Maximizing reciprocal benefits from Indonesia's green electricity export to Singapore

Key Findings

Renewable electricity imports from Indonesia are expected to help Singapore achieve its emission targets. However, Indonesia would like to understand the reciprocal benefits that would be offered before issuing a green electricity export permit.

Indonesia could gain substantial benefits from the electricity export plan, including projected annual foreign exchange earnings of at least USD4.2 billion and a tax revenue increase of USD210 million or more a year.

Given the potential scale of renewable generation needed to support exports, this plan can boost the development of Indonesia’s domestic renewable energy manufacturing industry and strengthen its supply chain sector.

To ensure equitable benefits, Indonesia could specify an export capacity quota, a special tariff for renewable energy electricity that reflects the market price, realistic local content requirements, and a fair allocation of carbon credit benefits.

In February 2025, Indonesia’s Minister of Energy and Mineral Resources (MEMR), Bahlil Lahadalia, stated that he would withhold the green electricity export permit to Singapore until Indonesia is offered reciprocal benefits.

Singapore has announced its commitment to reduce emissions to between 45 million and 50 million tonnes of carbon dioxide equivalent (MtCO2e) by 2035, a decrease from around 60MtCO2e projected for 2030. In 2022, the country’s total greenhouse gas emissions were 58.59MtCO2e.

