We’ve written a buyer-beware letter today to members of the Montana legislature on the perils of taking an ownership stake in the aged Colstrip Power Plant in eastern Montana.

We’ve written a buyer-beware letter today to members of the Montana legislature on the perils of taking an ownership stake in the aged Colstrip Power Plant in eastern Montana.

News organizations have reported recently that some state officials want to explore having either NorthWestern Energy—or the state itself—own or assist in the continued operation of Colstrip 1 and 2, the two oldest units at the plant.

Our letter points to a memorandum we completed this week (“Analysis of Cost to Ratepayers If Northwestern Energy or State of Montana Purchase Colstrip Plant”) that shows how any such deal would come at extraordinarily high cost to Montanans. (Talen Energy and Puget Sound Energy currently own Colstrip).

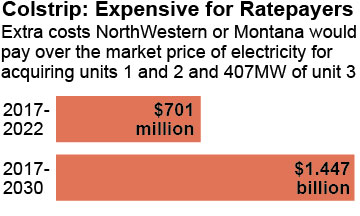

We’ve found that if NorthWestern Energy were to buy part or all of Colstrip Units 1 and 2, its customers would have to pay higher electricity bills to the tune of at least $207 million to $414 million more than they would if the utility were to buy power from the larger market through 2022. Alternately, the state—taxpayers—would have to subsidize such a deal.

The numbers of course are much bigger the further one looks into the future. The deal would cost ratepayers and/or taxpayers $405 to $810 million if its costs are calculated out to 2030.

Our research has long shown that market forces have made Colstrip Units 1 and 2 increasingly uneconomic to run, and that the situation will only get worse as time goes by. Moreover, as stark as the above numbers are, they actually understate the high cost of power from Colstrip Units 1 and 2 because they reflect only the fixed and variable operating maintenance costs of producing power at Colstrip. They do not include significant likely annual capital expenditures, debt and equity costs, and environmental remediation and decommissioning costs.

The analysis we’ve flagged today for legislators builds on IEEFA’s previous research into the declining economic and financial viability of the continued operation of Colstrip Units 1 and 2 (“IEEFA Analysis: Financial Condition of Montana’s Colstrip 1 and 2 Worse Than Previously Known” and “A Bleak Future for Colstrip Units 1 and 2”).

David Schlissel is IEEFA’s director of resource planning analysis.

Related posts:

Long-Dreary Outlook for Two Montana Coal-Fired Plants Has Gotten Worse

Wyoming’s Coal Miners Are Worthy of Better

Two More Aging Coal-Fired Power Plants That Should Be Retired