MENA in pole position for green steel race

Hybrid DRI processes integrating hydrogen give producers the edge.

Key Takeaways:

Recent announcements on developing low-emissions iron and steel capacities highlight the Middle East and North Africa’s (MENA) potential to become a global leader in steel decarbonisation.

MENA steelmakers must rapidly incorporate renewables into their energy mix to substantially lower indirect (Scope 2) emissions. For direct (Scope 1) emissions, they have an ideal opportunity to transition from gas to hydrogen gradually and transform their gas-based DRI plants into hybrid systems.

With carbon capture unable to make iron and steel truly low-carbon, increasing the allocation of green hydrogen to steel production in the region is essential. MENA producers could become key offtakers for green hydrogen projects.

Tighter international regulations on low-emissions steel present a valuable opportunity for MENA to become a key supplier of green iron. The green premium also may incentivise MENA steelmakers to fast-track their shift to low-emission products.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

19 September 2024 - (IEEFA Australia): Steelmakers in the Middle East and North Africa (MENA) can capitalise on advantages over competitors to take the lead in the global race to produce green iron and steel, according to the Institute of Energy Economic and Financial Analysis (IEEFA).

Technological advances that blend green hydrogen with gas can transform MENA’s existing direct reduced iron-electric arc furnace (DRI-EAF) plants to low-emissions production without costly modifications.

This hybrid process not only smooths the transition to low-emissions production for MENA manufacturers, it also ideally positions them for the global shift towards genuine green steel, led by key markets such as Europe, says Soroush Basirat, Energy Finance Analyst, Global Steel at IEEFA and author of a new briefing note, Practical steps to position MENA as a green steel leader.

“Existing gas-based DRI-EAF facilities must urgently prioritise the gradual reduction of Scope 1 and 2 emissions to align with the international stringent criteria for low-emissions steel production,” Mr Basirat says.

“Steelmakers in the MENA region have a significant opportunity to cut emissions by transforming their fleet of gas-based DRI plants into hybrid systems as a stepping stone towards a full switch to hydrogen.”

New hybrid DRI technologies such as Midrex Flex and Energiron Zero Reformer allow the gradual blending of hydrogen with gas without modifying existing plants.

“This partial substitution not only allows for smaller facility sizes but also results in reduced capital costs, making the transition process more feasible,” Mr Basirat says.

As global producers turn to DRI technology to slash their carbon footprints, MENA steelmakers have been producing DRI for decades, giving them a head start on the competition.

However, MENA’s heavy dependence on fossil fuels for electricity is a major obstacle to producers meeting growing international restrictions on higher-emissions steel, such as the EU’s Carbon Border Adjustment Mechanism (CBAM).

