Narrabri not the best solution for eastern Australia’s gas supply

Key Findings

Calls for the Narrabri gas project to be developed ignore the ongoing contribution of Santos’s Gladstone LNG project to tight domestic market conditions.

Narrabri gas is likely to be one of the most expensive sources of gas in eastern Australia, with estimated production costs 45% higher than for existing gas fields in Queensland.

Gladstone LNG has sufficient gas reserves to meet its export commitments and should be incentivised to develop these reserves before tapping the domestic market.

Santos has not clarified whether Narrabri would simply displace some or all of its domestic gas supply from the Cooper Basin, which could drive domestic prices up.

In recent days, the premiers of South Australia and New South Wales have publicly advocated for the approval of Santos’s contentious Narrabri gas project on the basis of addressing eastern Australia’s gas market tightness.

This follows calls from Santos for the project to be approved and arguments against further policy measures to divert gas destined for LNG export markets to the domestic market. In arguing its position, Santos has asserted that all gas from the Narrabri project in northern NSW will be supplied domestically.

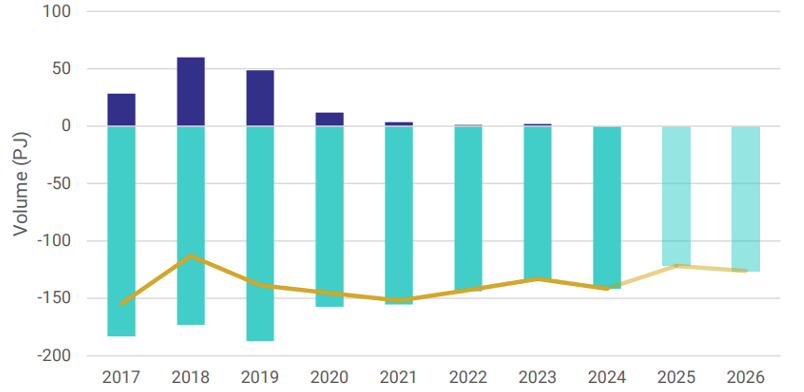

These arguments ignore the continuing impact of Santos’s Gladstone LNG (GLNG) project on domestic gas supply. Several factors have contributed to tight gas supply in eastern Australia. However, Santos’s decision to build a two-train LNG facility without sufficient reserves has resulted in GLNG siphoning material volumes of gas from the domestic market to meet its export contract over the past decade (Figure 1).

Figure 1: GLNG’s domestic sales (positive values) and purchases (negative values)

Source: ACCC Gas Inquiry 2017-30 June 2025 interim report.

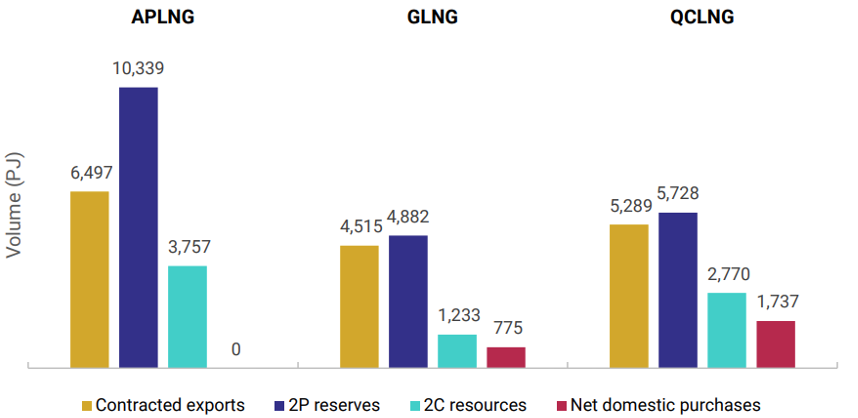

GLNG’s dipping into the domestic market is likely to continue, as it is reportedly seeking new domestic gas supplies to replace a recently expired gas supply agreement with Origin Energy and another with AGL Energy due to expire in 2027. Over the longer term, GLNG anticipates an additional 775 petajoules (PJ) of net domestic purchases (more than 1.5 times eastern Australia’s annual gas consumption) to meet its long-term export contracts. This is despite having sufficient 2P (proven and probable) reserves of its own (Figure 2).

Figure 2: Qld’s LNG exports to 2036 vs reserves, resources and domestic purchases

Source: ACCC Gas Inquiry 2017-30 June 2025 interim report.

Over the past decade, domestic gas prices more than doubled due to tight domestic market conditions, while eastern Australia’s gas consumption has fallen materially. Worsening market conditions have prompted governments to implement increasingly interventionist policy measures to prioritise domestic gas supply, with the Gas Market Review assessing whether these measures have been effective.

GLNG’s impact on the domestic market also prompted the other two Queensland LNG exporters, Australia Pacific LNG (APLNG) and the Shell-owned Queensland Curtis LNG (QCLNG), to call for regulatory reforms that share the domestic supply obligation across all three exporters and incentivise timely development of existing reserves.

Put simply, if GLNG were to develop its own reserves, it may be able to reduce its domestic purchases and free up gas that could otherwise be supplied to the domestic market.

This is presumably where the Narrabri project comes in. Additional domestic gas supply from Narrabri may help to ameliorate pressure on GLNG with respect to its domestic purchases of gas for export. Commitments to supply 100% of Narrabri gas domestically would certainly help.

However, despite these commitments, IEEFA is unaware of any guidance from Santos on the implications Narrabri would have for its continued domestic supply of gas from the Cooper Basin in south-western Queensland. In other words, will Narrabri simply displace some (or all) of Santos's domestic gas supply from the Cooper Basin, which will instead be directed to GLNG for export?

Without firm guidance from Santos, it is difficult to assess the impact of the Narrabri project on domestic supply.

One thing we do know, however, is that gas from Narrabri will be expensive. The Australian government’s Future Gas Strategy identified that Narrabri gas would have a production cost of almost AU$10/GJ, about 45% higher than production costs in Queensland. If Narrabri gas was the marginal source of supply for eastern Australia, it would be likely to have a relatively large influence on gas market pricing, ensuring prices remain relatively high.

In effect, development of Narrabri may lead to more costly domestic gas supply while cheaper gas from Queensland is exported and topped up with gas bought from other domestic suppliers, to the detriment of domestic gas users and households. Instead, GLNG should be required to develop its own reserves, and limit how much gas it siphons from the domestic market.