Key Findings

Japan’s recently approved Seventh Strategic Energy Plan (SEP) aims to increase its self-development ratio to achieve a stable energy supply. This target encourages Japanese companies to invest directly in fossil fuel development and production abroad.

Financial assistance, including subsidies, tax incentives, and risk-mitigation mechanisms through Japan’s public financial institutions, supports companies investing in liquefied natural gas (LNG) projects.

Global decarbonization efforts are expected to reduce fossil fuel demand, eroding the profitability of new projects. Heavy reliance on imported fossil fuels would not enhance energy security but would increase Japan’s exposure to global market fluctuations and geopolitical risks.

Japan can ensure a more secure, stable, and affordable energy supply by prioritizing renewable energy development and pursuing energy self-sufficiency targets rather than fossil fuel self-development ratios.

Japan’s Seventh Strategic Energy Plan (SEP), approved in February 2025, emphasizes a “stable energy supply” in the country’s energy security strategy. The plan aims to increase the self-development ratio, a metric officially referred to as the “independent development ratio,” which encourages Japanese companies to invest directly in fossil fuel development and production abroad. A key focus of this strategy is ensuring a stable natural gas supply, which accounts for over 30% of Japan's power.

Despite parallels with the more widely used self-sufficiency ratio, which measures a country’s domestic energy share, the self-development ratio has different implications for Japan. Heavy reliance on imported fossil fuels does not enhance energy security. Instead, it increases the country’s exposure to global market fluctuations and geopolitical risks while abdicating leadership in global decarbonization efforts. In other words, the self-development ratio provides a false measure of energy security. Japan can ensure a more secure, stable, and affordable energy supply by prioritizing energy self-sufficiency targets and renewable energy.

