Key Findings

Recent announcements on developing low-emissions iron and steel capacities in the Middle East and North Africa (MENA) highlight the region's potential to become a global leader in steel decarbonisation.

MENA steelmakers must rapidly incorporate renewables into their energy mix to substantially lower indirect (Scope 2) emissions. For direct (Scope 1) emissions, they have an ideal opportunity to transition from gas to hydrogen gradually and transform gas-based DRI plants into hybrid systems.

With carbon capture unable to make iron and steel truly low carbon, increasing the allocation of green hydrogen to steel production in the region is essential. MENA producers could become key offtakers for green hydrogen projects.

Tighter international regulations on low-emissions steel production and trade present a valuable opportunity for MENA to become a key supplier of green iron. The green premium also may incentivise MENA steelmakers to fast-track their shift to low-emission products.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

Steelmakers across the globe are rapidly embracing direct reduced iron (DRI) technology to significantly reduce their carbon footprints. The DRI-electric arc furnace (EAF) pathway not only delivers substantially lower carbon emissions than the traditional blast furnace-basic oxygen furnace (BF-BOF) route but also unlocks the potential to produce truly green steel using green hydrogen. Steelmakers in the Middle East and North Africa (MENA) have positioned themselves as global leaders in low-carbon iron and steel production, with a strong track record of utilising DRI technology over four decades.

World Steel Dynamics projects global DRI capacity will reach 175 million tonnes per annum (mtpa) by 2030, with the EU and MENA regions contributing 20mtpa and 69mtpa, respectively. Wood Mackenzie further estimates that by 2050, global demand for DRI will reach 320mtpa, with global trade reaching 75-85mtpa. MENA is expected to become a major exporter, contributing 35-40mtpa.

