IEEFA comments in response to shortcomings of 2024 LNG Export Study

The Institute for Energy Economics and Financial Analysis (IEEFA), a non-profit organization focused on research and analysis of global energy markets and trends, provides the following comments in response to the Notice of Availability of the 2024 LNG Export Study and its Request for Comments that Inform DOE Public Interest Determinations in the Permitting of Future LNG Export Terminals and Permitting the Expansion of Existing Sites to supply non-Free Trade Agreement nations, Docket Nos. 13-69-LNG, 14-88-LNG, 15-25-LNG, 16-28-LNG, 19-134-LNG, 20-23-LNG, 21-131-LNG, 22-39-LNG, 22-167-LNG, 23-34-LNG, 23-46-LNG, 23-87-LNG, 23-109-LNG, 23-137-LNG, 24-27-LNG, and 24-87-LNG. These comments address methodological shortcomings in the economic models used in the 2024 LNG Export Study. The models systematically underestimate domestic natural gas prices, leading to an unjustified reduction in the projected price impacts on the U.S. public.

The claim that 2024 LNG Export Study projections are representative of natural gas market conditions is inappropriate.

It is well known that equilibrium-based models, such as those used in the 2024 LNG Export Study, struggle to incorporate (or intentionally ignore) wide-ranging and unpredictable exogenous forces that influence commodity prices. But the absence of a mechanism to incorporate or adjust to future volatility changes indicates that the study is making projections about price with an inadequately represented component of price.

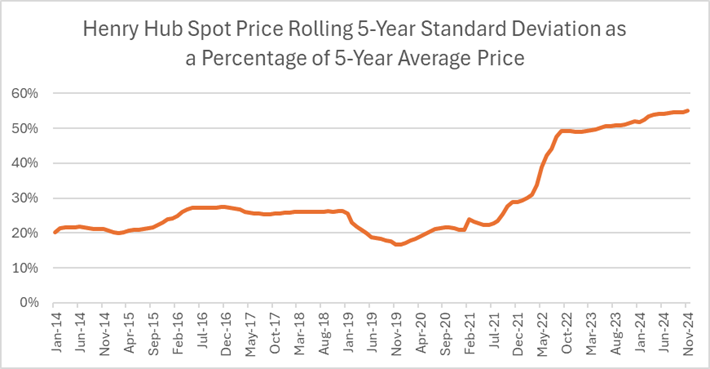

Volatility continues to represent more than half the value of natural gas prices (as measured by the ratio of standard deviation divided by the mean), yet the 2024 LNG Export Study projects volatility that comprises about 25% of future values. This suggests that the models used in the study leave about 30% of the mechanisms driving price change for natural gas unaddressed.

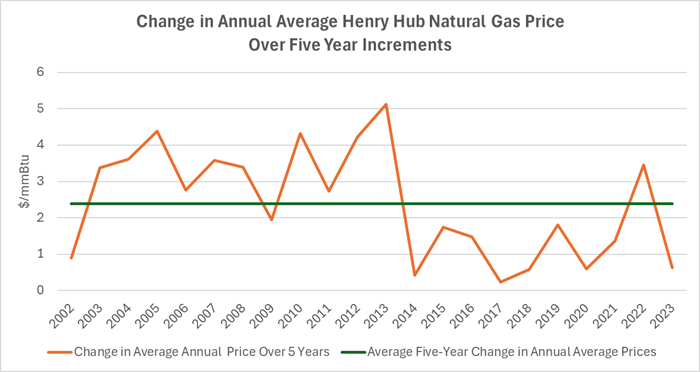

Natural gas prices, known for their volatile swings, have historically shown significant fluctuations over extended periods, including five-year intervals. From 1997 to 2023, the annual average Henry Hub spot price changed by an average of $2.40 per mmBtu compared to its value five years earlier. And over this period, the range of variance in five-year increments has spanned from as little as $0.24 per mmBtu (e.g., $2.99 in 2017 versus $2.75 in 2012) to as much as $5.13 per mmBtu (e.g., $3.73 in 2013 versus $8.86 in 2008).

Source: EIA

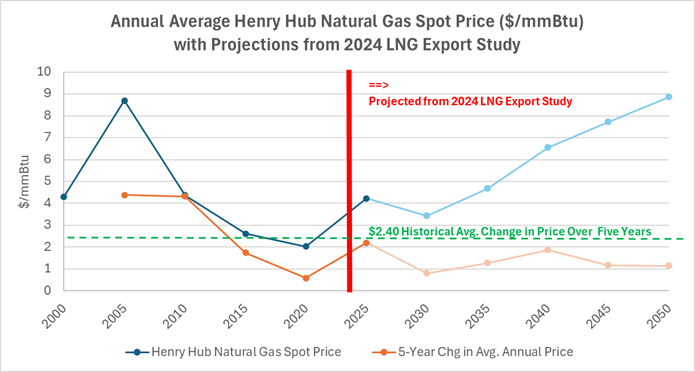

In comparison, the 2024 LNG Export Study, which provides its projections in five-year increments, suggests a significantly reduced volatility profile for Henry Hub spot natural gas prices. After adjusting their estimates to nominal dollars, the changes in annual average Henry Hub Spot natural gas price estimated in the study are all below the $2.40 per mmBtu average observed historically between 1997 and 2023.

Source: EIA, DOE/FECM 2024 LNG Export Study

* Note all dollar amounts in chart are nominal dollars with study projections converted from $2022 to nominal using conversion factors from AEO 2023 report.

We note that during the past decade, volatility has been increasing. The rise in volatility began occurring before Russia’s invasion of Ukraine, rebounding from low levels induced by the COVID-19 pandemic. Volatility in the future, even at levels experienced prior to the invasion, should produce price swings that are similar over five-year increments to historical levels.

Source: IEEFA computation (60-month Standard Deviation / 60-month price average) using EIA data

Second, the fall in the benchmark price projections (i.e., Henry Hub natural gas spot price) between the years 2025 and 2030 in the study is mostly based on a projected 22% drop in natural gas demand used for power generation over this timeframe. These estimates are contrary to growing gas consumption for electricity generation over the past decade (rising from 8.5 trillion cubic feet in 2014 to 13.2 trillion cubic feet in 2023).

Addressing these shortcomings with the study’s modeling methodology, design and assumptions would result in a substantially different estimate for natural gas prices than the conclusions from the 2024 LNG Export Study. Since a key determinant of whether a change in LNG export capacity will be detrimental to the U.S. economy hinges on an assessment of future price impacts, agencies relying on this study are starting from a disadvantaged understanding of future conditions. The reality that rising LNG exports will cause domestic natural gas prices to increase, while acknowledged in the study, is underestimated in its ultimate impact to the detriment of the public’s interest