Takeaways from Enel’s sustainability-linked bonds performance targets

Key Findings

Enel’s latest results show a significant year-on-year reduction in the share of thermal production, but it remains uncertain whether the company met its 2023 sustainability-linked bonds (SLBs) target tied to the scope 1 emission intensity of power generation.

Enel’s emissions targets are well in line with a 1.5-degree pathway, but by scaling back its renewable buildout plans the company seems to be moving in the opposite direction of the objective.

The potential interest burden through the bond coupon step-up is insignificant to Enel’s financials, indicating that the SLB market lacks the breadth to provide decarbonisation incentives and capture any increased business risks arising from missed targets.

Sustainability-linked instruments still have large potential to drive decarbonisation; combining such structures with a use of proceeds clause adopting the upcoming European Green Bond Standard can maximise impacts.

On 21 March, Italian utility Enel S.p.A. (Enel) reported its preliminary 2023 full-year results. The company showed a significant decrease in the share of thermal production to 27% in 2023 from 39% in 2022, resulting from a more than one-third decline in thermal output. Simultaneously, the share of renewable energy production (including hydro) increased to 61% in 2023 from 49% in 2022. These are likely to drive a significant reduction in the company’s emission intensity. But whether this is enough to meet its 2023 sustainability-linked bonds (SLBs) performance goal remains uncertain.

Enel’s 2023 scope 1 emission intensity aim of 148g of CO2 equivalent per kilowatt-hour (gCO2e/kWh) is tied to outstanding SLBs of around €10 billion, representing a 35% reduction from its 2022 level of 229gCO2e/kWh. Enel would have had to reduce its scope 1 emissions relating to power generation by more than 40% in 2023 to meet its target (the company reported a decline of around 30% in total emissions in 2023). Lower coal output in the thermal mix can help, but IEEFA estimates that it may take a mid-single-digit percentage reduction in its average emission intensity of thermal production to meet its target.

1. Is Enel’s 2023 sustainability performance target (SPT) ambitious enough?

The answer is probably yes. Enel’s 2023 scope 1 emission intensity of power production target is based on its 2021-2023 Strategic Plan announced in November 2020. It represents a 64% reduction from its 2017 level of 416gCO2e/kWh and sets a path for a further 45% decline to reach its 2030 target of 82gCO2e/kWh.

IEEFA positively notes that the plan commits the company to a Science Based Targets initiative-approved goal of an 80% greenhouse gas emissions reduction in 2030 versus 2017, in line with a 1.5-degree pathway. The plan includes an aim of reaching 60 gigawatts (GW) of installed consolidated renewable capacity (including hydro) by 2023 versus 45GW in 2020, entailing an investment of €17 billion. It also commits the company to exit coal by 2027.

In 2022, Enel disposed of its Russian power generation assets including mainly 5.6GW of conventional capacity, leading to a reduction in emission intensity. Considering the 2023 emission intensity target remains as it was, it still appears robust, representing a 59% reduction from its 2017 base of 365gCO2e/kWh (restated to exclude the impact of the disposal) and requiring a 51% reduction to reach the restated 2030 aim of 72gCO2e/kWh.

2. What would be the financial consequences of missing the target?

Highly limited. Enel has total outstanding SLBs of about €30 billion. All have a coupon step-up of 25 basis points (bps), which Enel will have to bear if it fails to meet the tests. About €10 billion of the bonds are subject to a test of 2023 targets, potentially translating into additional interest costs of roughly €25 million per year. This represents merely 1% of its interest expense and 0.1% of its reported EBITDA in 2023. The amount will decrease with half of these bonds maturing in 2025 and 2026.

A step-up of 25 bps tends to be a common market arrangement. The financial materiality relative to the company varies a lot. In the case of Enel, the step-up mechanism represents a very limited financial incentive, although the implications of a missed SPT can be broader from market and reputation perspectives.

3. What would it say about Enel’s transition plan?

IEEFA holds a general view that missing targets indicate laggards in transition progress, which may raise climate-related credit risks. As a result, the issuer's bond spreads may widen as the risks materialise, and the overall cost of capital may increase. SLBs—if appropriately priced—could act as an insurance, with a step-up structure counteracting any rising risks.

Anthropocene Fixed Income Institute first predicted in October 2023 that it was “highly unlikely” that Enel would achieve its SPT, based on interim operational data. It subsequently observed that these bonds “have outperformed compared to both non-SLBs and SLBs whose targets have already been achieved”. The institute’s latest analysis shows that “the emissions intensity target is still a stretch […but] the probability of it being met has increased”.

While the variations in Enel’s emission intensity in recent years can be somewhat attributed to changes in hydro and coal generation, its 2023 emissions reduction is likely to be meaningful. If the company fails to meet the 2023 SPT, this does not immediately conclude that Enel’s 2030 emission intensity target is out of reach. However, Enel should continue its actions to stay within the 1.5-degree pathway and uphold the credibility of its broader transition plans.

