Renewable energy is having a good year, but challenges loom ahead

Key Findings

While renewables have grown at an impressive pace in recent years, much more remains to be done. Challenges persist in the form of unequal geographical adoption of renewables, rising cost of capital that deters investment, and underinvestment in related areas such as grid and storage.

Non-financial barriers include the lack of policy clarity, onerous or unclear permitting requirements, and land acquisition problems.

More innovative use by multilateral development banks of their balance sheets may include providing risk-taking guarantees and catalyzing more private finance for renewable projects.

Governments need to address physical, administrative, and procedural hurdles that will help to reduce risk — and thereby reduce cost.

Investors, financiers, and developers need to respond with faster and better funded renewables development. That holds the potential to accelerate renewable growth globally.

The growth of renewables, especially wind and solar, continues apace. Building on the momentum, the COP 28 climate meeting has seen calls for tripling renewable capacities by 2030. However, there are looming challenges that pose substantial barriers to achieving the goal of limiting global warming to 1.5 °C.

In 2022, solar and wind power accounted for an impressive 80% of incremental power demand and 12% of electricity generated worldwide. According to the International Energy Agency (IEA)’s Net Zero Scenario (NZS), there is an anticipated 25% growth rate for solar generation annually from 2022 to 2030.

In 2022, investments in solar power generation reached nearly US$500 billion (bn), marking an increase of US$80bn from the previous year. Conversely, wind investments totaled US$162bn, reflecting a 5% decline from 2021 levels. However, despite the recent cancellations of offshore wind projects, mainly in the United States, two notable records were made: 103 gigawatts (GW) of wind farms are likely to be established in 2023 and a 22% year-on-year increase in renewable investments to US$358bn in the first half of 2023, setting a record for any half-year period.

Yet challenges come in many forms: unequal geographical adoption of renewables, rising cost of capital that deters investment, underinvestment in supporting infrastructure like grids and storage, which undermines the positive impact of renewables growth, and non-financial barriers that impede the adoption of renewables at a faster pace.

This commentary underscores the essential issues that must be addressed to facilitate the flow of finance to areas that require it the most.

Overcoming geographical inequality

While investment in renewables has seen a notable rise, it is notably imbalanced due to geographic disparities. Developed countries and China account for more than 80% of the total investment to date in renewables.

China alone represents a significant portion, contributing 52% of the global investment in clean energy, along with 42% in solar and 55% in wind capacity additions in 2022. Among Asian countries, only India, South Korea, and Vietnam made the top 10 list for renewable capacity additions from 2013 to 2022, with India being the sole country to retain its Top 10 position in 2022.

Large parts of the world, especially the emerging and less developed economies, are clearly lagging behind.

Take Southeast Asia as an example, green investments in the region dipped 7% in 2022 compared to 2021, reaching US$5.2bn. Despite having been historically favored by foreign investors, the region experienced a significant drop in foreign investments in its green sector (including renewables, electric vehicles, energy efficiency, and their upstream supply chains), plummeting over 50% year-on-year in 2022.

At the macro level, the annual developing country requirement of US$1 trillion (tn) remains far from being met. Grants and concessional loans accounted for less than 1% of global renewables financing. The International Renewable Energy Agency (IRENA) notes that developing countries’ recent annual investments of US$0.5tn are three times below the required level to meet the 1.5 °C target.

Buffering against higher cost of financing

The second reason for exercising caution regarding the funding outlook for renewables is not so much about the availability of finance, but rather its cost.

