The economics behind Indonesia’s dimethyl ether (DME) push are hard to justify

Key Findings

Indonesian President Prabowo Subianto directed an energy task force to restart coal gasification dimethyl ether (DME) projects in four locations in Sumatra and Kalimantan. This plan aims to process low-calorie coal to reduce liquefied petroleum gas (LPG) imports.

According to IEEFA’s estimates, the 1.4 million (mn) tonne DME plant in Sumatra would cost USD2.6 billion (bn) plus USD520mn in lost opportunity costs over ten years, totaling USD3.1bn.

Indonesia’s DME plant capex and opportunity cost would be 70% of the total LPG import annual cost of USD4.3bn but yield only 1mn tonnes of LPG-equivalent energy. Consumers would pay 42% more per unit of energy than LPG.

A 1.4mn tonne DME plant could offset 15% of Indonesia’s LPG imports, but its economic viability is uncertain, as evidenced by China’s Shanxi Lanhua halting its DME production in 2023 due to unprofitability.

In March 2025, Indonesian President Prabowo Subianto directed the National Energy Resilience and Downstream Task Force to restart coal gasification dimethyl ether (DME) projects in four locations in Sumatra and Kalimantan, with funding from Danantara, the country’s new sovereign fund. This plan aims to process low-calorie coal (which has a low heating value or energy content) to reduce liquefied petroleum gas (LPG) imports, emphasizing energy security and timely project completion over immediate economic returns.

However, based on cost calculations by the Institute for Energy Economics and Financial Analysis (IEEFA), the DME plan may not be financially viable and would be too expensive to provide energy security. According to IEEFA’s estimates, the 1.4 million (mn) tonne DME plant in Sumatra would cost USD2.6 billion (bn) and USD520mn in foregone profits over ten years.

A previous IEEFA report referenced Shanxi Lanhua, a listed Chinese coal and chemical company that produces DME, urea, and caprolactam (CPL), for calculating production costs. The company halted production of DME in 2023 due to unprofitability.

A renewed focus on DME

The new Indonesian sovereign fund Danantara is flagged as one of the funding sources for the DME project, differing from a previous project in 2020 that depended on foreign investors. With assets under management of USD983bn and an initial funding allocation of USD20bn, this fund could be a significant financier, given that in 2020, the DME project cost was USD2bn.

IEEFA previously examined the return on investment for a DME plant owned by U.S. company Air Products in collaboration with PT Bukit Asam (PTBA), concluding that the plant would lose USD377mn annually. Indonesian media reported that Air Products withdrew from coal gasification projects with PTBA and PT Kaltim Prima Coal as the high price of coal made the projects uneconomical. The new Indonesian investment approach would mean that foreign investors cannot withdraw funding midway through project implementation. It emphasizes project completion and energy security over profits. Air Products required a 15% profit, but the difficulty of achieving this return likely led to the company’s withdrawal.

