IEEFA U.S.: Ohio regulators have opportunity to do PTTGC a favor by nixing permit

The long-delayed Ohio petrochemical complex proposed by PTTGC would do well to heed a heads-up from a Standard & Poor’s credit opinion issued for a similar project proposed by Formosa Plastics. The message: Cancelling the proposed plant will be better for their credit rating than moving forward with it. Regulators have an opportunity this week to do it for them.

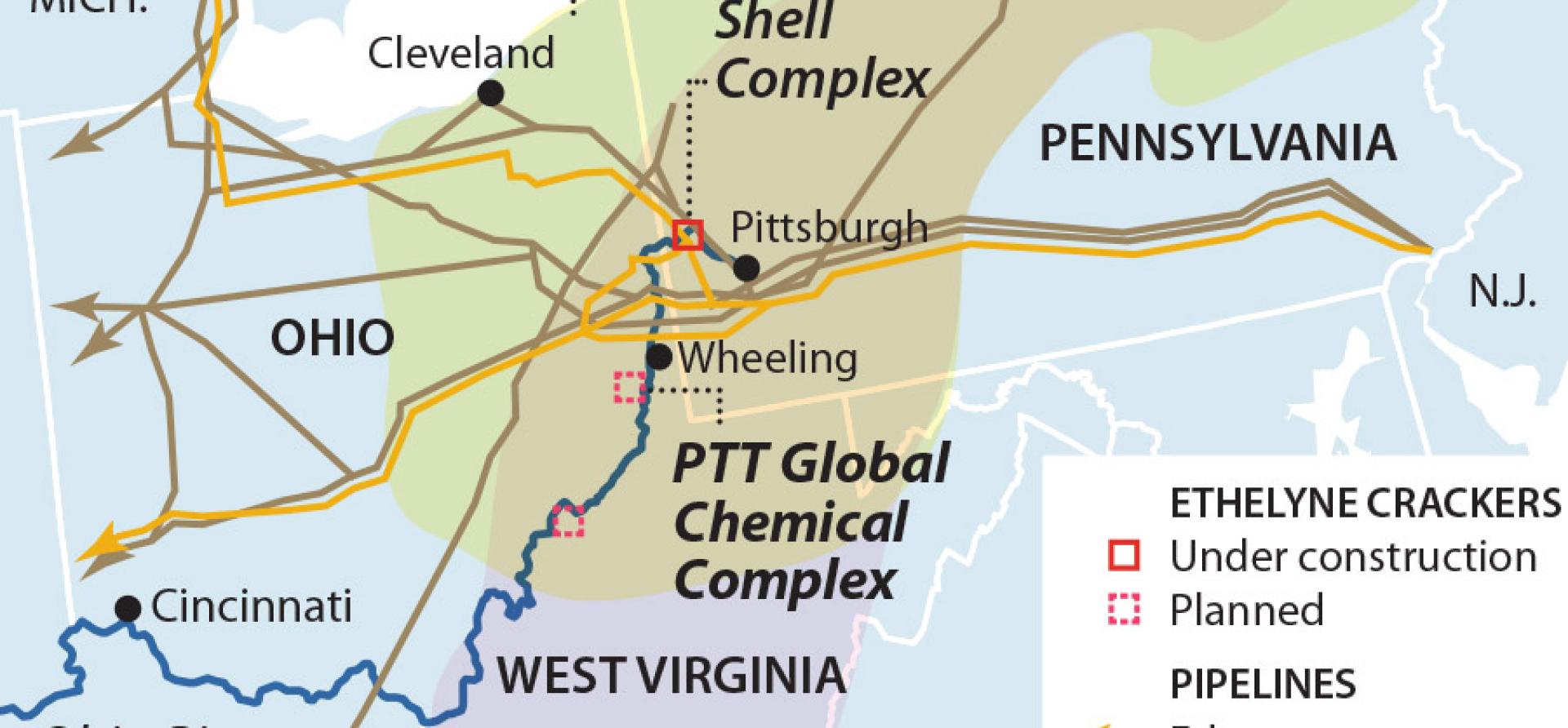

The PTT Global Chemical (PTTGC) Petrochemical Complex is to be built in southeastern Ohio. The $5.7 billion complex would support one ethane cracker with a capacity of 1.5 kilotons per year (ktpa) of ethane and two units of high-density polyethylene (HDPE) with a 350,000 ktpa capacity and 900 ktpa of linear low-density polyethylene (LLDPE).

No more time, money and community support should be wasted on a project unlikely to go anywhere

The project has been through a series of fits and starts. State grant dollars have flowed to keep it afloat, and permits have been renewed without much progress. Like many other companies, PTTGC said it couldn’t make progress until safety issues related to the COVID-19 pandemic had been resolved. PTTGC faces a new permit issue now, with an air pollution permit extension expiring Thursday.

Ohio regulators would do themselves and PTTGC a favor by refusing to renew the permit, so they don’t waste more time, money and community support on a project unlikely to go anywhere.

In an assessment of Formosa Plastics plan to build a similar complex in Louisiana, S&P said project delays have been good for the company’s credit rating because it’s helped them to build up their cash reserves instead of sinking money into a questionable deal. The delays have also been good for PTTGC, a competitor of Formosa. S&P said cancelling the project would be better for the company’s credit than proceeding:

“A further delay in the Louisiana chemical complex, if the project is not cancelled, gives the companies more time to strengthen the financial buffer for their ratings. We see diminishing probability that the planned mega project in Louisiana will go ahead, given the changing political atmosphere in the U.S. A decision by U.S. officials in August 2021 to order an environmental impact statement for the project cast significant doubt over its future. The project has been on hold since November 2020 when the U.S. government suspended a permit amid protests from local environmental groups. Formosa Petrochemical Corp. planned to review the project’s feasibility by the end of 2021. This was based on further potential delays as a result of the impact statement, sharply higher construction costs due to high inflation in material prices and wages, hefty tariffs on imported equipment from China, and lower availability of local labor due to the pandemic.”

The financial warning is clear: Rising construction costs, unstable trade arrangements, and a hard time finding workers add up to problems that suggest that project cancellation is better for the company. IEEFA would add that the rising construction costs are taking place just as plastics prices are coming down and are likely to continue to moderate over the next few years, tightening profit margins.

Surging global pressure to reduce carbon emissions as well as chemical and plastic pollution is of concern

Further to the point, S&P takes a broader view than just the United States. It is looking at the growth of major expansion projects in the commodity chemical field worldwide. A common risk to many of these projects is the “surging global pressure to reduce carbon emissions as well as chemical and plastic pollution.” The public concern is worldwide.

The credit agency provides advice to the company, which could also serve as a tip to local and state economic development leaders. The credit agency is looking at other sectors of the economy for credit-positive initiatives. S&P notes that the Formosa “companies are likely to shift their focus to specialty products, particularly electronic materials for emerging applications such as electric vehicles.”

Ohio regulators and leaders hoping to build the economy would do well to shift their focus to other sectors of the economy with a more robust and positive outlook. They should not renew the permit.

Tom Sanzillo ([email protected]) is IEEFA’s director of financial analysis.

Related items:

IEEFA. Why External Review of Price-Setting Mechanism for Plastic Resins Is Warranted

IEEFA. European-based regulatory model has global implications for complex plastics questions

IEEFA. IEEFA Europe: Proposed INEOS cracker plant would oversupply ethylene market