New Fortress Energy, leader of LNG growth bubble, facing bankruptcy

Key Findings

New Fortress Energy has notified investors that its ability to function as a going concern is in jeopardy if it cannot refinance some of its debt.

The implications of a potential bankruptcy for the oversupply in global natural gas may be the tip of the iceberg.

The company’s focus on natural gas has gone against Puerto Rico energy policies that seek to expand the use of renewable energy sources.

A New Fortress Energy bankruptcy would have ramifications for customers around the globe.

In 2020, IEEFA published a detailed review of the flawed process used to choose New Fortress Energy to serve the natural gas needs of Puerto Rico.

In 2022, IEEFA published a broader report strongly suggesting that the company’s overall business model was unlikely to succeed.

Earlier this year, IEEFA identified New Fortress as one of the greatest threats to the growth of renewable energy in Puerto Rico.

And last week, on Nov. 12, New Energy notified its investors that the company’s position as a going concern is at risk. It remains to be seen whether it actually files for bankruptcy.

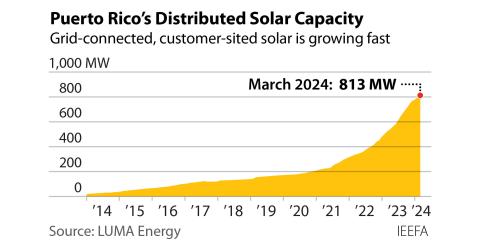

The possible liquidation of New Fortress’s assets would be unlikely to amount to much, given its tangle of indebtedness. The company’s only clear asset is in Puerto Rico, where it holds a contract for the delivery of natural gas and appears to be in line for other deals. The company’s constant moves to build more natural gas plants on the Island have served to undermine the statutory and regulatory requirements to increase solar energy in Puerto Rico as a tool to improve reliability, reduce budget deficits and safeguard future energy security.

New Fortress, a leader of the LNG global growth bubble, is now facing a financial crisis.

The implications of this potential bankruptcy for the oversupply in global natural gas may be the tip of the iceberg. New Fortress’ holdings during its short but tumultuous history have touched Sri Lanka, Jamaica, Trinidad, Mexico, the Netherlands, Jordan, Indonesia, Nicaragua, Brazil, Ireland, as well as the states of Florida, Pennsylvania, and New Jersey.

The implications of this failure are considerable and raise several questions:

- Will the markets see this as an isolated event or just evidence of one more link in a long chain of weakening financial benchmarks that engulf the fossil fuel sector? (The sector continues to lag the market, near last place in 2024).

- More narrowly, are LNG markets oversupplied and is this simply one more indicator of a shaking-out process?

- Will the countries that have entanglements with New Fortress Energy be able to extricate themselves from this flawed company?

- Will the growing list of investors bringing class-action suits actually succeed, driving the company into further financial distress? Recently, the New Fortress CEO called attention to the fact that in in the fourth quarter of 2024, the company anticipated a “modest” dip in revenues, pointing to a faulty valve on one of its assets.

There is more to come on New Fortress Energy.