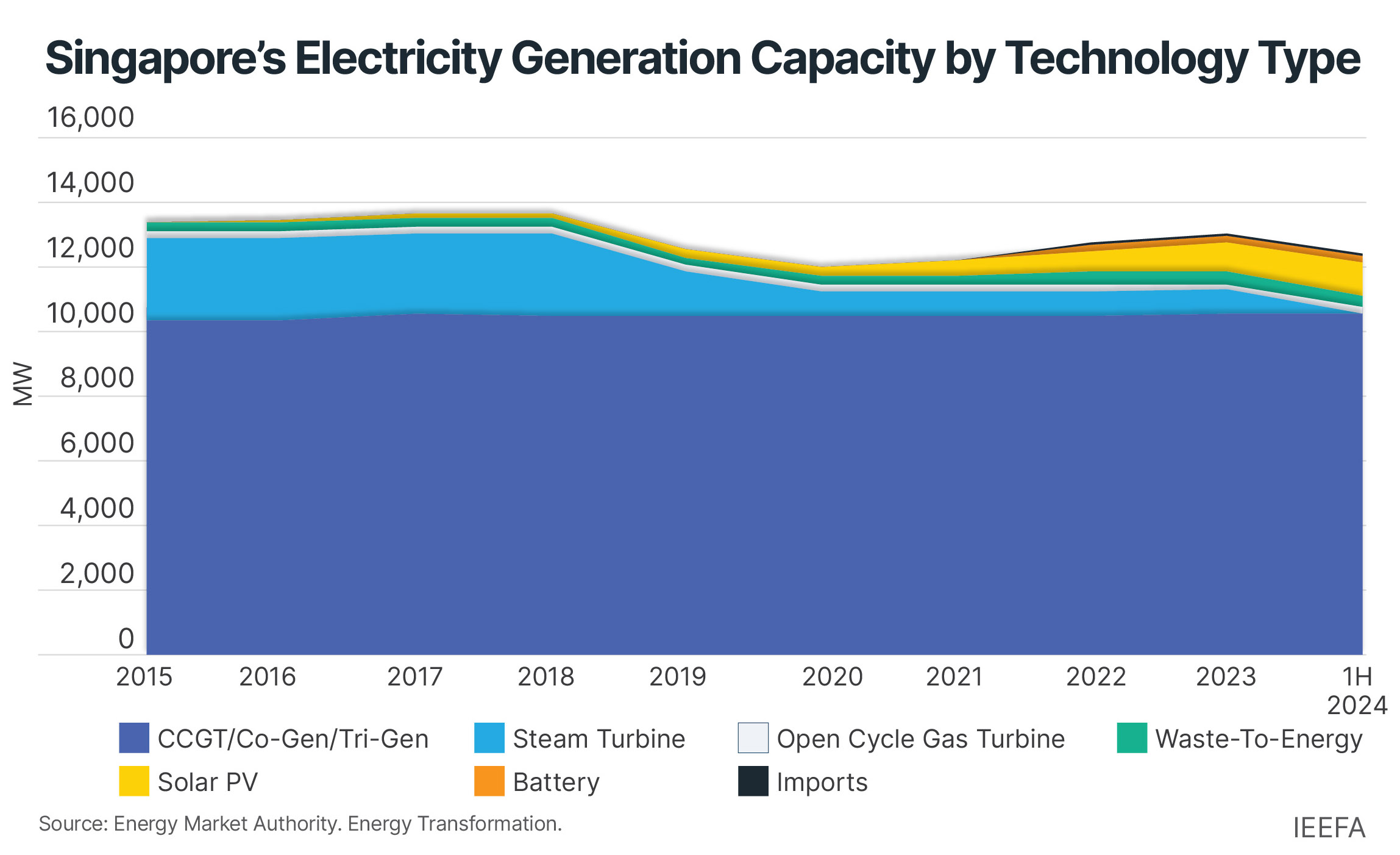

Singapore aims to increase its renewable energy capacity to at least 2 gigawatt-peak (GWp) by 2030, generating enough energy to meet around 3% of the country’s total projected electricity demand that year. Currently, Singapore relies heavily on liquefied natural gas (LNG) and oil, and renewables only account for about 5% of total electricity generation.