Japan’s energy self-sufficiency and fossil fuel self-development targets

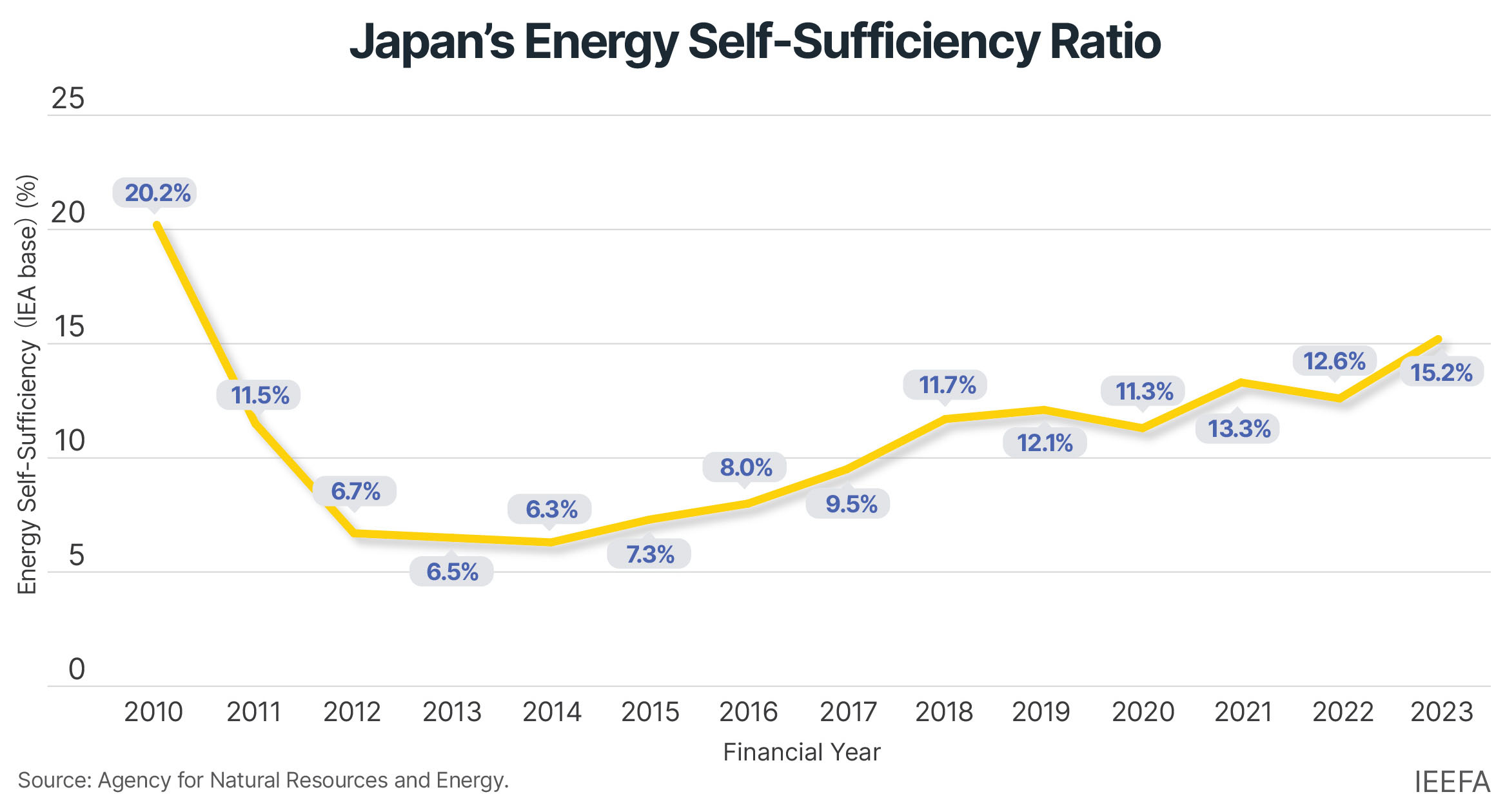

Japan’s energy self-sufficiency is the second lowest in the Organization for Economic Cooperation and Development (OECD). After the Great East Japan Earthquake in 2011, the self-sufficiency rate dropped sharply to 6.3% in 2014 from 20.2% in 2010 due to nuclear plant shutdowns. It has gradually improved following increased renewable energy generation and nuclear restarts. The SEP estimates that the self-sufficiency ratio will reach 30-40% by 2040. However, these are projections, rather than targets, based on current fossil fuel dependence and nuclear uncertainties.

The plan does set targets for the self-development ratio, which represents the share of the offtake amount of oil and natural gas controlled by Japanese companies out of the total imported oil and gas.The aim is to manage the energy supply chain’s upstream segments so that Japan can enhance its energy procurement stability, cost-effectiveness, and security. Higher self-development ratio targets encourage Japanese companies to increase overseas fossil fuel asset holdings.

The government aims to increase the self-development ratio to 50% by 2030 and 60% by 2040, an increase from 37% in fiscal year (FY) 2023. This goal aligns with government directives to Japanese companies to invest in overseas liquefied natural gas (LNG) projects. Financial support, including subsidies, tax incentives, and risk-mitigation mechanisms through public financial institutions such as Japan Organization for Metals and Energy Security (JOGMEC), Japan Bank for International Cooperation (JBIC), and Nippon Export and Investment Insurance (NEXI), encourage these investments.

LNG investment risks and fiscal burdens

Increasing upstream fossil fuel investment introduces significant market risks. Global efforts toward decarbonization are expected to reduce fossil fuel demand, eroding the profitability of newly developed projects. LNG demand has already peaked in major international markets, and the industry's push to open new avenues faces numerous challenges.