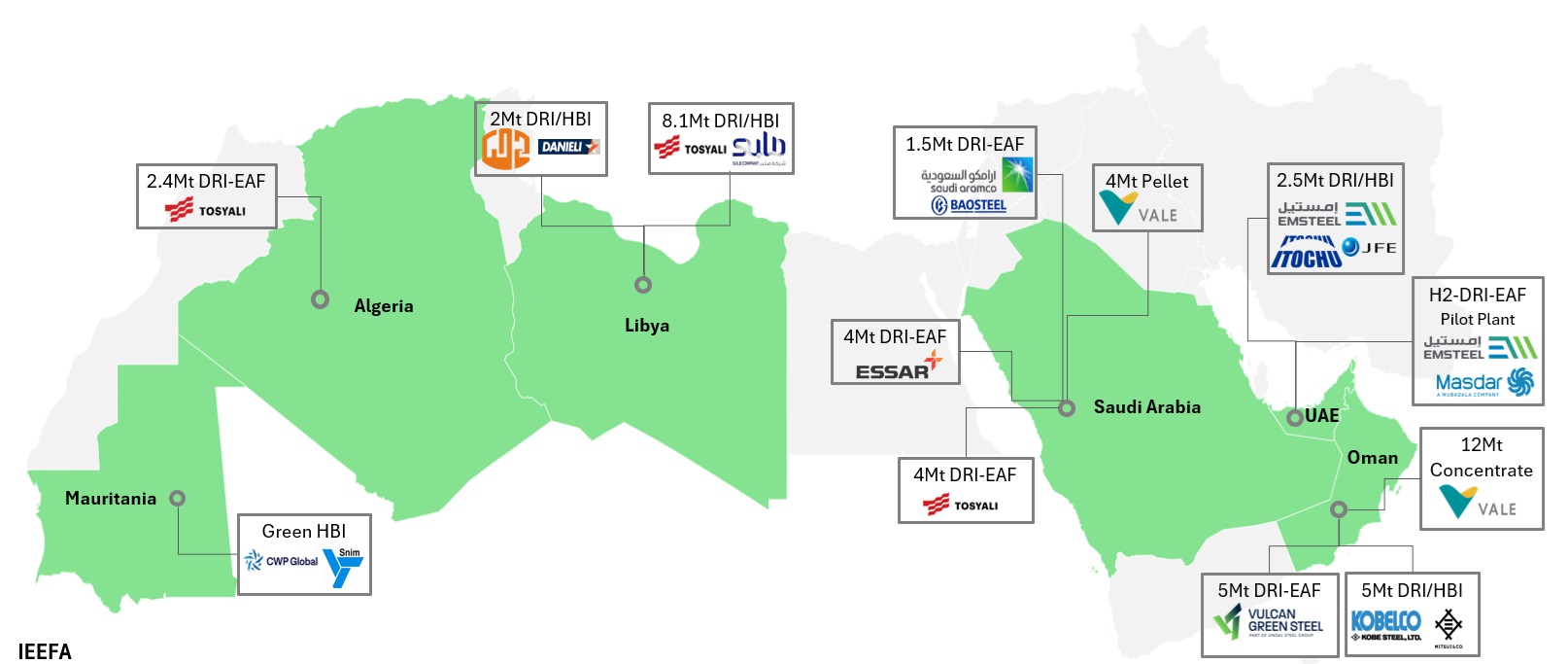

Figure: MENA low-emissions iron and steel initiatives

Recent announcements of low-emissions iron and steel projects in the MENA region indicate the green iron and steel transition has gained momentum. Much of the recent movement in new DRI capacity developed has been in the Middle East, but impetus is building in North Africa.

Turkish steelmaker Tosyali, in collaboration with the Libya United Steel Company for Iron and Steel Industry (SULB), will establish the world’s largest DRI facility, with a capacity of 8.1mtpa. The first phase of this mega project, with a capacity of 2.7mtpa, will use Midrex Flex technology, and is expected to produce hot briquetted iron (HBI) for neighbouring markets and the EU.

In another memorandum of understanding (MoU), Tosyali will collaborate with Saudi Arabia’s National Industrial Development Center (NIDC) to build a flat steel plant with a capacity of 4mtpa in the Ras Al-Khair industrial zone. The plant will utilise two Midrex Flex DRI plants, with a capacity of 2.7mtpa.

Libyan Iron and Steel Company (LISCO) signed an MoU with Danieli to produce 2mtpa DRI/HBI both for domestic use and export to Italy via offtake agreements with steelmakers. Danieli has also submitted a proposal to the Egyptian government to establish an integrated steel mill at a cost of US$4 billion. The proposal includes a DRI facility and hydrogen plant to produce low-emissions steel for the EU market.

Green hydrogen developer CWP Global has announced plans to use hydrogen from its 30 gigawatt (GW) AMAN project in Mauritania to produce green HBI for export to Europe. AMAN Green Energy has also signed an MoU with SNIM, Mauritania's largest iron ore producer, to collaborate on this project and produce the first green iron by 2030. Earlier this year, European Commission president Ursula von der Leyen mentioned Mauritania as a key supplier not only for green hydrogen but also for green iron, saying, “Mauritania is blessed with resources, that is space, sun and wind. With the right investment and infrastructure, this country can harness over 350GW of renewable energy only from wind and sun. But if we have clean energy coming into the game, the processing into green steel could stay here in Mauritania.”

China’s Baosteel has announced plans to increase its investment in BAP Al-Khair Steel Company, the new joint venture with Saudi Arabia’s PIF and Aramco, to maintain its 50% share. The new company aims to produce low-emission thick plates using DRI-EAF technology.

Vale has taken another step towards establishing three mega hubs in MENA (in Saudi Arabia, UAE and Oman), signing a partnership agreement to build a 12mtpa iron ore concentrate plant in Oman, to begin operations by 2027. This plant will supply Vale’s pelletising plant and future agglomeration facility in the region. Vale operates a pelletising facility with a capacity of 9mtpa.

While new plants are being designed to be hydrogen-ready and are set to transition to green hydrogen in the future, the region already has opportunities to play a significant role in this emerging market with its existing capacities. Given the limitations and barriers to developing the green iron and steel value chain in other regions such as the EU, MENA steelmakers must take decisive actions to position themselves at the forefront of this race. Existing gas-based DRI-EAF facilities must urgently prioritise the gradual reduction of Scope 1 and 2 emissions to align with the stringent international criteria for low-emissions steel production.

To read the full briefing note click here.