IEEFA U.S.: As utility company exits Four Corners Power Plant, NTEC seeks to keep it open

In announcing its merger yesterday with renewable energy giant Avangrid, PNM Resources reaffirmed its commitment to end its use of coal, stating that it would continue with the abandonment of the San Juan Generating Station in 2022, and that it was actively working to sell its 13% stake in the Four Corners Power Plant. The deal is a strong signal that the embrace of renewables by PNM and other Southwestern utilities was the right decision, and it bodes well for future economic growth from renewable energy development in the region.

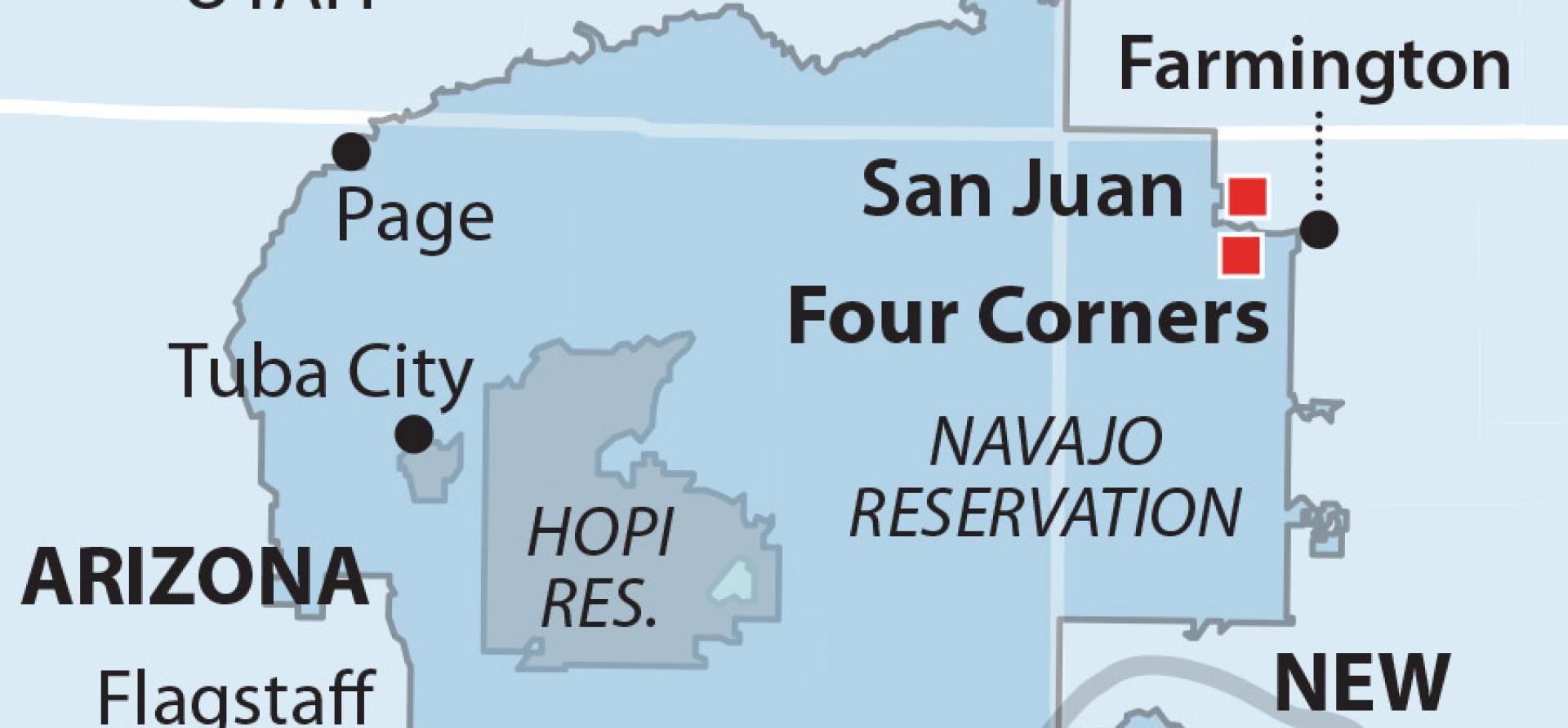

Both plants are near Farmington., N.M., at the heart of a region that has historically supplied coal-fired electricity to much of the Southwest but is in the midst of a rapid transition to other forms of generation. Four months ago, New Mexico regulators approved a plan for PNM to replace all its power from the San Juan plant with renewables and battery storage, and just a few weeks ago PNM explained exactly how it will do so beginning in January 2021.

NTEC wants to keep the plant open as long as possible and get a $75 million windfall

However, there is a troubling wrinkle in the deal. The Navajo Transitional Energy Company (NTEC), and a 7 percent owner of Four Corners, as well as its sole coal supplier, has been actively negotiating to acquire PNM’s share in the plant, largely in a bid to keep the plant open as long as possible and get a short-term windfall of $75 million that PNM Resources is willing to pay to get out of the plant. Such a deal would only add to the coal-centric risks the company has already exposed the Navajo Nation to when it bought three big coal mines in the Powder River Basin last year, and be in direct opposition to the carbon reduction goals of Avangrid, PNM Resources, and the state of New Mexico. NTEC is owned by the Navajo Nation but run independently by a board and management team in Colorado that seems intent on expanding its coal market presence even as the industry is in rapid decline.

