PLN’s financial sustainability rests on accelerated coal retirement and renewables deployment

Key Findings

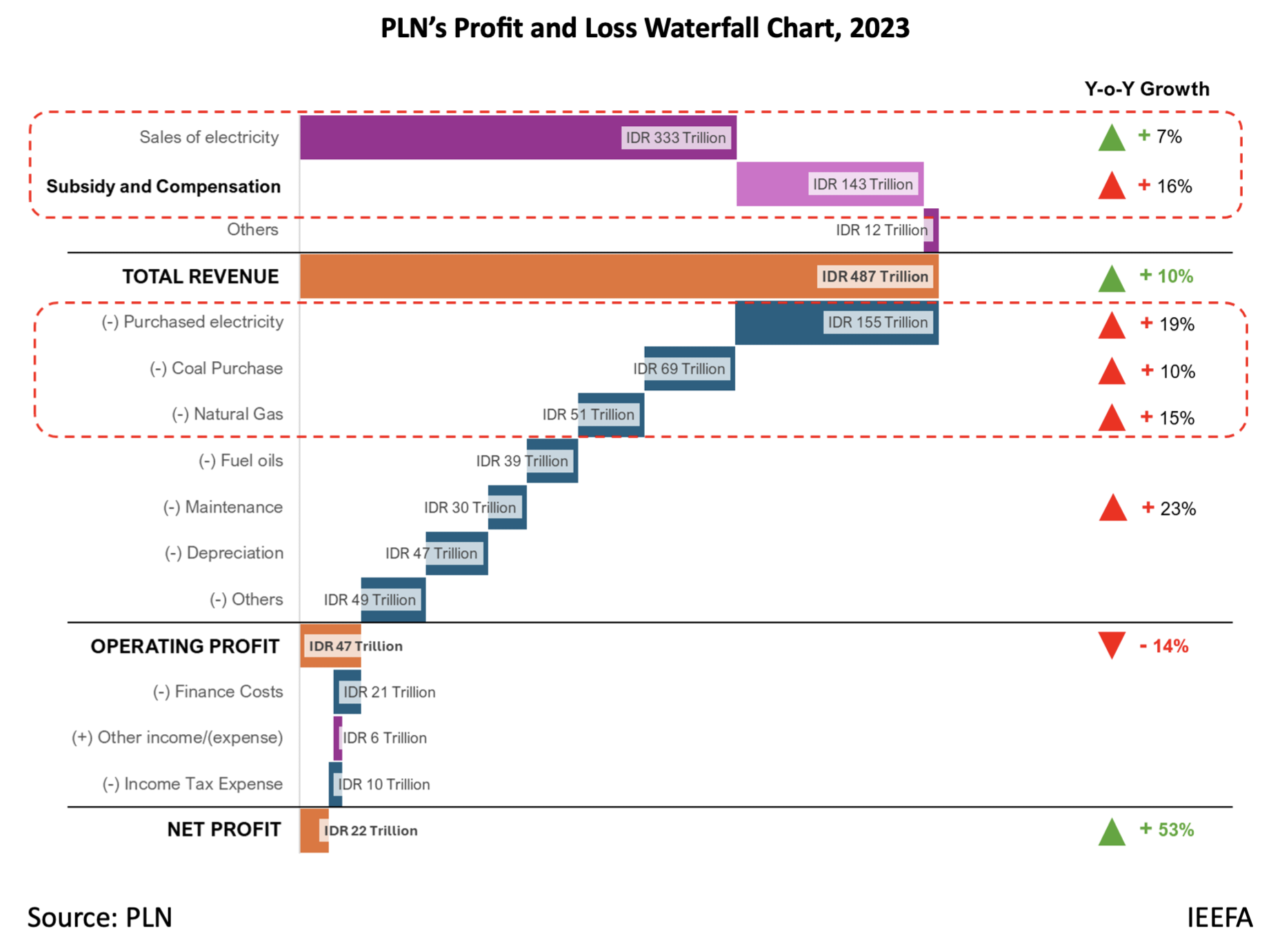

Indonesia’s national electricity utility, PT Perusahaan Listrik Negara's (PLN) reported net profit increase of IDR22 trillion (tn) for the fiscal year 2023 masks what would have been an IDR120tn loss without government subsidies and compensations. Discussions to reduce these subsidies and compensations are underway at the Ministry of Finance.

