Private equity in PJM: Growing risks for communities

Download Full Report

View Press Release

Key Findings

Risks are on the rise for communities in the PJM power market that host fossil fuel plants, as they face the increasing possibility of rapid plant closures and the economic dislocations that inevitably follow.

These growing risks for communities are a direct outcome of the increasingly challenging financial landscape and competitive power markets faced by plant owners, project developers and investors.

The economic disruptions caused by the Knighthead group’s sudden closure of Homer City should be seen as a harbinger of future dislocations, especially in places that host PJM’s aging coal-fired generation capacity.

Indiana County officials need to learn from Homer City to prevent a repeat with the Keystone and Conemaugh plants, particularly by utilizing new federal resources available through the IRA to help ease the shift.

Executive Summary

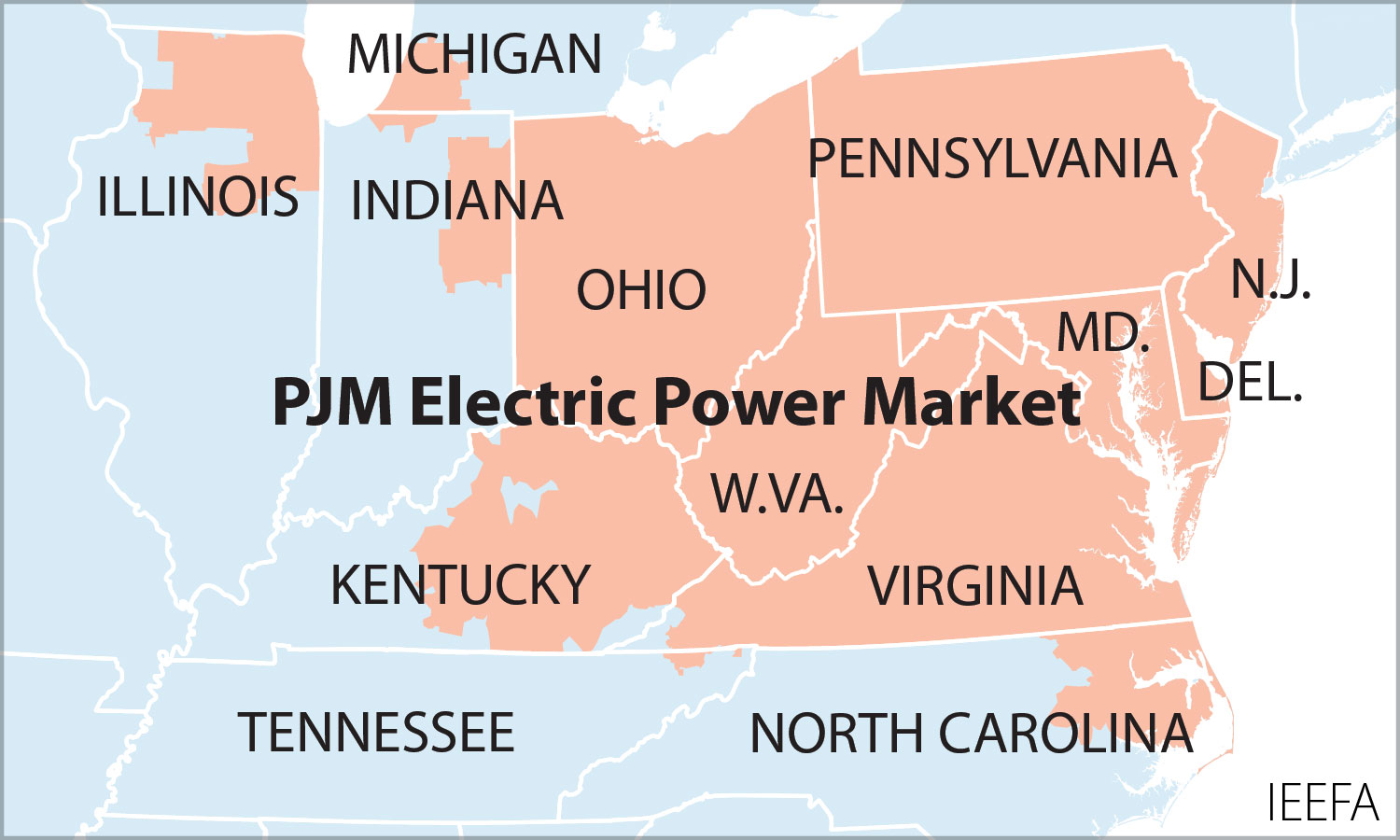

Private capital, particularly difficult-to-track private equity (PE) investment, has reshaped the PJM power market in the past decade. PJM data shows that 35,515 megawatts (MW) of combined cycle gas capacity have been built in the 13-state regional system since 2011, reflecting the impact of the fracking revolution that brought plentiful, low-cost gas supplies to the market. PE and other private sources developed more than 80% of the total—28,815 MW.

This gas-driven growth, coupled with significant PE investment in the region’s coal-fired power plants, has transformed the ranks of PJM’s largest generators. As recently as 2017, the five largest capacity owners were all regulated publicly traded companies: American Electric Power, Dominion Energy (the parent of Virginia Power), Exelon (the parent of Commonwealth Edison), FirstEnergy and NRG Energy. Today, three of the largest generators are private firms—ArcLight with 14,230 MW of operating capacity, LS Power (10,803 MW) and Talen (now controlled by Nuveen/TIAA and Rubric Capital), with 10,370 MW.[1] Beyond these three majors, there are several private and PE firms that own from 1,000 MW to 5,000 MW of capacity. Together, private capital now owns roughly 60% of the fossil-fuel fired generation capacity in PJM.

Ownership status is important. Utilities are overseen by state regulators who have a vested interest in keeping costs for ratepayers in check; private capital is largely free from that oversight. Utilities, as well as publicly traded independent power producers (IPPs), are also required to file regular financial reports with the Securities and Exchange Commission; private capital, by and large, is not. These differences largely shield private firms from public pressure, as well as regulatory and financial oversight.

In a three-part report, IEEFA is examining the increasing risk environment in PJM, the nation’s largest power market. This final report focuses on the risks posed by PE’s relative immunity from oversight and public pressure. This is a particularly serious threat for the places where plants are located, since PE generators can decide on short notice to close a facility if the economics no longer work, leaving unprepared communities facing significant economic dislocations from job and tax losses. This exact scenario played out in the spring at the Homer City power plant in Pennsylvania, as we will examine. That experience is not going to be the last, especially in areas that host the region’s aging coal-fired power plants. The transition away from fossil fuel generation resources is under way. Local and state leaders need to be planning now for those plants’ closures.

In the first of our reports, we examined the rising financial risks facing PE and other private firms. These risks include the recent substantial drop in capacity prices, the financial fallout from the 2022 winter storm in the northeastern U.S., and ongoing market reform efforts by the system operator.

The second report focused on the limited partners (LPs)—the pension and retirement funds that poured money into the PE sector in the past decade, and were generally well rewarded for their investments. But our research highlighted several funds with significant PJM fossil fuel generation assets that are underperforming, and we concluded that the changing regional power environment is likely to continue to drag down returns, boost investment risks, or both.