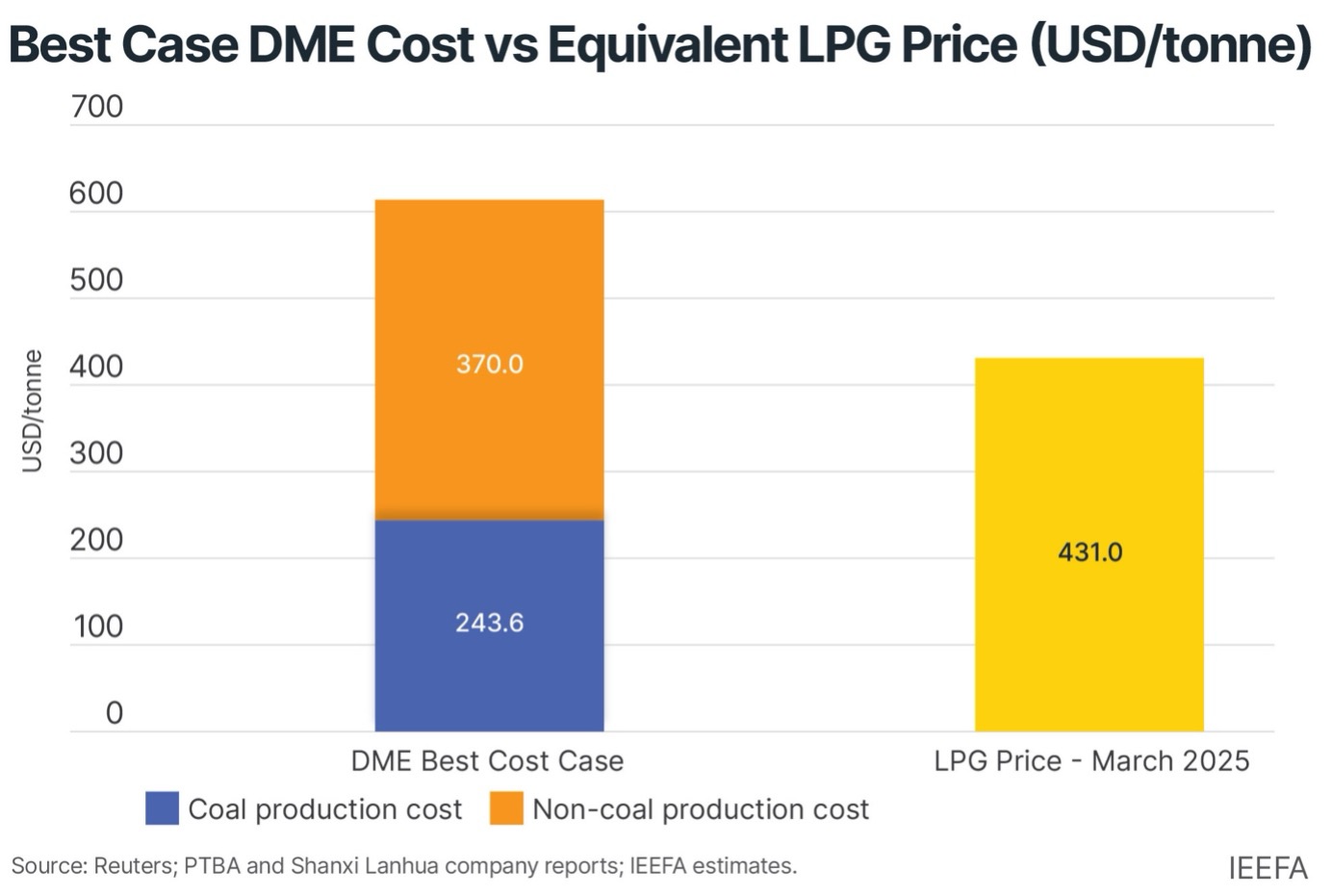

DME is a colorless gas synthesized from methanol produced from coal. The energy content of one kilogram of DME is 6,900 kilocalories (kcal) compared to 11,100 kcal for LPG. As DME contains 70% of the energy content of LPG, it should be priced at a 30% discount compared to the LPG price. The export LPG price set by Saudi Aramco for March 2025 is USD615 per metric tonne. An equivalent DME price should then be USD431 per tonne. However, the pricing and production costs for DME are far more complex.

In its first quarter results for 2024, Shanxi Lanhua announced that it had stopped producing DME due to losses. The company’s DME business went from a peak production of 256,000 tonnes in 2021 to 17,000 tonnes in 2022 and 8,100 tonnes in 2023. The average selling price per tonne of DME was USD508 and USD460 for 2022 and 2023, respectively. Meanwhile, production costs were USD582 per tonne and USD533 per tonne. Consequently, Lanhua lost USD73 per tonne of DME produced in both years.