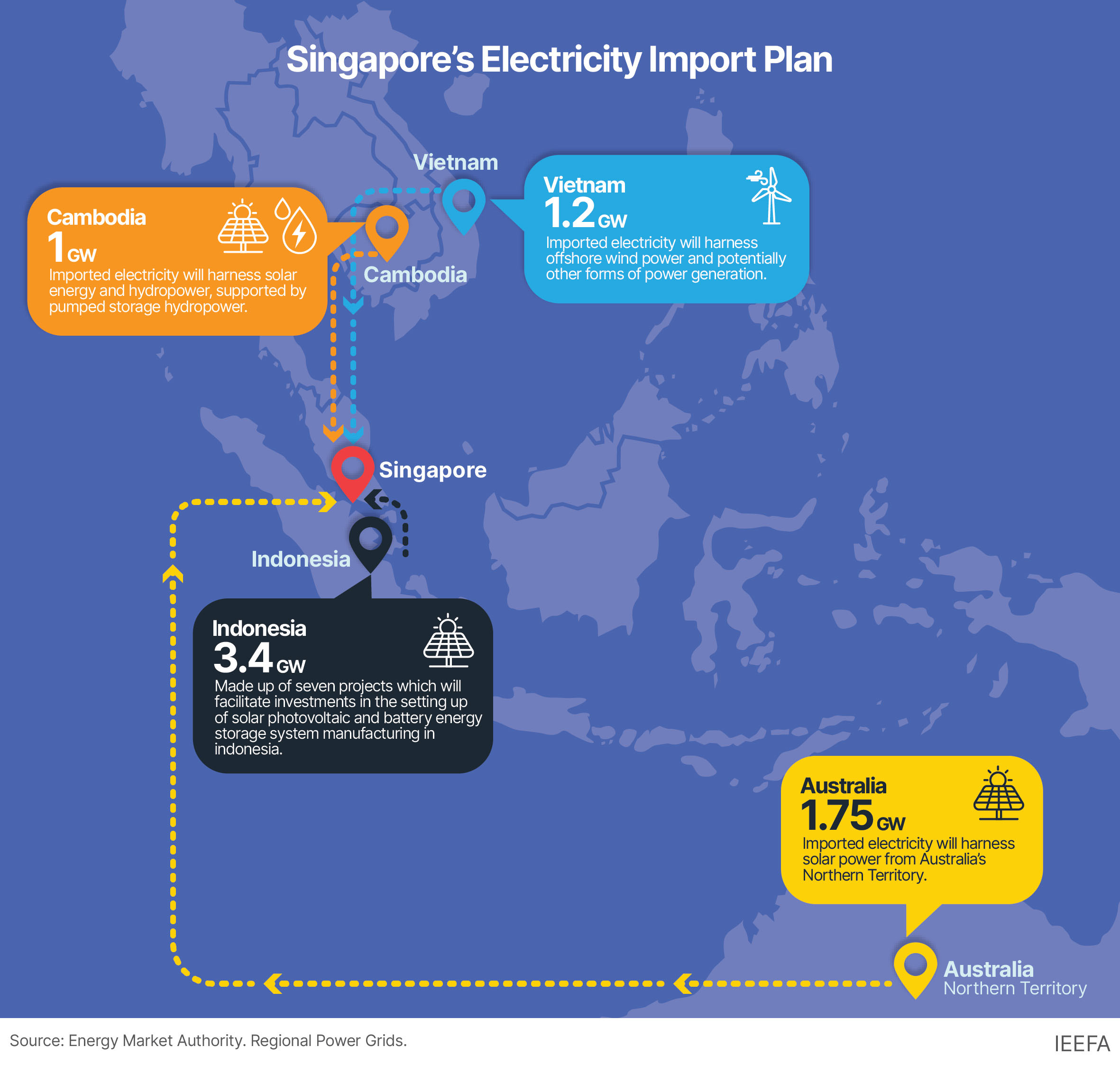

Given Singapore’s limited renewable energy sources and constrained land area, electricity imports, including those from Indonesia, are expected to help the country achieve its emission targets. According to Singapore’s Energy Market Authority (EMA), the country requires 6 gigawatts (GW) of renewable electricity by 2035, a 50% increase from the 2021 target of 4GW.

Singapore-Indonesia renewables trade

Singapore has been interested in importing clean electricity from Indonesia since 2021. Due to the countries’ geographical proximity, transmission costs for electricity transfers between the two nations are much lower than those of other countries. This locational advantage makes energy trade between Indonesia and Singapore highly profitable.