In its proxy filing outlining the terms of its agreement with Avangrid, PNM wrote that it would shed its ownership stake in the plant “as promptly as practicable but in any event no later than December 31, 2024.” In a sign of how important getting rid of the coal generation at Four Corners is to Avangrid, the merger agreement contains a special clause requiring PNM Resources to have agreements to “exit from all ownership interests in the Four Corners Power Plant” before the merger is finalized in late 2021. That would be a full decade before PNM’s current ownership and coal supply agreements for Four Corners are set to end.

The plant, like many in the region, is struggling to compete. Its capacity factor has fallen significantly since 2015, a reflection of the sharp increase in renewable generation in the Southwest in the past five years and the high cost of Four Corners’ electricity. According to Standard & Poor’s, the plant’s average operations and maintenance costs from 2016-2019 were more than $43 per megawatt hour (MWh). At the same time, solar costs in the region have fallen well below that, with recent deals by PNM ranging from $18.65/MWh to $27.35/MWh. A major factor in Four Corners’ rising costs is the above-market prices it pays for the plant’s coal.

NTEC’s intent is laid out in an email its chief executive sent to board members

NTEC’s intent to take over PNM’s share of Four Corners is laid out in an email NTEC’s chief executive sent last week to NTEC board members, Navajo Nation leaders and other NTEC executives. The email describes two failed attempts to solicit buyers for PNM’s share of the plant. Neither of those interests (a little-known company called Rainbow Marketing and an established independent power supplier, Guzman Energy) came to terms with NTEC, which wanted a partner that would commit to keeping the plant open—and keeping NTEC in business by buying its coal.

NTEC continues to seek a buyer that will act as a proxy, a tactic that if successful would keep Four Corners open longer than it might otherwise survive. Under the plant’s original ownership agreement, the four utilities that have a stake have had the right of first refusal on any share of the plant put up for sale. NTEC, although it is a co-owner, cannot vote on such decisions because of the conflict of interest it would present, since NTEC is the sole coal supplier to the plant (from its nearby Navajo Mine).

The maneuver is similar to one NTEC tried unsuccessfully in early 2019 to keep Navajo Generating Station running. That power plant closed a year ago.

The other owners of Four Corners are Arizona Public Service (APS), which owns 63%; Salt River Project (SRP), which owns 10%, and Tucson Electric Power Company (TEP), which owns 7%.While SRP and TEP, which are moving away from coal, have previously waived their rights of first refusal on the PNM stake in the plant, APS has not. But APS, like the other utilities, is also moving toward other sources of power generation and may well object to NTEC’s efforts to keep the plant running.

Under the terms of the deal being discussed with PNM, the utility would pay as much as $75 million for NTEC to take its share of the plant off its hands. NTEC has a short-term incentive to go forward with the deal, if only because it needs the money. Only a year ago, the company made a huge and ill-timed bet by purchasing three large coal mines in the Powder River Basin. At the time, IEEFA warned that the financial risks to NTEC of going all-in on coal by buying those mines—two in Wyoming and one in Montana—was extremely high.

Coal-fired generation has been rapidly losing market share to renewables and gas

Coal-fired generation is now one the highest-cost sources of power in much of the country and has been rapidly losing market share to renewables and gas generation. Policy forces toward transition have been a factor in states like New Mexico, which has mandated aggressive carbon-reduction emissions, but market forces are also driving the change. Coal, as a result, is in rapid and permanent decline. Many utilities—including PNM—have either sharply curtailed their coal use or retired their plants and have been investing aggressively instead in wind, solar, and battery storage.

Meanwhile, NTEC continues to stubbornly increase its stake in a dying industry. Navajo Nation leaders recognized as much when they refused last year to back the bonds NTEC needs to fully take possession of the Powder River Basin mines.

NTEC’s interest in Four Corners looks just as poorly placed, for at least three reasons.

First, Avangrid and PNM’s urgency now to get out of the plant suggests that the longer-term costs of operation and maintenance are too high—explaining why they are willing to pay a significant incentive to rid themselves of it. Part of this may also be that the high cost of power from the plant may be increasingly difficult to sell into a market with a growing amount of cheaper renewable generation.

Second, the lack of interest from and failed talks with potential partners strongly implies that there is little financial upside—and plenty of risk—in owning a piece of a plant that will close down within 10 years.

And lastly, a greater financial stake in Four Corners would represent another lost opportunity for the Navajo Nation, and NTEC, of not putting financial resources into wind and solar energy development—the very things that Avangrid sees as a big incentive to invest in New Mexico. The Nation needs the jobs that would come with such development, as well as the long-term revenue and other benefits. NTEC’s potential purchase would likely squander that opportunity, while only putting off the closure of the plant for a few years at most.

Seth Feaster ([email protected]) is an IEEFA data analyst.

Karl Cates ([email protected]) is an IEEFA transition policy analyst.

RELATED ITEMS

IEEFA U.S.: Navajo-owned energy company is in trouble

IEEFA Coal Outlook 2020: Market trends are pushing U.S. industry to a reckoning