PLN’s liquidity ratio (0.92), quick ratio (0.79), and cash ratio (0.39) were all below 1.00, which indicates that it is struggling to pay current debt with cash or current assets.

Coal and gas purchasing costs increased significantly in 2023, and PLN struggled with fluctuations due to currency exchange rate movements.

The levelized cost of electricity is around US$4.78¢/kWh for solar and US$4.77¢/kWh for wind. In comparison, coal costs around US$6.5¢/kWh, which is at least US$1.7¢/kWh more.

On 28 May 2024, Indonesia’s national electricity utility, PT Perusahaan Listrik Negara (PLN), released its financial report for 2023. Although the report showed a net profit increase of IDR22 trillion (tn), a 53% rise from 2022, the Institute for Energy Economics and Financial Analysis (IEEFA) calculates that PLN would have recorded a substantial loss of IDR120tn without subsidies and compensations from the Government of Indonesia (GOI).

At first glance, PLN’s cash reserves increased by 9% for the fiscal year 2023, and its electricity sales rose around 7%. This increase in sales contributed the most to PLN’s income growth, amounting to IDR22.2tn. However, despite the improved performance and positive figures, there are underlying red flags.

Despite increased cash reserves, PLN’s liquidity ratio (0.92), quick ratio (0.79), and cash ratio (0.39) were all below 1.00. These figures indicate that the utility is struggling to meet its urgent payment obligations with cash or current assets.

PLN’s financial performance heavily depends on GOI’s subsidies and compensations, which have risen by 16.4% from IDR123tn in 2022 to IDR143tn in 2023. However, these incremental increases could halt in 2025. Discussions at the Ministry of Finance are underway to reduce PLN’s subsidies and compensations under the new administration's programs and policies.

An imminent solution for PLN's financial independence is required. PLN's fiscal potential can be unlocked with minimal GOI assistance by improving efficiency, particularly by reducing operating costs through the adoption of renewables.

Reducing cost and volatility via renewables

The Basic Cost of Providing Electricity (BPP) is arguably the main factor determining electricity costs, which are then translated into tariffs paid by customers. Any increase in BPP adds to the GOI’s financial burden.