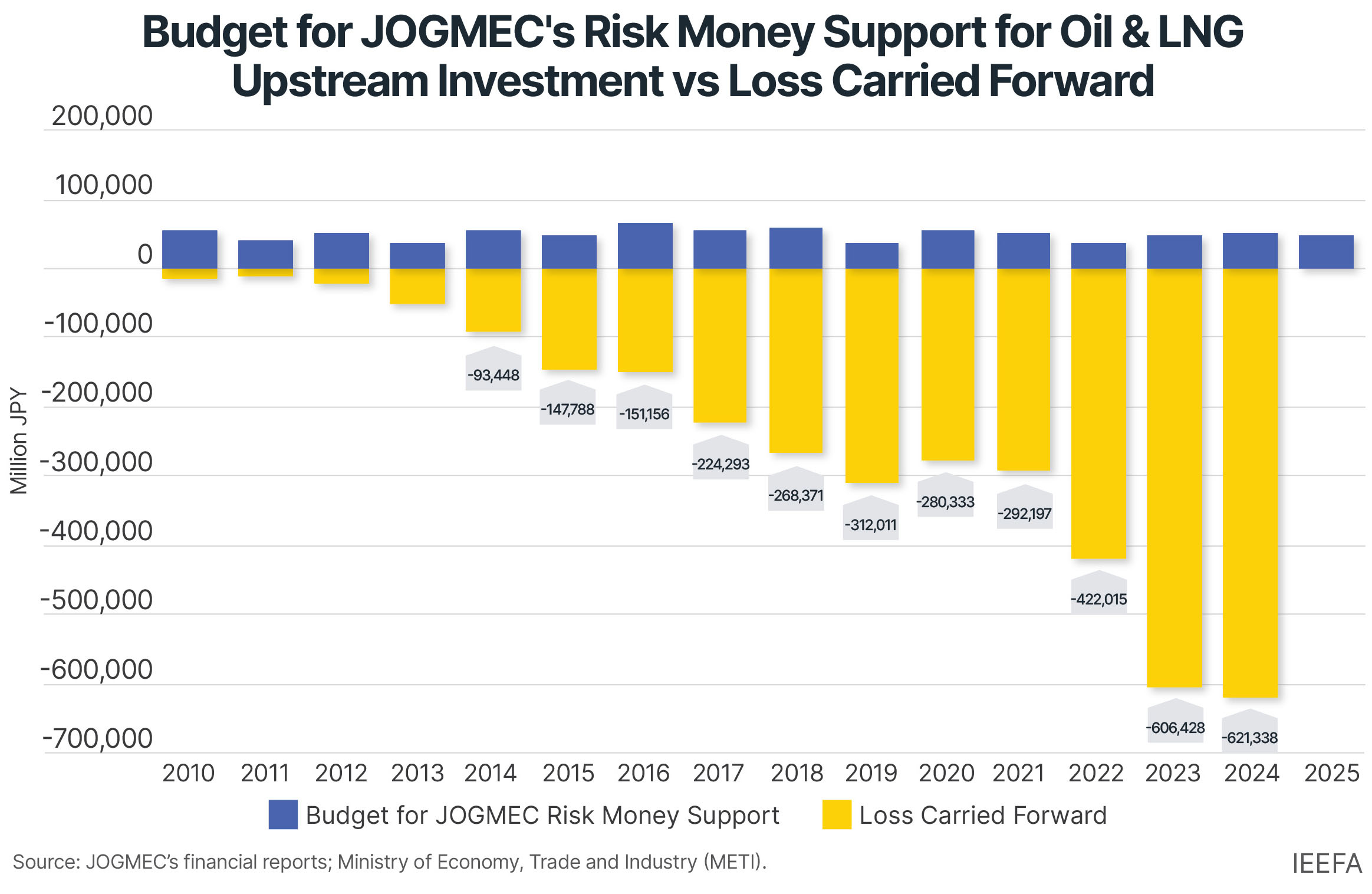

Japan’s push for fossil fuel “independent development” places a heavy financial burden on public institutions and private companies. JOGMEC has allocated a risk fund of over JPY1.2 trillion (USD8.11 billion) for oil and gas projects, but such investment support is increasingly insecure. As of FY2024, the organization’s cumulative losses have reached approximately JPY621.3 billion (USD4.2 billion), with some projects delayed or canceled, further exacerbating the financial strain. Although JOGMEC’s primary goal is to promote national energy security and support high-risk projects, significant losses could lead to financial burdens for the public. Project delays in Mozambique, Canada, and the Middle East resulted in net losses in FY2024 and FY2025 for private companies like JGC Holdings, a Japanese engineering and LNG equipment provider.

Geopolitical insecurity increases financial exposure

The Japanese government’s focus on the self-development ratio fails to address geopolitical risks and energy supply uncertainties.

A prominent example is the Mozambique LNG project, one of Japan’s key overseas investments, which has faced severe security threats and delays. The project, led by TotalEnergies with significant stakes held by Japan’s Mitsui and JOGMEC, was expected to be completed by 2024. However, insurgent attacks in northern Mozambique have repeatedly delayed the project. Escalating violence forced TotalEnergies to declare force majeure in 2021, suspending operations indefinitely.

Security risks have delayed production and increased project costs, raising concerns about long-term financial viability. USD14.4 billion of public funding from JOGMEC, JBIC, and NEXI, as well as private finance from Mitsui are already committed to this project, with additional investments required for security enhancements. Prolonged instability raises questions about whether Mozambique LNG can achieve stable operations, exposing Japanese investors to financial losses and supply uncertainty.

Renewable energy would improve energy security

Japan can significantly enhance energy security and affordability by accelerating the transition to renewables and prioritizing self-sufficiency over the self-development ratio. In 2023, renewables, excluding hydropower, generated 15.3% of the country’s total power. The levelized cost of electricity (LCOE) for utility-scale solar in Japan has decreased from almost JPY60 per kilowatt hour (kWh) in 2014 to JPY9.9 /kWh in 2023, following global downward trends. This figure is significantly lower than the fuel cost of LNG-fired power generation at JPY22.3/kWh and coal-fired power at JPY18.6/kWh in the same year.

Energy storage and grid development can support a more resilient and stable renewable-based system. Global battery prices fell 92% in 2024 from 2010 and are likely to decrease by 10% yearly. In Japan, energy storage costs fell from JPY165,000/kWh in FY2019 to JPY112,000/kWh in FY2022. In 2024, 88gigawatts (GW) of grid-scale battery storage capacity attempted to connect to the grid, triple the amount in 2023. However, only 6.2 GW of this capacity could be integrated into the transmission system. Grid enhancements, including expanded inter-regional transmission capability, will further strengthen Japan’s energy storage capacity and renewable energy reliability.

Securing Japan’s energy future requires a decisive shift from volatile fossil fuel markets toward a domestically sustainable, cost-effective, and resilient energy system. Expanding renewable energy is a climate necessity and an economic and strategic imperative to ensure long-term energy security. Japan should prioritize self-sufficiency targets focused on renewable energy rather than pursuing fossil fuel self-development ratios.