Key Findings

Russia’s invasion of Ukraine upended global LNG markets last year—spurring Europe to buy record amounts of LNG and pushing up prices to their highest level ever.

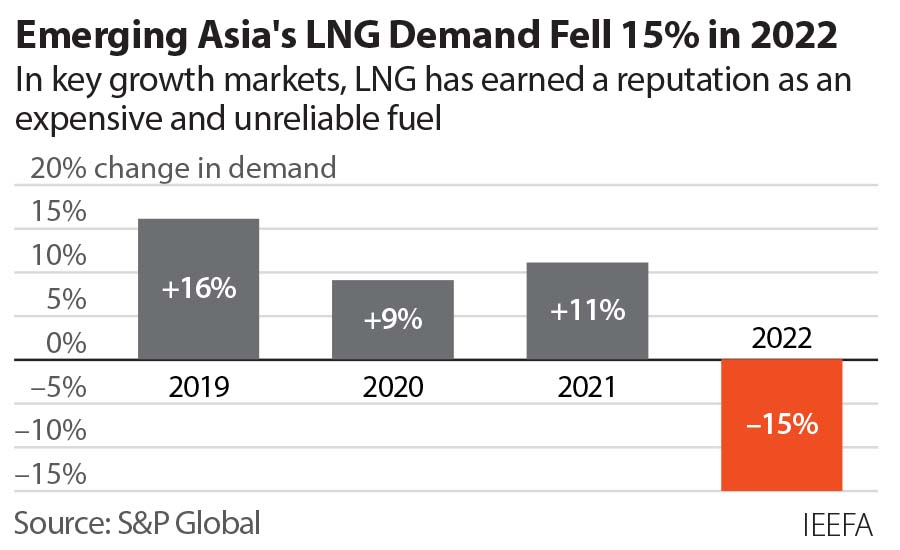

In Asia, LNG has now earned a reputation as an expensive and unreliable fuel source, clouding future demand.

The EU is taking aggressive steps to trim gas consumption, which could render new LNG import capacity unneeded.

Although LNG markets may remain tight for several years, the global LNG market will see a tidal wave of new projects coming online in 2025-27 — creating the potential for an extended supply glut and a return to the low global prices.

Executive Summary

Russia’s invasion of Ukraine in February 2022 upended global liquefied natural gas (LNG) markets. As Russia slashed pipeline gas shipments to the European Union, EU buyers purchased record volumes of LNG to replace lost Russian supplies. Europe’s red-hot demand drove global LNG spot prices to record levels, and squeezed the volumes available to developing economies.

High prices and supply disruptions have consequences. In many Asian nations, LNG has now acquired a reputation as a costly and unreliable fuel. Proposed LNG import projects in the region now face increased delay and cancellation risks, while governments in key LNG growth markets have announced new policies designed to limit dependence on global gas imports. This has clouded prospects for long-term demand in the regions that the global LNG industry had been counting on for robust growth:

- European countries boosted LNG imports by 60% in 2022 to make up for declining pipeline gas shipments from Russia. LNG demand could remain strong in 2023 but is poised to fall, as EU climate and energy security policies curtail gas demand by at least 40% through 2030. New LNG terminals could boost the continent’s import capacity by one-third by the end of 2024, but Europe’s energy transition targets mean that much of the new capacity could remain unused.

- Japan and South Korea, which have historically anchored global LNG demand, plan to reduce LNG purchases while boosting nuclear, wind, and solar power generation to achieve energy security, economic growth, and decarbonization goals.

- China cut its purchases of LNG by 20% last year, due to a combination of high prices, COVID-19 shutdowns, and slower economic growth. Prolonged high LNG prices have encouraged the country to rely more heavily on lower-cost Russian pipeline imports and domestic gas production, putting downward pressure on the country’s LNG demand growth.

- South Asia, including India, Pakistan, and Bangladesh, slashed LNG purchases by 16% last year. Many buyers in the region withdrew from spot markets altogether, and suppliers under long-term contracts often defaulted on cargo deliveries to obtain higher profits in other markets. Rising concerns over fuel supply security and affordability of LNG have downgraded the prospects for LNG demand growth in the region.

- Southeast Asia’s demand growth faces challenges related to high prices, limited LNG contract availability and infrastructure constraints. Long-term contracts with deliveries before 2026 are reportedly sold out globally, meaning price-sensitive Southeast Asian buyers risk high exposure to volatile, expensive spot markets.

For the next several years, global LNG markets will see modest supply additions, even as European nations continue to import significant LNG volumes to replace lost Russian pipeline gas. IEEFA anticipates that weak supply growth and robust demand will keep global LNG prices structurally elevated for several years. High prices will put sustained downward pressure on Asian demand growth, particularly among price-sensitive emerging markets that were widely expected to be the primary drivers of global LNG demand.

As high prices continue to alienate Asian buyers, European policymakers are moving aggressively to reduce gas consumption, driven by the triple imperative to cut energy costs, bolster energy security, and meet emissions reduction targets. Despite Europe’s short-term LNG buying frenzy to replace lost pipeline imports from Russia, climate and energy initiatives are likely to cause LNG demand growth on the continent to stabilize and reverse later this decade.

IEEFA expects that sustained high global LNG prices; weak LNG demand growth and elevated price sensitivity in Asia; declines in gas consumption in Europe; and a multi-year string of global capital investments in cost-competitive energy alternatives will undermine global LNG demand growth over the next several years.

After several years of weak supply growth, IEEFA anticipates that the global LNG market will see a tidal wave of new projects come online starting in mid-2025. The wave will likely crest in 2026, with the addition of 64 million metric tons of annual liquefaction capacity—the most in the history of the global LNG industry. The supply additions will boost global liquefaction capacity by roughly 13% in a single year.

Liquefaction projects targeting in-service after 2026 may be entering a much smaller demand pool than bullish market forecasts anticipate. As new supply floods the market, today’s tight markets may give way to a supply glut, with lower-than-anticipated prices, smaller netbacks, tighter margins, and lower profits for LNG exporters.