In November 2023, Enel revealed a new 2024-2026 strategy. Conspicuously, the company’s renewable energy ambitions have been scaled back. It plans to invest €12.1 billion in renewables between 2024 and 2026 and to reach a consolidated capacity of 63GW by 2026—small progress from its previous target of 61GW by 2025. Enel has not explicitly updated its 2030 renewables goal, but the company’s “selective approach” to renewables investments indicates that it will fall short. This will in turn require other means to achieve its future emission intensity reduction targets.

Enel’s wind and solar energy output increased by about 10% in 2023, slower than in previous years. The company may need to continue to boost the output of both through efficiency upgrades and restrain from fossil fuel generation. While the coal phaseout plan remains intact, the slower renewable buildout and a lack of other corrective actions may raise the risk of missing future targets.

4. What lessons should Enel learn?

Enel continues to tap the SLB market, issuing a total of €1.75 billion in January 2024. IEEFA positively notes this commitment. The recent SLBs have added 2026 to a robust list of test years that includes 2024, 2025, 2030 and 2040, thanks to the company being a first mover in the SLB market and its track record of sizeable offerings.

Any signs of not meeting the SPTs may have reputational implications. If Enel wants to signal continued seriousness to its transition plan, it should tighten its ambitions and avoid the appearance of setting easier-to-meet targets. Instead, Enel’s ambitions, according to its latest sustainable financing framework set in January 2024, appear to be less robust than the previous framework set in February 2023. The new 2026 scope 1 carbon intensity target of 125gCO2e/kWh shows a mere 3.8% reduction from its existing 2025 aim. This leaves a higher average annual reduction of 13% between 2026 and 2030 to reach the 1.5-degree-aligned objective of 72gCO2e/kWh in 2030. The 2026 scope 1 and 3 carbon intensity aim of 135gCO2e/kWh is flat from the 2025 ambition. Additionally, its installed renewable capacity share targets have been lowered to 73% from 76% for 2025 and to 80% from 85% for 2030.

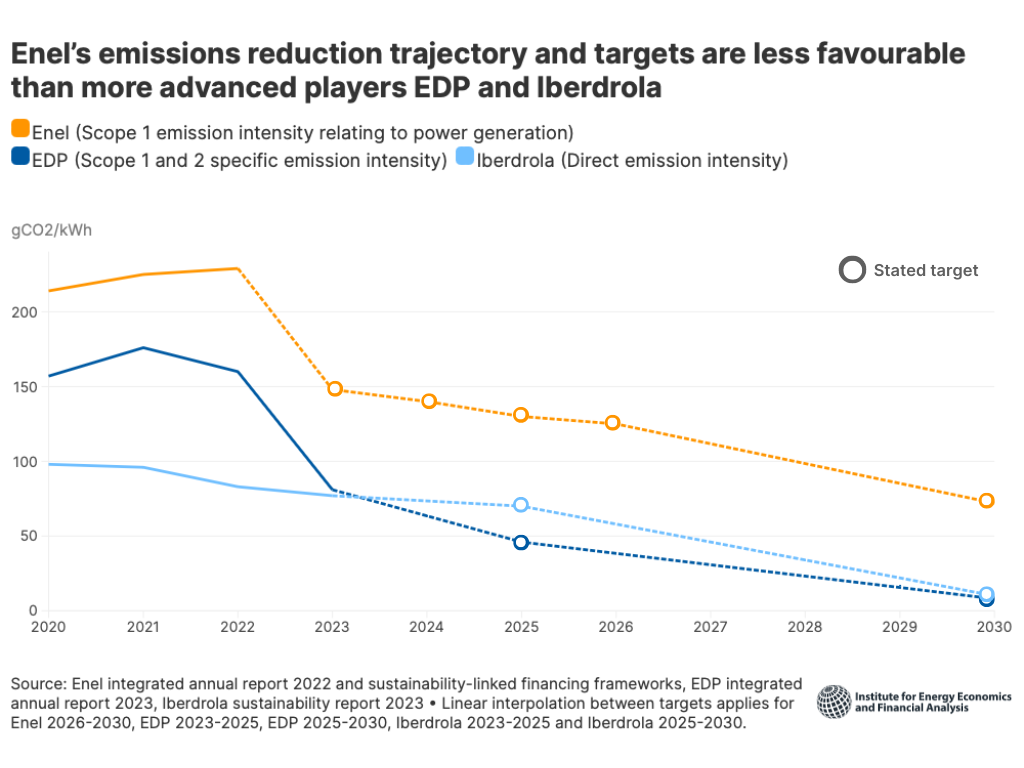

It’s worth noting some more advanced players show more favourable trajectories in emission intensity reduction. For example, Portuguese utility EDP reduced its 2023 scope 1 and 2 emission intensity by 50% year on year to 81gCO2e/kWh and has a target of 8gCO2e/kWh by 2030. Spanish utility Iberdrola’s emission intensity was 77gCO2e/kWh in 2023, with a target of less than 10gCO2e/kWh by 2030.