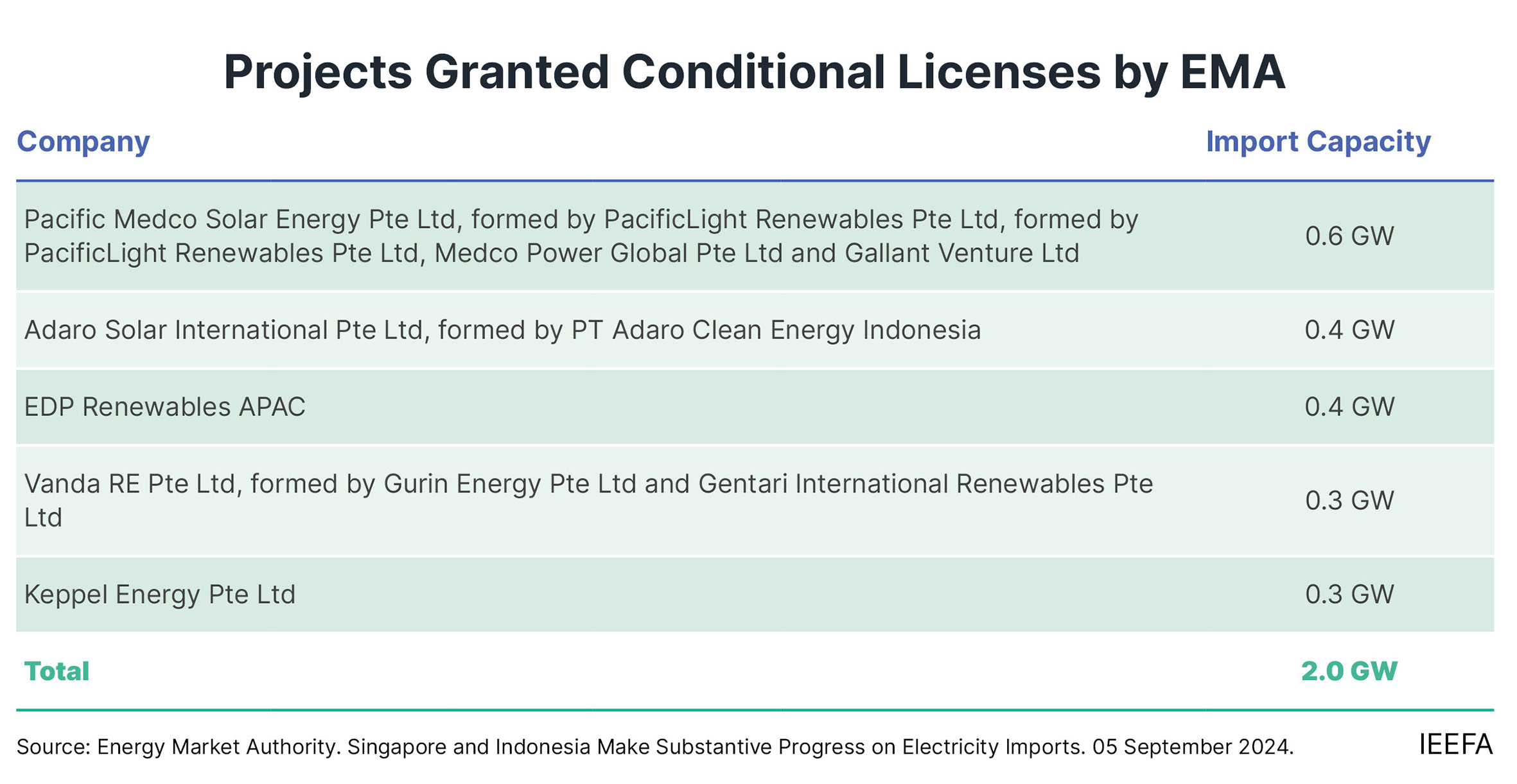

On 05 September 2024, during the Indonesia International Sustainability Forum in Jakarta, EMA announced that it had granted conditional licenses for five Indonesia-based projects to import 2GW of green electricity to Singapore. EMA also granted conditional approvals to two new projects for the import of 1.4GW of low-carbon electricity from Indonesia.

A conditional license from the EMA does not allow companies to import electricity to Singapore. Three approval stages must be completed before an importer license is issued. The steps include obtaining initial conditional approval, gaining a conditional license, and acquiring an importer license. In addition to EMA’s importer license application process, approval from the Government of Indonesia (GOI) is also required to export electricity from the country.

Currently, it appears that the GOI does not want renewable energy electricity to be sold to other countries when there is an insufficient clean energy supply for domestic consumption. The government is also uncertain about the benefits Indonesia would gain from its land and resource allocation. Additionally, the GOI aims to maximize domestic sourcing or manufacturing of the components required for constructing renewable energy projects.

While the government has legitimate concerns about the projects, Indonesia could benefit considerably from exporting electricity to Singapore. Measures can be taken to create a plan that is balanced and equally beneficial for both countries.

Significant potential benefits for Indonesia

Indonesia could generate significant revenue by exporting electricity to Singapore. In the second quarter of 2024, the regulated electricity tariff in Singapore was SGD29.8 cents per kilowatt hour (¢/kWh) (approximately USD22.2¢/kWh) — higher than the Indonesian electricity tariff of USD9.9¢/kWh in the third quarter of 2024. While a state-of-the-art high-voltage direct current (HVDC) transmission link between Indonesia and Singapore would entail considerable costs, the potential profit margins for companies selling electricity to Singapore could be substantial, generating significant revenue for Indonesia.

If Indonesia were to export 3.4GW of electricity, assuming an agreed tariff ranging from USD14¢/kWh to USD20¢/kWh, the annual foreign exchange addition could amount to approximately USD4.2 billion (bn) to USD6bn (IDR67 trillion [tn] to IDR95tn) per year. Over 25 years, this would total around USD105bn to USD150bn (IDR1,675tn to IDR2,375tn). Furthermore, the country could earn around USD210 million (mn) to USD600mn annually through a direct tax revenue benefit with no state investment. GOI could also potentially implement a royalty cost per kilowatt-hour (kWh) of electricity transferred to Singapore, further enhancing its revenue.

The collaboration could also boost the development of Indonesia’s renewable energy manufacturing industry and strengthen the supply chain sector. The country needs to create substantial and sustained demand for solar projects to unlock the domestic supply market potential. The current rate of installation, measuring less than a few hundred megawatts (MW) per year, is insufficient to support manufacturers that operate gigawatt-scale capacities to achieve economic efficiency.

