IEEFA Alert: Peabody’s Plan to Emerge From Bankruptcy Is Likely to End in Bankruptcy Again

Peabody Energy’s plan to emerge from bankruptcy will most likely end ironically.

Peabody Energy’s plan to emerge from bankruptcy will most likely end ironically.

In another bankruptcy, that is.

We’ve studied the plan and find it lacking in credibility on several points (here’s the underlying research memo we recently put together).

The plan is overly optimistic on financial projections in key areas, in its coal-production outlook and in its expectations for cost-control results. It fails to acknowledge that a post-bankruptcy Peabody may not be able to meet its self-bonding solvency requirements. The plan also misrepresents the true size of company assets and suggests wrongly that Peabody will be a larger enterprise than is likely.

Highlights of our review:

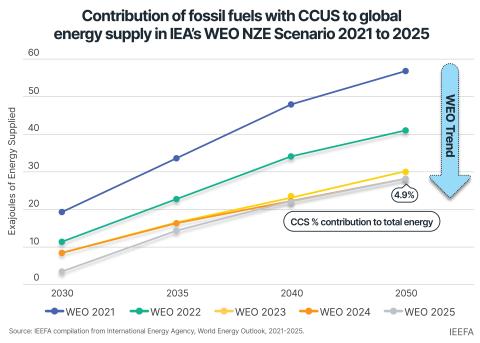

- The plan presents an overly optimistic profile of the company’s coal production and cash margins, especially in its operations in the Powder River Basin, the workhorse region for the company.

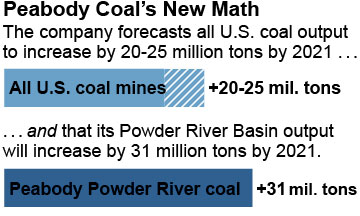

- In stating that its PRB operations will increase annual coal production from 100 million tons in 2016 to 131 million tons by 2021, the company is presenting numbers that are, well, jarring. The outlook all but ignores competition in the region and falling demand for coal, and is offered in stark and dubious contrast to United States Energy Information Administration estimates that total coal production growth in the Powder River Basin will range over that period of time from only 14 million to 36 million tons.

- The company itself—even as it asserts it will increase Powder River Basin production by 31 million—says it sees the U.S. coal industry as a whole increasing production by 20-25 million tons annually between 2016 and 2021. Peabody’s assertion that its PRB operations alone will produce an additional 31 million tons by 2021 suggests the rest of the industry will somehow continue to lose customers, sales and market share at a higher rate than Peabody.

- While Peabody anticipates that its annual average per ton PRB revenues over the plan period (2017-2021) will decline by 8% from its 2015 average PRB per ton revenues, the company says it will somehow maintain its profit margins through a program of aggressive cost controls. The business plan assumes basically flat costs for the next five years, which is unlikely.

- Peabody states that it currently has 6.3 billion tons of proven and probable reserves, including 2.9 billion tons in the Powder River Basin. These numbers inflate the company’s assets and make it appear as if the company is bigger than it is. A real post-bankruptcy plan would include mine closings and coal reserve reductions in both the Powder River and Illinois basins.

- Peabody is understating its reclamation-responsibility expenses.

- Peabody’s bankruptcy is reminiscent of the bankruptcy of Patriot Coal, which Peabody spun off in 2007.

One note on that last point: Industry consensus was that Patriot failed because it did not adequately align the company’s expenses and liabilities, particularly existing pension and environmental challenges with weak revenue potential in a declining coal region (Appalachia).

In December 2013, Patriot emerged from bankruptcy only to file for bankruptcy again in May 2015.

While Peabody’s financial condition is different in many respects from Patriot’s, the similarities are striking, especially in terms of stated coal reserves, overly optimistic cost-management strategies and declining revenue potential in a weak market.

Tom Sanzillo is IEEFA’s director of finance.

RELATED POSTS:

U.S. Coal Rebound, if It Happens, Will Most Likely Be Muted