Besides, Enel should ramp up its environmentally sustainable or European Union (EU) taxonomy-aligned investments. The target of 80% alignment between 2024 and 2026 has seen no improvement. A tighter ambition could bring Enel closer to Iberdrola and EDP, which reported 89%-96% EU taxonomy-aligned capital expenditure (capex) in 2023.

5. Is the SLB market in trouble? Should issuers turn to use of proceeds green bonds instead?

Enel issued €3.5 billion of green bonds between 2017 and 2019 but then became the world’s largest SLB issuer. Its commitment to SLBs over green bonds is based on its preference to showcase its overall strategy, of which its projects form a part.

Worries about the credibility of the SLB market have loomed recently. Based on IEEFA’s calculations and Environmental Finance Data, SLBs issuance in Europe decreased in two consecutive years from its peak in 2021, although the level is still materially higher than in 2020 before it skyrocketed. By comparison, green bond issuance in Europe reached a record high in 2023.

Use of proceeds green bonds are undoubtedly important for investments in the net-zero transition. The upcoming European Green Bond Standard (EUGBS) could be groundbreaking. A recent IEEFA report highlights its potential benefits for issuers through four pillars: commitments, capex pipelines, green asset delivery and governance. In the 2024-2026 strategy, Enel maps out a total gross investment plan of about €35.8 billion. Its 80% taxonomy-aligned capex target (with proceeds primarily going to renewable generation and grids) indicates a sum of €28.4 billion being potentially EUGBS-ready.

Having said that, green bonds and SLBs serve different purposes. SLBs exist as an innovative tool that enables performance-based incentives to drive decarbonisation for all issuer types, from sovereigns to corporates. IEEFA believes the instrument remains useful, particularly for hard-to-abate, high-emitting undertakings (“transition finance”). The Organisation for Economic Co-operation and Development outlines SLBs’ advantages to issuers over use of proceeds bonds: commitment enforcement, versatility, scalability and cost reduction potential.

A combined structure can benefit from both performance incentives and clarity of use of proceeds, in IEEFA’s view. Austrian utility Verbund issued sustainability-linked green bonds in 2021. It reported annually on its progress towards achieving its performance targets and provided updates on projects with allocated proceeds, which is good practice. However, the instrument structure remains rarely observed in the market.

In the context of the EUGBS, one way to structure a sustainability-linked green bond is to tie the performance targets to the instrument. For example, targets can be based on the expected bond proceeds’ contribution to environmental strategy (e.g. taxonomy-aligned key performance indicators) and the impact of expected proceeds (e.g. annual electricity generation and avoided emissions); such disclosure is already required at pre-issuance. This may act as an investor’s protection against any underperformance or weakness in the final contributions and impacts, ultimately creating more depth to the sustainable bond market.

6. How can the SLB market’s credibility be improved?

The SLB market is still in a nascent stage. To improve credibility, IEEFA believes that the overarching principle for an SLB structure is to enable meaningful decarbonisation progress. Hence, the performance targets must be ambitious enough: aligning to a 1.5-degree pathway across all scopes of emissions, explicitly avoiding carbon lock-in and promoting business transformation to “green” activities. Metrics to be measured against should be comprehensive, reflecting the “impact logic chain”. The likelihood of achieving them should be backed by a credible transition plan.

Market participants should take a more nuanced and innovative approach to enable wide-ranging forms of financial and/or structural features in the instruments to cater to different country, sectoral and individual needs. Event triggers may go beyond coupon step-up and include requirements of certain remedial actions, if applicable. The uniform 25 bps (or 50 bps) coupon step-up structure is simple to comprehend but does not function properly.

Pricing premium at issuance should be measured carefully to avoid any misaligned incentives. The value of the additional bond features should capture the expected gain or loss resulting from whether the targets are achieved or not.

The International Capital Market Association Sustainability-Linked Bond Principles have been established to support the transparency and credibility of SLBs. Optional disclosure for SLBs in the EUGBS regulation underlines the importance of transparency, but the SLB market remains unregulated. By late 2026, the European Commission is obliged to publish a report accompanied by a legislative proposal, where appropriate, on the need to regulate SLBs; IEEFA calls for the European Commission to speed up its legislative process, given the imminent needs for a wider adoption of the instrument and its transitional, dynamic nature.

As market standards and approaches take shape, a series of SLBs that are well structured and well complied with could represent clear ambitions, strong clarity of capex and action plans, a high level of confidence in plan delivery and robust governance. Similar to green bonds, this could in turn translate into lower transition risk.