliable electricity”.

- Require regular and full disclosure of actual profits by networks and consolidation and assessments by the AER in annual network performance reporting, similar to disclosure requirements imposed on retailers under the Retailer Reliability Obligation. This would also support regular review of network regulation outcomes by the relevant Auditors-General on behalf of National Electricity Law member parliaments.

- Amend the revenue and pricing principles to clarify what constitutes a reasonable risk-adjusted return to equity investors, including by clarifying that the actual (real) return on equity is the principal performance metric under the National Electricity Law and incentive regulation, not the estimated return on equity.

- Remove the current unfounded suggestion in the revenue and pricing principles that higher (lower) network profits result in increased network investment and, therefore, higher (lower) reliability.

- Change the rate of return instrument (RORI) provisions in the National Electricity Law to allow the 2022 RORI outcome to be amended in 2023. This is to correct a continued reliance in the draft RORI on a false capital pricing theory and use of incorrect assumptions instead of data. Amendments to the 2022 RORI process should be implemented without the usual delay of up to five years. In IEEFA’s view, the past delayed implementation of RORI to estimate the allowed RROE is based on the false assumption that network RROE outcomes are consistent with the revenue and pricing principles and the National Electricity Objective—they are not persistently excessive. Correcting errors in the RORI without the usual delay of five years would not be equivalent to “regulatory takings”, since to IEEFA’s understanding, networks do not hold legal rights to persistent supernormal profits. IEEFA considers that the immediate correction to the RORI is required under the revenue and pricing principles to prevent future supernormal profits for up to five years after a corrected 2022 RORI is handed down in 2023.

- Improve the design and operation of incentive schemes and data used to estimate cost building blocks, to prevent cost overestimation resulting in continued supernormal profits.

- Introduce a safeguards mechanism establishing that persistent and excessive supernormal profits unrelated to productivity and performance are returned to consumers.

Current barriers to the effective participation of consumer representatives in regulatory processes should be removed. These barriers include insufficient information on supernormal profits, errors in the data and methods used to set the RORI and the refusal by Energy Consumers Australia to support research into excessive supernormal network profits on three occasions since 2018.

Current barriers to the effective participation of consumer representatives in regulatory processes should be removed.

To ensure frameworks for future investment, including energy transformation investment, new jurisdictional schemes and the announced Rewiring the Nation Corporation are efficient, it will be necessary to ensure they do not contribute to excessive network supernormal profits.

A wider review of the performance of economic regulation should be undertaken—looking at sectors outside of the energy sector. Other economic regulators rely on false corporate finance theories in setting regulated prices for major infrastructure services. The commission should identify whether regulatory systems for monopoly infrastructure in other sectors also result in excessive supernormal profits and adversely affect consumers and international competitiveness.

* Note: This report was finalised before the AER's State of the energy market 2022 report was released.

** Correction notice: The discussion on the AER’s use of BBB+ credit ratings to set benchmark network debt cost allowances in Section 4.3.1 was amended in December 2022 to remove an unintentional conflation in the original version between the use by the AER of a BBB+ credit rating to set benchmark network debt cost allowances on the one hand, and the estimation of debt financing costs using another benchmark developed for the AER – the Energy Infrastructure Credit Spread Index (EISCI) – on the other. This flaw was identified by Garth Crawford of Energy Networks Australia. The amendment does not affect and makes no change to the conclusion that the AER’s proposed decision to retain the BBB+ credit rating, in its draft 2022 Rate of Return Instrument, does not reflect the available debt cost data.