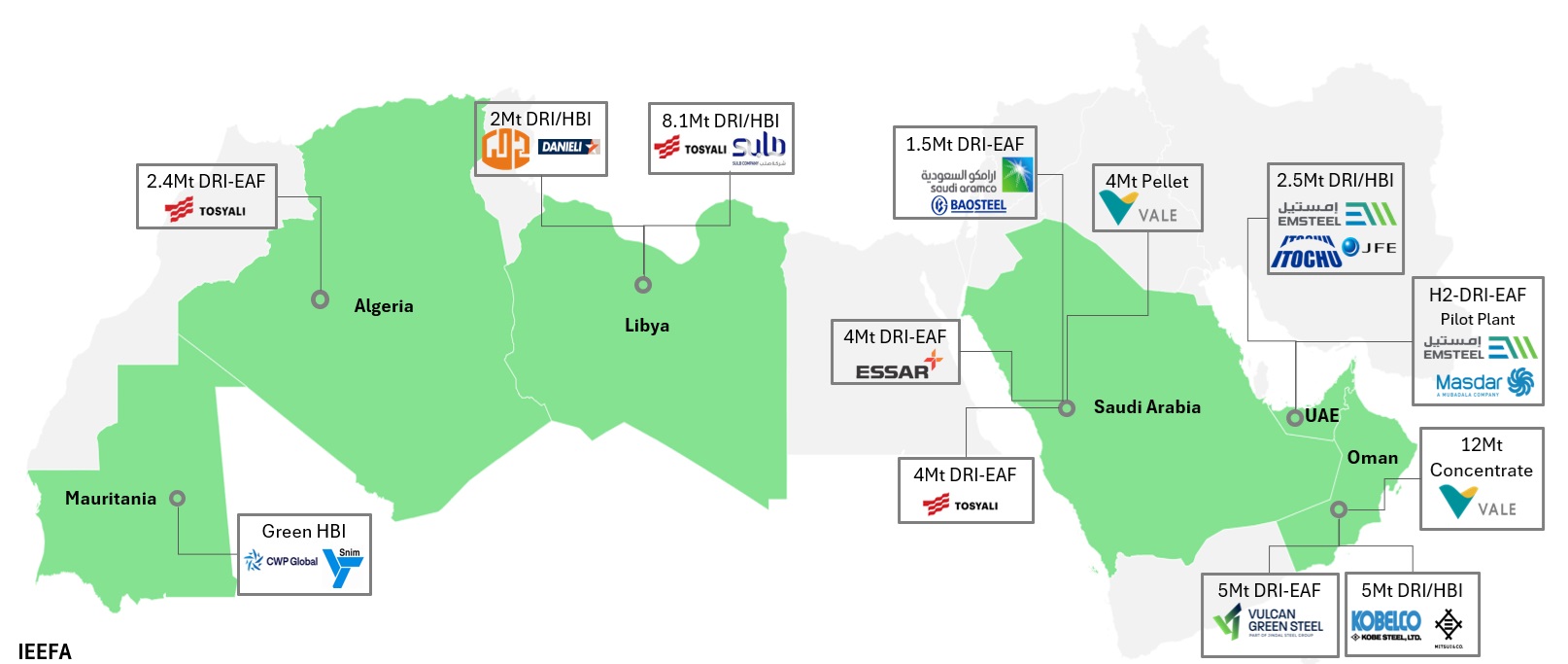

Hotbed of activity: MENA’s low-emissions iron and steel initiatives

The solution lies in MENA’s vast renewable energy resources, which would allow producers to reduce their dependency on grid power, further reducing the sector’s carbon emissions, Mr Basirat says.

“Utilising grid electricity in steel mills or for electrolysers negates MENA’s advantages due to its higher carbon intensity compared with other regions,” he says. “Given the high carbon intensity of MENA grids, prioritising less electricity-intensive iron production for export, such as DRI/hot briquetted iron (HBI), is strategically advantageous.”

Global DRI capacity is forecast to increase to 175 million tonnes per annum (mtpa) by 2030, with MENA contributing about one-third of production growth. Annual global DRI trade is projected to reach up to 85 million tonnes by 2050, with MENA tipped to contribute almost half of global exports.

A flurry of announcements of low-emissions iron and steel projects across the MENA region show the green iron and steel transition is already gaining momentum (see map above).

“As MENA gradually shifts to cleaner grids powered by renewables, this transition period presents an opportunity for collaboration between EU steelmakers and MENA ironmakers,” Mr Basirat says.

“The diverse opportunities and capabilities across regions underscore the inevitability of decoupling ironmaking and steelmaking processes, paving the way for a more integrated and efficient global steel supply chain.”

The German government has signed an agreement to produce 10,000 tonnes of green hydrogen in Morocco, to be sent to Germany to produce 50,000 tonnes of green steel. This green hydrogen will be distributed to offtakers through an international public tender, expected to commence in late 2024.

“While MENA steelmakers can comply with the ‘stick’ of regulations such as CBAM using existing lower-emissions technology, securing the ‘carrot’ of the green premium is more challenging, and will require further efforts to reduce emissions,” Mr Basirat says.

“In the years ahead, the green premium will be a key driver of the steel sector’s transformation. MENA steelmakers can meet the thresholds of some indices by gradually shifting to low-emissions electricity and replacing gas with hydrogen.”

Read the report: Practical steps to position MENA as a green steel leader

Media contact: Amy Leiper [email protected] +61 414 643 446

Author contacts: Soroush Basirat, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)