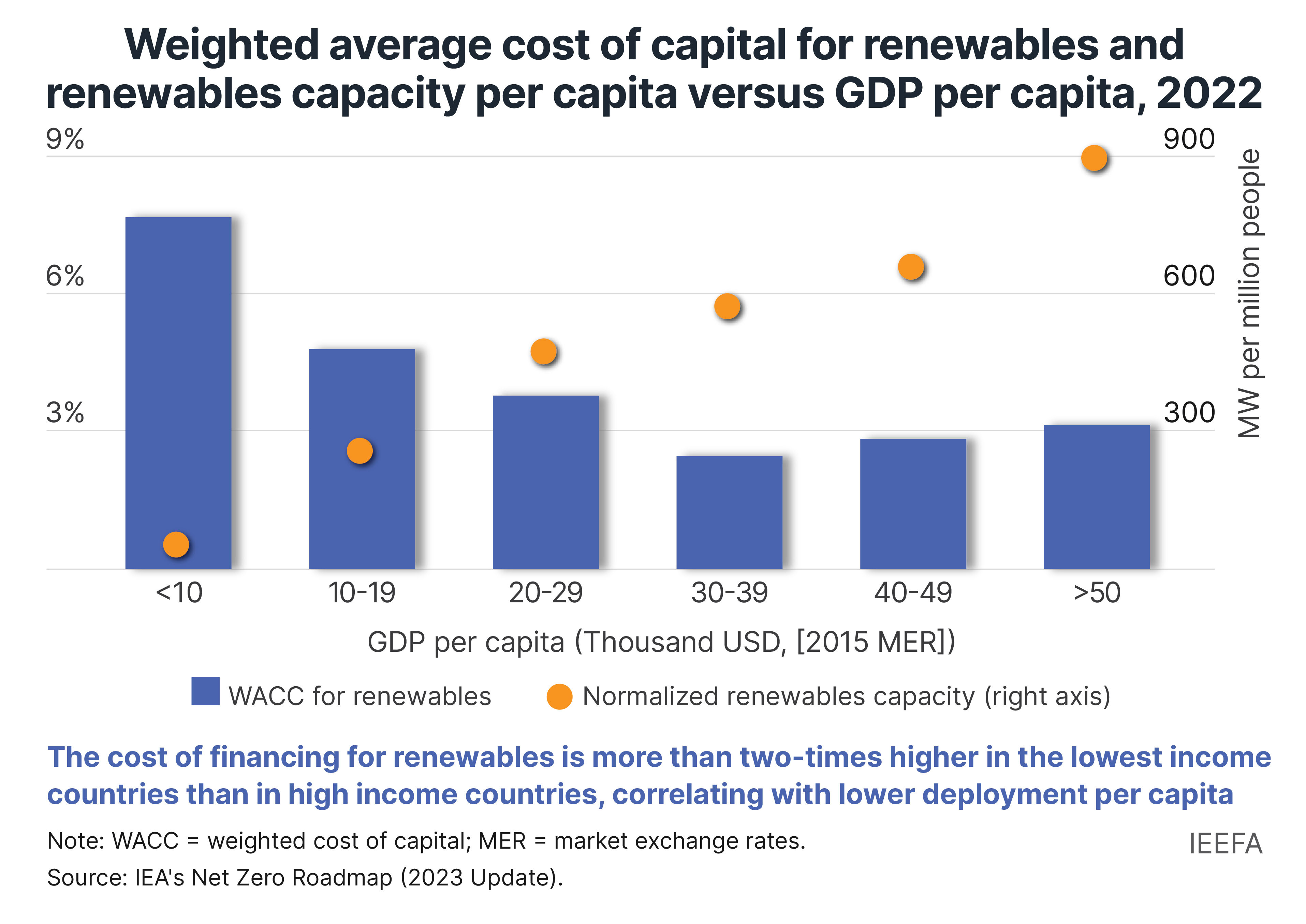

The rise in interest rates over the past two years has led to a sharp increase in financing costs, especially in countries with a weaker macro risk profile. This is made more acute by the developing nations’ typical reliance on external financing, which becomes scarce when international interest rates increase to curb inflation.

The volatility in financial markets has contributed to an uncertain financing environment, illustrated by the withdrawals exceeding US$70bn from emerging market stocks and bonds in 2022. While there has been a positive inflow of US$130bn year-to-date until October, investors withdrew nearly US$33bn from August to October 2023.

Simplistically speaking, a 4-5% increase in interest rates translates to an additional 4-5% in project costs every year. Even with a relatively short two-year construction period, this leads to an 8-10% increase in the overall cost of a project.

The financial sector participants, particularly development banks – whether domestic, bilateral, or multilateral – need to step up by providing more support to local financing at preferential rates whenever possible. This support is also justified by the financing’s positive impact on climate. Governments can encourage or mandate the financial sector to develop strategies and targets that align their financial portfolios with national climate commitments over time.

Multilateral development banks (MDBs) can employ more innovative strategies with their balance sheets, such as providing risk-taking guarantees and catalyzing additional private finance for renewable projects. A study has shown that MDBs are raising less than US$1 in private finance for every dollar that they lend. Similarly, national development banks should establish ambitious climate-related lending targets, particularly in the renewables sector.

Removing non-financial barriers

Non-financial barriers obstruct the flow of finance and hinder the bankability of projects, resulting in a misalignment between viable projects and available capital.

The non-financial barriers most cited by renewable project developers are lack of policy clarity, onerous or unclear permitting requirements, and land acquisition challenges. These factors impede the “bankability” of a project, disrupting or slowing down the flow of finance.

While issues related to policy clarity and land acquisition fall within the realm of government responsibility and good governance, the bankability of projects is also hampered by the absence of standardized transaction templates, particularly for smaller-size projects. These templates, designed for tender and contract documentation, due diligence, risk contingency clauses, and dispute resolution mechanisms, ensure a repeatable process that is comprehensible to all parties involved.

The absence of such tools leads to delays in planning and execution, contributing to increased costs. This is particularly detrimental in the current environment of high-interest rates and notably hinders investments in small-scale projects.

This situation poses a risk of widening the gap between the leaders and laggard countries in renewable power investments.

Accelerating investments in grid and storage

To achieve NZS, renewables must not only meet a substantial portion of the world’s energy needs but also do so consistently, irrespective of weather conditions. The variability in sunshine and wind necessitates significant investments in grids to enhance resilience.

The legacy electricity systems, characterized by centralized generators and a one-way flow of electricity to end consumers, are no longer suitable models. Previously, system operators could forecast demand and instruct generators (primarily thermal) to dispatch power as needed. However, the current mix of distributed and intermittent sources requires real-time demand and supply matching, demanding a more robust network that allows bidirectional flows to and from utility grids.

In this context, grids play a vital role in the energy transition, acting as conduits for transporting cleaner energy to and from consumers and connecting renewable sources.

Renewables rely on energy storage to address intermittency issues, both at the grid level (balancing disparities between electricity consumption and variable renewable power generation) and user level (providing reliable standby power for extended periods). As renewables costs decrease and integrate into the grid, the need for storage grows to mitigate supply volatility and ensure grid reliability.

Similar to renewable power capacity addition, the annual investment on grids and storage must double by 2030 to $900bn, under the NZS.

All of this means that there remains much to be done to keep the energy transition on track. Governments must tackle physical, administrative, and procedural hurdles to reduce risks — and thereby reduce costs. Simultaneously, investors, financiers, and developers need to respond by supporting faster and better-funded development of renewables development, potentially accelerating the growth of renewables globally.

This commentary was first published in the South China Morning Post.