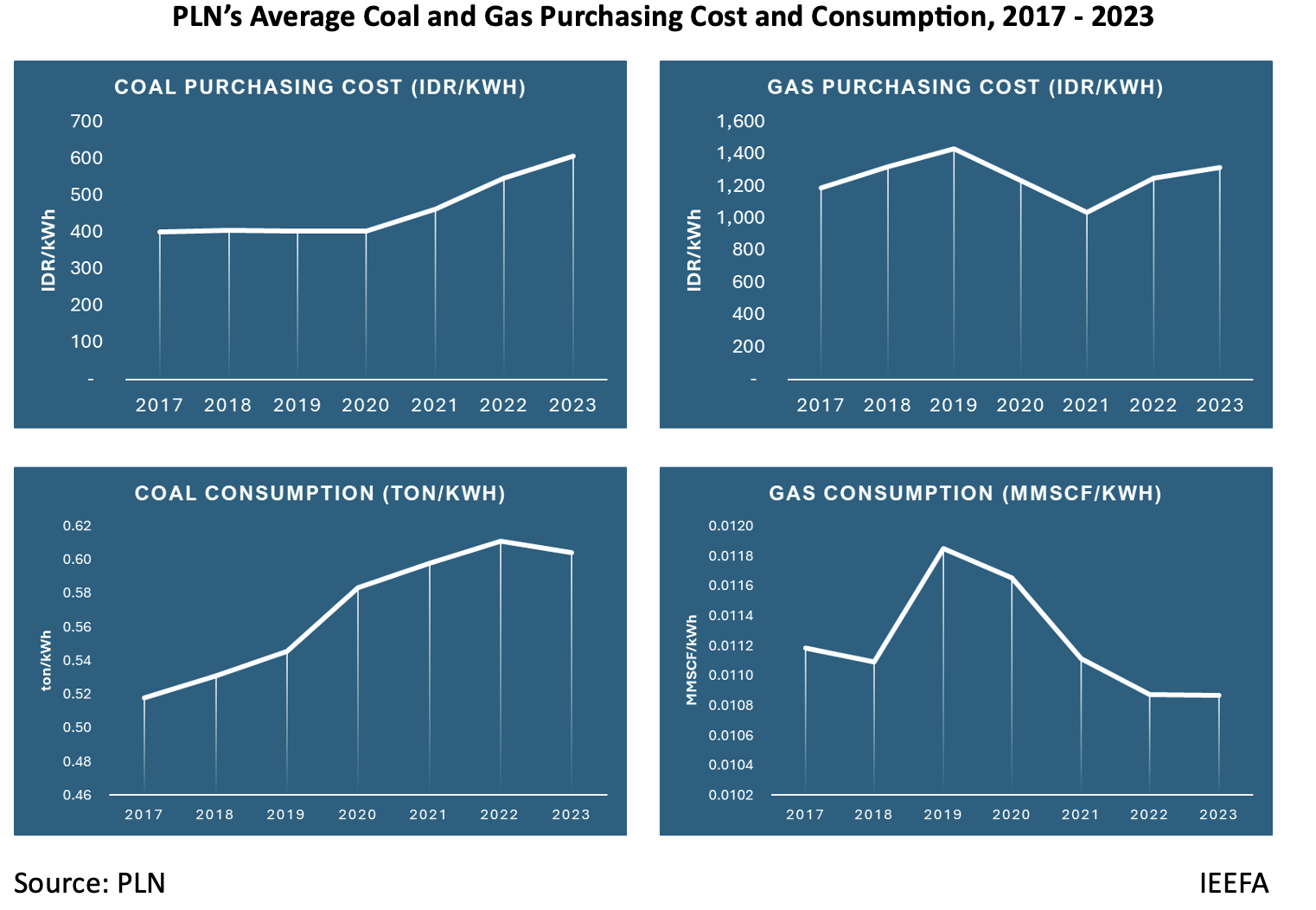

Since 2020, coal and gas purchase costs have increased significantly. In 2023, purchased electricity from coal and gas contributed to a 14% increase in operational expenses and accounted for 63% of total operating costs. On average, PLN spent around US$4-5 cents per kilowatt hour (¢/kWh) for coal purchases, almost 40% higher than in 2020.

Additionally, PLN’s exposure to US$-denominated coal prices requires reconsideration. Despite the GOI's coal price cap, PLN has struggled with coal price fluctuations due to exchange rate changes. While purchases are denominated in US$, PLN’s tariff collections are in Indonesian rupiahs.

Apart from the base fuel purchasing costs, PLN also had to factor in shipping and plant maintenance costs. As coal-fired power plants age, they lose efficiency and require more coal to produce each kilowatt hour (kWh) of electricity.

Considering the difficulty in reducing purchased electricity costs and renegotiating power purchase agreements with independent power producers, PLN should accelerate the transition from fossil fuel-based energy to avoid price volatility.

Renewable energy sources are low-cost to operate compared to fossil fuel power plants. Furthermore, IEEFA’s recent report has shown that the levelized cost of electricity is around US$4.78¢/kWh for solar and US$4.77¢/kWh for wind. In comparison, coal costs around US$6.5¢/kWh, which is at least US$1.7¢/kWh more.

Solar and wind are now the lowest-cost energy sources globally and are expected to become even cheaper by 2030. Notably, maintaining coal-fired power plants is more expensive than constructing entirely new, rapidly built renewable energy plants.

Consequently, the gradual retirement of coal-fired power plants and a concerted transition to renewable energy sources will be a win-win solution for Indonesia to fulfill its Paris Agreement commitments and financial goals.