IEEFA Update: A Growing Consensus on Transition

The speakers changed at IEEFA’s annual conference this year, but the message remained the same: coal can no longer compete economically with either renewables or natural gas.

Andrew Blumenfeld, head of market analytics with Doyle Trading Consultants, said this week during the IEEFA 2018 Finance Conference in New York that “even if power generators were agnostic regarding climate change, coal faces challenges on economic terms from natural gas.”

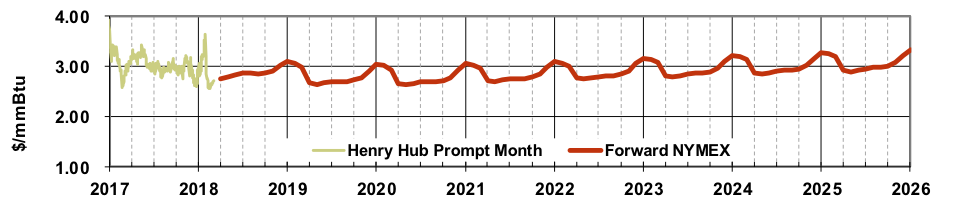

Natural Gas Price Outlook

(Source: Doyle Trading Consultants)

With natural gas prices so low, Blumenfeld said, it is hard if not impossible for coal to compete.

But that is hardly the only problem facing the coal industry, he said, pointing out how generators are bringing ever-larger and more efficient natural gas combined cycle plants into the marketplace, further undercutting coal’s economics. The latest gas units generate upward of 1,100 MW of electricity and can hit 61 percent efficiency—compared to a top end of roughly 40 percent for coal. These new turbines are the “single greatest threat to coal generation in the future,” Blumenfeld said.

The electricity market itself also is changing, and not to coal’s benefit. Demand in the commercial and residential sectors, which varies significantly during the year, is on the rise, while industrial consumption, which tends to be relatively consistent, is on the decline.

Coal units are most efficient when running constantly, but as Blumenfeld pointed out, the trend is in the other direction, with the difference between the highest amount of coal consumed monthly and the lowest amount during the year rising steadily over the past 20 years.

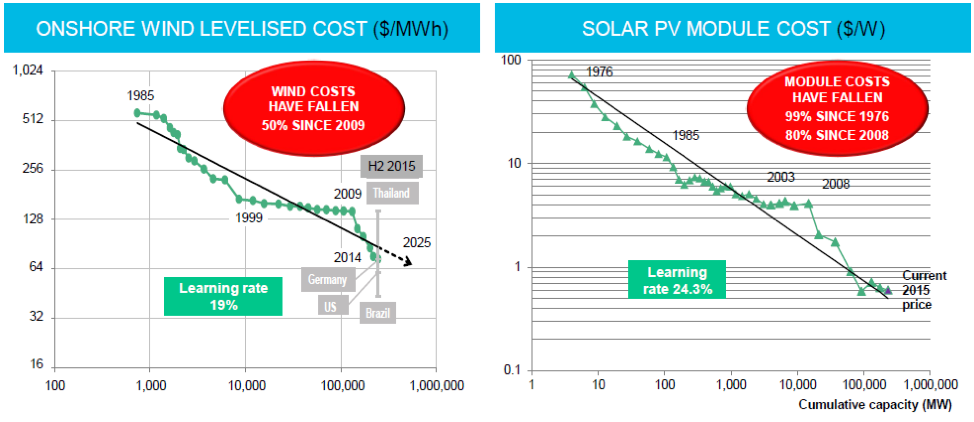

RENEWABLE ENERGY, LED BY WIND AND SOLAR, are also increasingly competing head to head with coal, driven by the sharp and continuing price declines past decade or so. Tom Murley of Two Lights Energy Advisors presented the graphics below to illustrate the sector’s changing economics:

Source: Bloomberg New Energy Finance

One doubt on the scope and speed of these changes, Murley said, has to do with the expectation that continuing price declines are so ingrained that it could cause some interested corporate investors to delay development efforts, assuming that if they wait prices will fall even further.

Jim Hempstead of Moody’s Investors Service said his group has not seen any slowdown in corporate or utility interest in wind and solar power development. In fact, Hempstead said, the Trump administration’s decision to pull out of the Paris climate accord may have helped spur corporate interest in moving forward with renewable procurement deals. Hempstead also said he did not think new U.S. solar tariffs would have any appreciable impact on the market, calling them little more than a “bump in the road.”

He predicted that storage and offshore wind would follow declining cost curves similar to those of wind and solar, further entrenching renewables as a competitive electricity provider.

THE REFRAIN WAS MUCH THE SAME WITH REGARD to markets outside the U.S. Melissa Brown, an Asian-based IEEFA analyst, said that coal’s share of the China electricity market was trending slowly downward, having dropped from 74 percent in 2013 to an estimated 65 percent last year, driven by increased efficiency at existing coal plants and “really dynamic renewables growth” over the past couple of years.

Brown noted Chinese tech companies—much like Google, Apple and Amazon, among others in the U.S.—are playing a key role in the push for greener power.

The scope of the shift from coal and toward renewable energy in both China and India was emphasized in a presentation by Christine Shearer, a senior researcher with CoalSwarm. Shearer said the amount of newly commissioned coal capacity worldwide dropped from 101 gigawatss in 2015 to 84 in 2016 and 61 last year, with China and India accounting for 77 percent of the total.

More important, the amount of new capacity being built has tumbled over the past three years Shearer said, from 170 gigawatts in 2015 to 47 last year. Looking forward, she projected that the annual amount of coal capacity being retired could top the new amount coming online by 2022—“beginning the era of contraction of the world’s coal fleet.”

Dennis Wamsted is an IEEFA editor.

RELATED ITEMS:

IEEFA Update: India Is Becoming a Transition Force on Par With China and Western Europe

IEEFA Update: America’s Coal Industry Is in Trouble

IEEFA Update: A Lobbyist With Coal-Colored Glasses Can’t See the End Game