Calculating DME production costs

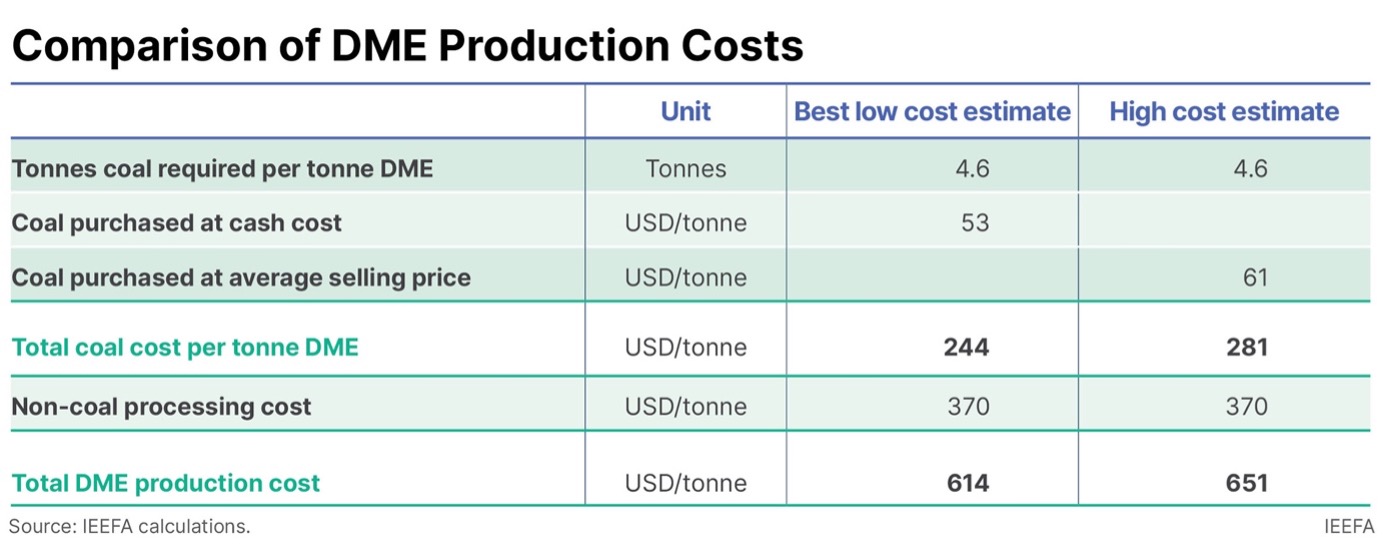

In 2020, PTBA proposed a USD2bn plant to produce 1.4mn tonnes of DME annually. Using the average inflation factor of 30%, IEEFA estimates this plant could cost USD2.6bn in 2025. The cost of DME consists of two parts: the coal required to produce it and the non-coal production cost per tonne.

For PTBA’s DME project in Sumatra, 6.5mn tonnes of coal is required to produce 1.4mn tonnes of DME. Therefore, 4.6 tonnes of coal is needed to make one tonne of DME. For the first nine months of 2024, PTBA sold 42.9mn tonnes of coal at an average price of USD61.2 per tonne (IDR 970,000) or a cash cost of USD53 per tonne (IDR 840,000).

Cash cost or average selling price can be used to calculate the cost of producing one tonne of DME from 4.6 tonnes of coal. If coal is charged at an average selling price, producing one tonne of DME would cost USD281. If priced at a cash cost, the cost of coal per tonne of DME would be USD244. Using coal priced at cost would mean a USD37 lower DME production cost.

Shanxi Lanhua is used as a reference to estimate the non-coal production costs. These costs are based on the company’s 2022 and 2023 non-coal DME production, which were USD370-419 per tonne. In the previously mentioned IEEFA report, the non-coal cost of producing DME was derived by deducting 4 tonnes of coal at production cost from the total DME production cost. For 2019, the calculation was USD304 per tonne. The same methodology infers a non-coal DME production cost of USD419 per tonne for 2022 and USD370 per tonne for 2023. This incorporates 22-38% inflation in coal prices compared to 2019.

Incorporating coal and non-coal costs, the estimated production cost for DME ranges from USD614-651 per tonne. The equivalent energy price of LPG adjusted to the lower DME energy content is USD431 per tonne. Therefore, even at the lower range of non-coal DME production cost, DME cost on a per unit energy basis is USD183 per tonne higher or 42% more than the price of LPG in March 2025.

There is also an opportunity cost for each tonne of coal sold to the DME plant at cost instead of market price. Based on PTBA’s nine-month results in 2024, the profit per tonne of coal was around USD8. If 6.5mn tonnes of coal were sold to the DME plant at cost, this would result in an annual USD52mn in foregone profit or USD520mn over ten years.

The total cost of the DME project would be USD2.6bn in addition to USD520mn in lost opportunity costs, totaling USD3.1bn. Moreover, Indonesian consumers would pay 42% more per unit of energy than LPG. In 2024, Indonesia consumed 8.7mn tonnes of LPG. 7mn tonnes of this were imported, resulting in an annual cost of USD4.3bn. Thus, the capex and opportunity cost of the DME plant would be 70% of the total LPG import cost, yet it would produce just 1mn tonnes of LPG equivalent energy.

Is the cost of DME worth the investment?

A 1.4mn tonne DME plant could generate enough energy to substitute 15% of Indonesia’s LPG imports. However, its economic viability is doubtful as profitability remains uncertain - evidenced by Lanhua’s decision to halt DME production in 2023. The current price of DME in China is RMB3,950 per tonne (USD548). This compares to the production cost range of USD614-651 per tonne calculated for the DME plant. Even if coal were supplied at cost price, producing each tonne of DME would still incur a loss of USD66, reflecting a negative profit margin of 12%. Considering the opportunity and sunk costs involved, along with the higher energy prices that Indonesian consumers would bear, a DME project would not be a feasible investment.