IEEFA comments to DOE on LNG export terminals and permitting

Download Full Version

The Institute for Energy Economics and Financial Analysis (IEEFA), a non-profit organization focused on research and analysis of global energy markets and trends, provides the following comments in response to the Notice of Availability of the 2024 LNG Export Study and its Request for Comments that Inform DOE Public Interest Determinations in the Permitting of Future LNG Export Terminals and Permitting the Expansion of Existing Sites to supply non-Free Trade Agreement nations, Docket Nos. 13-69-LNG, 14-88-LNG, 15-25-LNG, 16-28-LNG, 19-134-LNG, 20-23-LNG, 21-131-LNG, 22-39-LNG, 22-167-LNG, 23-34-LNG, 23-46-LNG, 23-87-LNG, 23-109-LNG, 23-137-LNG, 24-27-LNG, and 24-87-LNG. These comments are intended to address motivations behind the buildout of LNG export capacity that are associated directly with the benefit of a select few rather than the greater well-being of society.

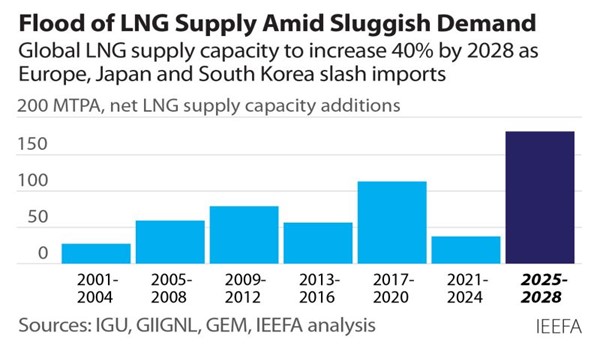

U.S. LNG companies have three strong incentives to push their projects forward despite the looming risk of global oversupply.

1. Long-term contracts insulate LNG projects from market risk.

U.S. LNG buyers sign take-or-pay contracts that guarantee 20 years of revenue, even if the buyers never take a single cargo. These contracts give lenders confidence that their debt will be serviced, no matter what happens in the LNG market.

Venture Global’s controversial CP2 LNG project has already secured guaranteed contracts with ExxonMobil, Chevron, China Gas, EnBW, New Fortress Energy, SEFE, Inpex, and Jera. Cheniere Energy has contracts with Equinor, Chevron, and PetroChina to expand its Corpus Christi facility. Saguaro LNG (a Mexican project sourced with U.S. gas) is fully contracted, and Delfin LNG has enough volume to support one train. Lake Charles LNG and Commonwealth LNG aren’t far behind, with a mix of firm contracts and preliminary agreements.

If these projects all receive their final export approvals from the U.S. Department of Energy, some of them will likely move forward, based solely on the contracts already signed.

2. LNG developers hope that soaring demand will quickly clear a market glut

LNG developers are doing their best to stimulate long-term demand. Take Japan, the world's largest public financier of gas and LNG projects. Japanese firms are involved in more than 30 different gas and LNG-related projects throughout South Asia, Southeast Asia, and Taiwan, including LNG import terminals, power plants, and gas distribution businesses. These companies plan to profit by building infrastructure, not by trading gas. Meanwhile, Japan’s largest LNG buyers plan to boost sales of LNG into developing Asian markets due to declining demand at home.

A glut could supercharge efforts to cultivate Asian demand. Over the last three years, LNG has earned a reputation as an expensive and unreliable fuel. An oversupply could help reset the market by making LNG seem more affordable—at least until the next global crisis sends the markets spiraling.

3. LNG insiders get rich when their projects get funded

Never underestimate the power of greed. A positive Final Investment Decision (FID) unleashes a gusher of money from lenders and equity investors. With most new projects needing to raise well over $10 billion in financing, insiders can skim off just a percent or two in fees and bonuses and walk away rich.

Remember, insiders can secure generational wealth even if their project isn’t successful. Yes, they do better if the project makes money. But their incentives are all aligned towards reaching FID at any cost—even if the market doesn't need more LNG.