With a 2GW net export target, a gross generation capacity of at least 11GWp of solar photovoltaic (PV) and 21 gigawatt hours (GWh) of battery energy storage system (BESS) would be required. According to EMA, the cross-border electricity trading projects will create extensive demand, facilitating the establishment of solar PV and BESS manufacturing plants in Indonesia.

Furthermore, exporting electricity to Singapore will open up new job opportunities in Indonesia. For example, the 192-megawatt peak (MWp) Cirata floating solar project employed 1,400 workers during construction and operation. For 11GWp of solar PV capacity, it is estimated that more than 80,000 workers would be needed, excluding the additional manufacturing industry workforce required.

Recommendations to ensure equitable benefits

It is crucial that both the electricity exporter, Indonesia, and the importer, Singapore, receive equitable benefits. Given its limited land area, Singapore needs to meet its domestic energy requirements with imported renewable energy sources. Pricing this renewable electricity involves regulatory instruments from both countries.

In Indonesia, the following matters should be addressed without conflicting with existing regulations:

1. Capacity quota

The GOI could set a capacity quota and determine the amount of renewable energy for export to Singapore while ensuring that domestic clean energy needs are met. Indonesia could then effectively balance its renewable energy resources, guaranteeing a reliable and sustainable energy supply for its citizens while still permitting and benefiting from international exports.

2. Special export tariff

A special export tariff for renewable energy electricity should be established, reflecting the market price agreed on with Singaporean buyers. Due to the large project size and additional HVDC transmission infrastructure costs, this tariff should be differentiated from the existing provisions for purchasing renewable electricity stipulated in Presidential Regulation No. 22 of 2022.

3. Role of PT Perusahaan Listrik Negara (PLN)

Indonesia’s national electricity utility, PLN, should play a key role in coordinating the commercial arrangements to ensure balanced benefits are delivered to the country. PLN would need to organize the development of transmission networks, including subsea cables, ensuring a single, efficient cross-country grid. This new transmission network should be exclusively for renewable electricity.

4. Project location

Considering the size of the project, the location should be carefully evaluated. Combining solar, geothermal, and other renewable options requires an estimated 10,000 - 15,000 hectares (ha) of land. This significant land requirement arises because 1MWp of solar energy generation needs approximately 0.9 - 1.4ha. Therefore, selecting a suitable site requires a thorough assessment of various factors, including land availability, environmental impact, proximity to transmission infrastructure, and alignment with community interests.

5. Local Content Requirements

To balance project development and supply chain industry growth, the GOI should implement realistic local content requirements (LCRs) linked to successful implementation. The GOI could also implement a phased approach to meeting LCRs, ensuring that the industry gradually adopts higher LCRs without compromising project timelines or cost efficiency. Considering that the Balance of System components can account for over 75% of the total investment cost of a solar project, there is significant potential for LCRs beyond the solar panels themselves.

6. Carbon credit rules

Indonesia and Singapore should agree on a fair distribution of carbon credit benefits from avoiding carbon dioxide in renewable energy electricity. Although Singapore is a buyer, this should not negate Indonesia's role since the plant is located there. The economic benefits of carbon credits should be distributed fairly to the Independent Power Producer (IPP) and PLN.

Renewable energy exports will elevate Indonesia’s energy portfolio

Exporting renewable electricity to Singapore will significantly boost Indonesia's renewable energy capacity. With solar power plants leading the way, Indonesia's renewable capacity will surpass 10GW, greatly enhancing its energy portfolio. By placing the financial responsibility for renewable electricity on Singapore, this arrangement avoids burdening the Indonesian national budget. This export plan will also yield substantial foreign exchange earnings and tax revenue, which can help Indonesia finance renewable energy projects for its own needs.

Collaboration between Indonesia and Singapore can serve as a regional model, demonstrating the advantages of cross-border cooperation in the renewable energy sector. Both nations can achieve sustainability goals and contribute to global efforts to combat climate change. This partnership strengthens economic ties and promotes regional stability and energy security.

Read the Bahasa-language summary here.