Key Findings

Western Australia’s gas consumption – already the highest in Australia – is forecast to continue growing over the next decade, fuelled by industrial developments.

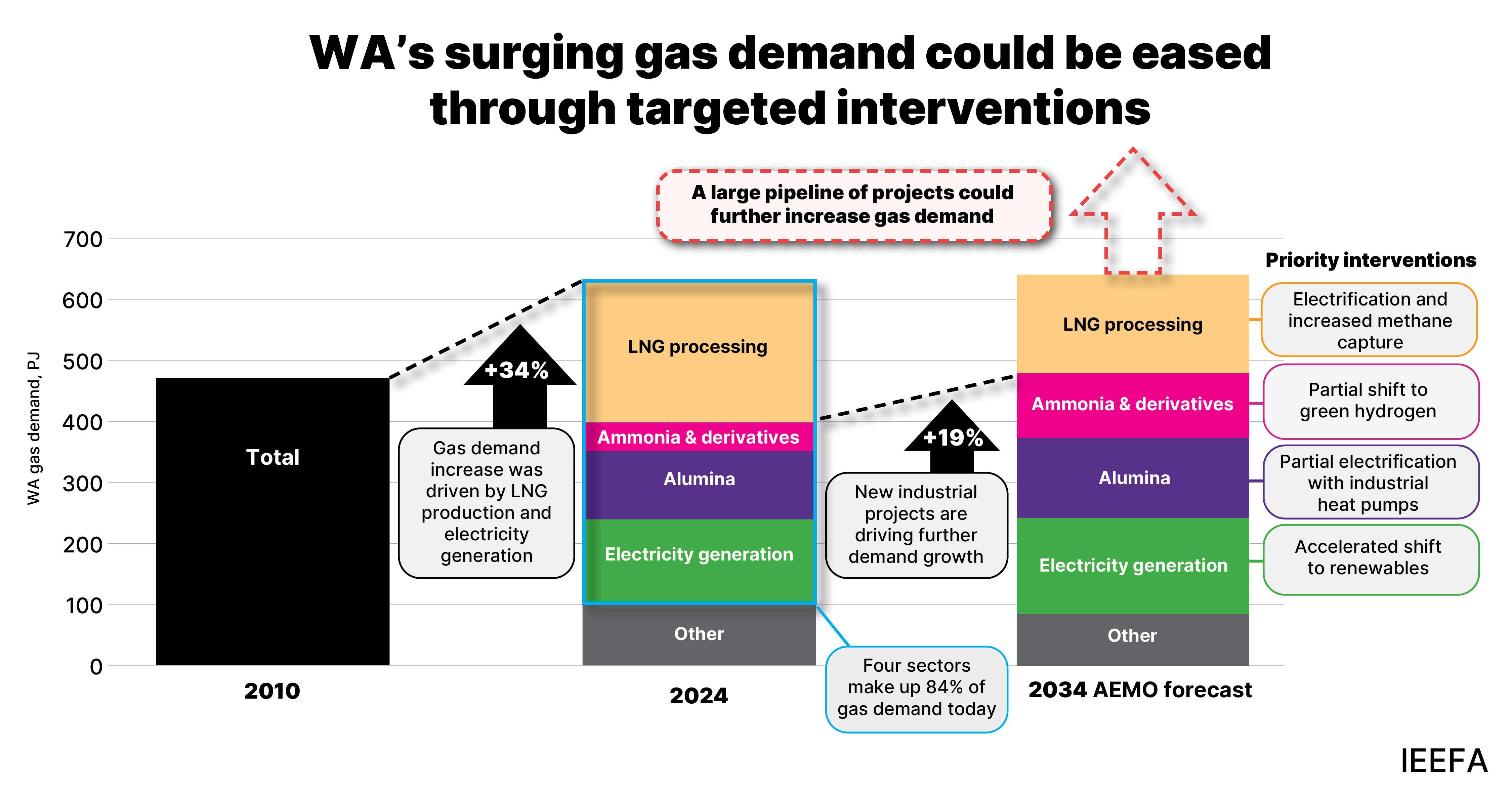

Eighty-four percent of WA’s gas use is spread across four sectors: LNG processing, electricity generation, alumina refining and ammonia production.

WA’s electricity system lags eastern Australia on the transition to renewables and batteries, in particular at remote mining and industrial sites that are heavily reliant on gas-based electricity.

Available technologies can significantly reduce gas use in LNG, ammonia and alumina production, but stronger incentives and support are urgently needed.

While the rest of Australia weans off gas, Western Australia (WA)’s consumption grows apace, led by just four industrial sectors. However, new technologies and access to abundant renewable energy could slash the state’s gas use and deliver benefits for industry.

WA is the only state or territory to increase gas use since FY2020, accounting for almost half of Australia’s total consumption. The vast majority (84%) of WA’s gas demand is concentrated in liquefied natural gas (LNG) processing (36%), electricity generation (24%), alumina refining (17%) and ammonia production (7%).

In the coming decade, WA’s gas consumption is expected to grow further with a large number of gas, metals and minerals projects in the pipeline. The state’s demand (excluding LNG processing) is forecast to be 19% higher by 2034 by the Australian Energy Market Operator (AEMO), but the growth could be even higher.

The expected increase in WA gas consumption risks locking in higher gas dependency just as supply constraints emerge. In addition, anticipated gas demand growth coupled with tightening supply risks could push prices higher and make gas-intensive industries less viable over time.

LNG processing is by far the biggest user of gas in WA, with 10% of the gas flowing through a facility consumed in the liquefaction process rather than sold as LNG. Electric turbines are a proven alternative for gas liquefaction that can reduce emissions by up to 90%, increase production and efficiency, and lower maintenance costs. Despite these benefits and technological maturity, there are no announced plans to deploy electric turbines in Australia’s LNG plants.

Large amounts of gas could also be recovered by capturing fugitive methane leaking from production and transportation systems at a net financial benefit, but there’s a lack of regulatory and policy incentives to drive action.

Although the WA LNG industry’s gas demand is forecast to fall by almost a third in the coming decade, this will be offset by demand growth in other sectors. In particular, two projects could more than double gas demand for the production of ammonia and derivative products.

Ammonia is an ideal first adopter for green hydrogen given that it is already made of hydrogen and that 30% of gas feedstock can be switched to green hydrogen without major equipment upgrades. A shift to green hydrogen could be incentivised by offtake requirements for miners who use half of Australia’s ammonia production through explosives. IEEFA has calculated that requiring 30% of explosives to be made from green hydrogen by 2035 would raise miners’ operating costs by just 0.2%.

Alumina production is the other large industrial gas user in WA where electrification is a promising option. Mechanical vapour recompression, a series of industrial heat pumps, could electrify 70% of alumina’s gas use at a ratio of 1GJ of electricity replacing 5GJ of gas. This means that the technology has the potential to become a financially attractive option even without government subsidies, but it needs to be demonstrated and derisked for industry.

Gas also plays a much larger role in WA’s electricity generation than in other states, with more gas used for power generation in WA than in the rest of Australia combined. This is driven by both grid and off-grid electricity; the concentration of mining and heavy industries in the state’s remote north-west has led operators to rely on gas for onsite power generation. WA’s transition to renewables has been slower than in the rest of the country, with very little progress in WA’s North-West in particular. This is at odds with the state’s excellent renewable resources, particularly wind and solar.

An over-reliance on gas could also risk Australia’s competitiveness in emerging green markets such as green iron and steel. Globally, countries chasing a share in the green iron and steel market are focusing on green hydrogen-based production, rather than gas-based production. There is a significant risk that steel produced using gas won’t meet future definitions of what constitutes ‘green iron’ and ‘green steel’.

There are many untapped opportunities to reduce gas demand in WA and transform the state’s industries whilst becoming a leader in the global energy transition. To this end, IEEFA recommends the following targeted actions:

- Develop a clear roadmap for gas demand reduction including targets.

- Limit the impact of new projects on gas demand by requiring renewable energy to power new mine projects, and green hydrogen be progressively integrated into new green iron and ammonia projects.

- Accelerate gas demand reduction in existing facilities by supporting the electrification of gas-intensive industries, such as LNG processing and alumina refining, through targeted trials, funding and other financial incentives, and by accelerating the transition to renewable electricity.